Rumors that Wall Street trading firm Jane Street was causing a Bitcoin " Dump" at 10 a.m. each day resurfaced on December 12, 2023, after the price of BTC plummeted during the day's trading session.

Online communities continue to speculate that large institutions and ETF market makers are behind this volatility. However, a closer XEM at the data reveals a more complex story.

What is the story of "Jane Street at 10 AM"?

According to a widely circulated theory, the price of Bitcoin typically drops around 9:30 to 10:00 AM (ET), when the US stock market opens. Jane Street is often mentioned because it is a major market maker and an authorized participant in US spot Bitcoin ETFs.

Allegations suggest these companies intentionally drove prices down to trigger liquidation orders, then bought them back at a lower price. However, to date, no regulatory body, exchange, or data source has confirmed that this coordinated activity actually occurred.

Bitcoin Futures Contract data does not indicate a sharp sell-off by investors.

Bitcoin prices remained flat during today's US market opening, fluctuating within a small range of $92,000–$93,000. There was no significant sell-off at the expected 10:00 AM (ET).

The sharp drop occurred later, near midday in the US. BTC briefly fell below $90,000 before recovering, indicating that selling pressure appeared later than it did right after the market opened.

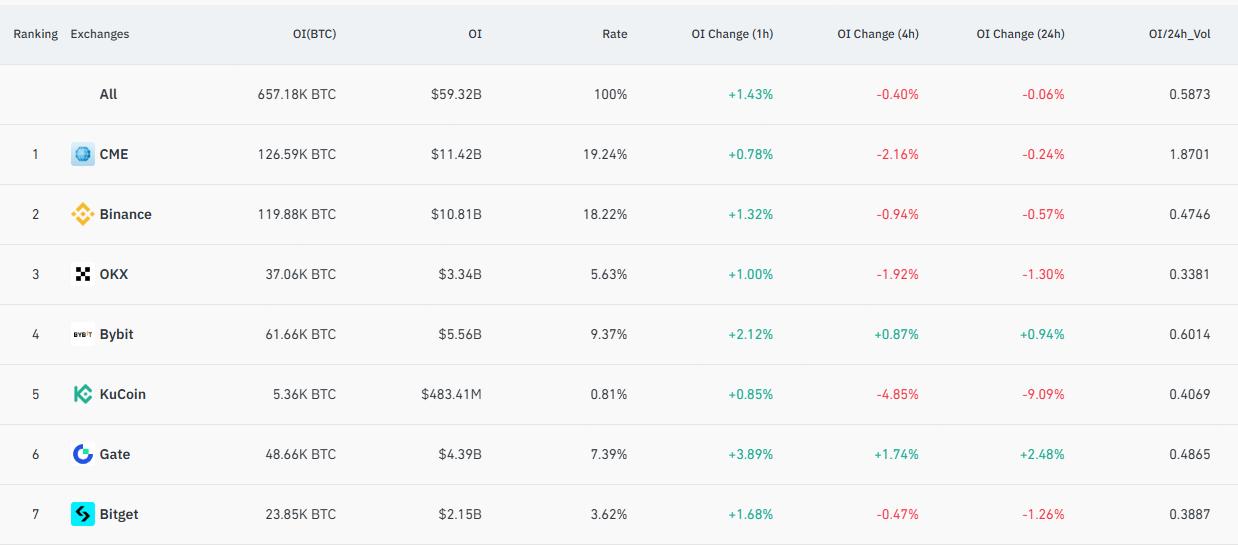

The volume of open contracts for Bitcoin futures on major exchanges remains fairly stable. The total open contract volume is almost unchanged from the previous day, indicating that no large amount of new Short positions have been created.

On the CME, where large institutions typically trade, open interest decreased slightly. This usually reflects risk reduction or hedging action, rather than a move to bet on a sharp price drop.

Summary of open BTC Futures contracts. Source: CoinGlass

Summary of open BTC Futures contracts. Source: CoinGlassIf a large organization were actually manipulating prices and driving them down across the board, the open interest data would show a sudden increase or decrease. However, this did not happen.

Liquidation explains the price fluctuations.

