ZORA's price has increased by 4% in the past 24 hours, thanks to a slight recovery in the broader cryptocurrency market.

Despite today's price increase, technical and on-chain indicators show that this distribution phase is still ongoing strongly, with a bearish sentiment still prevailing in the market.

ZORA's Price Momentum Gradually Fades

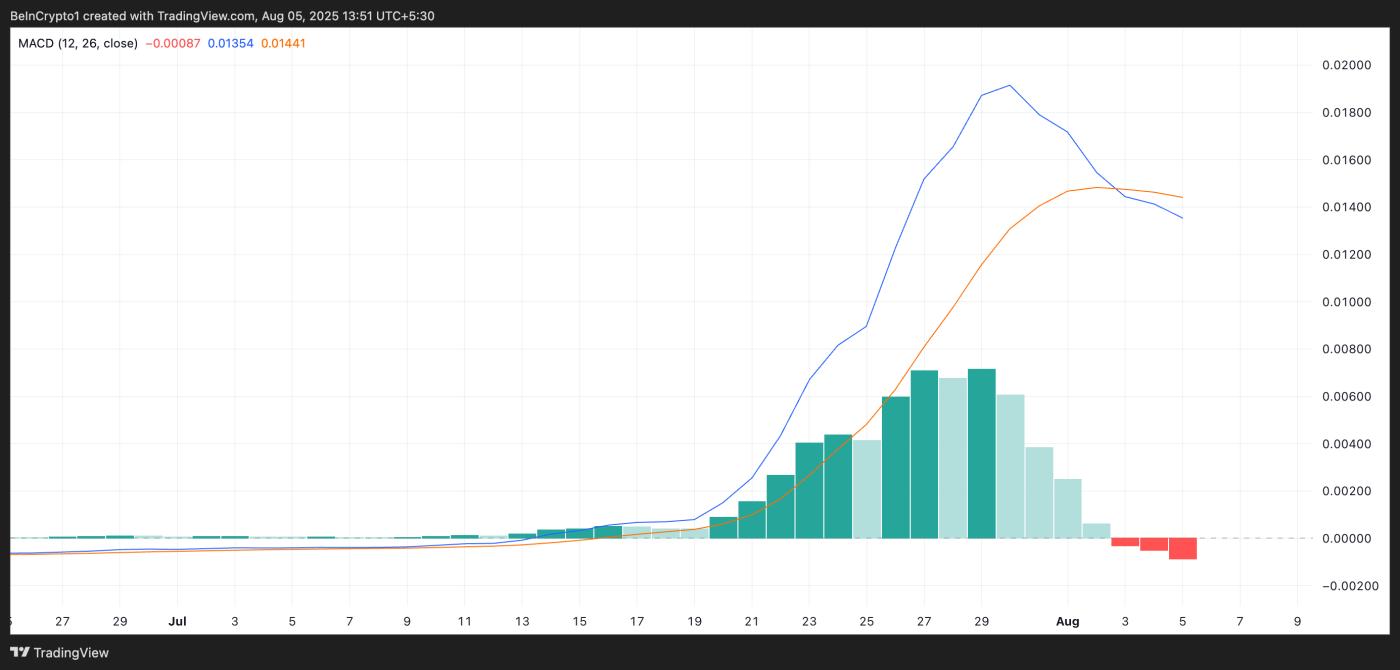

Indicators from the daily ZORA/USD chart show a recent negative crossover in the ZORA Moving Average Convergence Divergence (MACD) indicator. This occurs when the MACD line (green) crosses below the signal line (orange), a classic bearish signal indicating weakening momentum.

For token and market updates: Want more detailed information about such tokens? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

ZORA MACD. Source: TradingView

ZORA MACD. Source: TradingViewThe MACD indicator determines the trend and momentum of an asset's price movement. It helps traders detect potential buy or sell signals through crossovers between the MACD and signal lines.

When the MACD line is above the signal line, it indicates upward momentum, suggesting the asset's price may continue to rise.

Conversely, when the MACD line is below the signal line and drops to 0 — as currently with ZORA — it signals weakening upward momentum and likely shift to bearish control.

Moreover, the sentiment in ZORA's futures market is not different. This is reflected in its long/short ratio, currently at its 14-day low of 0.92.

ZORA Long/Short Ratio. Source: Coinglass

ZORA Long/Short Ratio. Source: CoinglassThe long/short index measures the ratio of long to short bets in an asset's futures market. A ratio above one indicates more long positions than short. This suggests bullish sentiment, as most traders expect the asset's value to increase.

Conversely, a long/short ratio below 1 means more traders are betting on the asset's price to fall rather than rise.

Therefore, ZORA's current long/short ratio indicates that most traders are increasingly preparing for a correction rather than a rise to new highs.

ZORA Stops at Resistance Level — Traders Prepare for Strong Volatility

At the time of writing, ZORA is trading at $0.06799, just below the resistance level formed at $0.06802. If bears increase control and buying pressure decreases, the token may witness a drop to the support level at $0.05666.

ZORA Price Analysis. Source: TradingView

ZORA Price Analysis. Source: TradingViewHowever, if accumulation increases and ZORA breaks through $0.6802, it could extend its upward momentum to $0.08431.