The Genius Act has been in effect for less than a month, and an unexpected sniper battle has begun in Washington.

On August 16, the American Bankers Association (ABA), leading 52 banks, lobbying groups, and consumer organizations, jointly issued an open letter to the Senate Banking Committee, calling for amendments to the Genius Act.

The core demand of the joint action directly targets a special clause in the Genius Act, arguing that it poses a threat to the existing U.S. financial system. Behind the joint letter is a multi-party game between new and old forces surrounding regulatory power, credit models, and profit sources. Traditional banking is wary that if the Genius Act is fully implemented in its current form, it may threaten its core position in the financial industry chain.

Background Tracing: The Rise of the Trillion-Dollar Stablecoin Market

The passage of the Genius Act coincides with the exponential growth of the stablecoin market. Over the past three years, the stablecoin market has grown steadily, continuously setting new records. As of August 19, the total stablecoin market size is approaching $267.5 billion. Among them, USDT and USDC occupy over 85% of the market share, with market capitalizations exceeding $165 billion and $66 billion respectively. The highly concentrated market landscape makes the influence of Tether and Circle, the two major stablecoin issuers, not to be underestimated.

Predictions from Standard Chartered Bank and U.S. Treasury Secretary Besent both indicate that under the regulatory framework of the Genius Act, the stablecoin market is expected to reach $2 trillion by the end of 2028. The anticipated explosive growth suggests that stablecoins are experiencing a role transformation from "crypto speculative tools" to "U.S. Treasury bond major buyers".

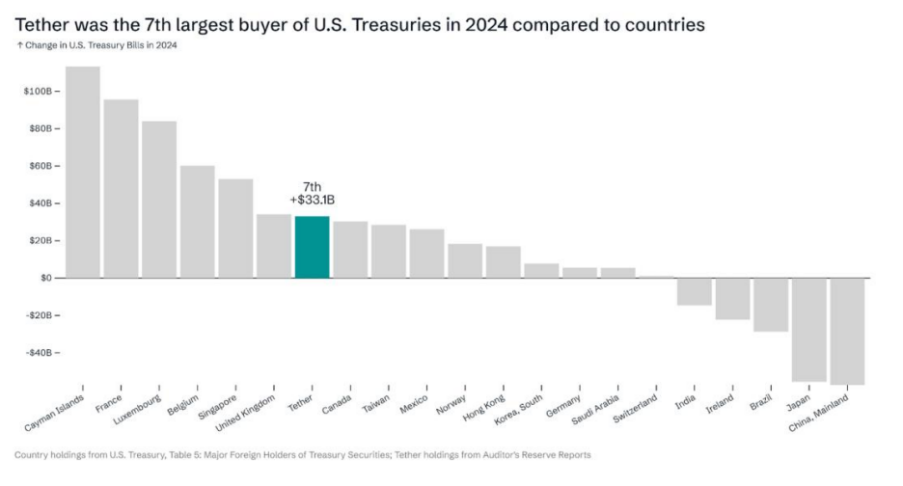

As the Genius Act imposes strict restrictions on stablecoin reserve assets, short-term U.S. Treasuries have become the ideal choice for stablecoin issuers due to their national credit endorsement, extremely low default risk, and high liquidity. Tether has become the seventh-largest U.S. Treasury bond holder, with its U.S. Treasury bond holdings exceeding $120 billion, a figure even higher than some sovereign countries like Germany.

The systematic trend of large-scale U.S. dollar capital converting into U.S. Treasury bond demand brings a stable new "patron" to the U.S. government, which also means that stablecoin development's impact has far exceeded the crypto market's scope, and its impact on U.S. fiscal and global financial landscape is gradually being realized.

Banking Industry's Cry: A Battle for Interests Under Multiple Concerns

The cause of the two-party game is the panic of the TradFi system about the deep structural impact that stablecoins are forming.

Led by the American Bankers Association (ABA), 52 organizations openly expressed serious concerns about the Genius Act in their letter. Although the act generally lays the foundation for banks to issue crypto assets, the banking industry's core demand is to revoke the Section 16(d), which is viewed as a "time bomb". Section 16(d) of the Genius Act gives uninsured state-chartered custodial institutions the space to open stablecoin subsidiaries and operate fund transfers and custody activities nationwide, meaning such institutions can bypass licensing requirements and regulatory provisions of their operating locations.

