Written by: @chingchalong02

TL;DR

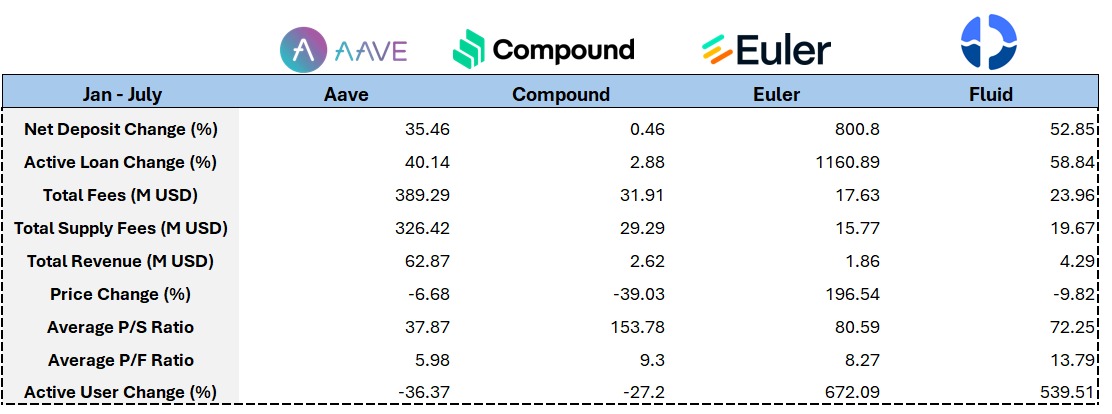

- Circular lending has become a mainstream DeFi practice, driving the fundamentals of underlying lending infrastructure platforms and eliminating lending protocols that cannot keep up with trends.

- Euler Finance emerged with the EVK framework allowing anyone to deploy lending Vaults, experiencing significant growth in fundamentals and token price, with future RWA asset lending deployment as another catalyst

- Aave benefited from the launch of USDe + PT-USDe, Umbrella mechanism, and GHO cross-chain issuance, with stable growth across various metrics in the first half of the year

- Lido Finance's revenue model appears prosperous, with future prospects expanded by Wall Street's demand for ETH staking rewards

- Jito, with its MEV infrastructure operations, jitoSOL leadership, and future reStaking applications, will begin to perform brilliantly from 2025 Q2

What are the Fee Sources for Lending Protocols?

Primarily derived from the total interest paid by all borrowing positions, whether uncleared, closed, or liquidated. This interest income will be proportionally distributed between liquidity providers and the DAO treasury.

Additionally, when a borrowing position exceeds its set LTV limit, the lending protocol will allow liquidators to execute liquidation. Each asset has specific liquidation penalties, with the protocol obtaining collateral assets and conducting auction/Fluid's "liquidity liquidation" mechanism.

