Written by: Daii

This time, the warning comes from Simon Johnson - a scholar who just won the Nobel Prize in Economics in 2024. This means that his views carry significant weight in both academic and policy circles and cannot be ignored.

Simon Johnson, who previously served as the chief economist of the International Monetary Fund (IMF), has long been concerned with global financial stability, crisis prevention, and institutional reform. In the fields of macroeconomic finance and institutional economics, he is one of the few voices that can influence academic consensus and shape policy design.

In early August this year, he published an article titled "The Crypto Crises Are Coming" on the globally renowned commentary platform Project Syndicate. This platform, known as the "column for global thought leaders," has long provided articles for over 150 countries and 500 media outlets, with authors including political figures, central bank governors, Nobel Prize winners, and top scholars. In other words, the views published here often reach global decision-makers directly.

In the article, Johnson points his finger at a series of recent crypto legislation in the United States, especially the recently passed GENIUS Act and the ongoing CLARITY Act. In his view, these acts appear to establish a regulatory framework for stablecoins and other digital assets, but are actually relaxing key constraints under the guise of legislation. (Project Syndicate)

He states directly:

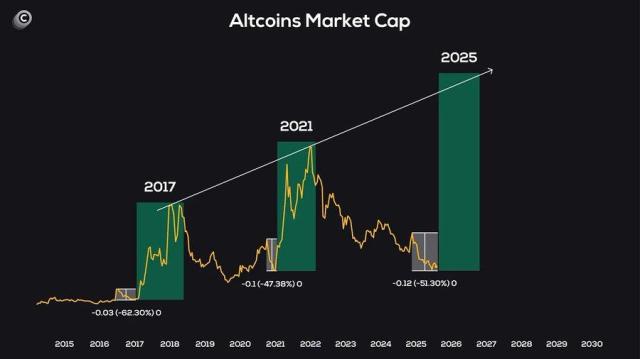

Unfortunately, the crypto industry has acquired so much political power – primarily through political donations – that the GENIUS Act and the CLARITY Act have been designed to prevent reasonable regulation. The result will most likely be a boom-bust cycle of epic proportions.

At the end of the article, he provides a warning conclusion:

The US may well become the crypto capital of the world and, under its emerging legislative framework, a few rich people will surely get richer. But in its eagerness to do the crypto industry's bidding, Congress has exposed Americans and the world to the real possibility of the return of financial panics and severe economic damage, implying massive job losses and wealth destruction.

Here is the English translation:The conclusion is: The regulatory puzzle of cross-border and interstate interactions, once combined with profit motives, often pushes risks towards the softest boundaries.

1.5 Fatal: No "Lender of Last Resort" and Relatively Loose Political Constraints

In institutional design, the GENIUS Act did not establish a "lender of last resort" or insurance backstop mechanism for stablecoins. The bill excludes stablecoins from the commodity definition but also does not include them in the scope of insured deposits - to achieve this, issuers must qualify as insured deposit institutions. As early as 2021, the PWG (President's Working Group on Financial Markets) had suggested only allowing insured deposit institutions to issue stablecoins to mitigate bank run risks, but this recommendation was not adopted in the bill. This means that stablecoin issuers have neither FDIC insurance protection nor access to discount window support during crises, showing a clear divergence from the traditional "bank-style prudential framework". (Congressional Network, U.S. Department of the Treasury)

[The rest of the translation follows the same approach, preserving names and specific terms as instructed, and translating all other text to English.]Even with high-quality reserves, the single point of vulnerability in the redemption path can be instantly amplified on-chain;

The "time gap" between the bank run speed and disposal speed determines whether it will evolve from a local risk to a system disturbance.

This is why Johnson discusses "stablecoin legislation" together with "bank run mechanics" - if legislation only provides a minimal safety cushion without incorporating intraday liquidity, redemption SLA (Service Level Agreement), stress scenarios, and orderly disposal into an executable mechanism, the next "moment of truth" may come even faster.

So the question is not "whether the legislation is wrong", but to acknowledge:

Active legislation is obviously better than no legislation, but passive legislation may be the true coming of age for stablecoins.

