Original Title: 《Crypto traders 'fool themselves' with price predictions: Peter Brandt》

Author: Ciaran Lyons, Cointelegraph Magazine

Compiled & Translated by: Fairy, ChainCatcher

Editor's Note:

Peter Brandt founded Factor Trading Co., Inc. in 1981, focusing on proprietary trading. From the mid-1980s to early 1990s, he also managed funds for several large institutional clients. He rose to fame for his precise predictions of trends in commodities, futures, and crypto markets (such as the 2017-2018 Bitcoin bull market) and is now one of the most watched technical traders in the crypto space.

In the noisy crypto market, Peter Brandt's voice has always been an outlier. He is both an old-school representative of the chart analysis camp and a controversial "cold-faced jokester". In traders' eyes, he is a "price hunter" who precisely buys the dips and sells the tops; in the crypto community, he is a provocateur who enjoys "fishing" and mocking ETH and XRP bulls.

This article provides an in-depth interview with this market veteran who has been trading commodities since 1975, reviewing how he entered the crypto world and how he views the true value of chart analysis.

Brandt's perspective may not be likable, but it is quite enlightening: in the market, not every prediction needs to be endorsed as a belief; sometimes, it is just an opportunity to place a bet.

Below is the original text, compiled by ChainCatcher.

"I only look for opportunities to turn $1 into $4."

