The price of Stellar has shown signs of recovery after two weeks of decline when this altcoin experienced a value drop.

However, recent developments indicate that this asset is recovering due to increased investment activity. Stellar is currently trying to turn the situation around and restore what has been lost.

Stellar investors are returning

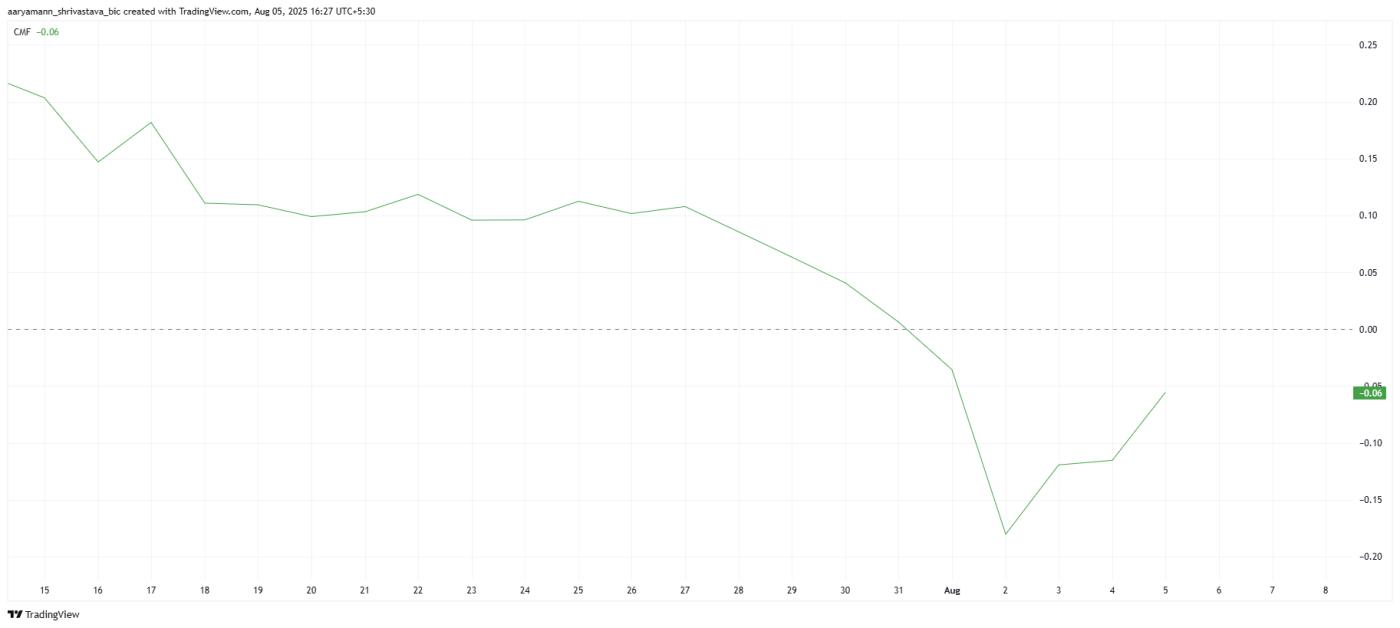

The Chaikin Money Flow (CMF) indicator, which tracks capital inflow into an asset, is showing an increase for Stellar. This suggests that XLM is experiencing an increase in capital inflow, which could be a positive sign for this altcoin. However, although CMF is increasing, it remains below the zero line, indicating that the capital inflow is not yet strong enough to trigger a sustainable upward trend.

For the capital inflow to continue and have a long-term impact on XLM's price, CMF will need to decisively cross the zero line. Although this could lead to further recovery in the coming weeks, investors will need to closely monitor this asset to ensure momentum continues to build.