3. The Coming of Age for Stablecoins - Passive Legislation

If the financial system is like a highway, active legislation is like drawing guardrails, speed limits, and emergency lanes before driving; passive legislation often appears after an accident, using thicker concrete barriers to fill previous gaps.

To explain the "coming of age for stablecoins", the best reference is the history of the stock market.

3.1 The Stock Market's Coming of Age

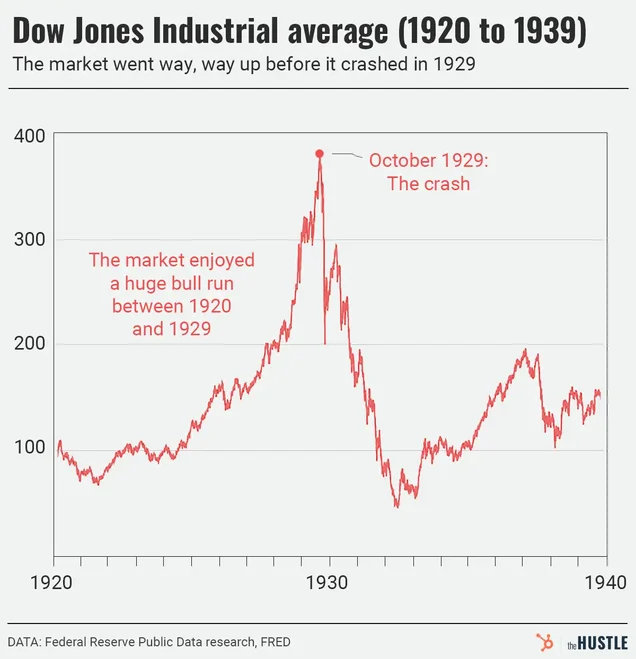

The US securities market did not initially have disclosure systems, exchange rules, information symmetry, and investor protection. These "guardrails" were almost all installed after accidents occurred.

The 1929 stock market crash dragged the Dow Jones index into an abyss, with banks continuously failing, reaching a peak of closures in 1933. After this disaster, the US passed the Securities Act of 1933 and the Securities Exchange Act of 1934, writing information disclosure and continuous supervision into law, and establishing the SEC as a permanent regulatory body. In other words, the maturity of stocks was not achieved through ideological persuasion, but shaped by crises - its "coming of age" was passive legislation after a crisis. (federalreservehistory.org, Securities and Exchange Commission, guides.loc.gov)