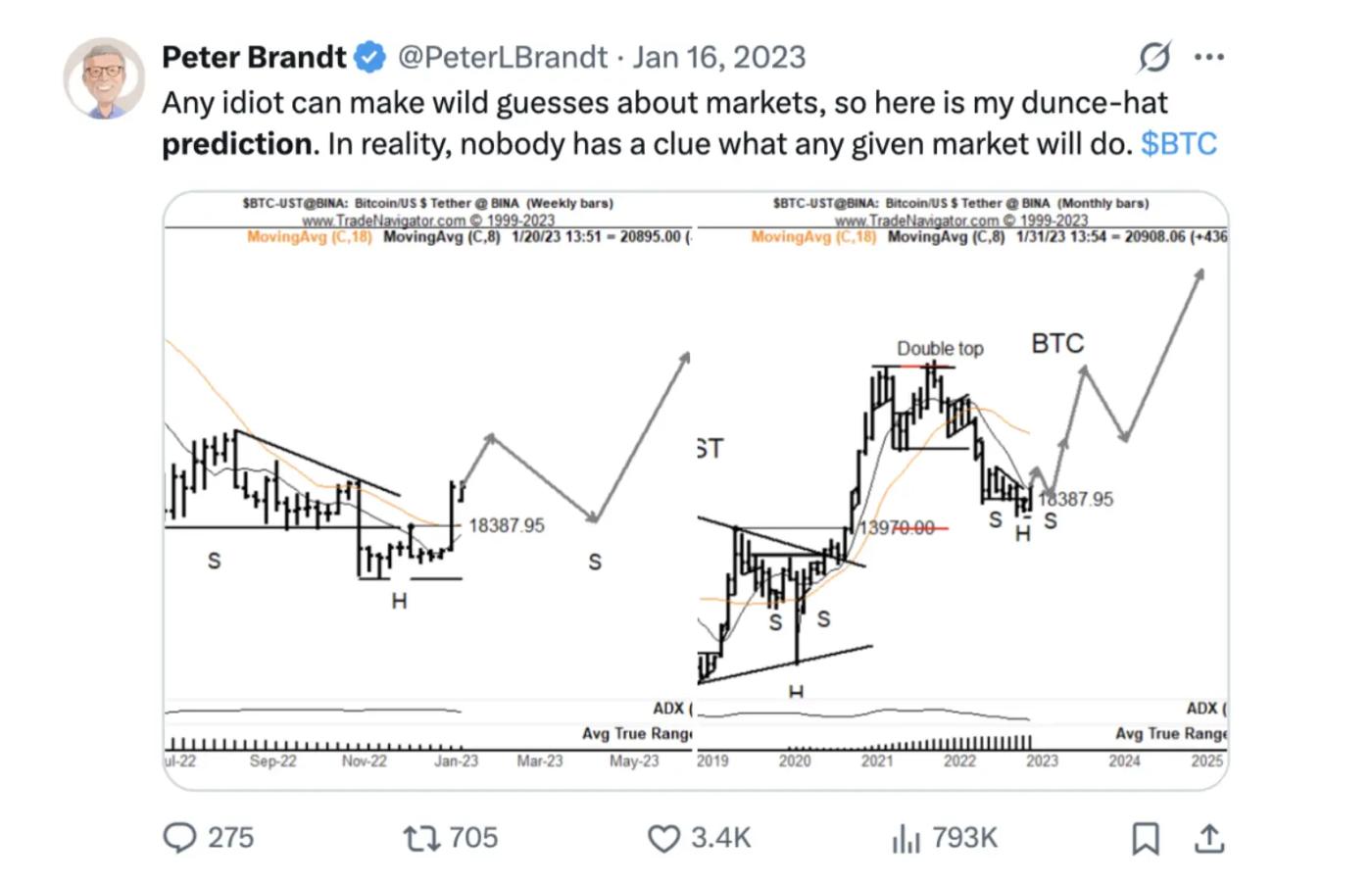

"Someone who looks at a chart and tells you where an asset will go in the future is actually fooling themselves."

The legendary trader Peter Brandt candidly shared his trading philosophy in the interview: charts cannot predict future prices, they can only tell you where prices "have been and where they are now".

In his view, the significance of charts is not to predict, but to identify opportunities with extremely asymmetric risk-reward. He said: "Probabilistically, markets usually run along the existing trend but fluctuate within a certain range. I focus on positions where $1 can potentially earn $4, even if only half of them are successful, I'm willing to make a move."

Peter Brandt's Half-Century Market Journey

Since entering the commodity trading market in 1975, Peter Brandt has been active for nearly half a century. On Twitter, he has over 800,000 followers. Economist and Wall Street Journal columnist Barry Ritholtz even rated him as one of the "30 most influential people in the financial industry".

Surprisingly, Brandt is not from a professional background. He graduated from the University of Minnesota's journalism department in 1970 and initially worked in advertising, serving clients like McDonald's and even witnessing the birth of the "McDonald's uncle" brand image.

It was only when a neighbor who traded soybeans introduced him to the market that Brandt began to pay attention to futures. A few years later, he decided to give up his stable advertising career and fully devote himself to corn futures trading. From the 1970s, he was active in agricultural markets, gaining considerable trading profits from dramatic market movements caused by weather changes and policy fluctuations.

Afterwards, he managed large institutional client accounts and founded his own proprietary trading company, Factor Trading Co., which is still in operation. In 2011, he published "Diary of a Professional Commodity Trader", which remained at the top of Amazon's trading book list for 27 consecutive weeks.

A Phone Call That Brought Him into the Crypto World

In May 2016, five years after his bestselling book "Diary of a Professional Commodity Trader" topped Amazon, Peter Brandt received a private message from Real Vision co-founder Raoul Pal: "Peter, I admire your perspective. What do you think of this chart?" The chart showed Bitcoin, which was priced below $450 at the time.

Brandt was immediately attracted and exclaimed, "Wow, this is amazing!" He immediately called Pal to ask how to buy Bitcoin.

A few months later, when Bitcoin rose to $1,000, Brandt sold out, successfully doubling his investment. From then on, Brandt began to frequently judge the tops and bottoms of Bitcoin and other crypto assets, sometimes winning applause and sometimes facing questioning.

In December 2017, he almost "precisely" predicted the Bitcoin top and foresaw an 80% pullback, which was fully realized in the next 12 months.

However, he candidly admitted that some shocking predictions actually had a joking element. For example, in June 2024, he once joked that Bitcoin might plummet 75%, but a month later, BTC hit a new high of $123,100. He said, "Looking back, my sarcastic tone wasn't obvious enough, I should have learned to use emojis, like adding four winks after a tweet."

Now he believes that such massive plunges are unlikely to recur. "Bitcoin has become institutionalized and widely accepted, and the era of massive pullbacks may be over."

But Brandt, who has experienced 50 years of market waves and entered the market decades before the 2008 financial crisis, also admits: "In the market, anything is possible."

