Author: Xiaobing, TechFlow TechFlow

In December's precious metals market, gold wasn't the main focus; silver was the most dazzling light.

From $40 to $50, $55, and $60, it surged through one historical price level after another at an almost out-of-control pace, giving the market almost no chance to breathe.

On December 12, spot silver briefly touched a record high of $64.28 per ounce before plummeting. Year-to-date, silver has risen by nearly 110%, far exceeding gold's 60% gain.

This was a seemingly "perfectly reasonable" rise, but that made it all the more dangerous.

The crisis behind the rise

Why is silver rising?

Because it looks like it deserves a price increase.

From the perspective of mainstream institutions, all of this makes sense.

Expectations of a Federal Reserve rate cut have reignited the precious metals market. Recent weak employment and inflation data have led the market to bet on further rate cuts in early 2026. Silver, as a highly volatile asset, has reacted more sharply than gold.

Industrial demand is also fueling the trend. The explosive growth of solar energy, electric vehicles, data centers, and AI infrastructure has fully demonstrated silver's dual nature as a precious metal and an industrial metal.

The continued decline in global inventories has exacerbated the situation. Fourth-quarter production from mines in Mexico and Peru fell short of expectations, and silver ingots in major exchange warehouses are decreasing year by year.

...

If we only consider these reasons, the rise in silver prices is a "consensus," or even a belated revaluation.

But the danger of the story lies in:

The rise in silver prices seems reasonable, but it feels unsettling.

The reason is simple: silver is not gold. It doesn't have the same level of consensus as gold and lacks a "national team" (government-backed investment).

Gold remains resilient because central banks worldwide are buying it. Over the past three years, global central banks have purchased more than 2,300 tons of gold, which are reflected on national balance sheets as an extension of sovereign credit.

Silver is different. Global central bank gold reserves exceed 36,000 tons, while official silver reserves are almost zero. Without central bank support, silver lacks any systemic stabilizers when the market experiences extreme volatility, making it a typical "isolated asset."

The difference in market depth is even more pronounced. Gold's daily trading volume is approximately $150 billion, while silver's is only $5 billion. If gold is likened to the Pacific Ocean, silver is at most a small lake.

It is small in scale, has few market makers, insufficient liquidity, and limited physical reserves. Most importantly, the main form of silver trading is not physical silver, but "paper silver," with futures, derivatives, and ETFs dominating the market.

This is a dangerous structure.

Shallow waters are prone to capsizing; the entry of large sums of money can quickly stir up the entire surface.

This is exactly what happened this year: a sudden influx of funds quickly pushed up a market that was not very deep to begin with, and prices were pulled off the ground.

Futures squeeze

What caused silver prices to deviate from their course was not the seemingly reasonable fundamental reasons mentioned above; the real price war was in the futures market .

Under normal circumstances, the spot price of silver should be slightly higher than the futures price. This is easy to understand, as holding physical silver requires storage costs and insurance fees, while futures are just a contract and are naturally cheaper. This price difference is generally called "spot premium".

But starting from the third quarter of this year, this logic has been reversed.

Futures prices have begun to systematically outpace spot prices, and the price difference is widening. What does this mean?

Someone is driving up prices wildly in the futures market. This phenomenon of "futures premium" usually only occurs in two situations: either the market is extremely bullish on the future, or someone is cornering the market .

Given that the improvement in silver's fundamentals is gradual, and that demand from photovoltaics and new energy sources will not surge exponentially within a few months, and that mine production will not suddenly dry up, the aggressive performance of the futures market is more like the latter: funds are pushing up futures prices.

An even more dangerous signal comes from the anomalies in the physical delivery market.

Historical data from COMEX (New York Mercantile Exchange), the world's largest precious metals trading market, shows that less than 2% of precious metals futures contracts are settled physically, with the remaining 98% settled in US dollars or rolled over.

