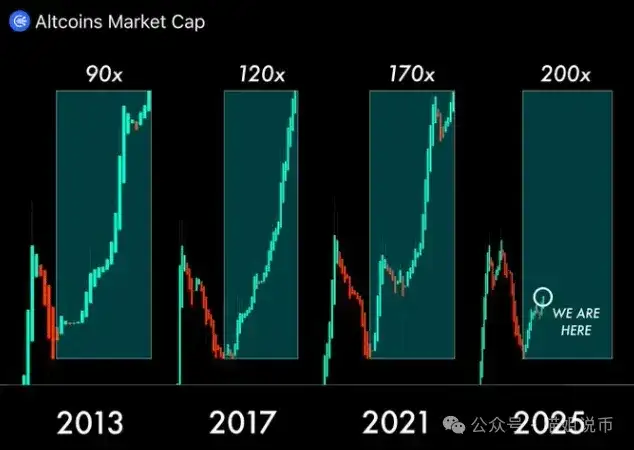

Another bloody night, but the bull market script hasn't changed!

Last night's market was thrilling - Bitcoin and Ethereum both led the decline by over 5%, and Altcoins were even worse, with many directly halved back to pre-liberation levels. Many panicked, thinking the bull market was over, but this is actually a typical psychological warfare - the main forces want to shake off retail investors with weak willpower to lightly charge towards new highs.

The weekly trend remains healthy, ETH just broke through a multi-year resistance, and the new cycle has just begun. The bull market isn't over, and as long as the trend isn't broken, every deep dip is a divine opportunity. Don't forget, panic is often when smart money builds positions.

Let's look specifically at the current market situation:

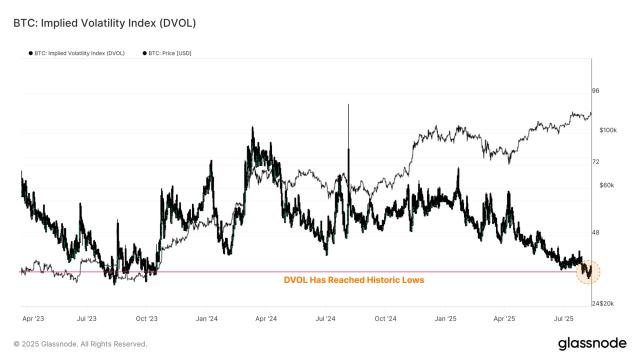

BTC: After briefly creating a new high, #Bitcoin experienced a panic sell-off, with the market blaming Bessant's reserve remarks and PPI data, but these news don't change the overall trend. If the trend isn't broken, you must dare to buy the dips.

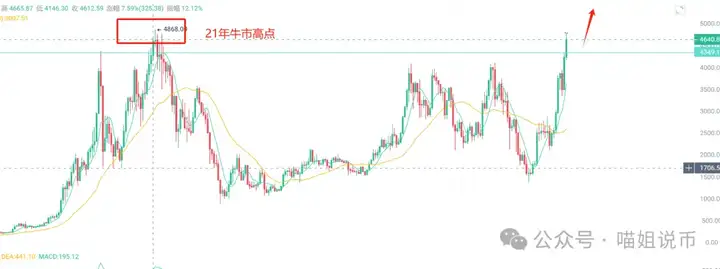

#Ethereum: Standard Chartered directly raises ETH year-end target to 7500

Logic is solid: Exchange+Q: 3806326575

- Institutions and ETFs are frantically buying, absorbing nearly 4% of global circulation since June, twice the speed of BTC's peak.

- Stablecoin regulation is landing, with over half of stablecoin transactions running on the ETH chain.

- Technical upgrades are accelerating, with fee income and capital flow nourishing the ETH ecosystem.

Standard Chartered even estimates ETH could reach $25,000 by 2028, with potential to break historical highs in the third quarter this year.

Regardless, I personally conservatively hold at 5000, will trade in waves later, won't short, will eat big meat in waves, and steady is the real truth.

Next, focus on three signals of wash-out ending:

- Decreasing drop range

- Support not broken

- Rebound signal appears

This is often the starting point of a new round of rise. But remember, choosing the wrong coin = wasted effort, capital is concentrating on leaders, and shit coins will be ruthlessly eliminated

Recent trends of some old projects, briefly sharing my observations:

#AVAX: This year's trend is like a roller coaster, high at the end of last year, giving back many profits early this year. Although the ecosystem is expanding, price has been questioned. Last month it rebounded from 19.09 to 27.38, but was blocked three times at 27. Breaking 25 again this month, outperforming the market, momentum is recovering, short-term support at 22.33, bullish trend unchanged. Exchange+V: c13298103401

#ADA: Cardano was tough this week, breaking through 0.90 resistance, briefly touching 1, with a weekly increase of nearly 20%. The next key is holding 1, if successful, 1.3 is the next stop, possibly even reaching 1.5. Buying sentiment is warming, this rebound has significant potential.

[The rest of the translation follows the same professional and accurate approach]