Trump's support for the crypto industry can be described as wholehearted.

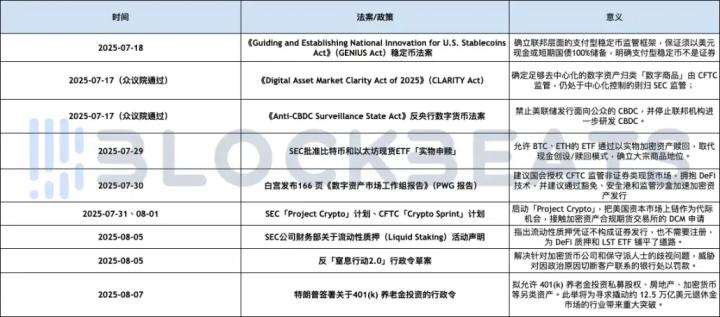

Just last week, Trump unleashed a major move by signing an executive order allowing 401(k) retirement savings plans to invest in more diverse assets, including private equity, real estate, and newly introduced crypto assets. This means that up to $8.7 trillion in retirement funds could potentially reach crypto assets. This event has profound significance for both the crypto realm and the pension system itself.

Interestingly, what would have previously been an instant market booster seems less impactful in today's crypto market. On the day of the announcement, BTC remained stable, while ETH unexpectedly experienced a rapid surge.

To discuss the executive order's impact on the crypto market, we must first explore the US pension system. The US pension system primarily consists of three parts: a government-managed national plan funded through social security taxes, individual retirement plans voluntarily participated in, and the 401(k) plan managed by enterprises.

The 401(k) plan, established under Section 401(k) of the 1978 Internal Revenue Code, is a private enterprise retirement benefit plan where employers and employees jointly contribute, with employees able to choose investment portfolios and enjoy tax-deferred benefits.

Although 401(k) is not a universal policy, nearly 60% of American households have one, making it the core of the US retirement system. According to public data, as of March 31, 2025, the total assets of employer-led defined contribution retirement plans reached $12.2 trillion, with 401(k) plans holding $8.7 trillion.

Where will these $8.7 trillion flow?

Currently, stock funds are the most common fund type in 401(k), with $5.3 trillion managed by mutual funds, including $3.2 trillion in stock funds and $1.4 trillion in hybrid funds.

On August 7, Trump signed an executive order allowing 401(k) plans to invest in private equity funds, Bitcoin, and other alternative assets. He also instructed the Labor Secretary to collaborate with federal regulatory agencies to potentially modify rules facilitating alternative asset inclusion.

From a policy perspective, this directive will have far-reaching implications for both pension funds and the crypto market. For pension funds, it introduces crypto and private equity into investment options, expanding diversification while introducing greater risk and volatility.

For the crypto market, this represents a breakthrough in mainstream acceptance. With pension fund eligibility, crypto assets have gained a "national-level" endorsement. ETF-packaged crypto asset products are expected to proliferate.

Interestingly, while BTC rose only 2% within 24 hours, ETH showed a contrary trend. ETH spot trading volume significantly increased, and its price rapidly rose from $3,600 to over $4,299. The ETH ETF saw net inflows of $6.8 billion in two days.

Market voices suggest funds are flowing from Bitcoin to Ethereum. The CME Ethereum futures' annual premium has exceeded 10%, higher than Bitcoin's, prompting some traders to shift positions from Bitcoin to Ethereum.

Looking at the ETH/BTC trading pair, although there has been a recent improvement, the trading volume has not significantly exceeded the average level, making the "blood-sucking" theory difficult to substantiate. As for why ETH is more sensitive, there might be multiple reasons.

First, the growth contribution of institutional coin hoarding: crypto treasury companies centered on ETH have already reserved approximately $13 billion worth of Ethereum, and with ETH's relatively lower price, the capital inflow brings more obvious growth. Second, support from large ETF institutions: ETH ETF has attracted over $6.7 billion in net inflows this year, with the backing of asset management giant BlackRock, whose core focus happens to be the SEC's blueprint of "entire financial markets on-chain", making Ethereum, as the public chain leader, a direct beneficiary; third, the shill voices from outside, such as last week's passionate shill by Tom Lee, Bitmine Board Chairman, who discussed Ethereum's future development in a podcast and believed ETH could reach $15,000 - a video with 180,000 views that seems to attract retail investors effectively.

Compared to the thriving BTC and ETH, the Altcoin market still looks not optimistic. In terms of market value, ETH broke through the long-awaited $4,000, and Altcoins also showed an upward trend, with market value rising over 15% compared to last week. However, upon closer examination, except for a few blue-chip Altcoins that have risen, over 70% or even 80% of Altcoins remain very sluggish.

The reason is evident: ETH's rise comes from institutional real money rather than crypto market's own funds. Under the current context of insufficient liquidity, institutional investment targets are more cautious and tend to prefer risk-controllable currencies. This means funds are unlikely to overflow into the Altcoin market, in other words, the ETH price driven by funds is difficult to transmit to Altcoins. In fact, there's already a market narrative that "current ETH is like last year's BTC", which makes sense. Of course, a comprehensive Altcoin revival might be difficult, but a structural Altcoin bull market still has opportunities, which depends on investors' own sensitivity.

Fortunately, another anticipated event is about to arrive. The US Labor Department's July non-farm employment growth was significantly lower than expected, and unemployment rate slightly increased, greatly enhancing the possibility of interest rate cuts. On August 9th local time, Federal Reserve Vice Chair Michelle Bowman released two key messages in her latest speech: she supports three rate cuts this year and will preside over a community bank conference on October 9th.

Moreover, CME's "Fed Watch" data reveals that the probability of the Federal Reserve maintaining interest rates in September is 11.6%, while the probability of a 25 basis point rate cut is 88.4%.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Community:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush