Author: Cosmo Jiang, General Partner at Pantera Capital, Erik Lowe, Head of Content at Pantera Capital; Translated by Jinse Finance

Our investment theme for Digital Asset Treasury (DAT) companies is based on a simple premise:

DAT can generate returns to increase net asset value per share, thereby acquiring more underlying token ownership over time, not just holding spot assets.

Therefore, compared to directly holding tokens or through ETFs, owning a DAT can provide higher return potential.

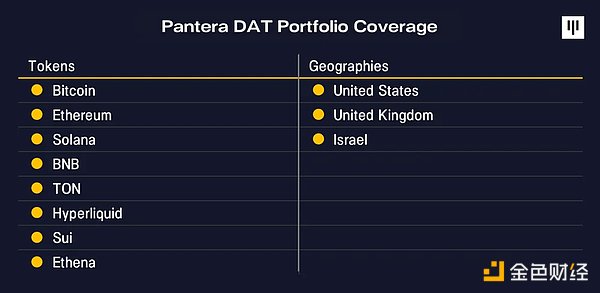

Pantera has deployed over $300 million in various token and regional DATs. These DATs are leveraging their unique advantages and strategies to accumulate digital assets with per-share appreciation. Here is an overview of our DAT portfolio.

BitMine Immersion (BMNR) is the first investment of the Pantera DAT Fund, embodying a company with a clear strategic roadmap and execution leadership. Fundstrat Chairman Tom Lee articulated BitMine's long-term vision of acquiring 5% of ETH's total supply - what they call "5% Alchemy". We believe examining the value creation of a highly executable DAT like BMNR will be very beneficial.

BitMine Case Study

Since launching its treasury strategy, BitMine has become the world's largest ETH treasury and the third-largest DAT (behind Strategy and XXI), holding 1.15 million ETH valued at $4.9 billion (as of August 10, 2025). BMNR is also the 25th most liquid stock in the US, with a daily trading volume of $2.2 billion (based on a five-day moving average as of August 8, 2025).

Bullish on Ethereum

The most critical factor for DAT success is the long-term investment value of its underlying token. BitMine's DAT is based on the view that Ethereum will be one of the biggest macro trends in the next decade as Wall Street moves on-chain. As we wrote in last month's blockchain investor letter, the on-chain migration is ongoing as token innovation and stablecoin importance continue to emerge. Currently, there are $25 billion of real-world assets on public chains - plus $260 billion in stablecoins, which are now the 17th largest holder of US Treasuries.

"Stablecoins have become the ChatGPT story of the crypto world." – Tom Lee, BitMine Chairman, Pantera DAT Call, July 2, 2025

Most of these activities occur on Ethereum, which benefits ETH through growing block space demand. As financial institutions increasingly rely on Ethereum's security to support their operations, they will be incentivized to participate in its POS network, further driving ETH accumulation demand.

Per-Share ETH Growth

After determining the base token's investment value, the DAT business model is to maximize its per-share token holdings. The primary methods to increase per-share token holdings include:

1. Issuing stocks at prices higher than net asset value per share ("NAV").

2. Issuing convertible bonds and other stock-linked securities to monetize volatility in stocks and base tokens.

3. Generating staking rewards, DeFi yields, and other operational income to acquire more tokens. Note that this is an additional leverage for ETH and other smart contract token DATs, which original Bitcoin DATs like Strategy do not possess.

