This is the third and likely final installment of my Defi & Yield Farming guide. If you haven’t read Part 1 and Part 2, I highly recommend doing that first, as they lay the foundation and groundwork for some of the more advanced concepts we’ll be discussing today.

There’s a near endless array of topics to cover when it comes to DeFi, especially since people are constantly developing new ideas and protocols, so I had to be selective with what to dive into today.

I decided to focus on three main areas, and then end with some more general notes.

The topics for the day are:

Pendle and yield trading

Looping and leveraging

Delta-neutral farming

Additional notes:

Distinguishing yield from protocol fees vs token emissions (real vs ponzi yield)

Timing yield opportunities

Why APR decays as TVL rises

1. Pendle and yield trading

I saw a tweet just a few days ago that said something along the lines of “if you can understand Pendle, you are in the top 1% of defi users”. Sounds about right to me.

It took me a long time to get my head around what Pendle is and does, and how it does what it does. Hell, I literally used it about 18 months ago, and didn’t really understand it. I was just YOLO’ing and following what others were suggesting.

Since then though I have taken the time to read and research and actually understand how it works, and it’s pretty damn mindblowing. And I still don’t understand all of it. I’ll try to make it as simple as possible, but please understand that the subject matter is complex, and if you don’t get it at first, you’re in good and plentiful company.

And if you were one of the people who did immediately get it, congrats, you’re a genius, wp, don’t look too poorly upon the rest of us mere mortals.

So, what Is Pendle?

Pendle is a DeFi protocol that unlocks a multitude of financial options relating to yield, and it does this by separating yield-bearing tokens into two tradeable components. It’s one of the few projects creating a fixed income market in crypto (similar to zero-coupon bonds in traditional finance if you’re familiar with those) while also unlocking yield speculation and other strategies.

Basically, it allows you to split an asset that earns yield into two assets: one that represents the yield, and another that represents the underlying token without any yield.

How does it work?

Step 1: Deposit a Yield-Bearing Asset

You begin by depositing a token that generates yield over time, such as stETH (liquid staked ETH) or kHYPE (liquid staked HYPE). These are called yield bearing tokens.

Step 2: The token gets split into PT and YT

Pendle wraps the yield bearing token and splits it into:

Principal Token (PT) – represents the initial principal, redeemable 1:1 at maturity

Yield Token (YT) – represents all future yield including points that the underlying token generates before maturity

This creates two new ERC-20 tokens, each tradeable or usable independently.

For example: you deposit 1 kHYPE into Pendle:

You receive 1 PT-kHYPE (matures at 1 kHYPE)

And 1 YT-kHYPE (entitles you to all the staking yield until maturity, at which point the yield token will be worth $0)

Step 3: Do fun stuff!

Okay so Pendle lets you split a yield bearing token into two tokens, that’s cool, but what does that actually allow you to do? Lots of fun things!

Fixed Yield

Probably the easiest to explain and most simple example is that you can now lock in a fixed yield over a time period. Normally when you stake a token in crypto (such as ETH or HYPE), the staking returns will vary depending on a variety of factors. You might end up getting 2%, or 3% or 5%, or something else. It’s hard to make plans around such a wide range of yields, and especially if you’re working with large amounts of capital, those small differences in percentages can add up to very meaningful amounts of money.

With Pendle, you could now sell your Yield Token (YT-kHYPE in the above example) and immediately receive an amount of money that represents that amount of yield. Even better than that, since any protocol points also go to the YT, you can also sell those and earn a much higher yield (as we’ll see in an example soon).

You can do this if you want security and certainty of a fixed yield, but you can also do this if you think the yield is liable to drop over time, or if the points will result in a lacklustre airdrop — thus resulting in a greater profit than if you simply held the token and earned the yield yourself.

Trade/speculate on yield

Another thing splitting a token into PT and YT allows a person to do is long just the yield part of a token. If you think the yield for staked ETH is going to go from 2% to 4%, then you can buy the yield token today for 0.02 ETH and either sell it when the staking yield goes up, or earn greater rewards by holding it until maturity.

An important note to reiterate is that all the “points” for airdrop farming purposes go to the holder of the YT (yield token).

What this means is that if you are bullish on an ecosystem and think they’re going to have a massive airdrop, you can basically buy points.

Provide liquidity

You can also add liquidity to a liquidity pool to facilitate the trading of all of the above, earning fees, tokens, points, and more, along the way — but not without some risk.

I honestly don’t even 100% fully understand how their liquidity pools work myself. I tried watching this video earlier to wrap my head around it, and it just made my head hurt. But again, if you’re a genius, or just more tech and finance minded than yours truly, please give it a watch and hopefully you’ll grasp it.

