Author: AIMan@Jinse Finance

Did Qubic Successfully Perform a 51% Attack on Monero?

As early as late July, the Monero community was spreading rumors that the QUBIC mining pool was attacking Monero. Now, QUBIC seems to have succeeded.

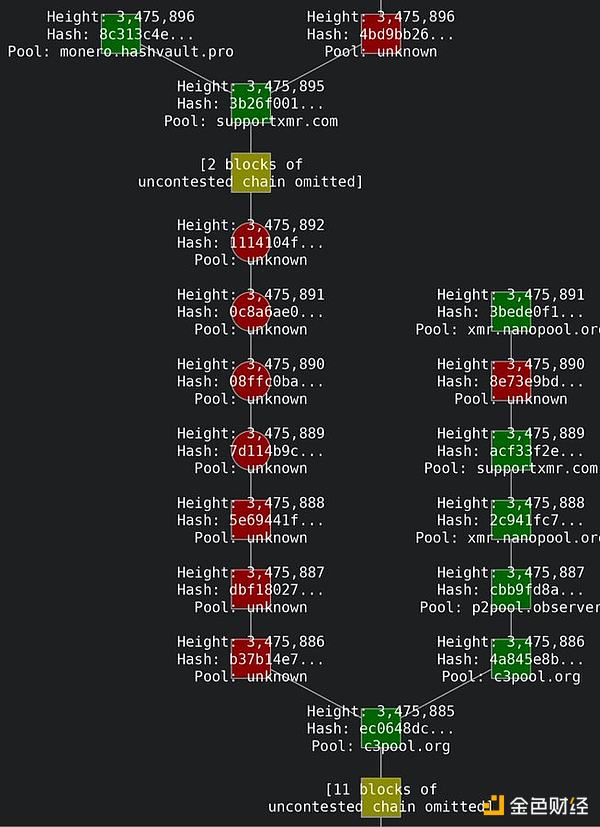

On August 12, 2025, Slow Mist tweeted that the Monero (XMR) network appears to have suffered a 51% attack. Monero recently experienced a chain reorganization of 6 block depths mined by an unknown mining pool. However, no mining pool on miningpoolstats owns more than 50% of the hash rate, so this could be a covert malicious hash rate attack or an accidental mining competition.

At the end of July, Monero's market cap was around $6 billion, and currently, XMR's market cap is about $4.6 billion, having dropped by over 20%. QUBIC's market cap is only around $2.3 billion. If QUBIC truly controls 51% of Monero's hash rate, we will witness a historic moment where a blockchain with a market cap of less than $300 million is taking over a blockchain with a market cap of $6 billion.

What Exactly Happened?

X user OrangeFren posted that Monero experienced a reorganization of 6 block depths. The 51% attack seems to have succeeded. If you are receiving XMR, please wait for at least 10 blocks.

Ledger CTO Charles Guilemet stated:

Monero appears to be experiencing a successful 51% attack. This privacy-focused blockchain, launched in 2014, has long been a target for government and three-letter agencies (note: FBI) and is now banned by most major centralized exchanges. The Qubic mining pool has been accumulating hash rate for months and now controls most of the Monero network's hash rate. This morning, a significant blockchain reorganization was detected. With its current dominant position, Qubic can rewrite the blockchain, enable double-spending, and censor any transaction. The estimated daily cost of maintaining this attack is $75 million. While the potential profits are substantial, it could destroy people's confidence in the Monero network overnight. Other miners have no incentive to continue attacking, as Qubic can easily turn any competing block into an orphan block, becoming the sole miner. In fact, a blockchain with a market cap of $300 million is taking over a blockchain with a market cap of $6 billion. Monero's recovery options are limited, and a complete acquisition is now possible, even likely.

Caffeinated User stated:

Qubic has just reached 51% of Monero's hash rate. This is a massive achievement. They will be the first to manipulate a cryptocurrency through a 51% attack. They plan to isolate all blocks from other miners, making themselves the sole mining entity for Monero. The only way to mine Monero is through them, and their profits are about 3 times that of direct mining. They will share half the profits with miners, and the other half will be used to buy and burn QUBIC. If they mine 100% of Monero blocks, they can mine 432 Monero daily. At current Monero prices, this is equivalent to $118,342.08. They keep 50%, distribute the rest to miners, and gain $59,171.04 daily from Qubic burns. Weekly burns of $414,197.28, monthly burns of $1.656 million. This is crazy. This is a historic moment. Qubic, with a market cap of less than $300 million, will become the sole miner of a $6 billion market cap currency.