A Disruptive Trading Master Without Emotions

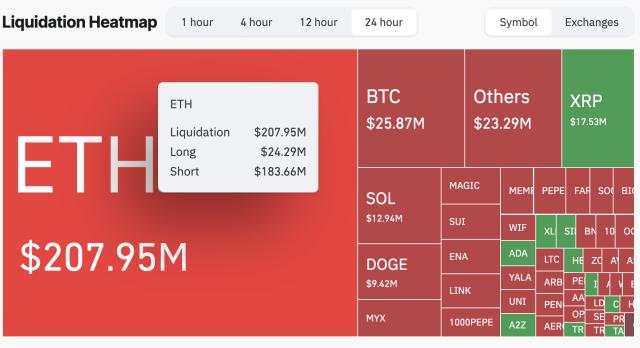

Peter Brandt is controversial in the ETH and XRP communities for frequently posting sharp and even provocative tweets. But he always insists that he is an "emotionless trader", not a fan of any particular coin. He believes that whether it's BTC or Solana, these are just trading tools, not objects of worship.

As a technical analyst, Brandt does not shy away from negative signals transmitted by charts, and is often criticized for posting bearish comments. Despite his harsh words, he still holds ETH and XRP in his investment portfolio, with Bitcoin positions accounting for about 40% of his total investment.

Brandt also candidly admits that he enjoys "disrupting" the crypto community, sometimes deliberately posting provocative comments to provoke reactions, which he calls a form of "fishing". He believes the crypto community is easily trapped in emotions, with many misinterpreting criticism of a coin as a personal attack and prone to labeling others.

For those "HODLers" who stick to their beliefs and have experienced multiple significant pullbacks, Brandt is critical, believing that such blind persistence could ultimately lead to bankruptcy.

Brandt: Rationally View Bitcoin's Million-Dollar Expectation

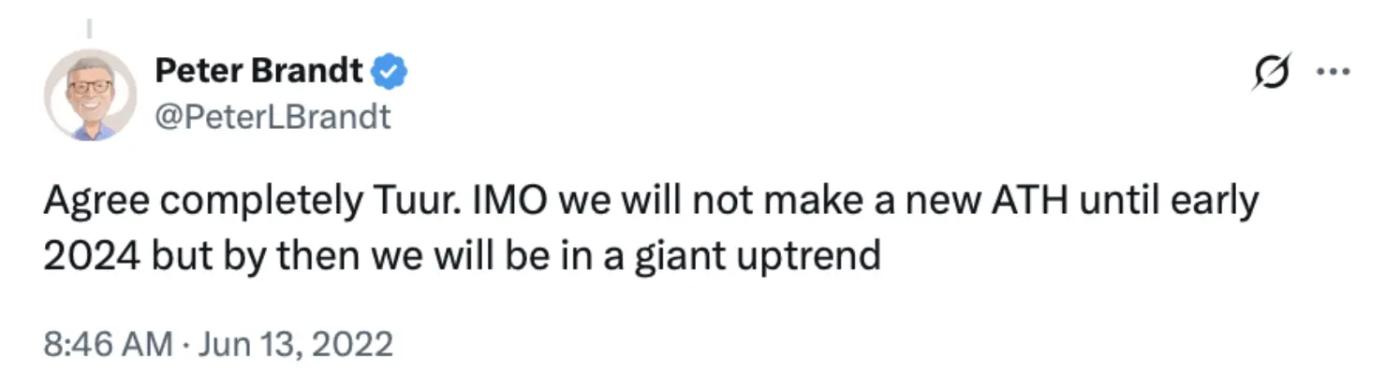

Peter Brandt believes that Bitcoin's bull market has long been underway, not just starting. He points out that when the market is at the top, investors are generally optimistic, while at the bottom, sentiment is often extremely pessimistic. Sentiment is driven by price and, in turn, drives price movements.

However, Brandt does not focus much on the "halving cycle" but more on the "bull market cycle", which is the complete time span from the bottom of the previous bear market to the top of the next bull market. By his judgment, the current bull market began in November 2022 and has lasted nearly three years, with a sufficiently long cycle.

He also revealed the "exponential decay" rule of Bitcoin bull market returns:

- The first bull market rose about 3,200 times;

- The second round about 630 times;

- The third round dropped to 122 times;

- The fourth round only 21 times.

Brandt points out that although Bitcoin's rise seems stunning, its actual returns have significantly decreased. He believes that claims that Bitcoin could rise to $1 million lack responsibility.

Brandt emphasized that this does not mean Bitcoin will never be able to reach this price, but it would be extremely difficult to achieve. Even with high government debt and continuous massive money printing, it is not enough to support the claim that Bitcoin should rise to $1 million.