However, in the past few months, physical silver deliveries on COMEX have surged, far exceeding historical averages. A growing number of investors are no longer trusting "paper silver" and are demanding the delivery of actual silver ingots.

A similar phenomenon has occurred with silver ETFs. While large amounts of capital flowed in, some investors began redeeming their shares, demanding physical silver instead of fund units. This "run" of redemptions put pressure on the ETF's silver ingot reserves.

This year, the three major silver markets—New York COMEX, London LBMA, and Shanghai Metal Exchange—have all experienced runs on silver.

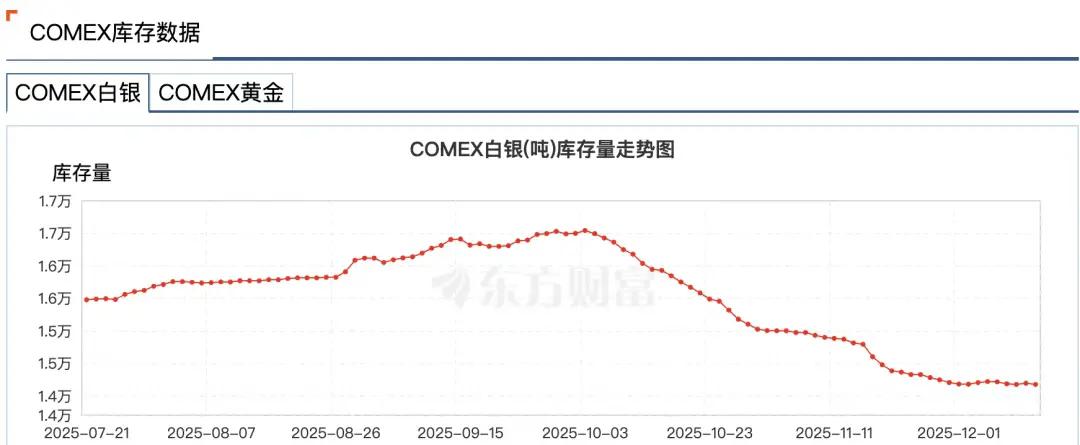

Wind data shows that silver inventories on the Shanghai Gold Exchange fell by 58.83 tons to 715.875 tons in the week ending November 24, a new low since July 3, 2016. CMOEX silver inventories plummeted from 16,500 tons at the beginning of October to 14,100 tons, a decrease of 14%.

The reasons are not hard to understand. During a period of dollar interest rate cuts, people are unwilling to settle in dollars. Another hidden concern is that exchanges may not have enough silver available for settlement.

The modern precious metals market is a highly financialized system. Most of the "silver" is merely a book value; actual silver ingots are repeatedly mortgaged, leased, and used for derivatives globally. One ounce of physical silver may correspond to more than a dozen different certificates of ownership.

Veteran trader Andy Schectman cited London as an example, noting that the LBMA has only 140 million ounces of floating supply, but daily trading volume reaches 600 million ounces, with over 2 billion ounces of paper claims on top of these 140 million ounces.

This "score reserve system" works well under normal circumstances, but once everyone wants the physical goods, the entire system will experience a liquidity crisis.

When the shadow of a crisis looms, a strange phenomenon seems to always occur in the financial markets, commonly known as "pulling the plug."

On November 28, CME experienced a nearly 11-hour outage due to a "data center cooling problem," setting a new record for the longest outage and preventing COMEX gold and silver futures from updating normally.

Notably, the outage occurred at a crucial moment when silver broke through historical highs, with spot silver breaking through $56 and silver futures even surpassing $57.

Some market rumors speculate that the outage was to protect commodity market makers who were exposed to extreme risks and could suffer large losses.

Later, data center operator CyrusOne stated that the major outage was due to human error, which fueled various conspiracy theories.

In short, this market trend, driven by a short squeeze in futures trading, has inevitably led to extreme volatility in the silver market . Silver has effectively transformed from a traditional safe-haven asset into a high-risk investment.

Who's in charge?