The banking industry believes that Section 16(d) provides certain non-bank entities with "special permissions" to operate across states like federally regulated banks, without bearing equivalent consumer protection and prudential regulatory obligations. Such regulatory arbitrage would not only destroy the balance between state and federal institutions in the U.S. financial system but also weaken states' power to protect their consumers. Under the traditional framework, uninsured custodial institutions must obtain approval and be subject to regulation from the hosting state when operating in other states. However, Section 16(d) of the Genius Act breaks this balance, opening a back door for institutions trying to escape strict regulation and increasing financial risks consumers face in case of institutional bankruptcy.

The banking industry's deeper concern is that stablecoins will threaten the low-cost deposit foundation on which they survive. If stablecoin issuers or their affiliated platforms attract users through rewards or yields, massive deposit funds may flow from the traditional banking system to the stablecoin system. A U.S. Treasury report estimates that if stablecoins are authorized to provide yields, it could cause up to $6.6 trillion in deposit outflows, with an even greater impact on small and medium-sized banks.

An article in the ABA banking industry journal also points out that if the stablecoin market reaches $2 trillion, it will lead to approximately $1.9 trillion in bank deposit losses, close to 10% of total U.S. bank deposits. Such large-scale deposit outflows will trigger a series of chain reactions:

1) Banks must seek new funding sources to fill deposit gaps, such as high-cost financing methods like repurchase agreements, interbank lending, or issuing long-term debt. According to ABA DataBank calculations, if 10% of core deposits flow out, banks' average funding costs may rise by 24 basis points. 2) Deposits are the source of bank lending. Deposit outflows will directly weaken banks' credit supply capacity, forcing them to reduce credit supply. 3) Rising funding costs and bank credit contraction will translate into higher loan rates, thereby increasing borrowing costs for small and medium-sized enterprises and households, suppressing real economic activity. Beyond the structural threat of deposit outflows, widespread stablecoin adoption will also erode banks' profit sources. Moody's analysts believe that as stablecoins penetrate the payment domain, banks' service fee income in cash management, clearing, and wire transfers will face long-term pressure. The essence of their contest is competition between different business models: banks profit through maturity mismatching by "accepting low-cost deposits - lending high-interest loans"; stablecoin issuers earn interest income by "absorbing US dollars - purchasing high-yield US bonds". Although the Genius Act prohibits stablecoin issuers from directly paying interest to users, their cooperating CEXs can still attract funds by offering rewards to circumvent the ban, enhancing the siphoning effect on bank deposits. For example, USDC has collaborated with exchanges like Coinbase and Binance to launch time-limited deposit incentive activities. Interestingly, the American Bankers Association (ABA)'s stance has not been consistent. While opposing some provisions of the Genius Act, they have also publicly praised the act for opening a "tokenized deposit" issuance channel. The ABA's contradictory attitude reflects the banking industry's critical strategy: they do not oppose crypto assets but wish to participate in a manner favorable to themselves, namely gaining control of the crypto economy through innovations like "tokenized deposits" while strenuously blocking non-bank entities from receiving equal treatment, ensuring their core position in the financial industry chain. Although competition between the two sides is intensifying, the business world is not just a zero-sum game of "you die, I live". Banking giants like JPMorgan have already begun exploring new business models such as "tokenized deposits", combining traditional banking's credibility with blockchain's instant settlement technology, blurring the lines between banks and stablecoin issuers. Banks are not just competitors of stablecoin issuers but can also become their important partners. With the implementation of the Genius Act, compliance-focused stablecoin issuers need to deposit reserve funds in banks and undergo periodic audits, bringing new deposit sources and opportunities for banks. Simultaneously, banks can provide custody, settlement, and compliance services, becoming critical infrastructure providers for stablecoin issuers. New and old forces are not incompatible but represent a "co-opetitive" relationship of complementing each other's strengths. However, it is certain that some TradFi institutions unable to keep up with new changes will disappear in the historical wave of tokenization. Rather than being revolutionized, it is better to self-innovate.