and iWhen "DonAlt" speaks, the market tends to listen, and for good reason. More than a year ago, he said XRP would go up from below $0.70, and he was right. The token went on a 700% historic rally.

Now the trader is looking at the bigger picture, not just one coin, and in his opinion the whole market is going to go up. Unless — and it is a big unless — something happens in the U.S. economy.

The timing of his comments is in one of the strangest periods we have had recently. For the first time in over 10 years, PPI inflation is set to be known before CPI inflation. The latest jobs report shows just how fragile things are right now.

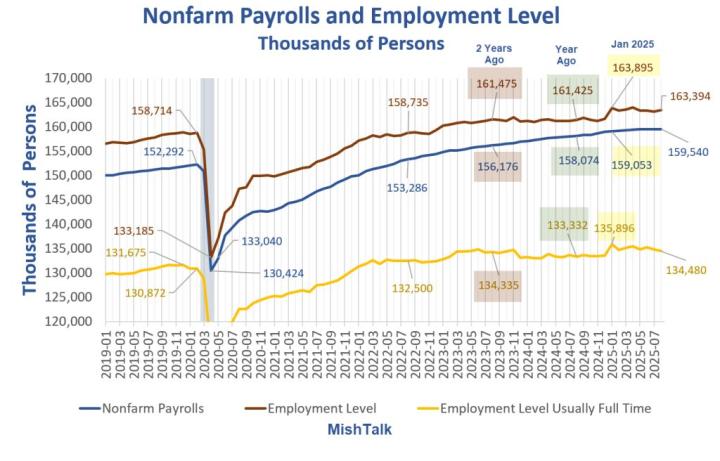

The payroll growth was expected to be around 75,000 but ended up being less than 22,000. June's figures were revised so much that what looked like a gain turned out to be a net loss of 13,000.

My general view on the market is it's poised to go up

— DonAlt (@CryptoDonAlt) September 8, 2025

The only way in my mind in which it doesn't is if something in the US properly breaks

Just need to pray that the US admin might be dumb enough to break something but not dumb enough to keep it broken

All this creates a stagflation backdrop — a situation in which prices keep climbing while the economy cools down. Then businesses have to deal with higher costs because demand is down, which leads to weaker earnings, softer guidance and thinner equity valuations.

"Keep it broken"

Investors may react with their usual "bad news is good news" burst, hoping weak data might unlock easier policy, but that optimism will be quickly replaced by a more serious view.

There are some bright spots, like Broadcom's earnings, but elsewhere things are not looking so good. Nvidia has already fallen by almost 10% since late August, small caps are struggling and there is not much risk appetite.

DonAlt's message is straightforward: the market can rise, but only if the U.S. avoids doing something it cannot fix quickly.