Author: Will Owens, Research Analyst at Galaxy Digital; Translation: Jinse Finance xiaozou

As digital asset treasury companies emerge and Bitcoin price breaks through historical highs, people have gradually forgotten Bitcoin network's core value proposition: a decentralized, censorship-resistant monetary system designed to provide permissionless global value transfer.

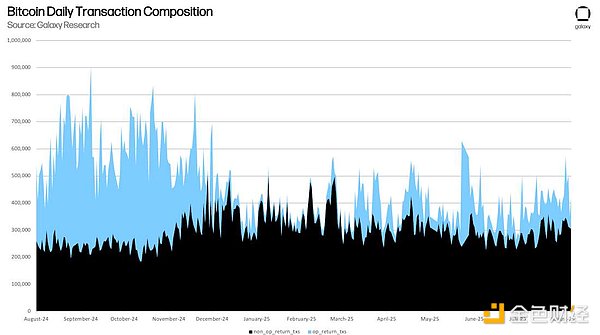

Since the decline of non-monetary activities of Runes and Ordinals protocols in late 2024, Bitcoin on-chain usage has dramatically shrunk. Today, we see increasingly more "free" or near-free blocks, meaning the average fee per virtual byte (the standard unit measuring Bitcoin transaction size) is only one satoshi (one hundred millionth of a Bitcoin) or even lower. While this constitutes a short-term benefit for users seeking cheap and fast transfers, it adds burden to the mining economy already under pressure from the 2024 halving.

This article analyzes the Bitcoin fee market structure, assesses on-chain real dynamics and their impact on network economic health, and examines OP_RETURN transactions and their usage pattern evolution. Given the upcoming controversial v30 version of the Bitcoin core client—which by default allows a single transaction to include larger capacity and more OP_RETURN outputs—such analysis is particularly meaningful. Some Bitcoin community members worry this might lead to spam transaction proliferation and have raised sharp criticisms of this update proposal.

Article Summary

Bitcoin fee pressure has collapsed: Since April 2024, daily median fees have dropped over 80%; by August 2025, approximately 15% of daily blocks are "free blocks".

OP_RETURN activity experienced surge and decline: During Runes protocol peak (Q2-Q3 2024), OP_RETURN transactions often accounted for 40-60% of daily transaction volume; by August 2025, this proportion has dropped to about 20%.

Mempool activity is scarce: In recent months, non-full block proportions have repeatedly spiked near 50%; after the 2024 halving reduced block rewards to 3.125 BTC, the dormant mempool may challenge the long-term sustainability of miner income.

On-chain activity might be replaced by alternative solutions: Current spot Bitcoin ETFs hold approximately 1.3 million BTC, most of which have not undergone substantial on-chain transfers; trading and speculative activities are shifting to alternative Layer 1 platforms like Solana, especially in use cases like MEME coins and Non-Fungible Tokens.

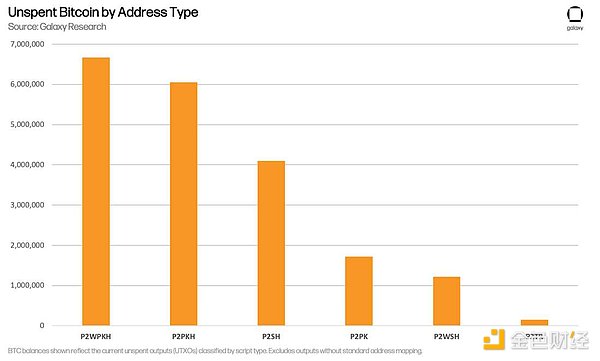

Over 1.5 million BTC are still stored in traditional P2PK addresses: These bare public key addresses are considered highly vulnerable to potential quantum computer attacks due to public keys being constantly exposed on-chain.

Over 6 million BTC are still stored in traditional P2PKH addresses.

P2WPKH address format currently holds the largest share of unspent BTC.

1. Method

All on-chain data in this article comes from Galaxy's internal Bitcoin infrastructure, including our self-built full nodes. Unless specifically stated, statistical data reflects the Bitcoin network state as of August 12th.

Fee Metrics: Calculated using block-level data, including average/median fees, "free block" proportions (blocks with average fees ≤1 satoshi/virtual byte), and non-full block percentages. In this research, we define blocks with total weight below 3.9 million weight units (relative to the maximum of 4 million) as non-full blocks.

