Original Title: 《 Monthly Outlook: Altcoin Season Cometh 》

Author: Coinbase, David Duong

Translated by: Odaily, Azuma

Core Summary

· We remain optimistic about the third quarter of 2025, but our view on the Altcoin season has evolved. We believe the current market conditions suggest that as September approaches, the market may shift towards a comprehensive Altcoin season - which we typically define as at least 75% of the top 50 Altcoins outperforming Bitcoin in the last 90 days.

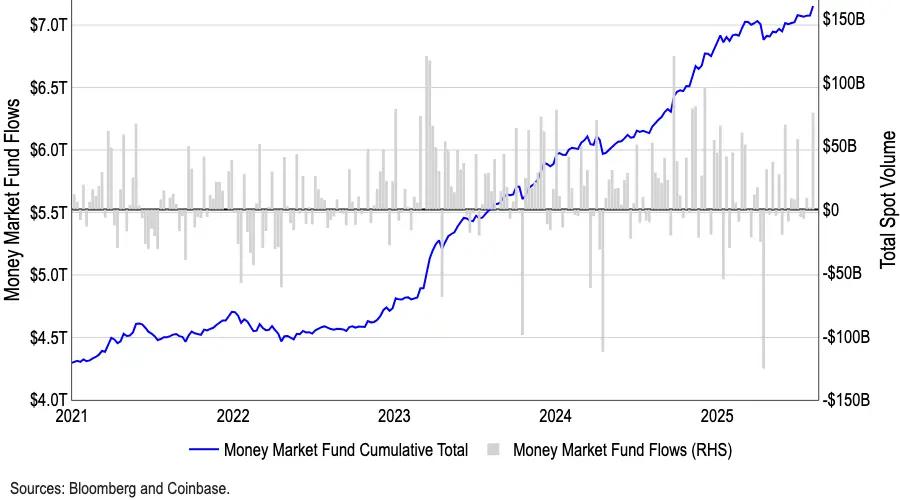

· While many argue whether the Fed's September rate cut will lead to a local top in the cryptocurrency market, we disagree. With a large amount of retail funds currently idle in money market funds (over $7 trillion) and other channels, we believe the Fed's loose policy may release more retail funds to participate in the market in the medium term.

· Focus on Ethereum (ETH). The divergence between the "overall sluggishness of CoinMarketCap's Altcoin season index" and the "50% growth in total Altcoin market cap since early July" largely reflects increased institutional interest in ETH. This is due to the demand for Digital Asset Treasury (DAT) and the growth of stablecoin and real-world asset narratives.

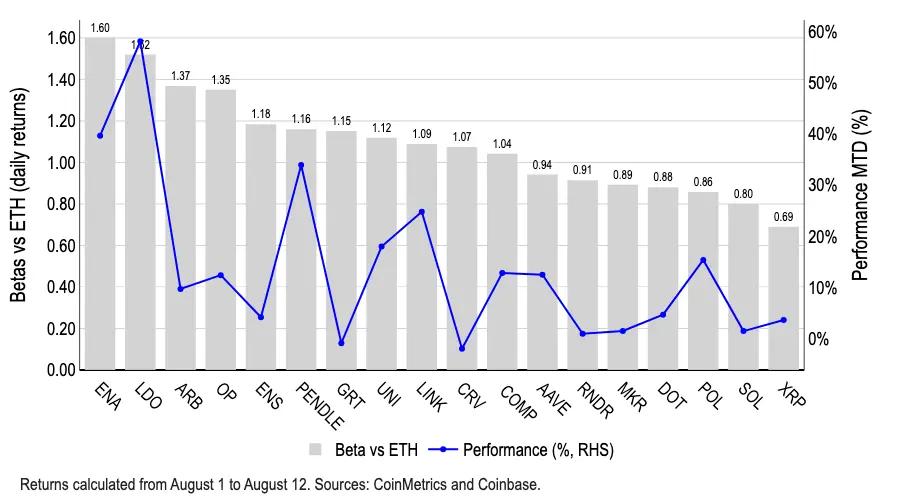

· Although tokens like ARB, ENA, LDO, and OP show higher beta values relative to ETH's daily returns, only LDO seems to have significantly benefited from the recent ETH price increase (up 58% so far this month). In the past, Lido provided a relatively direct ETH exposure due to the nature of liquid staking. Additionally, we believe LDO's rise is supported by the SEC's statement - under certain conditions, liquid staking tokens do not constitute securities.