Qubic founder Come-from-Beyond stated on social media: It seems Qubic has achieved a 51% advantage over Monero, and we are waiting for independent confirmation. Meanwhile, the Monero team is refining the details of their 51% attack protection. Many accuse us of being funded by some three-letter agencies to attack this anonymous coin. After helping Monero prepare to fight against these agencies in the future, what are your thoughts now?

Of course, some disagree. X user Luke Parker said that 6 reorganizations do not necessarily mean a successful "51% attack". In this case, we would see other mining pools performing infinite depth reorganizations/no blocks mined (assuming the opponent censors other pools like this one). This simply means the high-hash opponent got lucky.

Is Qubic's Attack on Monero Just to Verify Technology and Attract Attention?

First, let's understand Qubic. Qubic was founded by Come-from-Beyond, the co-founder of the Directed Acyclic Graph (DAG) architecture blockchain IOTA. Qubic is a unique L1 public chain with core mechanisms of useful Proof of Work (uPoW) and AIGarth. Traditional mining typically involves solving arbitrary puzzles, but Qubic converts computational power into actual productivity—training its AI model called AIGarth. Here's how it works: Miners contribute their raw computational resources to Qubic's validators (called Computors). These Computors then use this computing power to train AIGarth directly in memory, with all operations performed on-chain.

Qubic's larger vision is to provide outsourced computing for the real world, inviting third parties like enterprises, universities, hospitals, and research laboratories to use AIGarth. Through custom smart contracts, these entities can connect, adjust models according to their needs, and even use Qubic's computing network to train specialized versions, like opening a decentralized supercomputer to the world where collaborators can contribute and benefit without compromising security. However, this vision is not yet fully formed. Key components (such as Oracle Machines for seamless dataset integration) are still in development.

To prove the feasibility of outsourced computing in real environments, Qubic conceived custom mining: Qubic provides computing power outside its network, redirecting part of Qubic's hash rate to external tasks, such as mining Monero or other PoW coins. Qubic also states that the true potential of outsourced computing goes far beyond cryptocurrency mining.

So in late July, Qubic began custom mining Monero. Why start with Monero? Qubic officially stated that by venturing into the high-risk, competitive Proof of Work (PoW) crypto mining field, they not only verify technology but also attract industry attention.

How did it go?

Qubic's blog post shows that before integrating Monero custom mining, CPUs only accounted for 10% of Qubic's mining hash rate. Due to the attraction of higher profitability, more and more CPU miners have flocked to the network, and this number has risen to around 50%. In the week from July 30 to August 7, Qubic's network peak hash rate reached 2.77 GH/s, accounting for 50% of Monero's global hash rate. 4,285 Monero blocks were discovered, mining approximately 517 XMR + 6M XTM. These XMR, worth about $141,658, were sold, with 50% used for Qubic coin buyback and burn, and 50% to incentivize more CPU miners. Qubic officially stated that for miners, Qubic's profitability is about 3 times that of Monero, so many CPU miners joined the Qubic network.

During this period, the Monero community launched a DDoS attack on Qubic, but with little effect.

Qubic founder Come from Beyond stated on August 3 that despite suffering a severe DDoS attack, Qubic still successfully mined 20% of Monero blocks...

On August 6, Qubic's chief developer dkat pointed out on Discord: I asked about quotes yesterday, roughly $500 per IP, 100Gbps network speed, 24-hour continuous, including SYN Flood and reflection attacks. So about $20,000 per day, targeting all Qubic nodes and ecosystem. They have been DDoS attacking us for 7 consecutive days, so approximately $140,000...

What's Next for Monero?

Based on comprehensive information, the Qubic network may have truly gained control of over 51% of Monero's hash rate.

This 51% attack, as Qubic officially stated, was to verify technology and attract industry attention.

According to the official promise of Qubic, Qubic will "start from a pure 51% dominance attempt, and then shift to 'selfish mining' that only requires 33-40% computing power". The Qubic founder also hinted that they would help Monero fight against the government in the future.

But for Monero, how can trust in the crypto community be rebuilt?

Is Qubic an enemy or a new ally?

It remains worth observing.