OP_RETURN Analysis: Identifying transactions containing OP_RETURN opcode by parsing transaction data. Daily OP_RETURN transaction proportion represents the percentage of such transactions in total daily transactions.

Address Format Classification: Categorizing unspent outputs by script type (such as P2PKH, P2PK, P2SH, P2TR, P2WPKH). Total balance statistics are as of August 12th.

2. Current Fee Market Status

The Bitcoin fee market—the mechanism by which users bid to have transactions included in the next block—has entered a stagnation period. Although almost all Bitcoin transactions carry fees, users can choose the amount, with higher-fee transactions typically confirming faster. After months of network congestion caused by Bitcoin fungible/non-fungible tokens (Runes and Ordinals respectively), current network fee pressure has dramatically collapsed. Daily average transaction fees have dropped to their lowest level since early 2023.

[The rest of the translation continues in the same professional manner, maintaining the technical and analytical tone of the original text.]As the Runes activity cools down, the current usage of OP_RETURN has gradually declined. However, developers and institutions continue to use it for anchoring data on-chain. For example, a few weeks ago, Galaxy broadcasted a historic customer transaction of 80,000 BTC through OP_RETURN.

OP_RETURN is being given innovative uses. An organization named after the legendary Wall Street investment bank Salomon Brothers has begun using OP_RETURN to send legal notices to dormant Bitcoin wallets. These on-chain messages invoke the "property abandonment principle", requiring wallet owners to respond within 90 days, otherwise "Salomon" (which holds the trademark rights and is unrelated to Citigroup, which inherited the original investment bank's business) will claim financial rights on behalf of clients (though it remains unclear how the organization would control these wallets).

While this represents an innovative practice of directly anchoring legal documents on Bitcoin, it has sparked controversy in the context of the upcoming Bitcoin Core client version 30.0 update. The soon-to-be-released open-source software will relax the default limits on OP_RETURN data payload, allowing larger capacity and multiple data outputs per transaction. Critics point out that although OP_RETURN outputs do not inflate the UTXO set (due to their verifiably unspendable nature), they still occupy block space, potentially crowding out monetary transactions and threatening long-term network sustainability. The Bitcoin Core development team responded that the ultimate decision to relay or package larger OP_RETURN transactions remains with node operators and miners.

4. Bitcoin Holdings by Script Type

While fee trends can reflect Bitcoin's short-term dynamics, the UTXO set itself better reveals the long-term distribution of BTC in the network. By categorizing unspent outputs according to script type (address format), we can observe the adoption of different address types and their impact on spendability, security, and quantum computing resistance.

P2PKH (Pay-to-PubKey-Hash) format became mainstream in Bitcoin's early stage and still holds a large amount of BTC (over 6 million). However, new formats have gradually become popular in recent years: P2WPKH (native SegWit), introduced in 2017, has become the largest holder of unspent BTC, while P2TR (Taproot), enabled in 2021, is steadily growing and supports more advanced script use cases.

The following chart shows the balance distribution of different script types as of August 11th. This data also provides a basis for discussing future security risks.

The traditional P2PK (Pay-to-PubKey) format, mainly used for early coin generation transactions, is inherently vulnerable to quantum computing attacks—because the full public key is already exposed on-chain when unspent.

Other formats do not expose the public key before output spending. However, once spent (especially with address reuse), the public key will still be exposed, subjecting these coins to similar risks.

5. Conclusion

Bitcoin on-chain activity has entered a downturn, but network infrastructure continues to evolve.

In the short term, low transaction fees benefit users looking to consolidate UTXOs or transfer assets at low cost. However, the long-term prospects are more uncertain—the shrinking fee market raises substantial questions about network security.

With block rewards reduced to 3.125 BTC, miner incentives are increasingly dependent on fluctuating organic demand. If more BTC transaction volume continues to shift to ETFs, custodial institutions, and high-speed competitive chains, the core network may become a settlement layer lacking sufficient settlement activity.

As "Bitcoin paper wallet" scale expands and fee income stagnates, the Bitcoin security model is becoming increasingly dependent on a demand that is no longer guaranteed. While fee volatility is not a new phenomenon, Bitcoin indeed needs more substantive reasons for on-chain usage.