The market is retesting the low liquidity zone below the $114,000 threshold, with market excitement pausing and Bitcoin entering a reconstruction phase. Signals from various market sectors indicate cooling market momentum, cautious position deployment, and reduced risk appetite.

VX: TZ7971

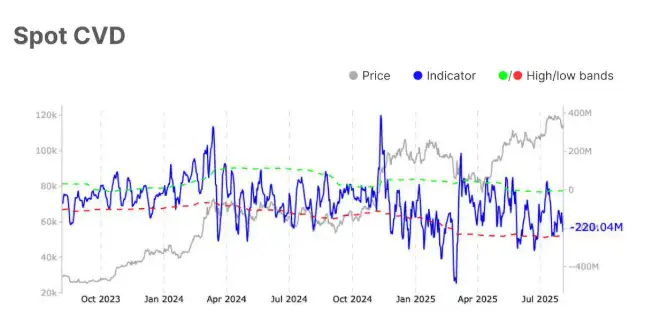

In the spot market, conditions have significantly weakened, with the Relative Strength Index (RSI) dropping from 47.4 to 35.8, breaking below the lower interval and entering the oversold zone. The Spot Cumulative Volume Delta (CVD) dramatically deteriorated from -$107.1 million to -$220 million, reflecting increased selling pressure. Spot trading volume also declined from $8.4 billion to $7.5 billion, indicating reduced market participation and liquidity during support level retesting.

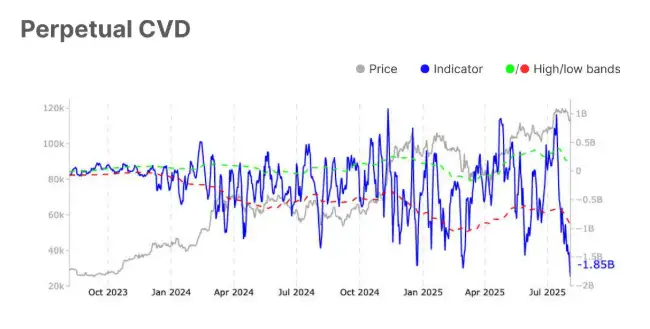

Futures market open interest slightly decreased from $45.6 billion to $44.9 billion, suggesting a moderate position unwind. Long funding rates dropped 33% to $3.1 million, marking a decline in leveraged bullish demand. The Perpetual CVD fell from -$1.2 billion to -$1.8 billion, well below its lower interval, highlighting active profit-taking and forced liquidations among traders.

In the ETF market, net inflows decreased by 24.9% to $269.4 million, far below the lower interval, indicating weak institutional investment demand. Trading volume increased by 9.9% to $19.8 billion, reflecting a sensitive but cautious market attitude. The Market Value to Realized Value (MVRV) ratio dropped from 2.4 to 2.3, showing a slight decrease in profitability, but with unrealized gains still present.

Market sentiment has shifted from excitement to cautious conservatism, with oversold conditions and seller exhaustion hinting at potential rebound opportunities. However, market fragility is increasing, with the overall structure remaining vulnerable to external negative catalysts or delayed demand recovery.

The US ETH spot ETF experienced its largest withdrawal since listing on Monday, with a single-day net outflow of $465 million. Despite recently achieving three consecutive weeks of inflows, market sentiment quickly reversed, making this pullback particularly noteworthy.

In the past few weeks, ETH spot ETFs maintained strong inflow momentum, with $2.2 billion net inflows in the second week of July and $1.9 billion in the third week. Even last week, despite slight cooling, it recorded $154 million in net inflows.

Observing Monday's outflow situation, BlackRock's ETHA suffered the most severe bleeding, with a single-day net outflow of $375 million. Fidelity's FETH, Grayscale's ETHE, and its mini fund ETH also recorded net outflows.

Market analysts generally interpret this capital withdrawal as short-term profit-taking.

This appears more like investors choosing to secure profits after ETH's recent rise, rather than a decline in institutional demand. Looking at July overall, ETH spot ETFs have attracted $5.4 billion, and with continued enterprise institutional accumulation, long-term market demand for ETH remains robust.

Notably, despite facing capital outflow pressure, ETH rose 1.7% in the past 24 hours, currently priced around $3,620, quickly recovering weekend losses.

This substantial capital outflow may have actually started last Friday when weak US employment data triggered selling pressure across risk assets, considering ETF fund statistics have a 1-2 day delay.

Given Monday night's strong market rebound, a data reversal tomorrow cannot be ruled out. Such single-day fluctuations should not be over-interpreted.

At the current stage, it may be premature or overly pessimistic to determine whether Bitcoin will fall back to the $105,696 21-week moving average. However, we still view this level as a key trend reference: prices above this level suggest a predominantly bullish trend, while falling below would warrant caution of bearish signals.

In the short term, some funds may flow back from high-volatility Altcoins to Bitcoin, providing some price support. However, caution and risk control remain necessary. This assessment, repeatedly mentioned in recent days, remains applicable.

With US stocks and tariffs impacting ETH's oscillation, the bull market trend is undoubtful, with recent pullbacks presenting buying opportunities, expected to welcome September rate cut expectations after mid-August.