A so-called Santa rally is looking less and less likely, with prices for top assets like Bitcoin, Ethereum, and XRP falling sharply on Monday, hitting their lowest prices in at least a week as liquidations piled up across the board.

Bitcoin was recently down more than 3% over the last 24 hours, falling from a mark of nearly $90,000 early Monday to a recent price of $85,833. That's the lowest price registered for the leading crypto asset since December 1, per data from CoinGecko.

Ethereum, meanwhile, was down about more than 4% to a price of $2,955, with XRP falling 4.5% to $1.90—its lowest mark so far in December. Over the last week, every coin in the top 10 assets by market cap is down, aside from dollar-pegged stablecoins.

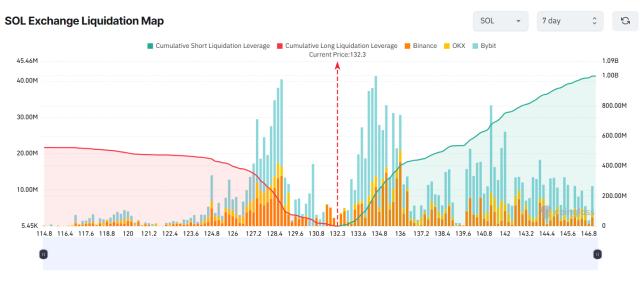

Monday's rough start to the new week has led to a smattering of crypto liquidations, tallying $573 million over the last day, per data from CoinGlass. Long positions, or bets that an asset's price will rise, make up the majority of the mess with $486 million worth.

Bitcoin is currently leading the pack for liquidations with $205 million in total, with Ethereum not too far behind at $156 million.

Overall, the crypto market has shed more than 3% of its value over the last 24 hours. Stock market indices aren't showing nearly as bad of a hit on Monday, however, with the S&P 500 dipping 0.1% and the Nasdaq down by about 0.3%.

Crypto stocks, on the other hand, are showing more substantial losses, with Bitcoin miner CleanSpark (CLSK) down 15% on the day, crypto exchange Gemini (GEMI) falling 12%, and top Ethereum treasury firm BitMine Immersion Technologies dropping 8% so far on the day. Coinbase has fallen by more than 5%, with Robinhood showing a less than 2% dip so far Monday.

Users on Myriad—a prediction market platform owned by Decrypt's parent company, Dastan—are growing increasingly bearish on the prospects of a Santa rally next week, currently giving that a less than 8% likelihood of happening. That's down from nearly 20% odds a week ago.