Deng Tong, Jinse Finance

From repeated bearish predictions to breaking through $4,300, in just a few months since April, Ethereum has emerged from a period of skepticism to the center of the crypto scene. What factors are driving Ethereum's surge? How high will ETH rise? What are the leading DeFi tokens worth watching?

1. What factors drove the surge in ETH?

1. April: Favorable regulation

In April 2025, ETH ushered in a wave of upward trend. It soared from the annual low of $1,385 on April 6 to $1,750 on April 23, an increase of 26.3%, with the highest single-day increase even exceeding 10%.

The driving force behind this round of upward trend can be attributed to favorable regulations.

On February 4, 2025, a draft of the GENIUS Act was introduced. On March 13, the Senate Banking Committee passed the GENIUS Act with bipartisan support of 18 to 6, officially sending the bill to the Senate. On May 8, the Senate held its first vote on a motion to end debate. Prior to this, expectations of a crypto market rally fueled by the GENIUS Act had been building, and ETH saw a run-up before the GENIUS Act's final approval.

On April 10th, the first cryptocurrency bill in the United States took effect. Trump signed a bill repealing a controversial Internal Revenue Service (IRS) tax reporting rule targeting DeFi platforms , which had originally required DeFi protocols to send 1099 tax forms to users. The bill passed the Senate by a vote of 70 to 28 and the House of Representatives by a vote of 292 to 132, becoming the first US bill specifically targeting cryptocurrency. The bill's implementation boosted industry confidence, with DeFi's value locked (TVL) increasing by 4.2% in the week to $46.7 billion.

On April 24th, the Federal Reserve announced the complete revocation of its 2022 regulatory guidance for banks' crypto asset and dollar token businesses , the abolition of the 2023 "regulatory no-objection" process, and the withdrawal from the crypto asset risk policy statement jointly issued with the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC). This move marks the end of the United States' heavy-handed regulatory policy on the crypto industry, "Operation Choke Point 2.0." Banks can once again provide accounts and payment channels for crypto companies. Institutions such as Circle, the issuer of the stablecoin USDC, have stated their commitment to accelerating cross-border payments and DeFi applications.

2. May-today: Pectra upgrade, Ethereum treasury reserve trend

On May 7th, Ethereum successfully implemented the Pectra upgrade, the most significant network update since the 2022 merge. This hard fork includes 11 EIPs, focusing on three key areas: improving staking efficiency, optimizing user experience, and enhancing Layer 2 scalability. The successful deployment of the Hoodi testnet in March laid the foundation for this upgrade. Pectra also lays the foundation for the Fusaka upgrade, which will introduce key technologies such as Verkle Trees and PeerDAS. The most notable feature of this upgrade is EIP-7702, the account abstraction scheme, which allows ordinary wallets to temporarily execute smart contract functions. This will enable innovative user experiences such as third-party gas fee payment, batched transactions, and even the recovery of lost private keys through social connections. Regarding the staking mechanism, the ETH staking limit for a single validator node has been significantly increased from 32 to 2048, allowing institutional stakers to reduce operational complexity through node consolidation. To support Layer 2 scaling, the blob data capacity per block has doubled to 6 (peaking at 9).

Since May, several companies have announced Ethereum treasury plans.

On May 27, SharpLink Gaming announced it had signed a securities purchase agreement for a $425 million private placement (PIPE) of approximately 69.1 million shares of common stock (or securities equivalents) at a price of $6.15 per share (or $6.72 per share for members of the company's management team). SharpLink Gaming will use the proceeds to purchase Ethereum (ETH) as its primary treasury reserve asset.

On May 31, the board of directors of Mega Matrix Inc., a New York Stock Exchange-listed company, approved Bitcoin and Ethereum as treasury reserve assets;

On June 26, Bit Digital, a US-listed company, announced a strategic transformation, planning to gradually cease its Bitcoin mining business and gradually convert its BTC holdings into ETH, focusing on Ethereum staking and asset allocation, becoming a "pure Ethereum staking and treasury company."