4. Acquiring another DAT trading near or below NAV.

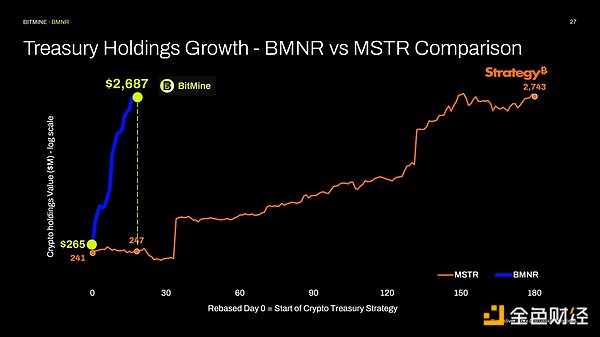

From this perspective, BitMine's per-share ETH value (also called "earnings per share") grew at an astonishing speed in the first month, far exceeding other DATs. The ETH value accumulated by BitMine in its first month even surpassed what Strategy (formerly Microstrategy) accumulated in its first six months of implementing the strategy.

BitMine primarily increases earnings per share through stock issuance and staking rewards, and we believe BitMine will likely soon expand its range of convertible bonds and other instruments.

Source: BitMine Company, July 27, 2025

Value Creation Actions

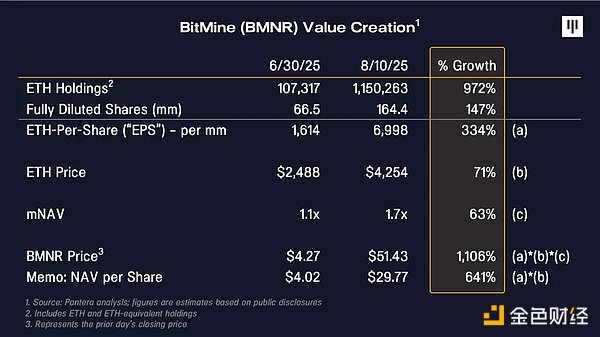

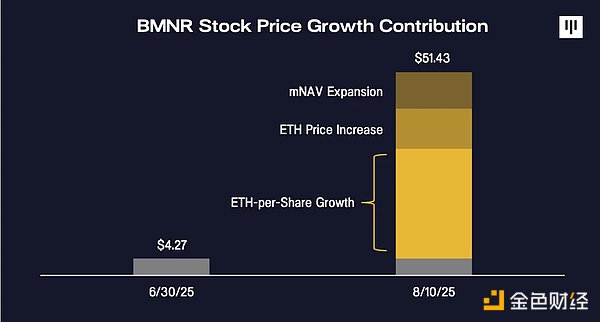

DAT price can be broken down into three components: (a) per-share tokens, (b) base token price, and (c) multiple of net asset value ("mNAV").

At the end of June, BMNR was trading at $4.27 per share, about 1.1 times its initial DAT financing NAV of $4 per share. Just over a month later, the stock closed at $51, approximately 1.7 times its estimated $30 per share net asset value. This means the stock price rose 1100% in just over a month, with: (a) per-share earnings growth of about 330%, contributing about 60% of the rise; (b) ETH price rising from $2,500 to $4,300, contributing about 20% of the rise; (c) net asset value expanding to 1.7 times, contributing about 20% of the rise.

This means most of BMNR's stock price increase was driven by per-share ETH growth, the core engine controlled by management that distinguishes DAT from simply holding spot ETH.

The third factor we haven't discussed is mNAV. Naturally, one might ask: Why would someone buy a DAT above its net asset value? I find it helpful to draw an analogy with asset-based financial businesses, including banks. Banks seek asset returns, and investors give valuation premiums to banks they believe can consistently generate returns above their capital costs. The best banks trade above their net asset value (or book value), such as JPMorgan's valuation being 2 times its net asset value. Similarly, if investors believe a DAT can consistently achieve per-share net asset value growth, they might choose to value it above net asset value. We believe BMNR's quarter-on-quarter NAV growth of about 640% sufficiently justifies the mNAV premium.

BitMine's ability to consistently execute its strategy will become apparent over time and will inevitably face challenges. BitMine's management team and its performance record so far have attracted support from traditional financial giants including Stan Druckenmiller, Bill Miller, and ARK Invest. We anticipate that BitMine's growth story as a top-tier DAT will, like Strategy, gain more institutional investor favor.