🚨 Last Night’s Crypto Flash Points — 1-Minute Market Recap | Dec 15

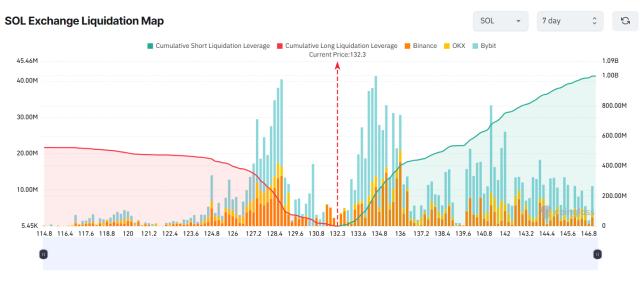

1⃣ $BTC, $ETH, $SOL declined again.

Watch U.S. equities on Monday. Crypto has lost its independent narrative and is now highly correlated with U.S. tech stocks.

2⃣ Strategy’s Michael Saylor once again posted Bitcoin tracker updates, potentially hinting at another BTC accumulation.

3⃣ CZ confirmed additional purchases of $ASTER, with an actual position size exceeding $2 million.

$ASTER is trading at 0.934, but market sentiment is so weak that even CZ’s endorsement is failing to move the price.

4⃣ Cathie Wood stated that the crypto market may have already bottomed.

She views ETH as institutional infrastructure and SOL as a consumer-facing blockchain ecosystem.

Crypto-related assets now account for 12–13% of her portfolio.

5⃣ Key macro data this week:

• Bank of Japan rate decision (Friday)

• U.S. November CPI (Thursday, 21:30)

• Final U.S. inflation expectations (Friday, 23:00)

6⃣ On $Polymarket, the probability of a 25 bps BoJ rate hike in December stands at 98%, making it investors’ biggest macro concern this week.

7⃣ Solana’s Breakpoint conference has concluded, with AI as a core focus.

Circle emphasized plans over the next 3–5 years to integrate stablecoin micropayments via x402, targeting billions of autonomous agents.

8⃣ TIME Magazine’s 2025 cover figures feature eight AI leaders, including Zuckerberg, Musk, Jensen Huang, and Altman.

Notably, they are depicted sitting on a fragile steel beam.

9⃣ Analysts:

Bitcoin’s key support is at $86,000. A breakdown could trigger a deeper correction.

For now, the crypto market remains range-bound, with low volume and weak trading confidence.