Author: Ada, TechFlow

Original Title: Traffic Migration in Progress: Crypto Exchanges "Conquering" Xiaohongshu

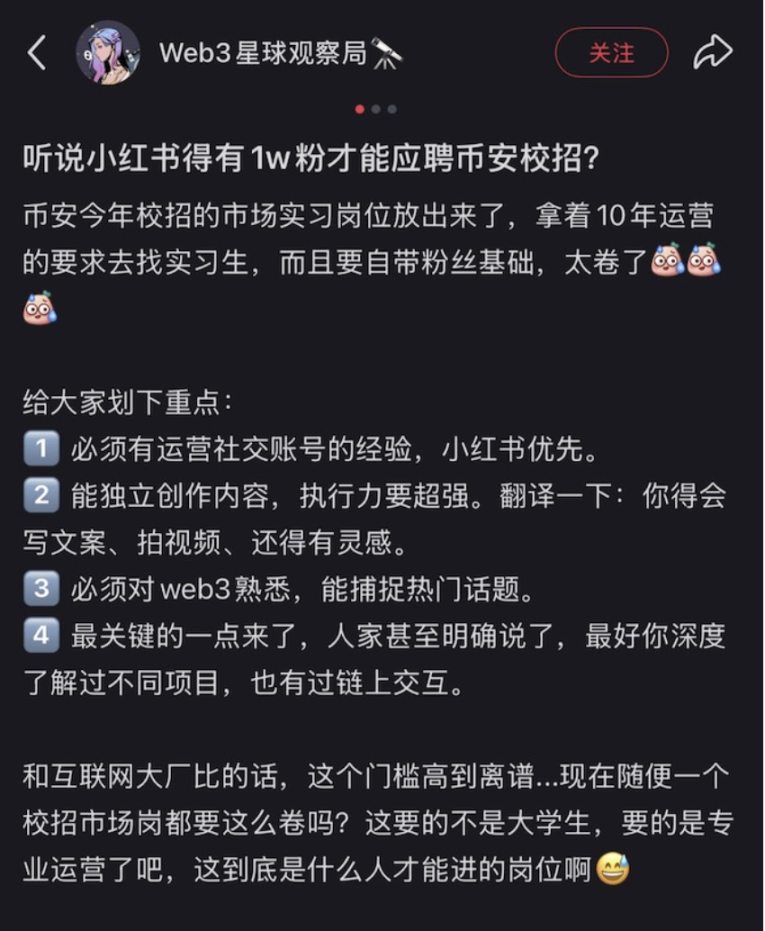

"I heard Xiaohongshu requires 10,000 followers to apply for Binance campus recruitment?"

A Xiaohongshu screenshot caused a stir in the crypto job-seeking group.

"Even harder than a 985 university degree," some joked in the comments.

In fact, Binance's official job description does not have a "hard fan threshold" but clearly states: "Priority given to those with successful social media account operation experience, especially in video, Xiaohongshu, and AI-related content directions."

This is no joke. Crypto KOL "AB Kuai.Dong" directly stated on X (Twitter):

"Major exchanges' attitude towards Xiaohongshu has shifted from 'whether to do it' to 'how to do it big', and they are now specifically recruiting fresh graduates with Xiaohongshu account growth experience."

From Weibo, Twitter, and TikTok to now Xiaohongshu, exchanges' marketing battlefields are quietly shifting.

This shift is not a momentary impulse.

Between 2023-2024, Xiaohongshu's user profile underwent a key change: investment, finance, overseas life, and remote work content grew exponentially; users aged 25-35, from first and second-tier cities, with undergraduate degrees or higher accounted for over 60%.

These people are exactly the core users crypto exchanges want to compete for.

On this platform that started with beauty and fashion, exchanges carefully explore platform boundaries, packaging their "ambitions" with street interview videos, workplace stories, and wealth notes.

Is Xiaohongshu truly a new growth paradise for the crypto industry?