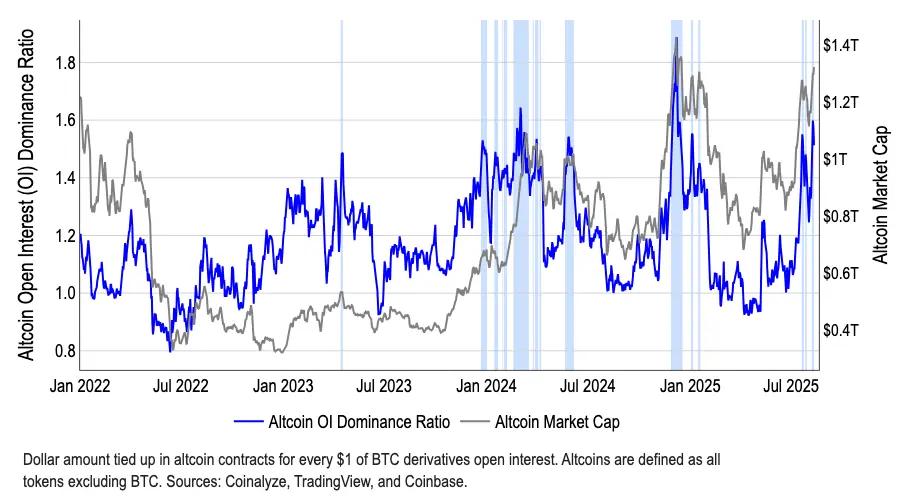

Note: Sharp increase in Altcoin open interest ratio.

Our optimistic outlook is based on a macro perspective and expected regulatory progress. We previously noted that changes in the global M2 money supply index often lead Bitcoin prices by 110 days, pointing to a potential new liquidity cycle in late Q3 or early Q4 of 2025. This is crucial because for institutional funds, the narrative still seems to revolve around large cryptocurrencies, while Altcoins are primarily supported by retail investors.

Notably, the size of US money market funds has reached a record $7.2 trillion, with cash balances decreasing by $15 billion in April, which we believe drove the strong performance of crypto and risk assets in subsequent months. Interestingly, cash balances have rebounded by over $20 billion since June, contrasting with the concurrent rise in cryptocurrency prices. Typically, cryptocurrency prices and cash balances are negatively correlated.

Note: Money market fund asset size has exceeded $7 trillion.

We believe this unprecedented cash reserve reflects missed opportunity costs, primarily due to:

1. Increased uncertainty in traditional markets (caused by issues like trade conflicts);

2. High market valuations;

3. Ongoing concerns about economic growth.

However, with the Fed set to implement rate cuts in September and October, we believe the attractiveness of money market funds will begin to diminish, with more funds flowing into cryptocurrencies and other high-risk asset classes.

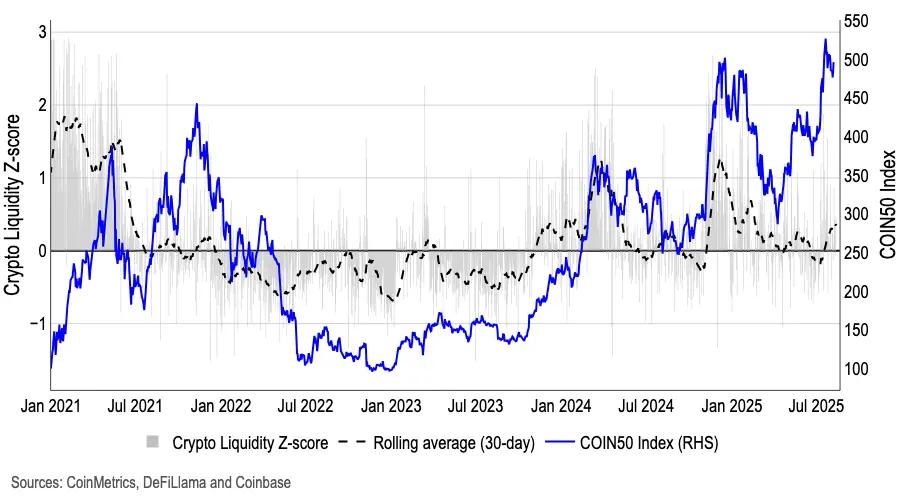

In fact, our cryptocurrency liquidity-weighted Z-score indicator (based on stablecoin net issuance, spot and perpetual contract trading volume, order book depth, and free float) shows that liquidity has begun to recover in recent weeks after six months of decline. The growth of stablecoins is partly due to a clearer regulatory environment.

Note: Initial signs of cryptocurrency liquidity recovery.

ETH Beta Options

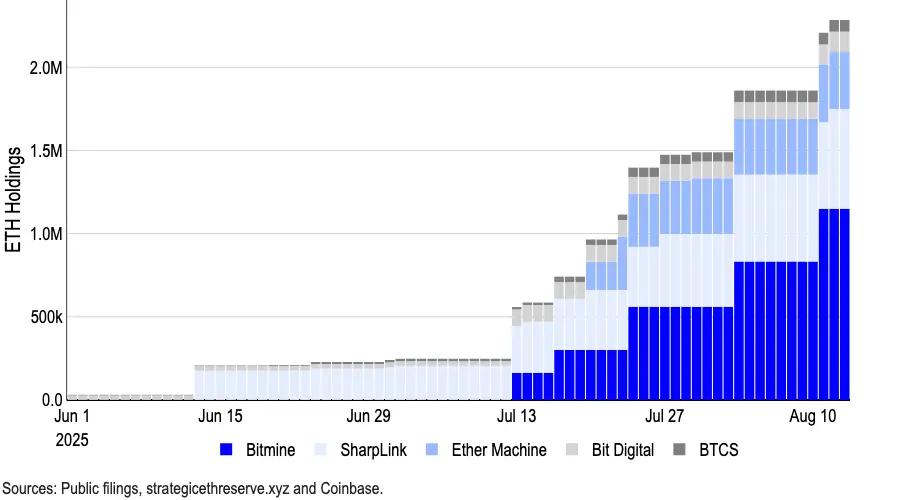

Meanwhile, the divergence between the "Altcoin season index" and "Altcoin total market cap" primarily reflects growing institutional interest in Ethereum (ETH) - supported by Digital Asset Treasury (DAT) demand and stablecoin and real-world asset (RWA) narratives. Bitmine Immersion Technologies alone has purchased 1.15 million ETH and still plans to continue accumulating through financing of up to $20 billion. Another DAT leader, Sharplink Gaming, currently holds about 598,800 ETH.

Note: ETH holdings of some Digital Asset Treasury companies.

As of August 13, top ETH treasury companies collectively hold approximately 2.95 million ETH, over 2% of the total ETH supply (12.07 million).

Among Beta options with higher returns relative to ETH, ARB, ENA, LDO, and OP are at the forefront, but only LDO seems to have significantly benefited from the recent ETH price increase (up 58% so far this month). Due to the nature of liquid staking, Lido has always provided a relatively direct ETH exposure, with LDO's current beta relative to ETH at 1.5 - a beta value greater than 1.0 theoretically means the asset is more volatile than the benchmark, potentially amplifying gains and losses.

Note: Beta values of some Altcoins relative to ETH.

We believe LDO's price increase is also supported by the SEC's statement on liquid staking on August 5. SEC Corporate Finance staff noted that when liquid staking entities provide services that are essentially "ministerial" and staking rewards are distributed 1:1 according to the agreement, the activities do not constitute securities issuance or sale. However, it's important to note: yield guarantees, autonomous re-staking, or additional reward mechanisms may still trigger securities classification. The current guidelines only represent staff views - future committee positions or litigation cases may change this interpretation.

Conclusion

We maintain a constructive outlook for the third quarter of 2025, but our assessment of the Altcoin season has evolved. The recent decline in Bitcoin's dominance indicates funds are initially rotating to Altcoins, but a comprehensive Altcoin season has not yet formed. However, with the rise in Altcoin total market cap and early positive signals from the "Altcoin season index", we believe the market is creating conditions for a more mature Altcoin season potentially arriving in September. This optimistic judgment is based on both macro factors and expected regulatory progress.

Click to learn about ChainCatcher's job openings

Recommended Reading: