Source: SEC, DTCC official websites; compiled by: Jinse Finance

On December 12, 2025, the U.S. Securities and Exchange Commission (SEC) issued a statement on its website stating that the SEC’s Division of Trading and Markets had issued a no-action letter to the Depository Trust Company (DTC), a subsidiary of the Depository Trust and Clearing Corporation of the United States (DTCC), allowing the tokenization of real-world assets held in custody by DTC.

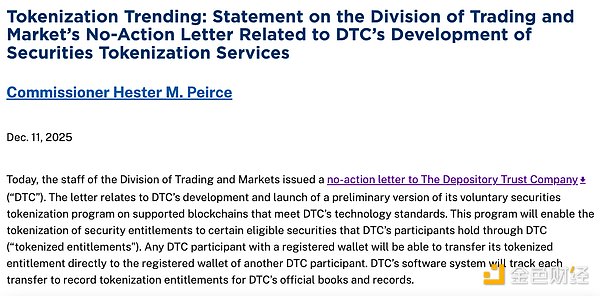

Today, the U.S. Securities and Exchange Commission's (SEC) Department of Trading and Markets issued a no-action letter to the Depository Trust Company of America (“DTC”) . The letter concerns a preliminary version of DTC’s voluntary securities tokenization program developed and launched on blockchains that comply with DTC’s technical standards. The program will allow DTC participants to tokenize their interests in certain eligible securities held by DTC (“Tokenized Interests”). Any DTC participant with a registered wallet can directly transfer their tokenized interests to another DTC participant’s registered wallet. DTC’s software system will track each transfer and record the tokenized interests in DTC’s official ledger and records.

What kind of company is DTCC?

DTCC (Depository Trust & Clearing Corporation) is a leading provider of post-trade market infrastructure for the global financial services industry. It is a financial institution jointly owned and managed by industry participants, including banks, brokers, and mutual funds. DTCC's core function is to automate, centralize, and standardize the processing of financial transactions, thereby reducing risk, increasing transparency, and improving efficiency. It plays a crucial central role in the U.S. capital markets, ensuring the safe and efficient completion of securities transactions.

Main functions and business:

DTCC offers a wide range of services through its various subsidiaries, including:

Clearing and Settlement Services: Providing clearing, settlement, and risk management services for a variety of asset classes, including equities, corporate and municipal bonds, government and mortgage-backed securities, and over-the-counter derivatives.

Securities custody and asset servicing: Through its subsidiary Depository Trust Company (DTC), it provides centralized custody and asset servicing of securities, holding securities electronically and reducing the need for physical securities certificates.

Risk Management: As a central counterparty (CCP) in many transactions, it manages and reduces counterparty risk through netting (which reduces the total amount of transactions and payments by approximately 98%) and transaction guarantees.

Transaction Reporting and Data Services: Provides transaction reporting services for derivatives and securities financing transactions through its Global Transaction Data Repository (GTR) service.

Innovative Services: Actively exploring the field of digital assets and tokenization, it recently received approval from the U.S. Securities and Exchange Commission (SEC) to provide tokenization services on the blockchain.

In short, DTCC is the core behind the scenes ensuring the smooth operation of the global financial system, ensuring that trillions of dollars in securities transactions can be completed safely and efficiently every day.

How does DTCC plan to tokenize?

Depository Trust & Clearing Corporation (DTCC) announced that its subsidiary, Depository Trust Company (DTC), has received a No-Action Letter from the U.S. Securities and Exchange Commission (SEC), authorizing it to offer a new service in a controlled production environment, in accordance with federal securities laws and regulations, to tokenize real-world assets held in custody by DTC. DTC expects to launch the service in the second half of 2026.

The SEC has authorized DTC to provide tokenization services to DTC participants and their clients on a pre-approved blockchain for a period of three years. According to the letter, DTC will be able to tokenize real-world assets, with the digital versions enjoying the same rights, investor protection, and ownership as traditional assets. Furthermore, DTC will provide the same level of resilience, security, and robustness as traditional markets.

This authorization applies to a range of specific highly liquid assets, including the Russell 1000 index (representing the 1000 largest U.S. companies by market capitalization), ETFs tracking major indices, as well as Treasury bonds, bonds, and stocks . The SEC's "no action" letter is significant because it allows the DTC to launch the service faster than it would otherwise have, provided certain conditions are met and relevant statements are made.

“I want to thank the SEC for their trust in us. Tokenization of the U.S. securities markets promises many transformative benefits, such as enhanced collateral liquidity, new trading models, 24/7 trading, and programmable assets, but this new digital age can only be realized with a solid foundation of market infrastructure,” said Frank La Salla, President and CEO of DTCC. “We are very excited to have this opportunity to further empower the industry, our participants, and their clients, and drive innovation. We look forward to collaborating with all stakeholders in the industry to securely and reliably tokenize real-world assets, thereby driving the future of finance for future generations.”

The SEC’s “no action” letter is a key driver of DTCC’s broader strategy to advance a secure, transparent, and interoperable digital asset ecosystem and fully realize the potential of blockchain technology.

“Since its inception, DTCC has been committed to pioneering groundbreaking technologies, reshaping market landscapes, and maintaining market integrity. Our tokenization initiative will take this a step further, enabling us to collaborate with stakeholders across the industry to usher in the digital market era,” said Brian Steele, President and Managing Director of Clearing and Securities Services at DTCC. “We will work with our clients and the wider market to tokenize securities with uncompromising security, a sound legal foundation, and seamless interoperability—all built on the resilience that has underpinned traditional markets for decades.”

To support this strategy, DTCC's tokenization scheme will enable DTC participants and their clients to leverage a comprehensive suite of tokenized services powered by DTCC's ComposerX platform suite . This will allow DTC to create a unified liquidity pool across the traditional finance (TradFi) and decentralized finance (DeFi) ecosystems, building a more resilient, inclusive, cost-effective, and efficient financial system.

“Distributed ledger technology (DLT) has the potential to reshape markets, and DTCC is leading this transformation through innovative initiatives and bold solutions,” said Nadine Chakar, Managing Director and Head of Digital Assets at DTCC. “Our suite of DLT products will underpin DTCC’s tokenization services and will work with the industry to drive the development of a new digital asset ecosystem for everyone.”

DTC has collaborated with participants, peers, and technology providers for nearly a decade to explore and promote the use of DLT technology to identify how it can enable market participants to leverage the advantages of blockchain and tokenization, including liquidity (the ability to transfer assets across jurisdictions and time zones regardless of standard trading hours or holidays), decentralization (market participants have more direct access to their assets), and programmability (the ability to use smart contracts to optimize asset transfers or distributions), all of which enjoy the same protection and accountability mechanisms provided by DTC.

Under SEC authorization, DTC is permitted to offer limited production-level tokenization services on L1 and L2 network providers. DTCC will provide more details in the coming months regarding listing requirements (including wallet registration) and the L1 and L2 network approval process.