On July 9, GameSquare Holdings, Inc. announced that its board of directors had approved the phased establishment of an Ethereum treasury with a total amount of up to $100 million.

On July 22, BitMine announced that ARK Invest had acquired 4,773,444 shares of BitMine common stock (BMNR) for a total value of $182 million. BitMine plans to use all net proceeds (approximately $177 million) to purchase ETH.

On July 26, Sandclock, a decentralized wealth management platform that supports access to insurance and SOC-2 certified on-chain, announced the launch of its ETH treasury strategy.

On July 30, Nasdaq-listed Fundamental Global Inc. announced the sale of 40 million common shares at $5 per share, with an estimated total proceeds of $200 million, which will be used to launch the company's Ethereum treasury strategy.

On August 5, Nasdaq-listed 180 Life Sciences Corp. (ETHZilla) announced the completion of a $425 million private placement financing and the official launch of its ETH treasury strategy.

On August 10, Huajian Medical issued an announcement stating that it has officially launched the "Global Enhanced Ethereum Treasury with Downside Protection Mechanism" strategy.

In response to the trend of companies establishing Ethereum treasuries, 1confirmation founder Nick Tomaino stated in a post that 1confirmation fully supports ETH. Without Ethereum, the crypto industry cannot continue to develop, and the innovative values of trusted neutrality, open source, and permissionless development must be promoted. The crypto industry is currently focusing on venture capital chains and corporate crypto treasuries. While this trend is not closely related to Ethereum's values, it is not necessarily a bad thing. Companies establishing ETH treasuries can be a good thing. As crypto pioneer Hal Finney said 33 years ago, "Computers should be used as tools to liberate and protect humanity, not as tools to control it."

July: Trump signs the GENIUS Act, Crypto Week begins

On July 19th, the U.S. House of Representatives passed a stablecoin bill, and President Trump officially signed the "Guidance and Establishment of a National Innovation Stablecoin for the United States Act" (GENIUS Act) at the White House. This marked the beginning of the implementation phase of U.S. stablecoin regulatory legislation and a turning point for the cryptocurrency industry. Most stablecoins are issued and traded on the Ethereum blockchain. As the use of dollar-pegged stablecoins increases, demand for ETH, used to pay transaction fees, has increased. The White House issued a statement praising the passage of the GENIUS Act, calling it historic legislation that will pave the way for the United States to lead the global digital currency revolution. President Trump said the bill "creates a clear and concise regulatory framework to establish and unleash the enormous potential of dollar-backed stablecoins. This is perhaps the greatest revolution in fintech since the birth of the internet."

From July 14th to 18th, the U.S. House Financial Services Committee launched "Crypto Week." Lawmakers debated and voted on three major crypto bills: the CLARITY Act, which defines regulatory oversight of the crypto market; the GENIUS Act, which establishes a framework for stablecoins and has already passed the Senate; and the Anti-CBDC Surveillance State Act, which would prohibit the creation of a U.S. central bank digital currency. "Crypto Week" not only brings short-term positive news to the crypto market, but in the long term, increased regulatory certainty will attract more institutional capital, pushing mainstream cryptocurrencies like Bitcoin into a "slow bull market." Furthermore, niche sectors like DeFi and NFTs may see a surge in innovation due to the exemptions provided by the CLARITY Act.

On July 29th, the US Securities and Exchange Commission (SEC) officially approved the "physical subscription and redemption" mechanism for Bitcoin and Ethereum spot ETFs , covering products from multiple institutions including BlackRock, Ark21, Fidelity, VanEck, and Franklin Templeton. This adjustment will make fund operations more efficient and reduce costs. The SEC also approved applications for portfolio funds that include Bitcoin and Ethereum spot assets, Bitcoin ETF options products, and the relaxation of position limits on some options. Chairman Paul Atkins called this move "part of establishing a more rational regulatory framework" that will contribute to the depth and vitality of the US crypto market.