In this dramatic short squeeze, one name cannot be ignored: JPMorgan Chase.

The reason is simple: he is an internationally recognized silver speculator.

For at least eight years, from 2008 to 2016, JPMorgan Chase manipulated gold and silver market prices through traders.

The method is simple and crude: place a large number of buy or sell orders for silver contracts in the futures market to create a false impression of supply and demand, induce other traders to follow suit, and then cancel the orders at the last second to profit from price fluctuations.

This practice, known as spoofing, ultimately resulted in JPMorgan Chase being fined $920 million in 2020, setting a record for a single CFTC fine.

But the real textbook example of market manipulation goes beyond this.

On the one hand, JPMorgan Chase suppressed silver prices through massive short selling and deceptive trading in the futures market; on the other hand, it acquired large quantities of physical metal at the low prices it created.

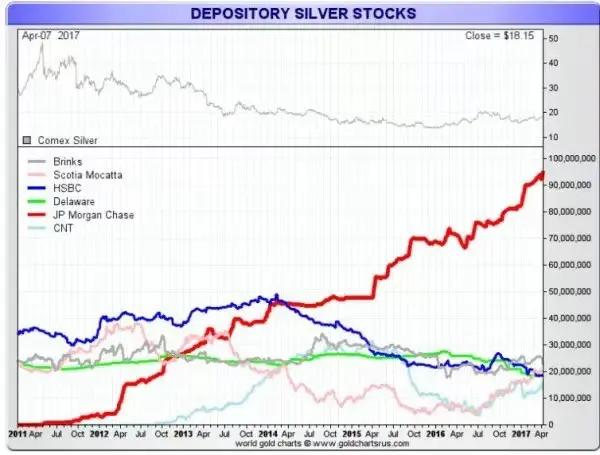

Starting in 2011 when silver prices approached $50, JPMorgan Chase began accumulating silver in its COMEX warehouses, adding to its holdings while other large institutions reduced their silver purchases, eventually reaching up to 50% of the total COMEX silver inventory.

This strategy exploits the structural flaws in the silver market, where paper silver prices dominate physical silver prices, and JPMorgan Chase is both able to influence paper silver prices and is one of the largest holders of physical silver.

So what role did JPMorgan Chase play in this round of silver short squeeze?

On the surface, JPMorgan Chase appears to have "turned over a new leaf." Following the settlement agreement in 2020, it underwent systematic compliance reforms, including hiring hundreds of new compliance officers.

There is currently no evidence that JPMorgan Chase participated in the short squeeze, but it still wields considerable influence in the silver market.

