Have you recently seen a 12% annual yield for USDC on some platforms? This is not just a gimmick. In the past, stablecoin holders were often "zero-interest depositors," while issuers invested the deposited funds in safe assets like US Treasury bonds and notes, earning massive profits. USDT/Tether and USDC/Circle were no exception.

Background: Binance Announces USDC Lending Benefit of "4% Annual Interest" - Can Savings Benefit of 12% Be Arbitraged?

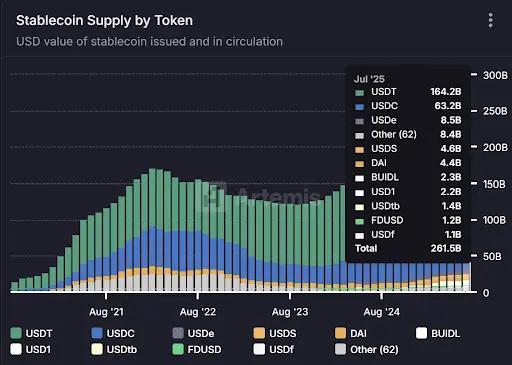

Now, the exclusive bonus that previously belonged to the issuers is being redistributed. Besides the USDC interest subsidy war, more and more new-generation yield-bearing stablecoin projects are breaking down this "yield wall," allowing token holders to directly share the interest income of underlying assets. This not only changes the value logic of stablecoins but may also become a new growth engine for the RWA and Web3 tracks.

[The rest of the translation follows the same pattern, maintaining the structure and translating the text to English while preserving any technical terms and proper nouns as specified.]Ethena's USDe

As the leading player in this wave of yield-bearing stablecoins, Ethena's stablecoin USDe naturally takes the spotlight, with its supply recently breaking the 10 billion mark for the first time. Ethena Labs' official data shows that at the time of writing, USDe's annualized yield remains as high as 9.31%, and it was previously even maintained at over 30%. The high yield primarily comes from two sources: - ETH's LSD staking yield; - Funding rate income from Delta hedging positions (i.e., short positions in perpetual futures); Among these, the former is relatively stable, currently fluctuating around 4%, while the latter completely depends on market sentiment. Therefore, USDe's annualized yield to some extent directly depends on the network-wide funding rate (market sentiment).Ondo Finance USDY

Ondo Finance, a star project in the RWA track, has always focused on bringing traditional fixed-income products to the on-chain market. Its USD Yield (USDY) is a tokenized note backed by short-term US Treasury bonds and bank demand deposits, essentially an anonymous debt certificate that can be held and earn returns without real-name verification. USDY essentially provides on-chain funds with near-Treasury-level risk exposure while giving tokens composability, which can be combined with DeFi lending, staking, and other modules to further amplify returns. This design makes USDY an important representative of current on-chain money market funds.PayPal's PYUSD

When PayPal's PYUSD emerged in 2023, it was primarily positioned as a compliant payment stablecoin, with Paxos as the custodian, anchored 1:1 to US dollar deposits and short-term Treasury bonds. After 2025, PayPal began attempting to overlay a yield distribution mechanism on PYUSD, especially in collaboration with certain custodian banks and Treasury investment accounts, feeding back some underlying interest income (from US bonds and cash equivalents) to token holders, trying to connect payment and yield attributes.MakerDAO's EDSR/USDS

MakerDAO's dominance in the decentralized stablecoin track needs no elaboration. Its USDS (an upgraded version of the original DAI deposit rate mechanism) allows users to directly deposit tokens into the protocol and automatically receive interest linked to US bond yields without additional operational costs. Currently, the Savings Rate (SSR) is 4.75%, with deposit scale approaching 200 million tokens. Objectively, the rebranding also reflects MakerDAO's repositioning of its brand and business model - evolving from a native DeFi stablecoin to an RWA yield distribution platform.Frax Finance's sFRAX

Frax Finance has always been the most proactive DeFi project in approaching the Federal Reserve, including applying for a Fed master account (allowing holding US dollars and direct transactions with the Fed). Its staking vault sFRAX, which utilizes US Treasury bond yields, purchases US Treasury bonds through a brokerage account opened in collaboration with Lead Bank in Kansas City, tracking Fed rates to maintain correlation. At the time of writing, sFRAX's total staking volume has exceeded 60 million tokens, with the current annualized rate around 4.8%. Additionally, it's worth noting that not all yield-bearing stablecoins can operate stably. For example, the USDM project has announced liquidation, with minting permanently disabled, only maintaining limited primary market redemption. Overall, most current yield-bearing stablecoins' underlying allocations are concentrated in short-term Treasury bonds and Treasury bond reverse repurchases, offering rates mostly in the 4%-5% range, aligning with current US bond yield levels. As more CeFi institutions, compliant custody platforms, and DeFi protocols enter this track, such assets are expected to occupy an increasingly important share in the stablecoin market.III. How to View Stablecoin Yield Enhancements?

As mentioned earlier, the core of yield-bearing stablecoins' ability to provide sustainable interest returns lies in the robust allocation of underlying assets. After all, the yield sources of most such stablecoins are extremely low-risk, stable RWA assets like US Treasury bonds. From a risk structure perspective, holding US bonds is almost equivalent to holding US dollars, but US bonds generate an additional annual interest of 4% or even higher. Therefore, during the high US bond interest rate cycle, these protocols invest in these assets to generate returns, subtract operational costs, and distribute part of the interest to token holders, forming a perfect "US bond interest - stablecoin promotion" closed loop. Holders only need to hold stablecoins as a certificate to obtain the "interest income" of US bonds as underlying financial assets. Currently, the yield of US short and medium-term Treasury bonds is close to or exceeds 4%, so most fixed-income projects supported by US bonds have rates in the 4%-5% range. Objectively, this "hold and earn" model is naturally attractive. Ordinary users can let idle funds automatically generate interest, DeFi protocols can use it as high-quality collateral to further derive lending, leverage, perpetual, and other financial products, and institutional funds can enter on-chain under a compliant, transparent framework, reducing operational and compliance costs. Therefore, yield-bearing stablecoins are likely to become one of the most easily understood and implementable applications in the RWA track. Because of this, RWA fixed-income products and stablecoins based on US bonds are rapidly emerging in the current crypto market, with competitive landscapes already taking shape from on-chain native protocols to payment giants and Wall Street newcomers. Regardless of future US bond interest rate changes, this wave of yield-bearing stablecoins born from the high-interest rate cycle has already transformed the stablecoin value logic from "anchoring" to "dividends". In the future, when we look back at this moment, we might find that it's not just a watershed in stablecoin narrative, but another historical turning point in the integration of crypto and traditional finance.[Disclaimer] The content described in this article is only for industry observation and information sharing, and does not constitute any investment advice. There are fraudulent and high-risk projects in the recent market under the guise of stablecoins or high yields. Please remain vigilant and be responsible for your investment decisions by thoroughly researching before making any investment or trading decisions.