Once attention forms a measurable and distributable structure on the blockchain, it has the foundation to be transformed into assets.

Written by: ChandlerZ, Foresight News

Over the past two years, RWA (Real World Assets) has become the most stable growth theme in the crypto asset market. The scale of US Treasury bonds, corporate bonds, and short-term yield products on-chain continues to expand, and the capital flow structure between DeFi and traditional finance has become predictable again.

A recent report by Standard Chartered Bank predicts that as DeFi becomes increasingly prevalent in payments and investments, the market capitalization of tokenized non-stablecoin RWAs will surpass $2 trillion by the end of 2028, far exceeding the current $35 billion. Of this, tokenized money market funds and listed stocks may each account for approximately $750 billion, with the remainder comprised of funds, private equity, commodities, corporate debt, and real estate.

However, as the infrastructure of the first phase is gradually improved, the industry faces a common problem: where will the space for further expansion come from?

On-chain markets are essentially global liquidity pools, and cultural assets inherently possess the ability to spread across geographical boundaries. Under this logic, the on-chain realization of cultural assets becomes possible. It does not rely on a single sovereign system, nor is it limited by the information structure of traditional art markets. Users are no longer merely viewers or collectors, but also become participants in the value network. The boundaries between culture and finance begin to blur.

The emergence of Ultiland, a Web3 creative asset platform, is based on this change. Ultiland is not positioned as a traditional art NFT platform, but rather as a "cultural asset tool." It starts with cultural assets such as art, IP, and cultural and creative content, and establishes an on-chain issuance, ownership confirmation, circulation, and financialization model for them, transforming them into asset units with sustainable trading structures.

RWA's new narrative: the on-chaining of cultural and creative assets.

RWA's first phase primarily focused on financial assets such as US Treasury bonds, real estate, and corporate bonds. These products offer clear cash flows and mature valuation models, making them suitable for institutional funds and high-net-worth investors. However, their asset sources rely on offline financial institutions, issuance is subject to regulatory constraints, product homogeneity is high, and yields are significantly affected by macroeconomic interest rate cycles. For ordinary on-chain users, the motivation to participate is largely driven by interest rate spread capture, creating a disconnect from the native crypto culture of participation.

Meanwhile, global cultural, artistic, and intellectual property assets have long been characterized by high value and low liquidity. The cultural and artistic IP market is estimated at around $6.2 trillion, but the circulation efficiency of this massive asset pool is very low, with assets concentrated in the hands of a few collectors, institutions, and platforms. Creators often find it difficult to share in the long-term appreciation of the secondary market, while ordinary users have little opportunity to participate in the early value formation. This is a typical mismatch between value and participation: concentrated asset value and scarce participation rights.

The expansion of the attention economy and creator economy has made this mismatch even more apparent. Increasingly, value stems not from stable cash flow, but from community density, reach, and cultural identification. The commercial returns of content, IP, and art projects largely depend on users' willingness to invest time and emotion. The difference between these assets and traditional RWAs is that the latter rely on a yield curve, while the former depends on user demographics and engagement. In a highly community-driven, globally fluid crypto market, the alignment between cultural assets and on-chain activity is actually higher than that of some traditional financial assets.

Therefore, cultural RWA is expected to become a new direction for development, where the target still comes from the real world, and the underlying assets can be artworks, IP copyrights, offline performances or other cultural content. However, the way to discover value is no longer just about discounted cash flow, but also includes narrative strength, user participation and long-term cultural identity.

However, the challenge lies in pricing. The traditional art and IP market relies on historical transaction records, assessments by authoritative institutions and experts. This system is friendly to professional investors but extremely opaque to ordinary participants. Cultural value itself is highly subjective and difficult to address with a single valuation model. Ultiland's approach is to partially entrust the valuation process to the market, allowing on-chain participation, trading depth, and holding structure to constitute part of price discovery. Using ARToken and an innovative meme-like RWA model, it creates a tradable experimental field for cultural assets. It introduces a more open participation layer, allowing cultural value to be re-evaluated with a larger sample size.

The change in participation thresholds is equally important. High-value art and IP have long been accessible only to a small group of people, with entry barriers often reaching millions. After assets are split on-chain, they can be offered to a larger user base in smaller segments. This changes the capital structure, not the artwork itself. For the existing market, this means that previously closed value units are being incorporated into a global liquidity pool for the first time. For the new market, this structure offers a participation method closer to that of the capital market and better aligns with the small-amount, frequent, and diversified allocation habits of crypto users.