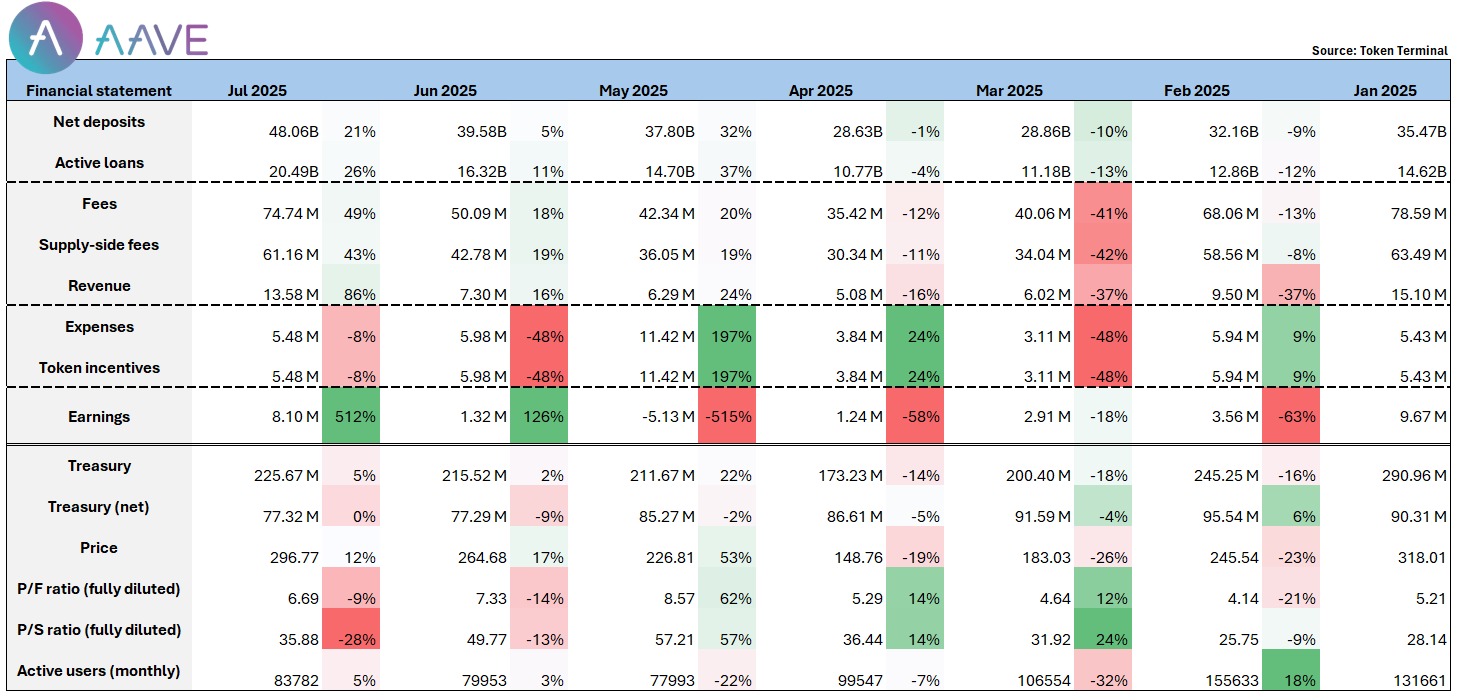

What Can We See from Aave's Financial Statement?

@Aave's protocol fees and income peaked at the beginning of the year, then gradually declined with market pullback. I believe the data recovery after May was mainly driven by the launch of USDe + PT-USDe, as the most significant circular lending demand this round was driven by Pendle's PT assets and Ethena's stablecoin.

Data shows that nearly $100 million in supply was quickly deposited into the Aave market during the early stages of PT-sUSDe's launch.

Moreover, the Umbrella mechanism was officially activated in June, attracting around $300M in deposit protection funds to date. Simultaneously, Aave's native stablecoin GHO's cross-chain issuance continues to grow (current circulation ~$200M), with its multi-chain application scenarios expanding.

Driven by multiple positive factors, Aave achieved a comprehensive breakthrough in July:

- Net Deposit exceeded $4.8 billion, ranking first network-wide;

- Protocol net profit in June increased nearly 5 times month-on-month, reaching ~$8M;

- Based on price-to-sales and price-to-earnings ratios, Aave remains an undervalued project in the track.

Given the current growth trend and product maturity, more traditional institutions are expected to choose Aave as a DeFi platform. In terms of fee income, TVL, and protocol profitability, Aave is poised to continue setting new highs and consolidate its position as a DeFi leader.

(Translation continues in the same manner for the rest of the text)Aave early participated in Fluid's token investment, buying FUID tokens with $4M and promoting the integration of its stablecoin GHO into the Fluid protocol pool. This action both acknowledges Fluid's product model and represents a positive bet from its competitors on its growth potential.

The protocol's income slightly increased from $790K to $930K in the first half of the year, with a stable financial situation; however, the token slightly declined during the same period, mainly due to the lack of significant token economic empowerment and a clear buyback mechanism. Despite the protocol's outstanding performance, its token value capture capability still needs improvement.

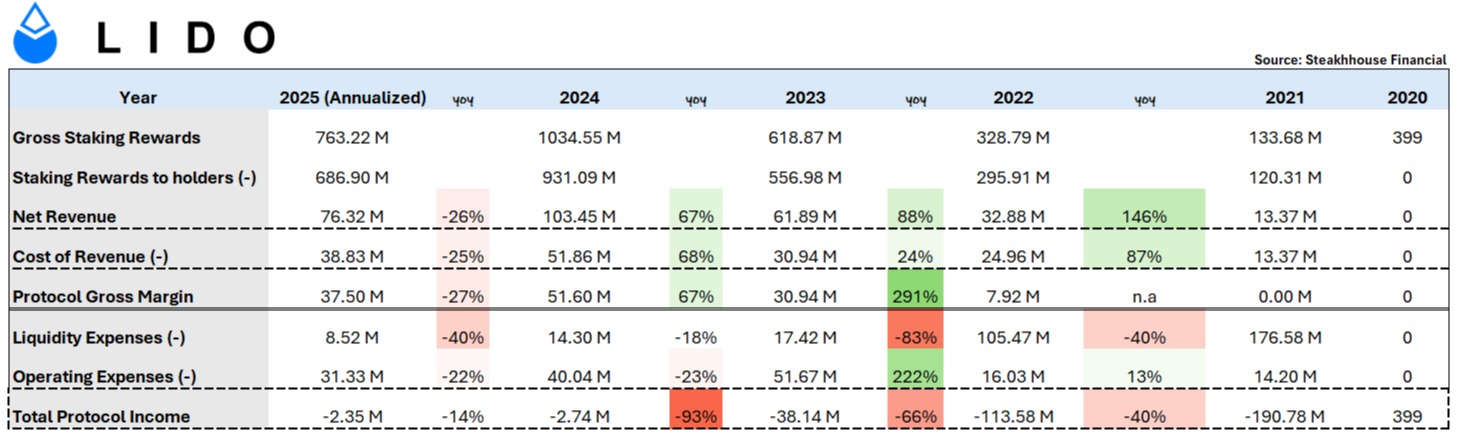

How is the financial statement performance of Lido, known as ETH Beta?

