Chainlink (LINK) is one of the strongest coins on the market, up more than 109% over the past year. In the last three months alone, LINK's price has increased by about 68.5%.

However, the past week has been a weak one, with the Token falling more than 9%, and both on chain metrics and technical charts suggest that the year-long uptrend may be losing momentum, at least for now.

Profit-taking pressure increases as investors are making profits

One of the clearest signs comes from the percentage of LINK supply in profit, which remains at an all-time high.

As of August 29, 2025, nearly 87.4% of the circulating supply is in profit, close to the recent peak of 97.5% on August 20, 2025. This peak coincided with a LINK price surge to $26.45, which quickly fell more than 6% to $24.82 the following day.

Chainlink Price and Profitable Supply: Glassnode

Chainlink Price and Profitable Supply: GlassnodeLooking further out, a similar pattern emerges. On July 27, 2025, the profitable supply reached 82.8%, just before LINK corrected from $19.23 to $15.65, a 19% drop. The current reading of nearly 87% is again uncomfortably high, suggesting a high risk of profit-taking.

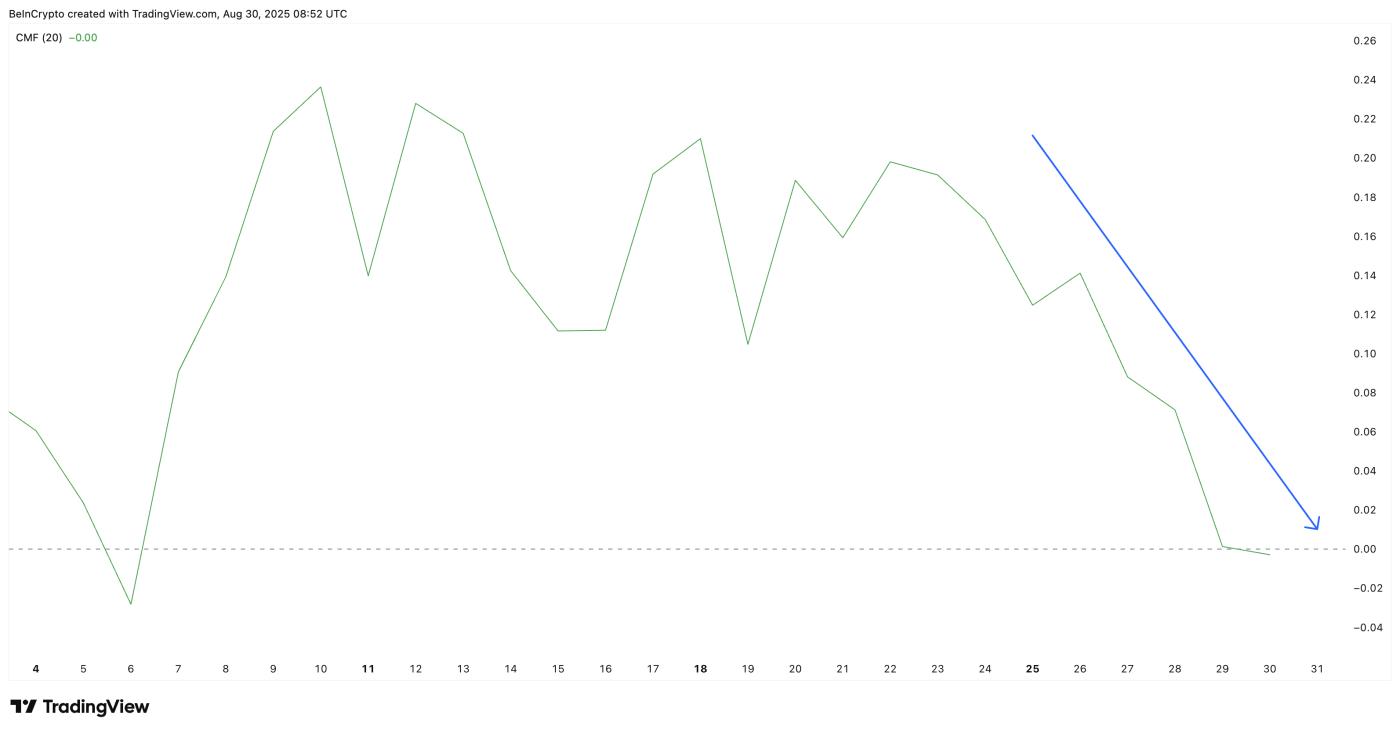

LINK Capital Capital Show Signs of Decline: TradingView

LINK Capital Capital Show Signs of Decline: TradingViewAdditionally, Chaikin Money Flow (CMF), which tracks Capital and outflows, has been trending down since August 22, 2025, and finally slid below zero on August 29, 2025 for the first time since August 6, 2025. This move into negative territory signals waning buying pressure and Capital , reinforcing the possibility of a downside correction.

For TA Token and market updates: Want more Token news like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Chainlink (LINK) Price Action Indicates Bearish Exhaustion

The daily chart reinforces this caution. LINK is currently trading at $23.31, within a rising expanding wedge pattern — a structure typically associated with a loss of bullish momentum near the end of a bull run. This “speaker” pattern is notorious for initiating bearish reversals, a risk that LINK is currently facing.

Price Analysis LINK: TradingView

Price Analysis LINK: TradingViewThe key support to watch is $22.84. A decisive break below this level would open up the next downside target at $21.36, and a drop below that could lead to a deeper correction. This could range from 6% to 19%, as experienced during local “Profitable Supply” tops.

On the other hand, if LINK price can reclaim the $25.96 level, it may still attempt to make a move higher.

But even with such a recovery, it cannot completely reverse broader signs of exhaustion unless the Token can convincingly break above $27.88.