Author: Kyle

Translated by: TechFlow

The term "Internet Capital Markets" has multiple meanings. In the current context, it refers to the "alchemy-like" results purely derived from blockchain technology advantages: a financial technology form that transcends geographical boundaries. From mortgaging "magical internet money" to tokenization of government bonds and private credits, to stablecoin applications - in today's world where traditional finance and digital assets intersect, these are all seen as manifestations of "Internet Capital Markets".

Original Tweet Link: Click Here

However, for on-chain traders like us who have been deeply involved in this asset class over the past few years, "Internet Capital Markets" has another layer of meaning. It's not just about "on-chain government bonds", but also encompasses multiple speculative tools such as Non-Fungible Tokens, DeFi, Initial Token Offerings, and the token trading derived from these tools. This all began with the deployment of the first smart contract on Ethereum in 2015, driving the birth and development of countless innovations over the past decade.

In this article, I want to delve into this aspect of Internet Capital Markets - focusing on tokens, narratives, 10x or even 100x returns, airdrops, and other mechanisms that constitute the core initial concept of Internet Capital Markets.

[The rest of the translation follows the same professional and accurate approach]Hyperliquid is an enterprise with a market value of $40 billion, without a business plan or equity burden. It is a pure on-chain giant that has rapidly risen from scratch, dominating the market and now moving towards an annual revenue of $1 billion. This is the purest embodiment of how internet capital markets operate.

But before you think this is just an article promoting Hyperliquid, let me take a step back. I believe this is not just Hyperliquid's story. In the coming years, we will see more similar cases.

Isn't this exciting? We are entering an era full of opportunities - don't let your cynicism destroy your dreams. However, what saddens me most is that all of this is obvious to anyone who truly observes the trends, but we are busy chasing the 50% surge of random Altcoins because the market of the past four years has made us accustomed to this pattern. It's time to look beyond and dream bigger - and the blueprint for success is already in front of us.

In a chance conversation, I discussed the following with @connorking_ (whom I am fortunate to call my good friend):

Huge opportunities are coming: Investors can fight alongside the team and become operational partners

Today, the shackles that bound us no longer exist. For too long, people have been restricted by traditional structures, but in the era of "internet capital markets", owning 5%-10% of your own token and building it into a product worth $100 million or $1 billion will far exceed most people's expectations.

Yes, financing is still necessary; yes, there's nothing wrong with an ICO. But look at Hyperliquid's path to success - if you are confident in your product, this is a direction worth emulating. Look at the wealth of Hyperliquid's founders now - they didn't rely on venture capital, they simply held a significant part of their own product and listed it on the internet capital market. And the market, as the arbiter of truth, will reward generously if it recognizes your product.

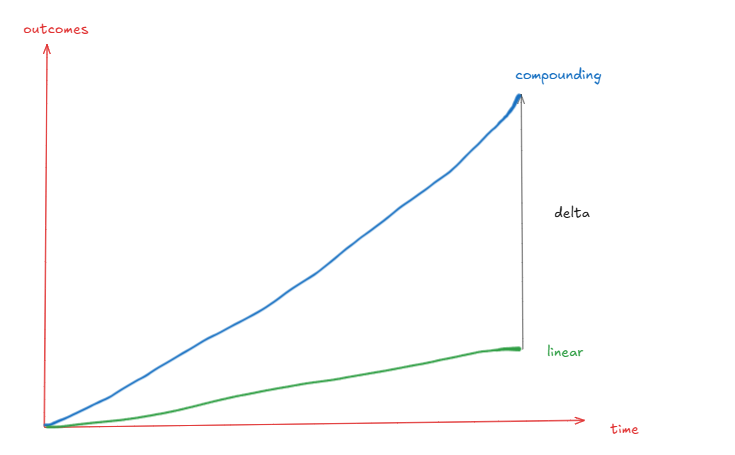

Do you know what the problem with capitalism is? It's that most participants in capitalist markets are short-sighted. Capitalism can indeed drive innovation in the right direction, but not far enough. People often compromise for quick profits, whereas if they were willing to persist for a few years, they might get a much greater return. This is the true embodiment of the mathematical power of compound interest.

Long-term thinking usually brings geometric rather than arithmetic changes - for example, doubling in two years (2x), growing fivefold in four years (5x), tenfold in five years (10x).

Of course, you can make $10 million by quickly launching a product and then abandoning it, but if you're willing to spend a few more years refining the product, you might earn $300 million.

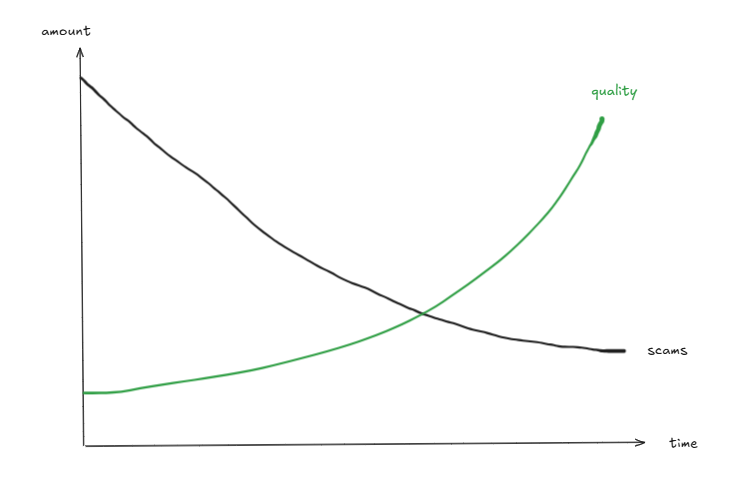

Finally, I want to talk about the speculative nature of the market. Undoubtedly, the market is more like a voting machine in the short term. We will still see many "valueless" assets rising in price, and possibly "quality" assets priced far above their fundamental value. Phenomena like team sell-offs may still occur.

But the key is that the upcoming digital wave will attract more truly excellent founders to the battlefield - this is the trend shift I believe in, which will drive the creation of many great on-chain products.

More S/A-level founders participating = less focus on C-level and below founders = less attention to "air projects", more focus on high-quality products that can bring compound growth.

Such trends will never go to zero, nor do they need to. Look at Hyperliquid, look at Ethena, look at Aave - annual revenue of $1 billion, stablecoin Total Value Locked (TVL) of $1 billion, net deposits of $6 billion. Look at Pengu and Rekt - total views of 197 trillion, 2 million toys sold globally, beverage brands entering US 7-11 shelves, all through blockchain token issuance.

Of course, we can argue whether they are overvalued or undervalued. But I would rather discuss these issues than return to an era where we could only invest in short-selling promises with no actual results. I would rather own a part of something real than pretend to play a game of "hot potato".

Another perspective - from @ImmutableSOL

If you always think every token is a "meme", then this view is meaningless. Excellent talents like Jeff from Hyperliquid issuing tokens is no longer a fantasy. The next "Steve Jobs" could completely issue tokens on-chain. Some of these assets will ultimately become on-chain giants defining future finance, and we all have a chance to participate. Simply viewing them as "just a meme project" might miss out on 1000x returns.

This is what I call the evolution of speculation. We have evolved from trading valueless air projects to being able to own shares of solid, enduring, and most importantly, on-chain assets that will shape the world.

It's time to believe. Believe in future possibilities, not being weighed down by past constraints. Break free from the shackles of history and turn the bearish sentiment into ashes. The future is bright, friends. We cannot let the shadows of the past obscure our optimism about the future.

Ladies and gentlemen, in my view, this is the future: Internet. Capital. Markets.

Editor's note on long-term results:

Japan is known worldwide for its excellent quality, but this quality was not achieved overnight, but is the accumulation of decades of culture, products, and lifestyle. If they had merely "optimized for profit", they might not have reached where they are today. But because they have had a long-term plan spanning decades, they are now reaping the rewards. The results of this long-term thinking cannot be fully measured by numbers - clean streets, cool vending machines, these may not directly reflect in "GDP", but they attract a large high-consumption group, bringing income to the country.