XLM CMF. Source: TradingView

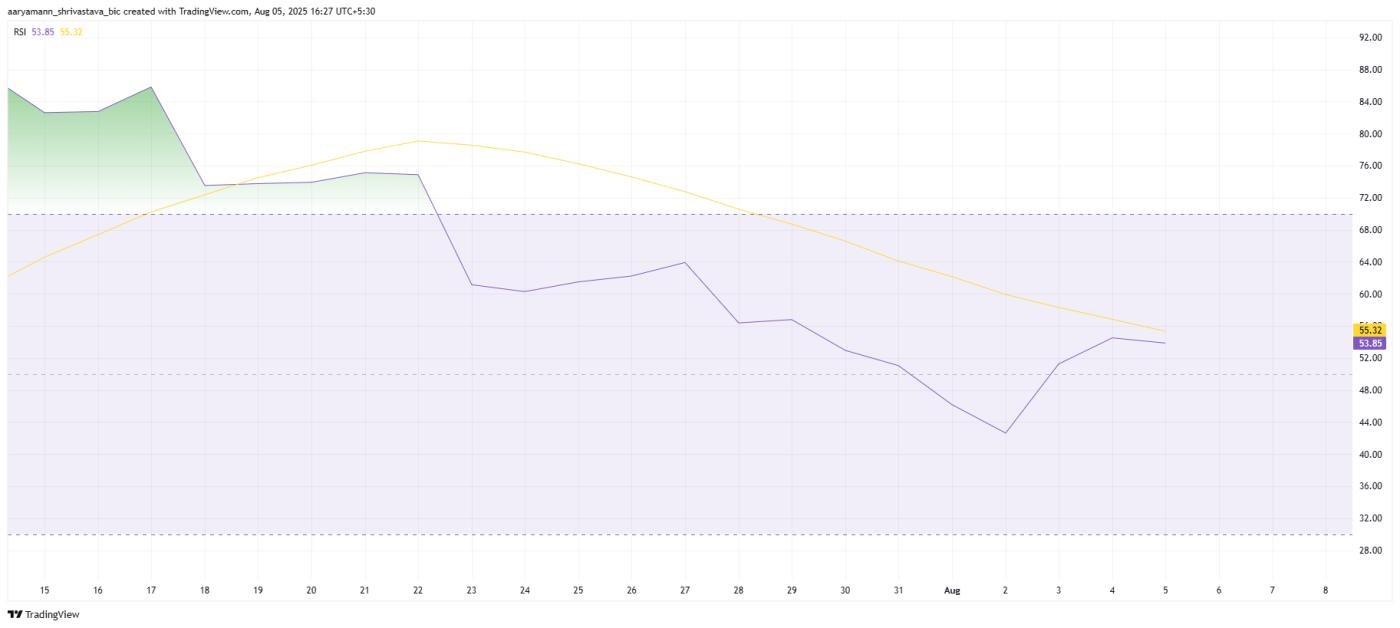

XLM CMF. Source: TradingViewEthereum's technical indicators also show a return of price momentum. The Relative Strength Index (RSI) has returned to the positive zone, above the neutral 50.0 level, after temporarily dropping to the negative zone. The reversal from the previous downward trend indicates that XLM is regaining strength.

RSI shows that investor sentiment is improving. The short-term price decline may be due to uncertainty and skepticism in the broader market. However, with RSI returning to the positive zone, the likelihood of further price increases has risen.

XLM RSI. Source: TradingView

XLM RSI. Source: TradingViewXLM Price Heading Towards Recovery

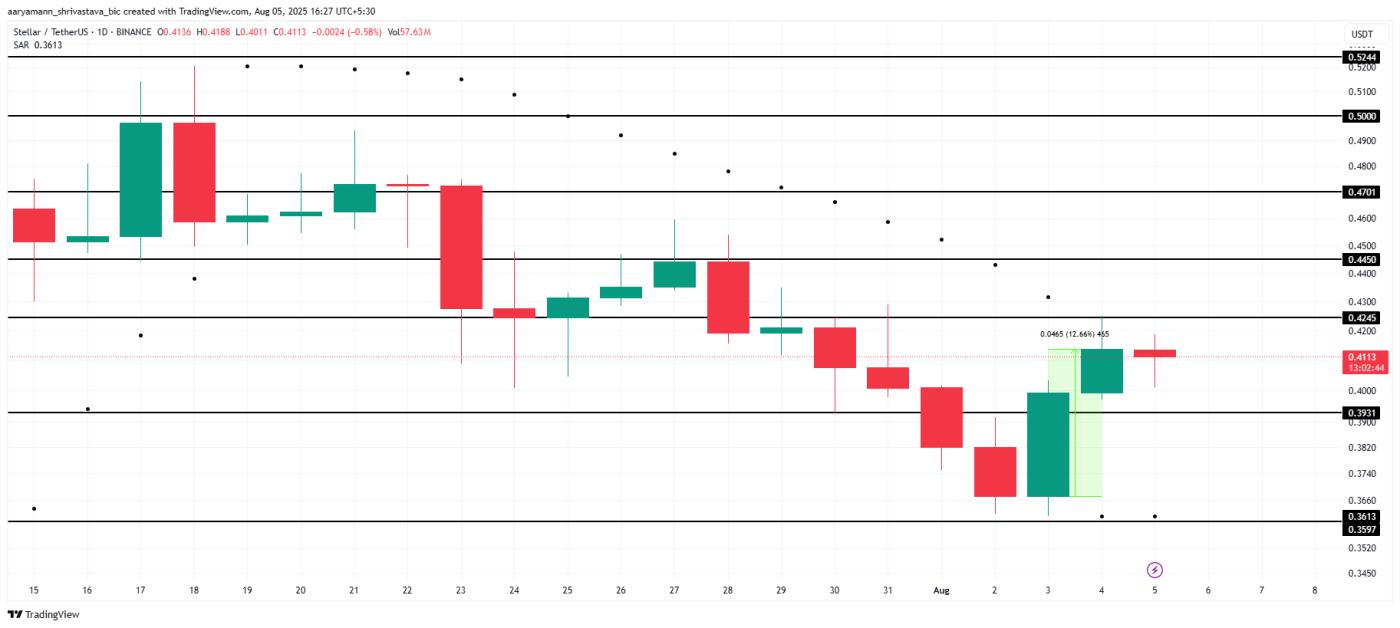

Stellar's price is currently trading at $0.411, just below the resistance level of $0.424. Breaking through this resistance level will be key for XLM to recover recent losses and continue its upward trend. The Parabolic SAR moving below the candles after two weeks indicates that the downward trend is gradually ending.

If Stellar can convert $0.424 into support, it could pave the way for an increase beyond $0.445 and potentially reach $0.470. This would allow XLM to recover a significant portion of the losses it has suffered over the past two weeks and continue its upward trend.

XLM Price Analysis. Source: TradingView

XLM Price Analysis. Source: TradingViewHowever, if broader market conditions do not maintain the upward trend and investor sentiment turns negative, Stellar may face a decline. If it fails to maintain support at $0.424, XLM could drop to $0.393, with continued downward momentum potentially pushing the price down to $0.359, negating the price increase prospects.