Amidst ongoing market pressures, real estate assets (RWA) have emerged as one of the few sectors to maintain sustained interest. This market has grown by over 150% this year alone. Furthermore, Chris Yin – co-founder and CEO of Plume – predicts the industry could expand tenfold to twentyfold in both value and user base within the next year, even with conservative forecasts.

In an interview with BeInCrypto, Yin explained why RWAs are gaining increasing attention these days. He also discussed why physical assets may remain Vai throughout the next market cycle.

Why investors are choosing RWAs in 2025.

In the fourth quarter, the crypto market as a whole faced significant pressure, causing many investors to withdraw. However, the RWA sector continued to attract both retail and institutional investors .

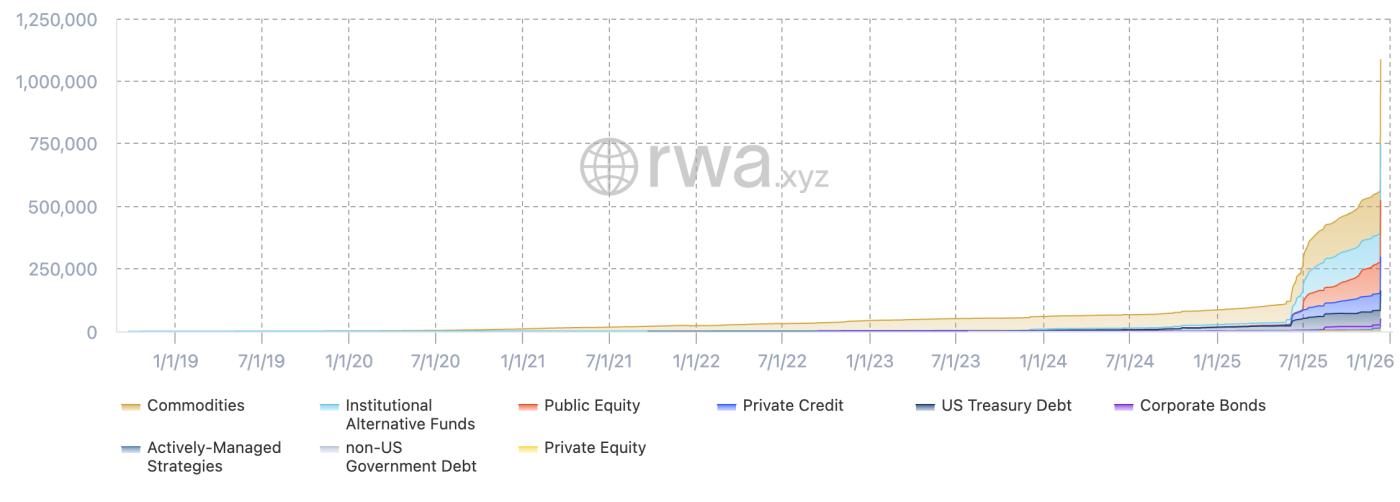

Data from RWA.xyz shows that the total number of RWA asset holders has increased by 103.7% over the past month. This indicates increasing participation despite generally weakening market sentiment.

Growth in the number of RWA holders. Source: RWA.xyz

Growth in the number of RWA holders. Source: RWA.xyzAccording to Plume's co-founder ,

“The RWA market is being driven by interest across various sectors in on-chain assets tied to real-world conditions. This provides a certain degree of certainty as we are experiencing a period that is neither quite a bear market nor a bull market.”

Against the backdrop of a continuing economic downturn, Yin emphasized that investors are becoming increasingly cautious about the volatility and stability of yields in the decentralized finance (DeFi) market. Conversely, RWAs are increasingly XEM as a more stable source of returns.

As profits from DeFi decline and the economic situation remains uncertain, tools like tokenized Treasury or private credit are becoming more attractive due to their more reasonable risk-reward ratios.

He also pointed to the rapid growth of stablecoins this year as evidence of the overall market shift towards stability, especially for institutional investors.

“Stablecoins are the foundation for bringing RWAs on-chain, so the logical next step would be to develop coins and yield opportunities related to RWAs. Everyone wants to own high-quality assets that generate safe, stable, and reliable returns. Stablecoins are helping to attract users, and the yield opportunities are the driving force behind both institutional and retail investors getting into these assets,” Yin Chia with BeInCrypto.

As investors continue to seek stability, Yin also acknowledged that one of the biggest concerns associated with RWAs is the potential for identity verification (KYC) and legal compliance risks associated with this asset class.

However, he argues that Tokenize actually helps strengthen legal control, as identity verification processes, access control, and transfer restrictions can all be programmed at the asset level.