Crypto Traffic Migration History

To understand why exchanges are betting on Xiaohongshu, one must first understand the "crypto traffic migration history".

In many old crypto veterans' memories, Weibo was long the public opinion center of the Chinese crypto world.

Between 2017 and 2022, exchange executives sparred on Weibo, fighting for persona and making bold statements, like an industry "public arena". Many newcomers completed their first trade through Weibo crypto bloggers' popularization and shilling.

At that time, whenever Bitcoin surged, an exchange would invest in buying Weibo hot searches, letting terms like "Bitcoin surge" top the list and attract numerous retail investors.

However, everything stopped abruptly after regulatory implementation. As policies tightened, Justin Sun, He Yi, and other industry OG accounts were shut down, and many KOLs were thoroughly cleared. Everyone was forced to migrate, ultimately converging on today's X (Twitter), forming a new Chinese crypto social circle.

X (Twitter) is certainly the crypto world's largest "square" - Vitalik publishes Ethereum upgrade progress here, CZ responds to doubts, and KOLs engage in verbal battles. But the problem is precisely that: it's too "insider".

After years of traffic competition, potential new crypto users have long been divided by KOLs with invitation links, and today's market looks more like a tug-of-war among existing users.

For most Chinese-speaking users, Twitter remains behind a glass wall, unable to reach the lower-tier market or leverage broader audiences.

TikTok was once seen as a potential "crypto traffic gold mine". It has unparalleled content explosion power, but the problem is: this explosion is hard to solidify.

Fast-food style content consumption struggles to build the trust required for financial products.

"TikTok content's lifecycle is too short," commented new media analyst Youdu Zhi, "Its design intent is exposure and traffic, not trust. Once outside TikTok, its vitality quickly diminishes, and its influence is hard to settle into users' daily lives."

Bilibili once carried exchanges' educational content, from "coin science popularization" to "strategy teaching", serving as a window for acquiring new user traffic.

Similar to Weibo's predicament, with stricter regulation, terms like "Bitcoin" and "exchange" were systematically restricted, creators were exhausted, and exchanges' investments gradually lost stability.

Unlike these old battlefields, Xiaohongshu quietly completed a thorough evolution in the past two years.

It's no longer just a beauty and fashion sharing community. Content about investment, finance, tech exploration, and overseas life has grown exponentially, with users aged 25-35, from first and second-tier cities, with undergraduate degrees or higher accounting for over 60%.

This group is precisely the core demographic crypto exchanges dream of.

More importantly, Xiaohongshu's traffic distribution is completely different from TikTok.

It doesn't rely on head bloggers' monopoly but allows KOCs with just 1000 followers to gain significant exposure. For instance, a regular Xiaohongshu user's post "Bybit still allows card opening, hurry" can receive thousands of likes and interactions.

Xiaohongshu's another secret weapon is its natural "trust chain".

Unlike public traffic platforms, Xiaohongshu's community is human-centered. Users interact with bloggers in comment sections, consult via private messages, even join group chats, making the entire process feel like friend-to-friend recommendations rather than cold advertisements.

For crypto products with high barriers and steep learning curves, this chain means a shorter conversion distance.

Xinbang's research report even calls Xiaohongshu the "trust engine of social e-commerce":

It integrates internet celebrity traffic, sales information flow, and consumer opinion leader attributes. Traffic depends more on users' active searches than platform recommendations, making sales conversion more precise and less likely to cause annoyance.

So when we see Binance, OKX, Bitget starting to invest resources in Xiaohongshu, it's not a momentary whim but a strategic bet following new traffic logic.

Exchanges' Covert Growth Technique

"OKX cut more than half of its Twitter KOL investment budget and started heavily focusing on Xiaohongshu. Many internal departments are simultaneously working on Xiaohongshu, with the Chinese language department almost entirely dedicated to it."

Crypto blogger Wuwei exposed on X.

