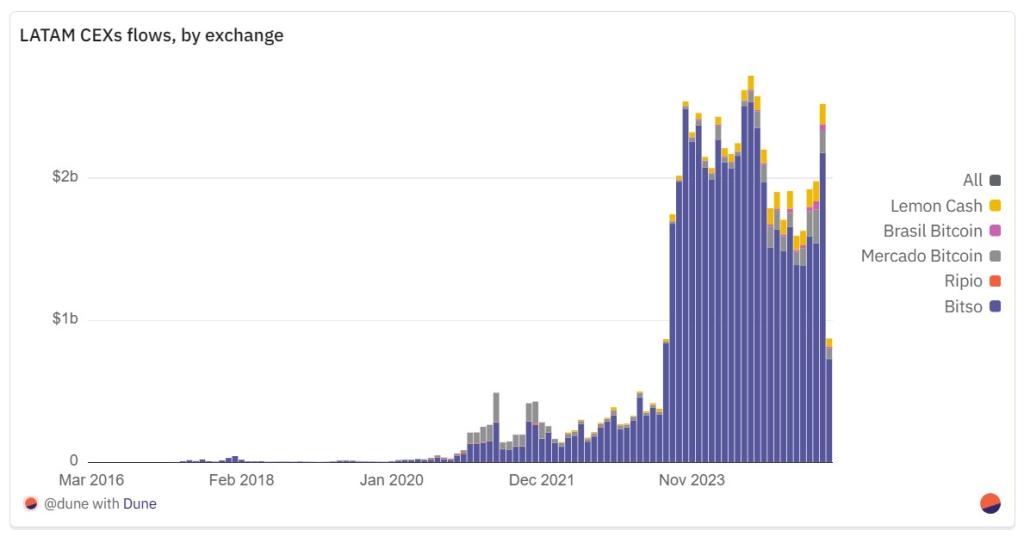

Capital flow through CEX in Latin America surged from $3 billion to $27 billion in three years, reflecting market maturity and real utility needs.

Centralized cryptocurrency exchanges (CEX) in Latin America have undergone a spectacular transformation, from a niche market to an important financial infrastructure pillar in the region. According to a new report from Dune Research, the total capital flow through these exchanges has skyrocketed from $3 billion in 2021 to $27 billion in 2024, equivalent to an 800% growth.

This explosion shows a clear trajectory of maturity and centralization, as the initially fragmented ecosystem has developed into integrated platforms serving both retail and institutional customers. In this growth picture, Bitso emerges as an absolutely dominant force.

Since 2021, Bitso has maintained its leading position, but its scale has expanded remarkably. In 2021, Bitso processed around $2 billion, occupying 66% of the regional market share. Three years later, this number has increased by 1,160% to over $25.2 billion, and the exchange's market share has risen to a dominant 93%. Other exchanges like Mercado Bitcoin and Lemon Cash have also seen significant growth, but cannot compare to Bitso's scale.

Importantly, according to the Dune report, this growth is not entirely dependent on the prolonged price cycle in the global market. Instead, it reflects a profound shift towards applications with real utility. Use cases such as cross-border trade, remittance payments, and currency risk mitigation against inflation are the primary drivers pushing people and businesses in the region towards digital assets.

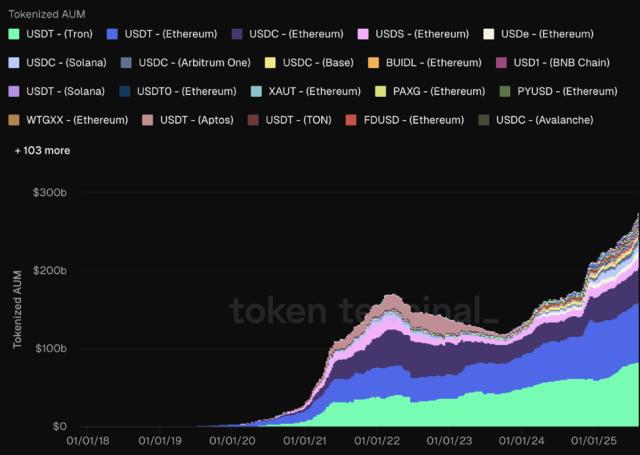

In terms of blockchain infrastructure, Ethereum-based transactions absolutely dominate, with over $45.5 billion in capital flow recorded since January 2021, accounting for about 75% of the total volume. The TRON network stands in second place with $12.5 billion, mainly due to low transaction costs for stablecoins like Tether (USDT). Solana and Polygon follow with more modest volumes, at $1.45 billion and $1.17 billion respectively.

Ethereum's dominance reflects the maturity of the DeFi and stablecoin ecosystem in the region, particularly the use of USDC and other tokens for payment and value storage. TRON's second-place position shows the importance of transaction costs in daily payment applications, with USDT on TRON becoming a popular choice for small transactions.