@LidoFinance currently has ~8.8M ETH staked in the protocol, with a total value of ~$33B, accounting for ~25% of total ETH staking and 7% of ETH network-wide. It is basically the project with the most ETH "holdings" in the circle (sharplink: ~440K ETH; bitmine ~833K ETH).

"ETH Staking Track Leader" - this narrative inevitably will be considered as ETH Beta, but the project has faced a serious problem since its inception - the founding team has never been profitable in five years.

To dissect the reasons, we must start from the fine lines of the financial statement.

Staking Rewards to holders: Lido's role is only to aggregate retail investors' ETH, establish validator nodes, and then distribute staking rewards proportionally to retail investors.

In other words, Lido does not hold most of its rewards. For example, in 2024, Lido earned $1.034B in staking rewards, of which $931M was essentially distributed to stakers, which also complies with Lido's protocol fee terms - stakers (90%), node operators (5%), and Lido DAO treasury (5%)

Cost of Revenue: This refers to node rewards + Slashing distribution, as the Slashing cost is borne by Lido

Liquidity Expense: Fees for LP investment

Operational Expense: LEGO Grant + TRP (Token Rewards Plan) are two ecological grant and incentive frameworks. The former is an external grant program supporting community or developer proposals beneficial to Lido; the latter is an internal token incentive scheme for rewarding DAO core contributors

The good news is that Lido has improved cost control in recent years, with Liquidity Expense decreasing annually to ~$8.5M in 25, and Operating Expense also reducing by ~20% from 23. Therefore, with a significant increase in income (88%/67%) and cost reduction in 23/24, the project's income loss has dramatically dropped (-66%/-93%), reaching only ~$2M this year.

Lido's Future Trend?

If we say that the income level of the "ETH Staking Track Leader" is still not up to standard, it would be too harsh, but costs are indeed decreasing year by year. What exactly causes continuous losses? First, the 10% fee is an industry standard and difficult to change.

The only variable is the track's scale - ETH staking volume. It's worth knowing that ETH's staking ratio is relatively low compared to Solana/Sui/Avax/ADA. The macro catalyst - Wall Street's demand for ETH staking yield will be key. It's known that Blackrock has applied to add staking functionality in iShares ETH ETF.

Once there's a precedent, ETH staking will become a new revenue source for institutions. For them, holding an ETH position that generates interest is an additional cash flow source. If the first choice is the largest scale Lido (or possibly Coinbase, or staking projects supported by institutions like Puffer), it will be a crucial moment when the track's ceiling opens. Of course, as the staking rate increases, ETH issuance rewards will also be compressed.

We also see DAO members proposing to enable LDO staking income sharing mechanism to enhance token utility and long-term value incentives. The problem is obvious: the income sharing mechanism will further weaken the project's income and be less beneficial to long-term development. Another proposal in the DAO about an "excess surplus sharing mechanism" seems more reasonable.

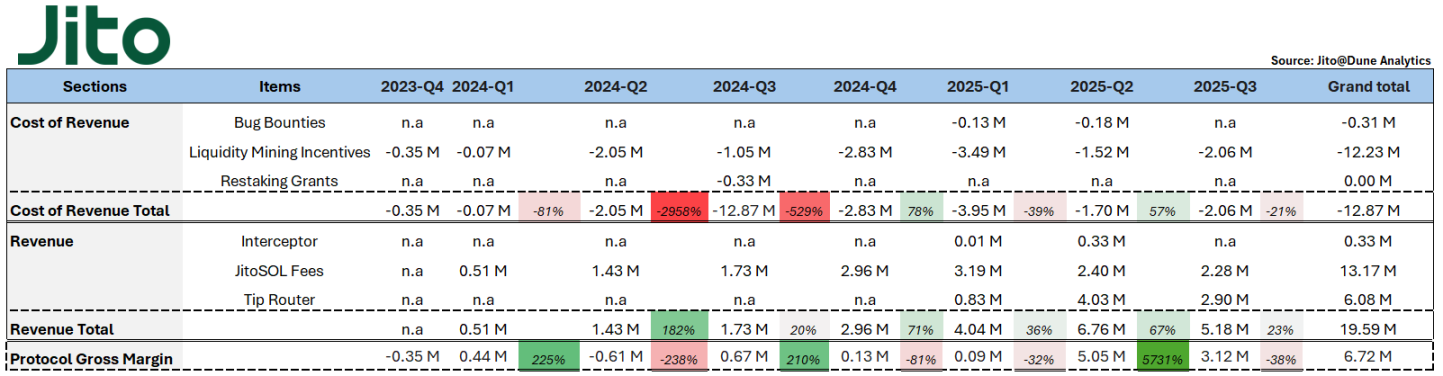

Jito's Unique Income Model - MEV Tips

@jito_sol, as the leader in the SOL staking track, has at least a "surface business" financial performance much better than the Lido analyzed yesterday. Jito currently has ~16m SOL staked (jitoSOL), accounting for ~23% of the network.

The track's ceiling - that is, SOL's staking rate is already relatively high among L1s (67.18%). It's worth noting that Jito also began providing underlying infrastructure services for liquid restaking in October last year, thereby generating various restaking services, with VRT (Vault Receipt Tokens) providers (such as @fragmetric140, @RenzoProtocol) operating on its underlying infrastructure.

I personally believe that liquid restaking will be Jito's future business expansion and revenue growth track. Currently, only ~1.1m SOL is restaked, equivalent to ~6% of Jito's staked SOL and ~2% of the network's staked SOL. In comparison, ETH's restaking/staking ratio is ~26%, which still leaves ample room for SOL's growth and is a market share Jito needs to capture.

Returning to Jito's financial report, let's first explain the project's various expenses and revenues:

Bug Bounties: Expenditure to encourage discovering and reporting protocol vulnerabilities. Valid vulnerabilities submitted by white hat hackers can receive rewards

Liquidity Mining Incentives: Used to reward users providing liquidity for JitoSOL or VRT trading pairs on DeFi platforms (such as Orca, Jupiter)

Restaking Grants: Issued to Node Consensus Network (NCN) developers' ecosystem to support development, deployment, and operation of restaking infrastructure

Interceptor Fees: A mechanism to prevent malicious short-term arbitrage by liquid staking protocol holders of JitoSOL. Their held JitoSOL will be temporarily frozen for 10 hours, and if users want to withdraw early, they can choose to pay a 10% handling fee

JitoSOL Fees: JitoSOL charges a 4% management fee from staking rewards and MEV revenue (calculated after deducting validator commissions). Converted, this is equivalent to ~0.3% management cost per year on users' deposited SOL (7% APY * 4%)

Tip Routers: MEV accumulates as Tips in each epoch, then distributed through TipRouter, extracting 3% as protocol fees, of which 2.7% goes to DAO treasury, 0.15% rewards JTO stakers, and 0.15% rewards JitoSOL users

So... what strategies can be observed in Jito's financial statement?

First, let's analyze the expenditure part. Liquidity Incentive has always been Jito's largest expenditure item, with fees sharply rising since 2024 Q2 and currently maintaining around 1m - 3m per quarter.

This mainly comes from the foundation's implementation of JIP-2 + JIP-13 proposals, using $JTO for incentives across various DeFi applications (mainly on @KaminoFinance). It can be seen that jitoSOL's income has indeed significantly increased since 2024 Q2. I personally understand this as the effectiveness of defi-looping using jitoSOL increasing -> willingness to stake SOL as jitoSOL increasing -> more jitoSOL -> more staking income.

From 2025, the foundation also proposed investing 14M JTO (~$24M) in continued incentive measures, especially with the rise of restaked assets and corresponding DeFi operations, hoping to improve VRT adoption rate.

By 2025 Q3, ~7.7m JTO has been distributed as incentives. The effect is also very significant, with income rising quarterly by 36%, 67%, 23%, which is higher than the incentive distribution ratio, proving this is a positive EV proposal.

In terms of revenue, jitoSOL fee + Tip Router are Jito's two main income sources. Since 2024 Q4, benefiting from the Solana ecosystem's meme boom, network transaction volume suddenly surged, and Jito naturally became the first major beneficiary.

At that time, Jito's tips accounted for 41.6% to 66% of Solana REV (Real Economic Value), and since Q2 2025, the Tip Router's profit income has exceeded jitoSOL fee, showing that Jito's technical barrier is MEV infrastructure, and users/arbitrageurs on Solana are willing to pay tips to improve transaction priority, which is an economic system rarely found on other public chains.

The rise in Solana network transaction volume + MEV infrastructure's operational capability + jitoSOL's leading position + future development of reStaking applications on Jito, drove the project's net profit to reach a peak in Q2 2025, increasing 57 times quarterly to ~$5M. Although the current meme craze is not as crazy as pump.fun in 24, I personally believe that if SOL's reStaking track becomes more mature, it will be the next catalyst for Jito.