On Xiaohongshu, OKX's "North Electric Campus Beauty" themed street interview video garnered over 87,000 likes. Similar themed interviews almost always easily break 10,000 likes, and Nezha series AI shorts also receive thousands of collections.

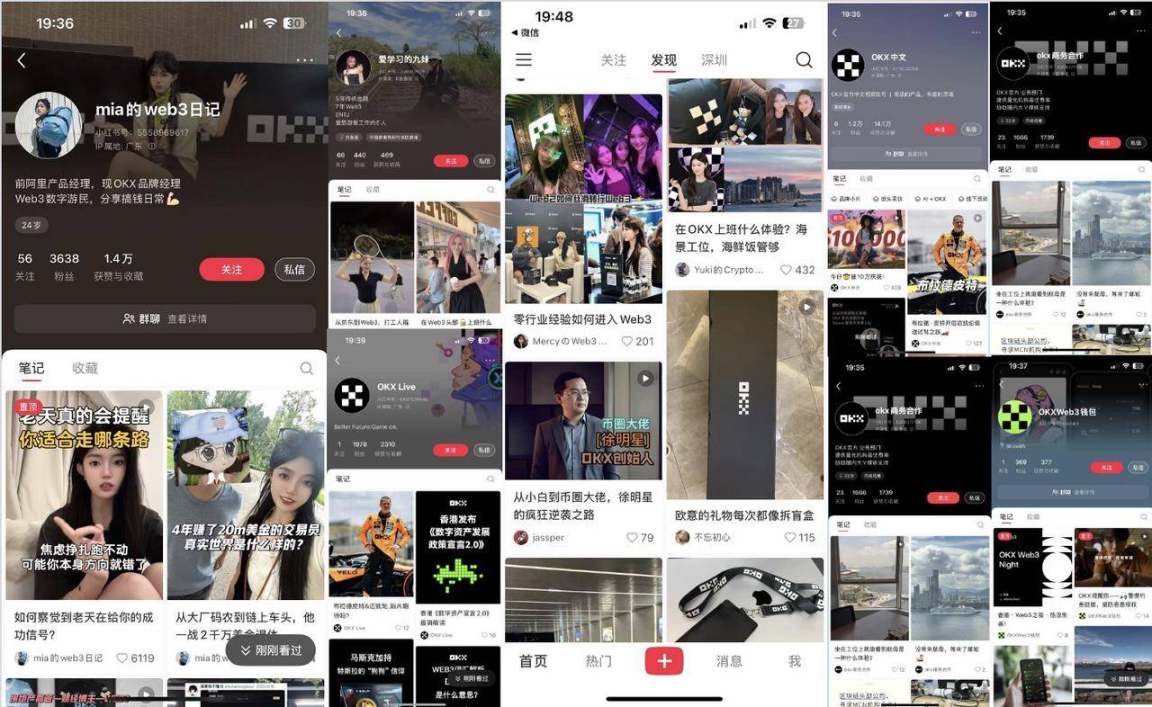

OKX clearly does more than just make videos. Its Xiaohongshu strategy looks more like a carefully planned marketing layout: official accounts create topics, employee accounts infiltrate various content circles, a matrix-style penetration.

Besides the official account, employees like Jiumei, Mercy, and Mia accumulated numerous followers with "Web3 career transition experiences" and "Exchange workplace daily" narratives. They seem independent but frequently interact with official accounts in comment sections, creating secondary exposure and closing the distance.

This matrix approach can offset account blocking risks while allowing the brand to penetrate more细分 user pools, such as young professionals wanting to enter Web3 or freelancers pursuing a "digital nomad" lifestyle.

For exchanges, Xiaohongshu's role might not just be acquiring direct registered users. More often, it plays a "brand display window" role - penetrating content to familiarize potential users with the exchange brand, ensuring they think of it first when they truly need trading.

Real efficient conversion often happens in the "underground world".

