#ETH

- Technical Outlook: ETH shows short-term bearish signals but maintains key support levels that could catalyze a rebound

- Fundamental Strength: Growing institutional holdings and network upgrades contrast with technical selling pressure

- Long-Term Trajectory: Ethereum's utility as a programmable money platform supports multi-decade growth potential

ETH Price Prediction

ETH Technical Analysis: Short-Term Bearish Signals Amid Long-Term Potential

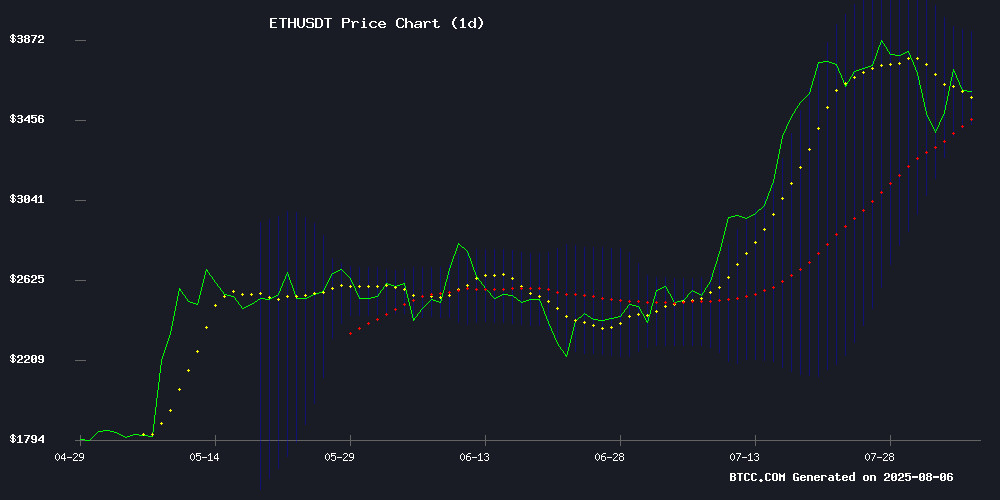

ETH is currently trading at $3,583.34, below its 20-day moving average of $3,673.70, indicating short-term bearish pressure. The MACD histogram shows a positive crossover (181.61) but remains DEEP in negative territory (-36.57 signal line), suggesting weak momentum. Bollinger Bands show price testing the lower band at $3,428.77, which may act as support.

"The technical picture shows ETH is in a consolidation phase," says BTCC analyst Sophia. "While the MACD shows some bullish divergence, traders should watch for a sustained break above the 20MA at $3,673 to confirm trend reversal."

Mixed Market Sentiment as Ethereum Network Activity Grows

Ethereum's price decline to $3,500 coincides with strong fundamental developments: the Dencun upgrade boosting scalability, institutional accumulation (SharpLink Gaming now holds 521k ETH), and a 70% MoM transaction growth. However, Base Network outages and shifting investor preferences create near-term uncertainty.

"The news FLOW reveals a tug-of-war," notes BTCC's Sophia. "While cloud mining adoption and Lido's new staking features are bullish, the market is punishing any infrastructure weaknesses harshly as investors prioritize utility over speculation."

Factors Influencing ETH's Price

Ethereum Nears $3,500 as Investors Flock to ZA Miner’s VIP Cloud Mining Ecosystem

Ethereum (ETH) is inching closer to the $3,500 mark, a psychological threshold that has drawn renewed attention to cloud mining platforms promising high returns. ZA Miner, a UK-based platform operated by ZA FUNDINGS LTD, has emerged as a focal point for investors seeking passive income through ETH-based mining. The platform recently completed a system upgrade, introducing VIP-grade cloud mining with incentives, instant gains, and full automation.

ETH’s 12% monthly surge and sustained developer activity around ETH 2.0 scaling have fueled demand for mining solutions. ZA Miner distinguishes itself with eco-friendly, FCA-certified operations and a referral-based income model. "We’re creating a high-trust financial ecosystem," a company representative noted, emphasizing compliance and compounding opportunities for serious investors.

The platform’s ETH Popular Miner plan offers a streamlined path to ROI, capitalizing on Ethereum’s bullish momentum. As institutional and retail interest converges, ZA Miner’s VIP club is positioning itself as a gateway to scalable, environmentally conscious crypto wealth generation.

Ethereum’s Dencun Upgrade Fuels Investor Optimism as AIXA Miner Democratizes ETH Earnings

Ethereum reclaims market momentum following its Dencun upgrade, surpassing $4,000 for the first time since 2021. The enhancement's scalable infrastructure and reduced transaction costs have reignited institutional interest, with analysts projecting sustained growth through 2025.

AIXA Miner emerges as a disruptive force, enabling passive ETH accumulation through algorithmic cloud mining. The platform circumvents traditional barriers—hardware costs, technical expertise, and capital requirements—via AI-driven coin selection and reward optimization. Its automated market analysis continuously reallocates resources to maximize yield.

SharpLink Gaming Expands Ethereum Holdings to Over 521,000 ETH

SharpLink Gaming has aggressively increased its Ethereum holdings, purchasing an additional 83,561 ETH for $304 million. This brings its total stash to 521,939 ETH, valued at over $1.9 billion as of August 3, 2025. The Nasdaq-listed firm now ranks as the second-largest corporate holder of Ethereum.

The acquisition was executed at an average price of $3,634 per ETH, funded through SharpLink's at-the-market facility. Since June 2025, the company has raised $264.5 million from public stock offerings to fuel its Ethereum accumulation strategy. Staking rewards have already generated 929 ETH ($3.4 million) in passive income.