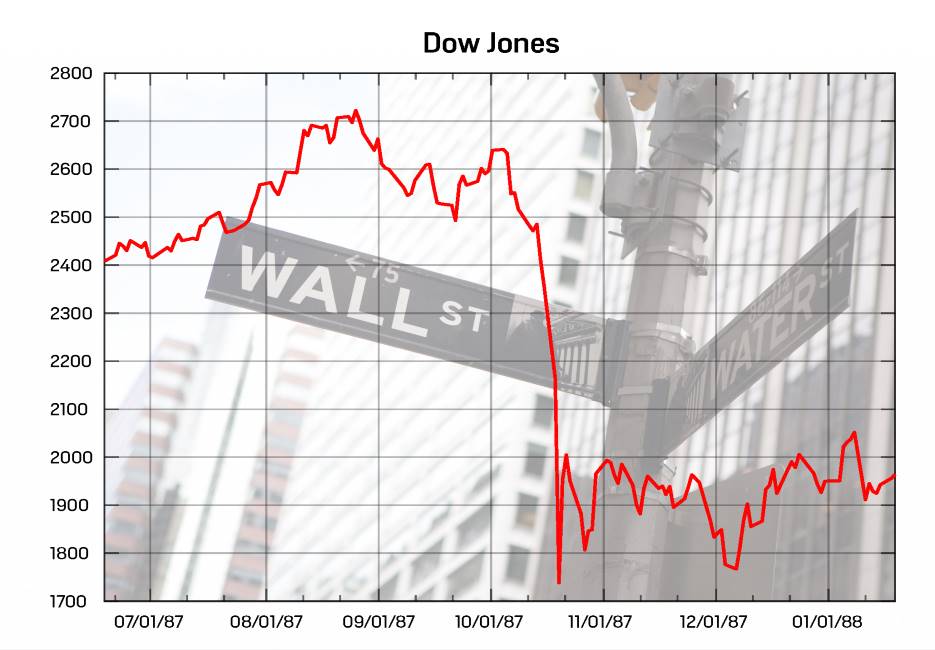

The "Black Monday" in 1987 was another collective memory: the Dow plummeted 22.6% in a single day, after which US exchanges institutionalized the "circuit breaker" mechanism, providing the market with brakes and emergency lanes. In extreme moments like 2001, 2008, and 2020, "circuit breakers" became a standard tool to suppress panic. This is a typical passive rule-making - first pain, then system. (federalreservehistory.org, Schwab Brokerage)

3.2 Stablecoins

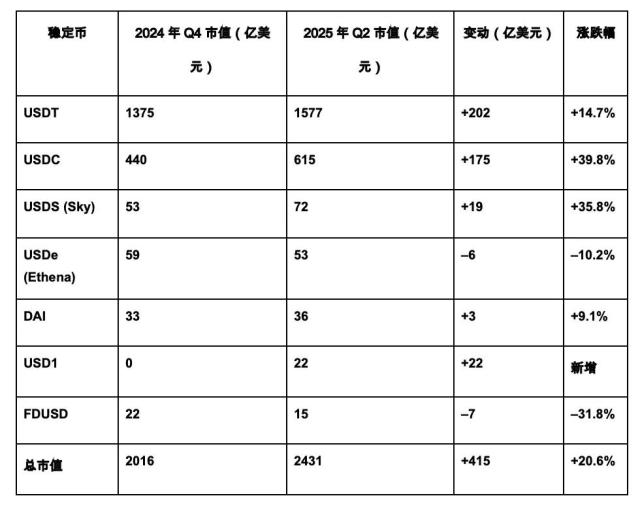

Stablecoins are not a "secondary innovation", but like stocks, belong to infrastructure-type innovation: stocks transformed "ownership" into tradable certificates, reshaping capital formation; stablecoins transform the "fiat cash leg" into a programmable, globally 24/7 settleable digital object, reshaping payment and clearing. The latest BIS report directly states that stablecoins have been designed as gateways into the crypto ecosystem, serving as transaction mediums on public chains and gradually deeply coupling with traditional finance - this is already reality, not a concept. (Bank for International Settlements)

This "reality-virtual" grafting is being implemented.

This year, Stripe announced that Shopify merchants can receive USDC payments and choose to automatically settle to local currency accounts or directly retain USDC - the on-chain cash leg directly connects to merchant ledgers. Visa also clearly positioned stablecoins on its stablecoin page as a payment carrier of "fiat stability × crypto speed", incorporating tokenization and on-chain finance into the payment network. This means stablecoins have entered real-world cash flows, and when cash legs go on-chain, risks are no longer limited to the crypto realm. (Stripe, Visa Corporate)

Last Lender of Resort (LLR) provides public backstop for liquidity in crisis (such as central bank discount window / special tools). When absent, individual liquidity shocks are more likely to evolve into systemic selling.

Fire Sale refers to a forced rapid asset sale causing price overshooting chain reaction, commonly seen in bank runs and margin liquidation scenarios.

"Breaking the Buck" occurs when tools nominally fixed at 1 dollar (like MMF/stablecoin) experience price deviation below par value, triggering chain redemption and hedging migration.

Intraday Liquidity is the ability to call/liquidate cash and equivalents within the same trading day. Determines whether "minute-level liabilities" can be matched by "minute-level assets".

Service Level Agreement (SLA) is an explicit commitment to redemption speed, limits, and response (such as "T+0 payable upper limit" "queue processing mechanism"), helping stabilize expectations.

Orderly Resolution involves allocating and liquidating assets and liabilities according to a plan when default/bankruptcy occurs, avoiding disorderly trampling.

Equivalence/Recognition is the acknowledgment of "equivalence" in regulatory frameworks between different jurisdictions. If "equivalent ≠ identical", regulatory arbitrage can easily occur.

Buffer represents redundancy in capital, liquidity, and duration to absorb stress and uncertainty. Overly low "minimum sufficiency" can fail in extreme moments.