Instead of relying on a fragmented Off-Chain Capital process, issuers can directly apply rules to the Token, enabling real-time participation checks, automated reporting, and transparent audit traceability.

RWA is predicted to continue to be a key market theme in the next cycle.

Although RWA continues to grow strongly this year , Yin believes that this sector will remain a focus of both traditional and decentralized finance in the next market cycle.

He noted that currently, most of RWA's value is concentrated in Tokenize T-bills. However, as the market develops further, Yin expects private credit assets to be more widely adopted, along with many other alternative asset classes.

These assets may include mining rights for minerals such as oil, as well as GPUs, energy infrastructure, and many other tangible assets.

"The ultimate winners will be those who recognize new opportunities, rather than simply focusing on repeating what has worked before," the leader remarked.

Recently, last month, Coinbase Ventures also identified perpetual RWAs as one of the areas they want to invest heavily in by 2026, demonstrating strong confidence in the sector. Yin also stated that the company remains optimistic about perpetual RWAs.

According to Yin, perpetual markets typically have volume far exceeding spot markets, primarily due to a significantly superior user experience. He explains that perpetual markets are easy to use, allowing investors to implement flexible investment strategies and easily leverage their investments.

“At Plume, we’ve always believed that to successfully bring RWAs onto the chain, we need to build an experience that fits the habits of crypto users. For spot RWAs, the key factors are permissionlessness, interoperability, and liquidation – which is what we’ve done with the Nest protocol on Plume. As for perpetual RWAs, crypto investors are very familiar with this trading method, and we are really optimistic about this format and its potential for RWAs,” he Chia .

Yin also highlighted the increasingly powerful innovation in the field of yields on real assets, arguing that this is changing how yields are accessed and traded online.

For example, Yin refers to the Pendle protocol, where the separation of Capital and yield has created a new market structure for the flow of funds from Tokenize RWAs.

Besides specific protocols, Yin Chia that RWAs are currently thriving in many different blockchain ecosystems.

"The wave of RWAs on Solana is showing what happens when yields become fast, programmable, and accessible to millions of users," he added.

Yin added that Solana 's processing speed and scalability make it one of the few platforms capable of supporting high-frequency profit-making activities at scale. This capability is increasingly important, especially as real-world assets (RWA) are shifting from passive income generation tools to more actively traded, flexible profit-generating models.

“The current experiments are like a XEM for the next chapter of the RWA field. The tools that bring RWA to the blockchain in a crypto-centric way are really exciting. For example, perpetual RWA is a potential segment, alongside many new asset classes like sports/Pokemon trading cards with Tradible, new financial models like insurance with Cork, and many more,” he Chia .

Alongside this expansion, Yin emphasized that legal compliance and proper guidance will always be top priorities. He stated that projects focused on compliance will have a greater chance of long-term success, especially as governments and large organizations increasingly demand clearer regulations and standards for issuing assets on the blockchain.

What can the RWA industry offer in 2026?

Looking ahead, Yin points to three key factors he believes will drive explosive growth in the RWA sector over the next 12 months. First is the continued expansion of users and the increasing rate of RWA adoption.

Yin stated that the total value of RWA has more than tripled compared to the previous year. The number of RWA holders has also grown more than sevenfold.

“The launch of Plume’s mainnet has more than doubled the number of RWA holders, and I think this trend will continue to accelerate in the traditional crypto community, as RWA still only accounts for a very small fraction of the total crypto market Capital ,” he commented.

Next, Yin emphasized the growing consensus among organizations and regulators. He noted that governments, financial institutions, and technology companies are now heavily focused on Tokenize assets. While these initiatives often take time to implement, Yin believes that if successful, billions of dollars worth of assets will be moved onto the blockchain.

Finally, the Plume representative mentioned that global macroeconomic factors are currently "favorable winds" for this sector.

“The current macroeconomic situation is driving everyone, both inside and outside the blockchain, to constantly seek opportunities for stable returns. Alternative asset classes are also gaining more attention, and these factors will naturally drive the growth of RWAs on the blockchain,” he Chia with BeInCrypto.

Yin concluded that there was no reason to believe this momentum would slow down, especially with so many driving factors currently in place. According to him,

"Seeing value and user base grow 10-20 times in the next year is just a conservative scenario that we should expect."

Thus, RWA is gradually becoming a fundamental market shift, not just a short-term trend in 2026. With increasing acceptance, diversified asset classes, and a clear development direction, this sector is projected to play a central Vai in the next phase of growth for the blockchain economy.