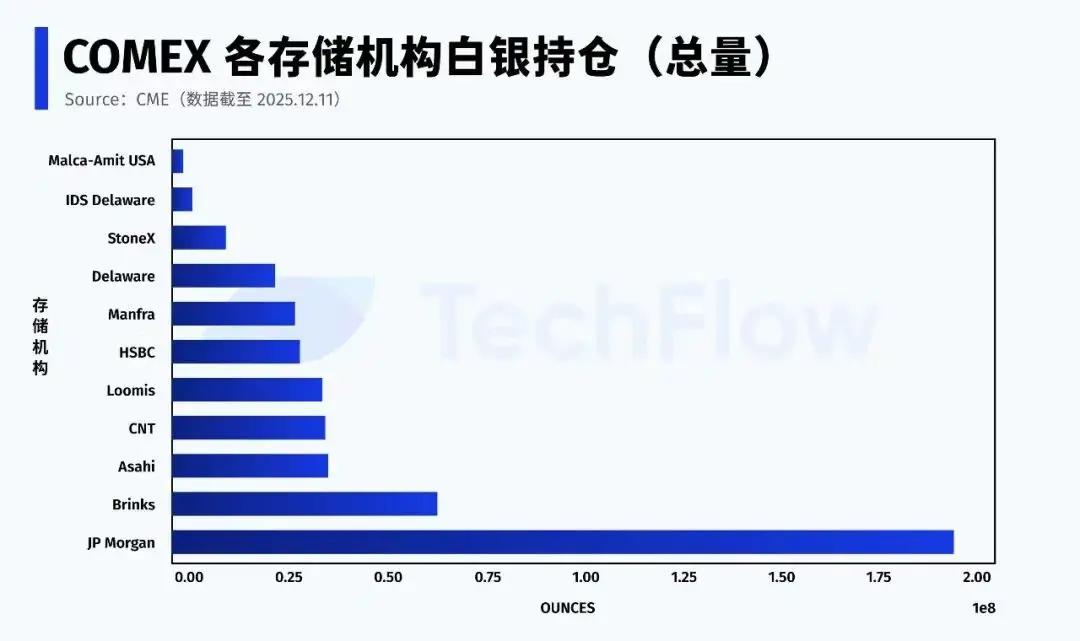

According to the latest data from CME on December 11, JPMorgan Chase holds approximately 196 million ounces of silver in the COMEX system (proprietary trading + brokerage), accounting for nearly 43% of the exchange's total inventory.

In addition, JPMorgan Chase has another special role: the custodian of the Silver ETF (SLV), holding 517 million ounces of silver, worth $32.1 billion, as of November 2025.

More importantly, JPMorgan Chase controls more than half of the eligible silver (i.e., silver that is eligible for delivery but has not yet been registered as deliverable) market.

In any round of silver short squeeze, the real game in the market boils down to two points: first, who can produce physical silver; and second, whether and when this silver is allowed to enter the delivery pool.

Unlike its past role as a major short seller of silver, JPMorgan Chase is now sitting at the "silver gate."

Currently, deliverable registered silver accounts for only about 30% of the total inventory, while the majority of eligible silver is concentrated in the hands of a few institutions. Therefore, the stability of the silver futures market actually depends on the behavioral choices of a very small number of key players.

The paper system is gradually failing.

If you had to describe the current silver market in just one sentence, it would be:

The market is still in motion, but the rules have changed.

The market has undergone an irreversible shift, and trust in the "paper system" of silver is crumbling.

Silver is not an isolated case; the same changes have occurred in the gold market.

Gold inventories at the New York Mercantile Exchange continued to decline, with registered gold repeatedly hitting lows. The exchange had to allocate gold bars from "eligible" gold, which was not originally intended for delivery, to complete the matching process.

Globally, capital is quietly migrating.

Over the past decade or so, the mainstream asset allocation trend has been highly financialized, with ETFs, derivatives, structured products, leveraged instruments, and everything else being "securitized".

Now, more and more funds are withdrawing from financial assets and turning to physical assets that do not rely on financial intermediaries or credit guarantees, such as gold and silver.

Central banks have been continuously and massively increasing their gold reserves, almost without exception choosing physical form. Russia has banned gold exports, and even Western countries such as Germany and the Netherlands have requested the repatriation of their gold reserves stored overseas.

Liquidity is giving way to certainty.

When the supply of gold cannot meet the huge physical demand, funds begin to look for alternatives, and silver naturally becomes the first choice.

The essence of this material movement is a renewed struggle for monetary pricing power in the context of a weak dollar and deglobalization.

According to a Bloomberg report in October, global gold is shifting from west to east.

Data from the CME Group and the London Bullion Market Association (LBMA) shows that since the end of April, more than 527 tons of gold have flowed out of vaults in New York and London, the two largest Western markets. Meanwhile, gold imports have increased in major Asian gold-consuming countries such as China, with China's gold imports in August reaching a four-year high.

In response to market changes, JPMorgan Chase moved its precious metals trading team from the United States to Singapore at the end of November 2025.

The surge in gold and silver prices reflects a return to the "gold standard" concept. While this may not be realistic in the short term, one thing is certain: whoever controls more physical commodities will have greater pricing power.

When the music stops, only those with real money can sit down safely.