- Technical indicators show short-term overbought conditions, but the medium to long-term trend remains intact, with the 20-day moving average at 4025 USDT as a key support level

- Institutional funds flowing in (single-day ETF net inflow of $520 million) offset whale profit-taking selling pressure

- Layer 2 innovation and asset tokenization vision will drive ETH into a trillion-dollar valuation track after 2030

ETH Price Prediction

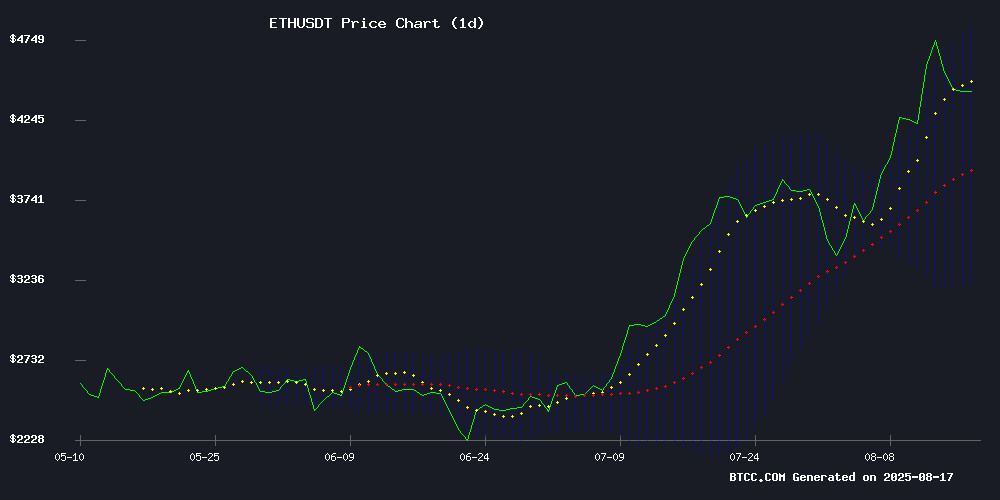

ETH Technical Analysis: Short-term Correction Pressure Coexists with Long-term Support

According to BTCC financial analyst Emma's technical analysis, ETH's current price is 4403.60 USDT, slightly above the 20-day moving average of 4025.16, indicating a still bullish medium-term trend. However, the MACD indicator shows a negative value (-400.60/-238.68), and the price is near the upper Bollinger Band at 4837.58, potentially facing short-term correction pressure. The key support level is at 3212.75 (lower Bollinger Band), and if this level holds, there is still a chance to challenge the historical high.

Market Sentiment Divergence: Whale Profit-taking vs. Institutional Fund Inflow

BTCC analyst Emma points out that ETH is facing a tug-of-war between bulls and bears: on one side, whales have profited $20.68 million through staking, with an unprecedented unstaking queue creating selling pressure; on the other side, BlackRock's ETH ETF saw a single-day inflow of $519.8 million, and Google lifting the non-custodial wallet ban provides market support. The controversial proposal for Base chain's game economic model and Sharp LINK Gaming's $100 trillion asset tokenization market expectation still show long-term confidence in ETH as infrastructure.

Key Factors Affecting ETH Price

Ethereum Faces Selling Pressure as Unstaking Queue Reaches Historic High

According to validatorqueue.com data, Ethereum validators' exit queue has surged to a record 897,599 ETH. The accumulation of these unstaking requests may exacerbate selling pressure on the cryptocurrency, which has already fallen from recent highs.

Bitwise senior investment strategist Juan Leon warns that the continuously growing unstaking queue could negatively impact ETH price. Leon explains: "Tokens like stETH may trade at a discount, reducing their collateral value, triggering risk reduction, hedging operations, and potential liquidations, ultimately leading to spot market selling."

This situation could create a vicious cycle. As ETH borrowing costs rise, leveraged positions through DeFi protocols will become unprofitable, forcing traders to close positions and sell ETH. Leon notes: "The leveraged 'stETH loop' trades through liquidity pools will no longer be profitable, and traders will repay loans by closing positions and selling ETH, creating synchronized selling pressure."

Whale Realizes $20.68 Million Profit Through ETH Staking and Appreciation

A significant Ethereum holder unlocked 10,000 ETH after 18 months of staking, realizing total gains of $20.68 million through price appreciation and staking rewards. The whale's initial Ethereum deposit was worth $25.86 million and grew to $46.55 million before transferring to Kraken exchange.

Profit breakdown shows $18.2 million from ETH price surge and $2.48 million from accumulated staking interest. This occurred after the whale redeemed 10,564 ETH (including 564 ETH rewards) from the Mantle liquid staking protocol, subsequently transferring 10,819 ETH ($47.79 million) to Kraken.

Coinbase's Base Leader Advocates Chain Game Economic Model, Sparking Industry Debate

Coinbase's Ethereum Layer 2 network Base leader Jesse POLlak argues that implementing an on-chain economic model for 'Fortress Heroes' could unlock billions in value. He emphasizes that an open ecosystem allows players to truly own assets, while businesses benefit from third-party innovation. "Lower fees, global participation, and genuine player value capture" are his core arguments.

Opposing views cite Roblox's existing developer-friendly model. AR mor Labs' John Wang highlights Roblox's detailed data analysis and API tools, questioning whether blockchain merely adds complexity without clear benefits. "Why fix what isn't broken?" he directly states, pointing out the current instability in the Web3 gaming sector.

Google Revokes Play Store Ban on Non-custodial Crypto Wallets Due to Community Backlash

Google suddenly revoked its controversial policy that would have removed non-custodial crypto wallets from the Play Store, following strong opposition from the crypto community. The August 13th update to its crypto service licensing framework originally required wallet developers to comply with strict regulatory standards, including FinCEN registration, state banking licenses, or EU MiCA compliance.

The proposed rules targeted major self-custody wallets like MetaMask, Phantom, and Ledger, demanding anti-money laundering (AML) procedures and know-your-customer (KYC) verification—requirements fundamentally opposed to decentralized finance (DeFi) principles. Crypto lawyers and industry participants condemned the move as "monopolistic regulation," arguing it would effectively ban most non-custodial wallets on Android devices.

Community pressure forced Google to unusually withdraw the policy within days, a significant victory for DeFi advocates. This incident highlights the increasing tension between Web3's permissionless spirit and centralized platforms' compliance frameworks as cryptocurrencies become more mainstream.

BlackRock's Ethereum ETF Sees $519.8 Million Single-day Inflow, Trading Volume Surges

BlackRock's Ethereum ETF recorded a massive $519.8 million fund inflow yesterday, demonstrating strong institutional investor demand for cryptocurrencies. The fund's single-day trading volume reached $2.9 billion, fully reflecting the rising market activity.

This wave of capital inflow highlights the market's increased confidence in Ethereum as a core digital asset, with institutional investors accelerating the allocation of cryptocurrency investment tools. Such capital inflows often signal broader market momentum, indicating traditional finance's continued extension into the digital asset realm.

SharpLink Gaming Co-CEO Predicts Asset Tokenization Market Will Reach $100 Trillion, with Ethereum as Infrastructure

SharpLINK Gaming Co-CEO Joseph Chalom predicts that the asset tokenization market will surge to $100 trillion, with Ethereum serving as its infrastructure. In an interview with Golden Finance, Chalom emphasized Ethereum's neutrality, reliability, and programmability as key factors driving decentralized asset tokenization.

Ethereum's trustless ecosystem architecture enables it to fully leverage the tokenization trend, and Chalom believes this will, in turn, accelerate ETH adoption and network growth. This symbiotic relationship highlights Ethereum's evolving role beyond decentralized finance, moving into institutional-grade asset digitization.

Ethereum Briefly Breaks $4,600 Before Slight Pullback

Ethereum briefly touched the $4,600 mark before narrowing its gains, currently trading at $4,603.19, down 0.35% intraday. This second-largest cryptocurrency continues to demonstrate resilience amid overall market volatility.

OKX market data shows this brief breakthrough occurred during Asian trading hours but failed to maintain its position above the psychological resistance level. Traders are monitoring whether eth can consolidate above the $4,500 support level, as the market digests recent price movements.

ETH Price Forecast: Outlook for 2025, 2030, 2035, 2040

| Year | Price Range (USDT) | Key Driving Factors |

|---|---|---|

| 2025 | 3,800-5,200 | ETF Fund Liquidity, Post-Merge Deflationary Effect |

| 2030 | 12,000-18,000 | Institutional Adoption Rate, Layer 2 Transaction Volume |

| 2035 | 25,000-42,000 | Global Settlement Layer Status, Smart Contract Market Share |

| 2040 | 60,000+ | Tokenized Real-World Asset Scale, Web3 User Base |

BTCC analyst Emma emphasizes that ETH will be constrained by market volatility in 2025, but with the continued effect of the EIP-1559 burning mechanism, it may test $5,200 by the end of 2025. By 2030, with the compliance of security tokens, ETH will enter a new growth phase as the preferred issuance platform. The ultra-optimistic 2040 prediction is based on ETH potentially achieving over 80% market share in decentralized financial infrastructure, where a $60,000 valuation would represent only 0.3% of global wealth at that time.