Under this logic, Ultiland's work is not simply about changing how art is sold, but rather an attempt to build a complete on-chain infrastructure for cultural assets. This includes everything from ownership confirmation and issuance to splitting and trading, and then to using a dual-token economic model to facilitate long-term value transfer. Looking at the evolution of RWAs, this is a branch that has emerged following changes in the real-world economic structure. Traditional financial RWAs deal with funds and interest rates, while cultural RWAs deal with attention and recognition. Although they differ in asset attributes, they have the opportunity to be placed within the same market mechanism on-chain.

Ultiland's core mechanism: On-chain issuance and value loop of cultural assets.

The on-chain realization of cultural assets requires a clear path. Ultiland's approach starts from the business logic of art and IP, supporting the on-chain issuance and lifecycle management of a wide range of real-world assets, including artworks, collectibles, music, intellectual property, physical assets, and non-standard equity. Users can enjoy a full-stack service: token minting, asset valuation, decentralized auctions, and AI-assisted creation tools.

The value of this type of asset is composed of three dimensions: cultural value, financial value, and application value. It attempts to establish a unified way of expressing these three on the blockchain and form a sustainable value cycle structure.

Ultiland's foundational layer is ARToken. This is an on-chain unit representing cultural or artistic assets, serving as both an expression of ownership and a form of asset circulation in the market. ARToken supports the on-chain issuance of various assets, including artworks, antiques, design works, and IP copyrights, and completes the processes of ownership confirmation, valuation, issuance, and trading through its RWA Launchpad.

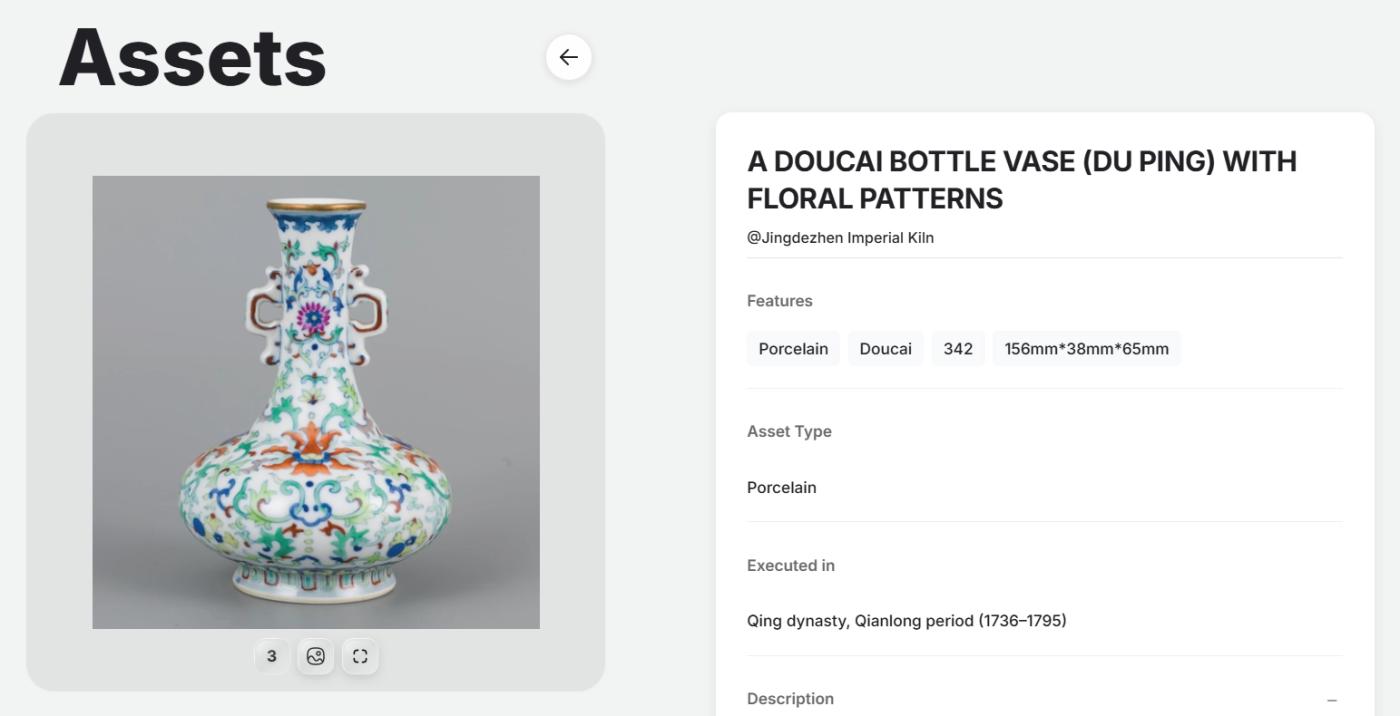

Ultiland's first foray into the market was EMQL, an art RWA project corresponding to a "Doucai (enamel-painted) double-eared flat-bellied vase with intertwined floral patterns" from the Qianlong period of the Qing Dynasty. This unique imperial kiln piece originally belonged to a niche collector's market, and is said to have been a token of affection given by Emperor Qianlong to his beloved concubine. It is extremely valuable and is currently held in escrow in Hong Kong. Ultiland split it into 1 million ARTokens on-chain, with a subscription price of 0.15 USDT per token, making this asset, which originally existed only in a closed market, accessible on-chain.

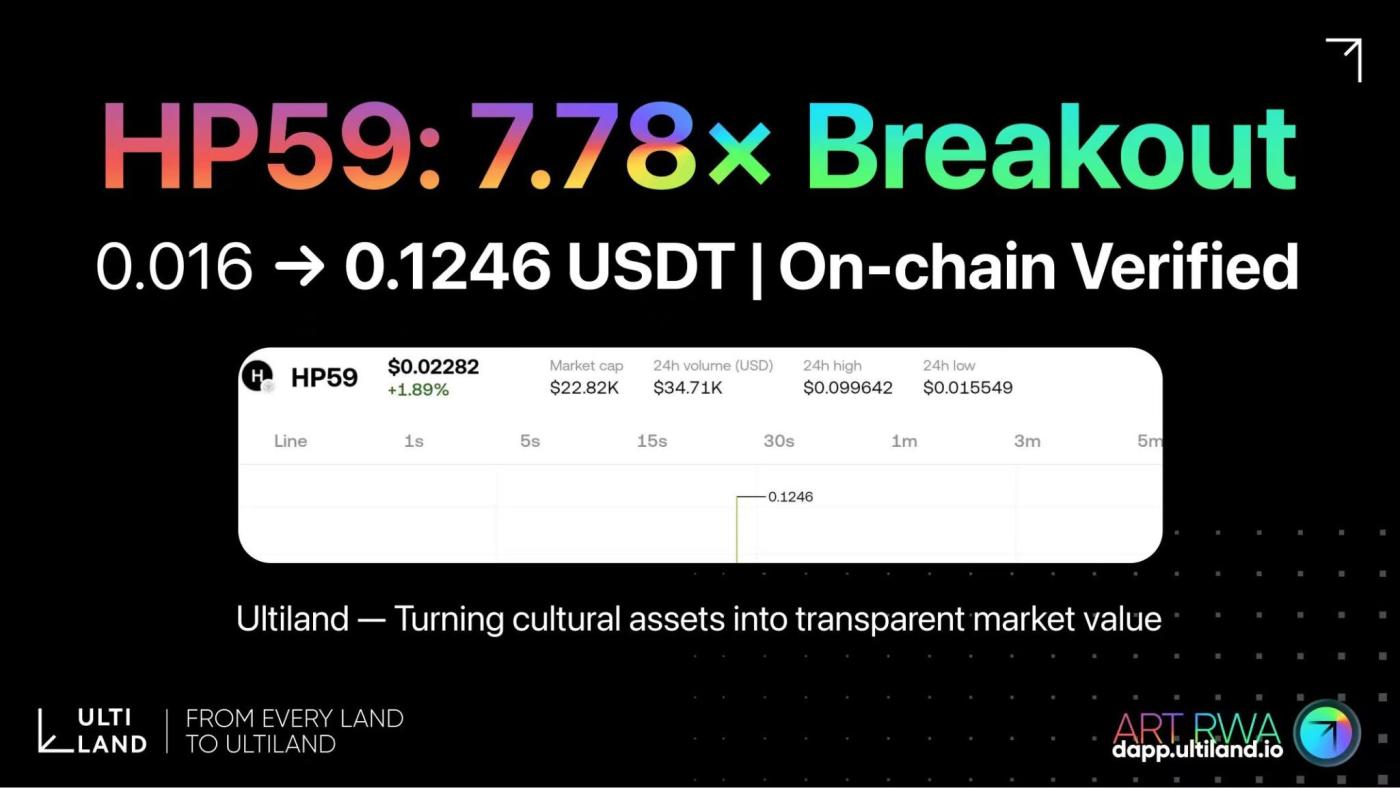

On December 3rd, Ultiland launched its second RWA ARToken, HP59, a token inspired by "Here and There - Spirit Series - No. 59," created by Wu Songbo, the designer of the dynamic sports icons for the 2022 Winter Olympics and a digital media artist. Symbolizing the fusion of nature and spirit, it features a pheasant soaring above rocks in Taihu Lake, surrounded by bamboo groves and distant pine trees. The token embodies harmony, vitality, and eternal tranquility. HP59 saw a peak increase of 7.78 times after its launch.

Another mechanism of Ultiland emphasizes market-driven value discovery. Based on its Meme-like RWA model, this approach applies the dissemination characteristics of memes to cultural RWAs, allowing the market to participate in value discussions in a more open manner at an early stage. While the valuation process in the traditional art market is typically dominated by experts and institutions, the on-chain model delegates some valuation authority to the market, reflecting the level of attention given to cultural assets through participation, transaction density, and dissemination intensity.

The value of cultural assets is often difficult to measure with a single indicator, and market sentiment can provide a certain degree of genuine feedback on the demand side. Ultiland incorporates this feedback into its price discovery system, enabling cultural assets to gain a more proactive space for value expression globally.

The most noteworthy aspect of Ultiland's structure is its 2+1 token system (including ARTX, miniARTX, and user-defined ARTokens), and the introduction of the VMSAP dynamic capacity adjustment mechanism to achieve a supply-demand driven release path. Official information shows that the maximum supply of ARTX is 280 million, of which 107 million are used for community incentives, ecosystem building, and global airdrops; and 123 million will be generated through creative mining and staking participation. RTX is the platform's sovereign asset, used for value settlement and governance participation, while miniARTX serves as proof of user contributions.

miniARTX is the sole entry point for ARTX releases; all new circulation must be completed through releases and liquidity binding to form a closed supply system. The majority of platform revenue goes into a buyback pool to enhance ARTX's liquidity and scarcity. miniARTX's output comes from users' trading, creation, and promotion activities, making participation a source of value. For cultural assets, participation density itself is part of the value; this model creates a synergy between the two.

- A 30% eco-tax is levied on miniARTX exchanges for ARTX, of which 10% is directly destroyed and 20% is injected into the eco-incentive pool.

- miniARTX's on-chain transfers follow a net allocation logic of 10→7, with 1 coin burned and 2 coins added to the ecosystem pool to continuously replenish community incentives and maintain liquidity.

- In certain incentive scenarios, the 10% cost of ARTX→miniARTX can be waived, and certain counterparty transactions will also have a 20% reward pooling.

The key lies in the cost of release. Users who want to convert miniARTX to ARTX need to choose between linear release or accelerated release. Accelerated release requires additional investment and triggers a buyback. This continuous release increases the buying power of ARTX, establishing a stable value center for the token system. The mini ARTX testnet is about to launch, and the next crucial moment is for validating Ultiland's dual-token model.

Ultiland has built a five-module underlying framework around cultural assets. RWA LaunchPad breaks down artworks, IPs, and collectibles into tradable ARTokens, providing a standardized entry point for issuance. All ARTokens support staking/trading mining (as a contribution metric based on participation), rewarding community circulation and contributions. More innovative issuance models will be launched in the future. The Art AI Agent connects generative content with on-chain price signals, providing a continuous supply of creative ideas for assets. IProtocol handles IP registration, licensing, and cross-chain use, solidifying copyright and licensing relationships on-chain. The DeArt ecosystem provides auction, rating, NFT conversion, and secondary trading environments for these assets, placing creation and trading in the same market. SAE connects with the RWA Oracle to manage offline asset custody, valuation, and data synchronization, providing a reliable on-chain mapping of real-world assets. These five modules, combined, correspond to the five stages of issuance, creation, ownership confirmation, trading, and compliance, forming a relatively complete cultural RWA infrastructure, rather than a single application.

Ultiland's RWA Unicorn Upgrade Path

From a timeline perspective, Ultiland's implementation has followed a relatively clear path. After the issuance of EMQL, its subscription speed significantly exceeded the team's expectations, with the first round almost completely sold out, demonstrating a clear user interest in cultural assets like ARTokens. This result provides the most direct market feedback: cultural assets have real demand on the blockchain, and the splitting model effectively expands participation, bringing previously niche collectibles into a new price discovery system. On November 26th, the Qianlong vase asset was transferred, and it will soon enter the secondary market after the transfer.

EMQL's market response laid the foundation for Ultiland's subsequent expansion, allowing the team to allocate resources on a larger scale. Recently, Ultiland announced the launch of the Ultiland ART FUND, with a scale of 10,000,000 ARTX (approximately US$50 million), to promote the entry of traditional artists, creators, and cultural institutions worldwide into Web3, expanding the on-chain issuance and circulation of cultural assets. This fund will serve as Ultiland's "Arts and Culture IP Web3 Engine" and "Cultural RWA Growth Pool," focusing on four core areas: incentivizing traditional artists to participate, supporting the issuance of art assets via RWA, promoting ecosystem collaboration, and rewarding creator growth.

Ultiland stated that ART FUND is expected to support 100,000+ artists, issue 20,000+ art assets, and promote the Web3 transformation of global cultural content in a more standardized way.

Once the underlying products are launched, case studies emerge, and supply-side resources are in place, the ecosystem begins to unfold. Art is merely the entry point. IP licensing, film and music content, performances and the fan economy, and even the influence and rights of the creators themselves can, in theory, be broken down, mapped, and traded within a similar framework. While cultural production is accelerating and the number of creators is constantly increasing, the current distribution structure remains concentrated in the hands of platforms and a few leading institutions, making it difficult for the vast majority of content to be transformed into tradable assets. Standardized on-chain issuance tools, coupled with sufficiently clear rights designs, have the potential to bring this long-term accumulated value into a more transparent market environment.

The financialization of cultural assets has the potential to become the next cycle for RWAs, not because the concept is new, but because of the difference in underlying drivers. Financial RWAs are more constrained by interest rate levels, regulatory frameworks, and the pace of institutional balance sheet expansion, with marginal growth highly dependent on the macroeconomic environment. The expansion of cultural assets, on the other hand, relies more on content supply and user time, with a growth logic closer to the internet traffic market. Once attention forms a measurable and distributable structure on-chain, it has the foundation to be converted into assets. The crypto market itself is driven by high-frequency narratives and high-density participation, and cultural assets match this characteristic better than traditional debt or real estate assets. This gives cultural RWAs the opportunity to form another growth curve on the same infrastructure.

In this sector, Ultiland is being discussed as a potential unicorn, primarily because the cultural RWA market currently lacks a practically operational product system. Most projects remain at the conceptual or single-function level, failing to form a closed loop of "issuance—rights confirmation—trading—value return." Ultiland has already established a preliminary structure in terms of mechanisms, asset issuance, user participation, and supply-side resources, and has obtained real-world market validation through EMQL. For a newly emerging market, platforms that can provide replicable models and empirical data naturally become a key focus for industry observers.

summary

According to a joint report by Art Basel and UBS, the global art market is projected to reach $75 billion by 2025. Innovations such as NFTs and RWAs allow artists, collectors, and stakeholders to view art as both a cultural product and a financial instrument. Ultiland's position on this path depends on its ability to consistently provide a high-quality supply of cultural assets, maintain a clear value recovery mechanism for both creators and investors, and ensure the stability of its token model amidst market fluctuations. If asset issuance can expand from individual artworks to IP, entertainment, and the creator economy, the platform will gradually transform from a project provider into an asset-layer infrastructure provider. Conversely, if the asset portfolio remains limited to a small number of items, or if the token cycle relies too heavily on real revenue, the infrastructure narrative will weaken.

In the future, the on-chaining of cultural assets will not replace financial RWAs, but rather coexist with them, forming two asset classes with different risk-return characteristics. The former is more volatile but highly correlated with user participation; the latter offers stable returns but is more institutionally friendly. Ultiland is currently building a platform on the cultural asset side that can support large-scale experiments. If a relatively mature cultural RWA sector emerges in the market in the next few years, then projects like these today will likely be seen as early-stage infrastructure prototypes.