SharpLink's moves reflect growing institutional confidence in Ethereum's long-term value proposition. The company continues exploring capital formation opportunities, including potential debt or equity-linked offerings, to further expand its crypto treasury.

Investors Shift from Meme Tokens to Utility-Driven Projects Like Rollblock and Sei

The cryptocurrency market is witnessing a notable pivot as investors move away from speculative meme tokens toward projects with tangible utility. Rollblock, an Ethereum-based iGaming protocol, and SEI Coin are emerging as frontrunners in this shift, offering functional ecosystems, staking rewards, and scalable solutions.

Rollblock distinguishes itself with a fully licensed, revenue-generating platform that features over 12,000 games, a sportsbook, and AI-enhanced interfaces. The project has already raised $11 million in presale and onboarded 50,000 users, emphasizing real-world adoption through seamless fiat and crypto integrations.

SEI Coin, another utility-focused contender, is gaining traction for its scalable infrastructure and developer-friendly tools. Both projects highlight the market's growing appetite for blockchain applications that deliver measurable value beyond hype.

CrediX Recovers $4.5M in Stolen Crypto Through Exploiter Negotiation

CrediX, a money market abstraction protocol, has successfully recovered $4.5 million in stolen cryptocurrency following a private settlement with the attacker. The funds, stolen in a Monday breach, were bridged to Ethereum via a Tornado Cash-funded wallet. The exploiter agreed to return the assets in exchange for an undisclosed payment from CrediX's treasury.

Affected users will receive refunds within 48 hours. This resolution marks a departure from traditional recovery methods, highlighting the growing trend of negotiated settlements in crypto hacks. Blockchain security firm Cyvers confirmed the theft's scale, underscoring the protocol's swift response.

Base Network Outage Disrupts Transactions, Highlights Decentralization Concerns

Coinbase's Ethereum Layer-2 network Base suffered a 30-minute outage on August 5, 2025, halting block production at height 33,792,704. The disruption froze deposits, withdrawals, and Flashblocks operations—marking the network's first major downtime since launch.

While quickly resolved, the incident reignited debates about infrastructure reliability in decentralized ecosystems. "It's a sharp reminder that decentralization still matters," tweeted @VJweb3, juxtaposing Base's stumble against hypothetical "lightning fast" chains.

The outage occurred as Base reportedly surpassed Solana in new token launches, compounding scrutiny of its technical resilience during growth phases. Network operators continue monitoring stability after restoring operations.

Linea Introduces Auto-Staking for Bridged ETH via Lido to Enhance Yield Efficiency

Linea, an Ethereum Layer 2 solution developed by Consensys, is launching a groundbreaking feature called Native Yield. This innovation automatically stakes ETH bridged to the network using Lido v3, enabling users to earn 3–5% staking rewards without manual intervention. The move addresses inefficiencies in DeFi, where capital often sits idle or chases unsustainable short-term yields.

The feature sends bridged ETH back to Ethereum mainnet for staking via Lido while remaining usable on Linea. This dual functionality allows liquidity providers to benefit from Ethereum's proof-of-stake rewards while participating in Linea's DeFi ecosystem. The rewards originate from Ethereum's native staking mechanism, not from risky lending protocols.

Linea's team criticizes the current DeFi landscape as plagued by transient yield opportunities and opaque risks. Native Yield represents a paradigm shift toward sustainable capital productivity from the moment assets are bridged. The solution could significantly improve capital efficiency across Layer 2 ecosystems.

Base Network Experiences First Downtime Since Launch, Halting Operations for 29 Minutes

Base, Coinbase's Ethereum layer-2 scaling solution, suffered its first operational disruption since its 2023 debut. The network ceased block production, deposits, withdrawals, and flashblock operations for 29 minutes before services were restored.

The outage occurred at 06:15 UTC due to an "unsafe head delay," a technical fault that impeded block confirmation. The team identified and resolved the issue by 06:44 UTC, implementing additional monitoring to prevent recurrence.

This incident marks a notable break in Base's previously unblemished uptime record. The network has become a significant player in Ethereum's layer-2 ecosystem, amassing $4.2 billion in total value locked—$1.5 billion of which is tied to the Morpho lending protocol.

Ethereum Network Activity Surges as Transactions Jump 70% MoM

Ethereum's blockchain is experiencing a resurgence in activity, with total transactions soaring 70% month-over-month. The rally coincides with Ether's price surge from $1,800 in April to $3,915 by July—a 120% gain that has reignited network participation.

Daily transactions climbed from 1 million in January 2025 to 1.82 million by July's end, marking the highest throughput since January 2024. This revival signals renewed DeFi engagement as regulatory clarity around stablecoins improves, positioning Ethereum as the prime beneficiary among smart contract platforms.

Institutional accumulation compounds the growth. Corporate treasuries—including BitMine, SharpLink, and The Ether Machine—now hold over $10 billion in ETH reserves, with acquisitions continuing apace. While Ethereum dominates overall activity, Hyperliquid L1 leads in daily transaction volume among Layer 1 chains.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Base Case | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $4,200 | $6,500 | $9,000 | ETF approvals, Dencun adoption |

| 2030 | $12,000 | $18,000 | $25,000 | Enterprise DeFi adoption |

| 2035 | $30,000 | $45,000 | $70,000 | AI+blockchain convergence |

| 2040 | $60,000 | $90,000 | $150,000 | Global settlement layer status |

"Our projections factor in Ethereum's deflationary supply post-Merge and its lead in smart contract platforms," explains Sophia. "The 2025 base case assumes moderate institutional adoption, while 2040 targets reflect Ethereum potentially becoming the backbone of Web3's financial infrastructure."