Weekend market is here, and this recent market downturn can be considered one of the largest corrections since the bull market began.

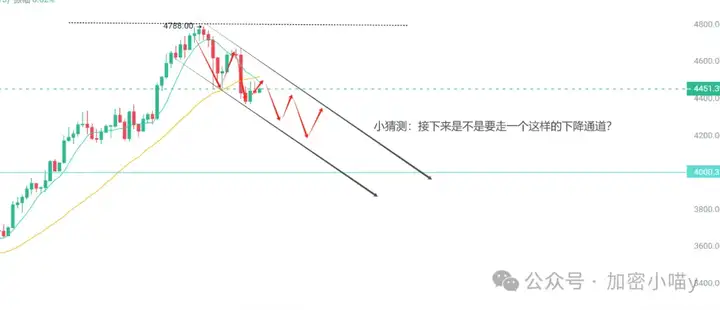

BTC dropped from its historical high of 124,400 to 116,700, and ETH fell from near its previous high of 4,788 to 4,374. However, Altcoins' performance is truly outrageous - they're slow to rise but quick to plummet.

Three consecutive days of decline, a typical wash trading method, rising during the day and washing back at night. Altcoin players are heavily injured, but the most miserable are the TRON party.

Altcoins have always been an "amplifier" in the crypto history - rising fiercely and falling sharply, essentially adding leverage to BTC without the risk of liquidation. Previously, with ample liquidity, mainstream coins would be followed by Altcoins' rise, but this time due to ETF, crypto stocks, and new chain assets dilution, speculative uniqueness is gone, and the Altcoin season has directly turned into an "Altcoin sacrifice". Exchange +V: c13298103401

The driving force behind this is inflation data, each more stimulating than the last.

The latest July PPI jumped directly from 2.6% to 3.7%, a surge so dramatic that Powell's blood pressure would likely spike. More heartbreaking is that this is only July's data, and with Trump's tariff policy in August, inflation will likely surge further.

So the question is - Why was Tuesday's CPI unremarkable, but Thursday's PPI exploded?

The reason is simple: PPI is a production-side cost indicator, while CPI is a consumer-side price indicator. When production costs rise, they will eventually transmit to the consumer side, so PPI is like a "warning light" - once it lights up, CPI is likely to follow.

Does this mean the Federal Reserve will still cut rates in September?

From the interest rate market, the probability of a rate cut remains higher than no cut, mainly because employment data is still weakening. However, this high inflation somewhat casts a shadow on the rate cut, potentially causing increased market volatility in the short term. The 3 AM "Trump meeting", followed by Powell's set Jackson Hole Annual Conference on August 22nd - the Fed's most heavyweight meeting that basically determines the policy direction for the next six months. So next week might enter a "waiting for the shoe to drop" mode, with trading volume likely to significantly decrease.

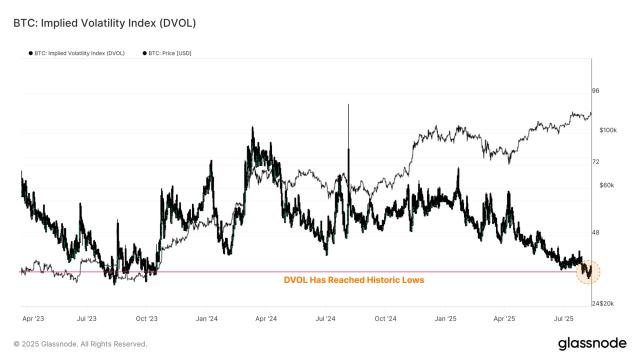

The underlying logic of Bitcoin's rise and fall: Just look at M2

Bitcoin's rise and fall has little to do with mysticism, but is closely related to global money supply (M2). Historically, when M2 rises, Bitcoin often surges one to two months later; when M2 contracts, Bitcoin is likely to pullback.

Now that M2 has ended its six-month growth period and begun to slightly stagnate or even slightly decline, BTC will likely maintain a consolidation, waiting for the next "liquidity injection" to potentially start a new major upward wave.

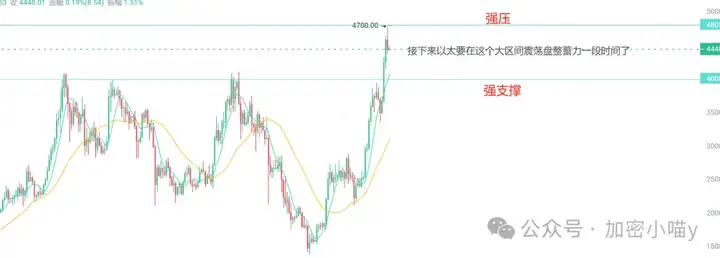

Ethereum's Supporting Force

I still remain bullish on ETH long-term, as many institutions are using fiat financing to accumulate, and won't sell easily. The ETH inventory in exchanges is declining, indicating whales are buying and withdrawing, which is usually a positive signal.

Short-term, pay attention to the strong resistance around 4,800, consider taking profits or even light reverse positions when approaching.

Additionally, most #ETH is in staking status, with unlocking requiring 5-10 days, so next week will be the key point for testing selling pressure.

Technical Key Levels Exchange +Q: 3806326575

- BTC: If the neckline below doesn't break, the bull market pattern remains; try rebounding. If it breaks and can't recover, it might form a Double Top, requiring caution.

- ETH: Focus on 4,800 resistance level and chain unlocking situation.

Don't set a fixed profit target when trading crypto, as this will only increase pressure and lead to chaotic operations. Following the trend is the key:

- M2 liquidity injection → Go all in

- Consolidation period → Wait patiently

Bull markets aren't afraid of corrections, but of lack of planning. Don't easily go all-in on Altcoins, and don't fantasize about getting rich overnight with TRON. There will always be another market cycle. Preserving capital is key to waiting for the true major upward wave. The bull market isn't over, we have plenty of time. Don't be scared away by short-term fluctuations; our opportunity is just beginning.

That's all for now! If you're still unclear about the crypto direction, why not plan with me? Join the VX + Q group for first-hand market analysis, Altcoin opportunities, and individual coin operations... waiting for you, otherwise you might miss the next market wave.