Multiple civilian studios have long been active on Xiaohongshu, tirelessly placing traffic-diverting notes.

These notes typically disguise themselves as "Pitfall Guides," "Financial Diaries," or "Beginner Tutorials" to attract users to join groups or private chats, then throw out registration links. Once users deposit and start trading, these promoters can receive commission income for a long time, and some studios even directly place registration ads on Xiaohongshu - which is one of the most stable gray businesses in the crypto.

On Xiaohongshu, cryptocurrencies are often not just cold financial tools, but packaged as a lifestyle choice.

Instead of saying "investing in cryptocurrencies," they say "How I achieve over 10,000 yuan in passive income monthly"; not discussing K-line charts, but sharing digital nomads' financial experiences; not talking technical analysis, but discussing wealth freedom for post-00s generation...

This "lifestyle" packaging perfectly matches Xiaohongshu's content ecosystem and lowers users' psychological barriers.

Crypto blogger Viki summarized the currently valuable Web3 account types on Xiaohongshu:

Professional consulting: Sharing career transition experiences, attracting job seekers;

Investment insights: Seemingly life records, actually investment tutorials;

Lifestyle type: Stories of digital nomads, remote work, overseas living;

Personal IP: Establishing trust through strong identity labels.

"Exchanges will collaborate with KOLs or KOCs with these four types of accounts, ultimately guiding users into communities and completing conversions through registration referral links," Viki explained.

Behind this, exchanges are attempting a long-term brand transformation: from cold trading tools to community companions, or even "narrative leaders".

Dancing on Thin Ice

Crypto exchanges flooding into Xiaohongshu seems like the first step to escape "crypto jargon" and enter mainstream social context, but this path is not smooth.

The trader "Crypto Poison" with 50,000 Twitter followers directly stated that doing Xiaohongshu is an "extremely low-value proposition". He had paid the price of over 20 accounts being repeatedly banned before understanding the rules.

"Back then, the industry hadn't gone competitive, now with exchanges frantically entering, traffic is no longer a blue ocean," another KOL "Digital Trend" said, claiming that doing Xiaohongshu now is like "internal competition within a siege", and the dividend period has disappeared.

Besides fierce competition, the platform's review mechanism is also a high wall.

"Low traffic means no effect, high traffic triggers manual review," Viki summarized, "Once repeatedly violating rules, you'll be lightly restricted in traffic or severely banned - creating content is like dancing in shackles."

To avoid pitfalls, many creators must design unique strategies for different stages, from copywriting to layout to traffic diversion, further lowering the input-output ratio.

More tricky are compliance and user cognitive risks. Xiaohongshu's mainstream user group is mostly young people who lack understanding of contracts, leverage, and on-chain assets. A slight mistake could cause financial losses due to misleading information, potentially triggering regulatory tightening. Even though the platform currently maintains some ambiguous space for crypto content, with financial content management becoming standardized, any public opinion explosion could lead to a platform-wide ban.

The risks are obvious, but exchanges are still investing heavily.

"If you don't rush in, competitors will get ahead," a crypto exchange marketing manager said.

This is exactly like a classic "prisoner's dilemma":

If only you do it, you can indeed grab the dividend

If everyone does it, dividends get diluted and risks amplified

If you don't do it, you'll watch competitors harvest users

So even knowing there are traffic traps and potential risks, they still jump in.

Breaking boundaries always comes at a cost - the question is whether this cost is worth it.

Exchanges' adventure on Xiaohongshu is like dancing on thin ice - every step could be the last, but when the music plays, no one wants to stop.

How long will this traffic carnival last? Nobody knows the answer.

The only certainty is: in an era of increasingly expensive traffic and stricter regulation, the "easy money" era has gone forever. What exchanges need to consider is not just how to acquire users, but how to truly create value under compliance and sustainability premises.

Otherwise, today's Xiaohongshu might become tomorrow's Weibo.

History doesn't repeat, but always rhymes.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush