This week will be a short one for the US economic calendar, as traditional financial markets (TradFi) will be closed on Monday due to the Labor Day holiday.

However, some US economic data will be released later and could impact Bitcoin (BTC) and the cryptocurrency market. Meanwhile, Bitcoin price continues to show weakness, with Ethereum (ETH) also falling after losing support at $ 4,400.

US Economic Indicators Crypto Traders Need to Watch This Week

Traders looking to protect their crypto portfolio this week can do so by getting ahead of the following events.

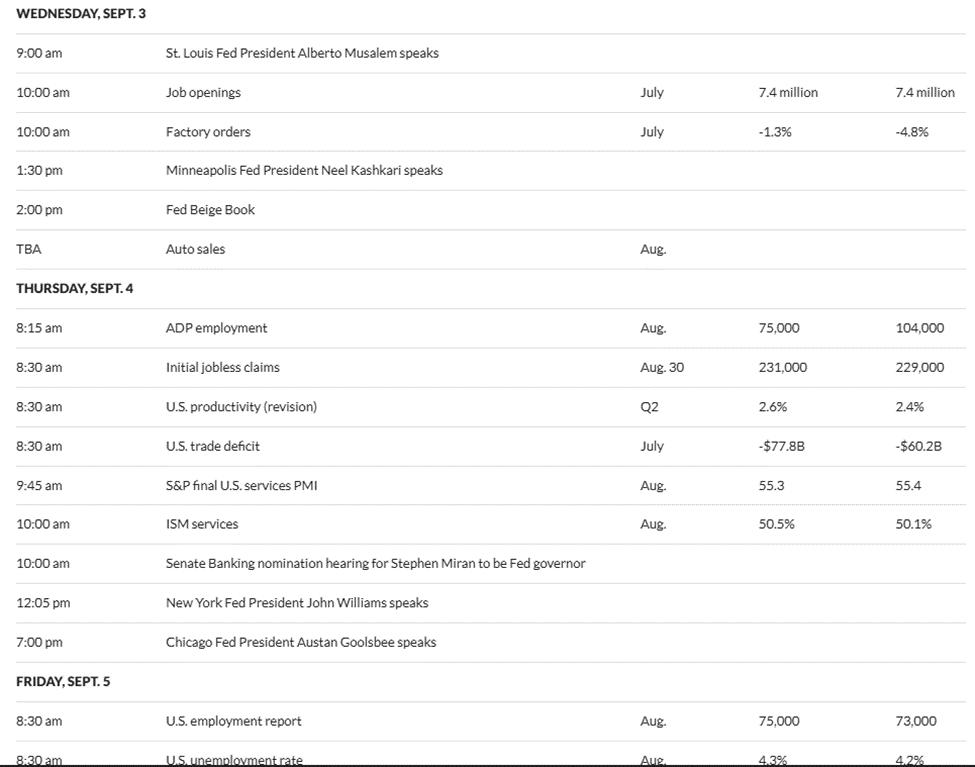

US economic signals this week. Source: MarketWatch

US economic signals this week. Source: MarketWatchJOLTS

First on the list of important US economic data that could influence Bitcoin sentiment this week is the job vacancy report, released by the Bureau of Labor Statistics. This macroeconomic event will take place on Wednesday, September 3, 2025, after the previous JOLTS report showed 7.4 million job vacancies in June and 7.8 million in May.

July data on U.S. job vacancies, hiring and firings could hit 7.4 million, the same as June , according to economists surveyed by MarketWatch.

If true, this would indicate a stable labor market, keeping Federal Reserve (Fed) policy “higher for longer.” This would support the dollar and curb liquidation expectations and could put Bitcoin under mild pressure, absent other macroeconomic factors.

ADP Jobs

Another U.S. economic event this week is the ADP jobs report, considered a more comprehensive and official measure. It is a private sector survey based on payroll data from its clients.

This US economic data, due out on Thursday, showed that the number of jobs created in July was 104,000, much higher than economists' forecast of 82,000. However, economists predicted a further decline, with August expected to be 75,000.

This points to a continued decline in hiring, signaling cooling demand for labor. A weaker labor market weakens the dollar and lowers yields, boosting liquidation -sensitive assets like Bitcoin and cryptocurrencies.

Traders often view weaker ADP reports as a positive signal for digital assets, predicting risk-on flows and stronger demand for alternatives to traditional markets.

However, if the decline sparks recession fears , short-term volatility could hit cryptocurrencies before liquidation expectations fuel long-term growth.

Initial unemployment claims

Additionally, initial jobless claims, released every Thursday, are also on the list of U.S. economic data to watch this week. They measure the number of Americans who filed for unemployment insurance for the first time last week.

There were 229,000 initial jobless claims in the week ending August 23, with economists now expecting claims to rise to 231,000 last week.

A rise in jobless claims could signal economic weakness, which would increase the likelihood of the Fed adopting easier monetary policy.

Such a change could lead to a weaker dollar, increasing Bitcoin’s appeal as an alternative asset . However, if the surge in claims is seen as a temporary fluctuation, the impact on Bitcoin could be limited.

Meanwhile, analysts say a strong labor market, coupled with Dai inflation , could allow interest rates to remain high. However, signs of a cooling employment sector could soften the Fed’s path.

Job report

Finally, with labor market data increasingly becoming an important macro factor for Bitcoin , Friday’s US jobs and unemployment reports could also impact the crypto market this week. Both of these data are important indicators of the health of the economy.

The jobs report is forecast to show 75,000 new jobs, up from 73,000 in the previous month, while the unemployment rate is expected to rise from 4.2% in July to 4.3% in August.

Such a result in the employment data would suggest that hiring is improving slightly, suggesting resilience in the labor market. Meanwhile, a slight increase in the unemployment rate would indicate that there are more people looking for work than there are jobs being created, pointing to potential surpluses.

Markets typically view this as a neutral to dovish signal, where there is growth, but rising unemployment suggests conditions are softening.

For Bitcoin and cryptocurrencies, this could support interest rate cut expectations ( liquidation friendly), bringing a slight uptrend despite the increase in employment.