4. August: Project Crypto, SEC Liquidity Staking Guidelines

On August 1st, U.S. SEC Chairman Paul S. Atkins publicly delivered a speech on "Project Crypto," stating that Project Crypto will be the SEC's goal to help President Trump achieve his historic goal of making the United States the "crypto capital of the world." He noted: First, we will work to bring the distribution of crypto assets back to the United States; second, to achieve the President's goal, the SEC has a responsibility to ensure that market participants have maximum choice when deciding where to custody and trade crypto assets; third, a key task during my tenure as chairman is to allow market participants to innovate using "super apps"; fourth, I have instructed SEC staff to update outdated agency rules and regulations to unleash the potential of on-chain software systems in our securities markets; and finally, innovation and entrepreneurship are the engines of the American economy.

On August 5th, the U.S. Securities and Exchange Commission (SEC) staff issued guidance on liquidity staking. Under certain conditions, liquidity staking activities and the resulting receipt tokens do not constitute a securities offering. Mara Schmiedt, CEO of blockchain development company Alluvial, noted, "Institutions can now confidently integrate LST into their products, which will undoubtedly generate new revenue streams, expand their customer base, and create a secondary market for the staked assets. This decision lays the foundation for a wave of new products and services that will accelerate mainstream participation in the digital asset market." This wave of institutional adoption may help retail traders and influence institutions to provide DeFi services.

2. How high will ETH go?

As ETH continues to rise, whale are voting with their feet.

According to on-chain analyst Ember, over 1.1 million ETH (approximately $4.78 billion) has been hoarded by multiple unknown whale and institutions through trading platforms and institutional business platforms since July 10th. The average price of these hoarded ETH is approximately $3,584. During this period, the price of ETH has risen from $2,600 to $4,300, a 65% increase.

In the past 24 hours, Arthur Hayes has increased his holdings of ETH and a variety of DeFi blue-chip assets , including 1,500 ETH (worth approximately US$6.35 million), 425,000 LDO (worth approximately US$557,000), 420,000 ETHFI (worth approximately US$517,000) and 185,000 PENDLE (worth approximately US$1.02 million).

Analysts predict the future price of ETH as follows:

Analyst Merlijn said that the upward price channel of ETH has been opened, and the current highest target price may be set at 20,000 US dollars.

Trader BitBull pointed out that driven by massive short squeeze and institutional buying, it may be easier for ETH prices to hit new historical highs. If the weekly closing price is above the $4,100 range, the new historical high may appear within 1-2 weeks.

Analyst Lord Hawkins stated that Ethereum is showing signs of breaking out of its current Wyckoff accumulation pattern. According to Wyckoff theory, once buyers gain control, this phase typically ends with a decisive breakout. This breakout appears to be underway, with ETH breaking through the $4,200 resistance zone, a phase known as a "sign of strength" (SOS). In Wyckoff's model, this is typically followed by a brief pullback, or "last point of support" (LPS), to confirm a new uptrend. If the LPS holds, the price will enter a rising phase, accelerating as demand outstrips supply. Measuring the height of the accumulation range, the technical target price is near $6,000.

As of Sunday, ETH has broken above the upper trendline of its multi-year symmetrical triangle, located in the $4,000-4,200 range, according to analysts Crypto Rover and Titan. This breakout signals potential price action equal to the triangle's highest point and points to a move above $8,000 in the coming months.

Analyst Nilesh Verma highlighted a recurring pattern in which ETH rebounds sharply after retesting major bottoming support levels. ETH repeated this "bottom retest" pattern in April 2025, rebounding strongly from the $1,750-$1,850 range. A sustained rally could continue until April 2026, with the fractal's robust target being "minimum $10,000" and, in a best-case scenario, $20,000.

3. DeFi flagship tokens worth paying attention to

DeFiance Capital founder and CIO @Arthur_0x posted on social media that Ethereum's rise is like a rising tide, driving many projects in the decentralized finance (DeFi) space, while Bitcoin's rise is more isolated. He expects a series of major developments for top DeFi projects in the near future.

Here are the DeFi tokens worth watching.