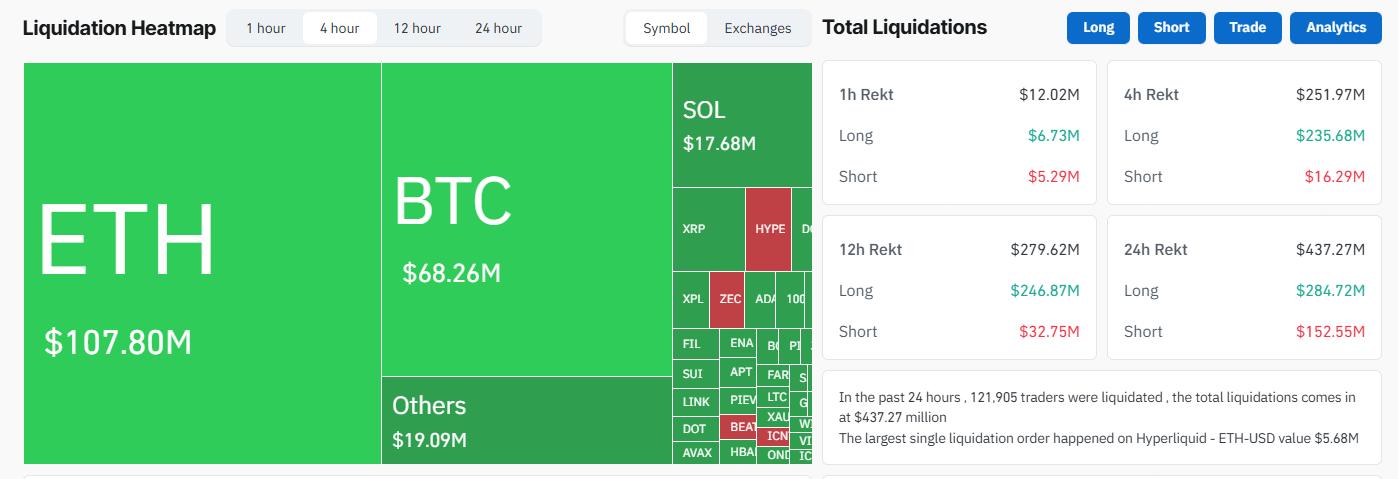

Liquidation data provides a clearer picture. In the past 24 hours, the total number of liquidated positions in the crypto market exceeded $430 million, with the majority being Longing positions.

Bitcoin alone saw over $68 million in liquidations. Ethereum recorded an even larger figure. This indicates a market-wide "forced liquidation" wave, not just for Bitcoin.

Crypto positions liquidated on December 12, 2023. Source: CoinGlass

Crypto positions liquidated on December 12, 2023. Source: CoinGlassWhen prices break through key levels, forced liquidation orders push prices down even faster. This often creates shock dips without the need for a single large seller.

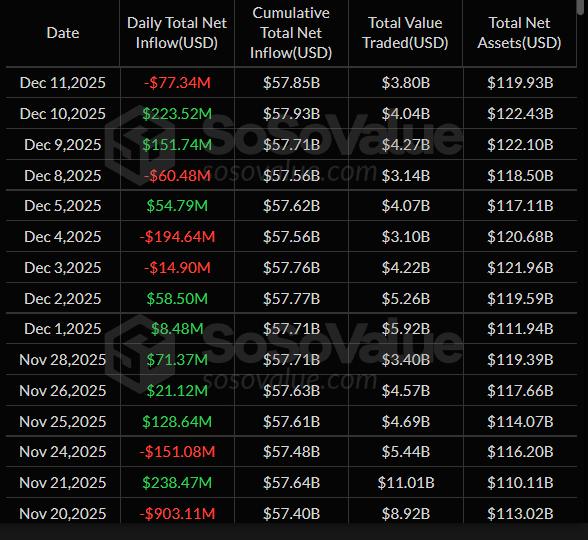

Notably, US spot Bitcoin ETFs also recorded Capital of $77 million on December 11, 2023, following two consecutive days of steady Capital . The sharp price fluctuations today were largely a result of this move.

Daily Bitcoin ETF inflows in the US. Source: SoSoValue

Daily Bitcoin ETF inflows in the US. Source: SoSoValueNo single exchange led the sell-off.

This price drop occurred across multiple exchanges such as Binance, CME, OKX, and Bybit. There were no signs of concentrated selling pressure on any particular exchange or product.

This is quite important because manipulative activities often leave clear traces. The recent event involved many parties in the market, reflecting widespread automatic position-closing.

Why does the story of Jane Street always come back to me?

Bitcoin's volatility is often concentrated during US market opening hours, driven by ETF trading activity, macroeconomic news , and portfolio adjustments by large institutions. These structural factors make price movements appear to follow a recurring pattern.

Jane Street is a prominent name in the ETF market and is often mentioned during periods of volatility. However, its market-making activities primarily focus on portfolio balancing and risk hedging, rather than actively manipulating prices up or down in any particular direction.

Today's developments are similar to many previous periods: increased leverage, a slight price drop, mass liquidation of positions, and subsequent emergence of various perspectives and opinions.