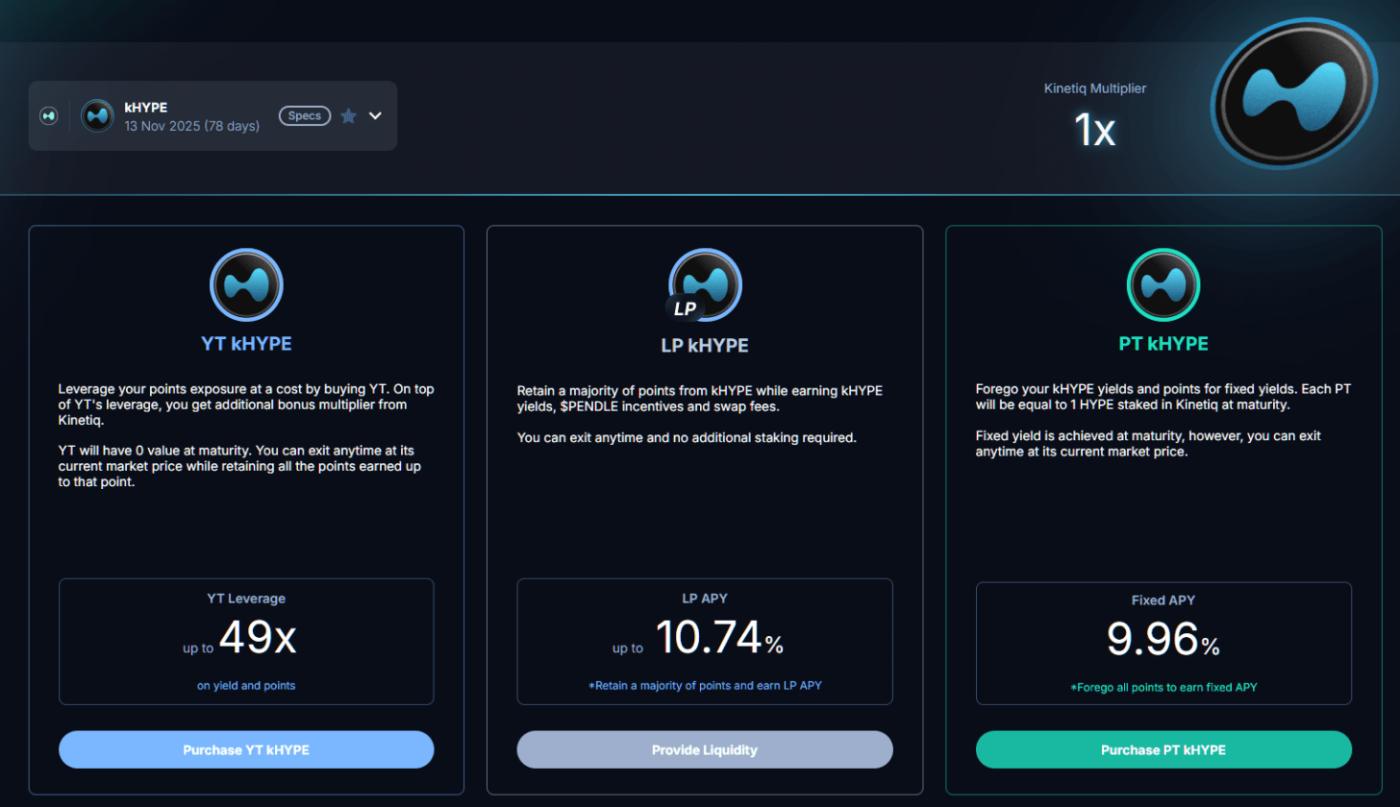

To put all of this together, have a look at the screenshot below as an example for some of the different ways you can utilize Pendle for Kinetiq, a liquid staking protocol on HyperEVM:

You can buy the YTs and receive 49x the points for the same amount of money as if you simply bought kHYPE (note that you’ll lose most of the money at maturity, since the staking yield is very low and most of the value comes purely from the points).

You can provide liquidity to the liquidity pool and earn points, yield, and swap fees (but not without some level of risk).

You can forego any right to future yield or points and lock in a 9.96% fixed yield — very good if you’re not bullish on the protocol airdrop, or simply because you want a stable strategy.

HOPEFULLY this all made some sort of sense to you. I really tried to make an insanely complex topic as simple as possible.

Pendle has many many many many many more markets, and you can really explore an insane amount of strategies on there. It’s one of the most powerful tools in the whole of DeFi, and those who understand it can earn significant yields with large amounts of capital, safely, and securely.

A great resource for learning more about Pendle and how it works is their very own education guide, and also their official docs.