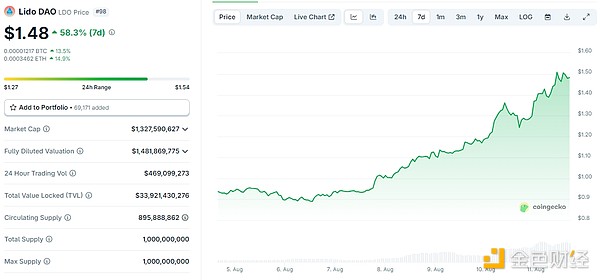

1. Lido Finance (LDO)

As Ethereum's largest liquid staking protocol, Lido occupies 25% of the staking market share, with a 7-day increase of 58.3% and is currently priced at US$1.48.

Recent good news:

The EU MiCA Act entered its second phase of implementation in July 2025. As one of the first liquid staking protocol to pass MiCA certification, Lido has obtained the qualification of "systemically important stablecoin service provider". In July 2025, a proposal was passed to invest 20,000 ETH in the vault into Pendle's fixed income vault, locking in an annualized return of 6.2%, which not only optimized the efficiency of fund use, but also sent a signal of long-term value holding to the market. On August 1, 2025, the Monetary Authority of Singapore (MAS) approved Lido's payment license, allowing it to conduct cross-border settlement through stETH, which means that stETH can enter the traditional financial system as a compliant asset.

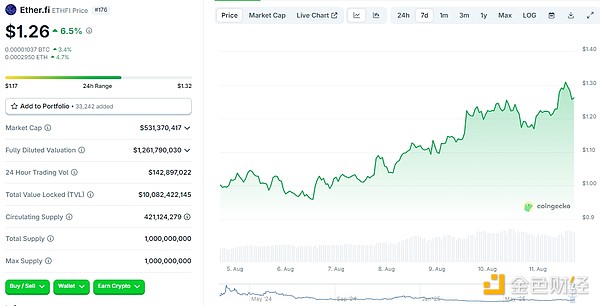

2. Ether.fi (ETHFI)

Ether.fi is the first native liquid staking protocol on EigenLayer. It allows users to stake ETH or other LST (such as stETH) to obtain eETH and earn additional yield by re-staking on EigenLayer. Currently trading at $1.26, it has risen 6.5% in the past 24 hours.

Recent good news:

Ether.fi's total locked value was US$4.9 billion at the beginning of 2025, and exceeded US$6.2 billion in August, a year-on-year increase of 126%.

In July, the ether.fi community voted to approve the "Deploy ETHFI Staking Contract" proposal with 99.5% approval. The proposal seeks approval for the deployment of the ETHFI staking contract on the Ethereum mainnet. The ETHFI staking mechanism aims to provide real utility by tying rewards to governance participation and effective balance within the ecosystem. The staking contract will include future incentives and voting functionality for staked tokens.

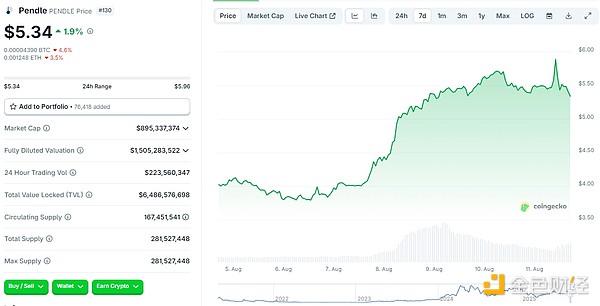

3.Pendle (PENDLE)

Pendle is a yield trading protocol focused on interest-bearing assets. By separating the principal and interest of interest-bearing assets, it aims to provide users with interest rate trading tools for risk management and yield optimization. Currently trading at $5.34, it has risen 1.9% in the past 24 hours.

Recent good news:

On August 6th, the Pendle team launched Boros, a margin trading platform on Arbitrum. Users can speculate and hedge margin trading rates through the platform. Currently, it supports trading Binance BTCUSDT and ETHUSDT margin trading rates, with plans to expand to more assets (such as SOLUSDT and BNBUSDT), more platforms (such as Hyperliquid and Bybit), more maturities, and more yield products in the future. Boros uses Yield Units (YUs) for trading. Each YU represents the yield on one unit of collateralized asset until maturity, similar to Pendle's YT.

Pendle TVL exceeded US$8 billion in August, of which the Ethereum chain contributed US$7.41 billion. DeFi Llama data showed that it occupied 58% of the market share in the income track, which is 5 times that of the second place.

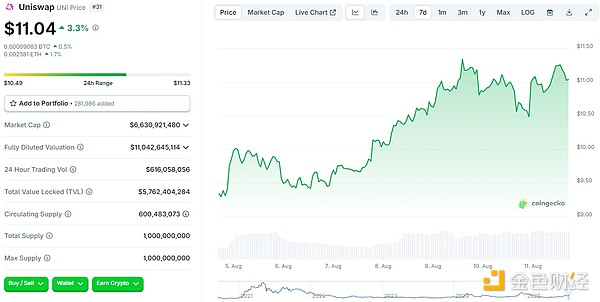

4. Uniswap (UNI)

Uniswap uses an automated market maker (AMM) mechanism to facilitate asset exchange. Uniswap automatically matches trades through a liquidity pool, rather than relying on order books and centralized matching. Currently trading at $11.04, Uniswap has risen 3.3% in the past 24 hours.

Recent good news:

According to Dune data, the number of transactions on the Uniswap protocol since 2025 has reached 7,19,951,542, setting a new record for the number of annual transactions.

On June 13th, Uniswap Labs announced that Uniswap Wallet users can now enable the Smart Wallet feature, unlocking one-click swaps through bundled transactions, enabling smarter swaps and lowering costs. New wallets created on the Uniswap mobile app or browser extension will default to the Smart Wallet. Future features will include gas sponsorship and the ability to pay for gas fees with any token.

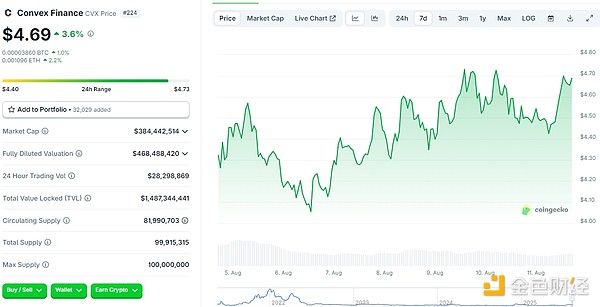

5. Convex Finance (CVX)

Convex Finance primarily serves Curve Finance's liquidity providers and CRV token holders, acting as a yield optimizer for the Curve protocol. CVX is currently trading at $4.69, up 3.6% in the past 24 hours.

Recent good news:

In June 2025, Convex entered into a strategic partnership with Frax Finance to jointly launch a CVX-based stablecoin vault, offering users an 8.5% annualized return and rapidly exceeding $45 billion in assets under management. Convex continues to expand its presence on Ethereum Layer 2 networks (such as Arbitrum and Optimism), with the TVL of its cross-chain liquidity pools increasing by 39% in the second quarter of 2025.

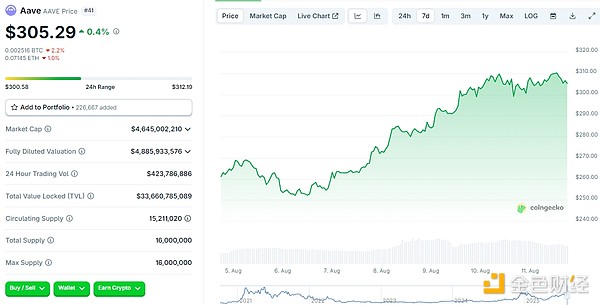

6. AAVE

AAVE is a decentralized, non-custodial liquidity market protocol that allows users to borrow and lend crypto assets without an intermediary. It's currently trading at $305.29, up 0.4% in the past 24 hours.

Recent good news:

On August 8th, Aave partnered with Plasma to launch an institutional incentive fund, designed to incentivize fintech companies and institutions to migrate their operations to the blockchain and build a new financial system on Plasma. On August 7th, Aave's total deposits reached $60 billion, a record high for the protocol.