Written by: Trendverse Lab

Since 2024, the stablecoin market has been experiencing a new transformation driven by structural innovation. After USDT, USDC, and other fiat-backed stablecoins have dominated for years, USDe launched by Ethena Labs quickly rose to prominence with its "no fiat support" synthetic stablecoin design, with its market value briefly exceeding $8 billion, becoming the "high-yield dollar" in the DeFi world.

Recently, the Liquid Leverage staking activity jointly launched by Ethena and Aave has sparked market discussion: with an annualized return close to 50%, it seemingly appears to be a typical incentive strategy, but may also reveal another signal worth noting - the structural liquidity pressure that the USDe model bears during ETH bull markets.

This article will focus on this incentive activity, briefly explaining USDe/sUSDe and related platforms, and analyzing the systematic challenges hidden behind them from perspectives of revenue structure, user behavior, and capital flow, while comparing with historical cases like GHO to explore whether future mechanisms have sufficient resilience to cope with extreme market scenarios.

I. Introduction to USDe and sUSDe: Synthetic Stablecoins Based on Crypto-Native Mechanisms

USDe is a synthetic stablecoin launched by Ethena Labs in 2024, designed to avoid dependence on traditional banking systems and issuers. Currently, its circulation has exceeded $8 billion. Unlike stablecoins like USDT or USDC supported by fiat reserves, USDe's anchoring mechanism relies on on-chain crypto assets, especially ETH and its derivative staking assets (such as stETH, WBETH, etc.).

Image source: Coingecko

Its core mechanism is a "delta neutral" structure: on one side, the protocol holds ETH and other asset positions, while on the other side, it opens an equivalent ETH perpetual short position on centralized derivative trading platforms. Through a hedging combination of spot and derivatives, USDe achieves a near-zero net asset exposure, thereby stabilizing its price around $1.

sUSDe is the representative token obtained by users after staking USDe in the protocol, featuring automatic yield accumulation. Its revenue sources mainly include: funding rate returns from ETH perpetual contracts and derivative yields from underlying staking assets. This model aims to introduce a continuous revenue model for stablecoins while maintaining its price anchoring mechanism.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.]IV. Does the Incentive Plan Reveal Structural Challenges Similar to USDe and GHO?

Although both are stablecoins issued based on crypto asset pledges, USDe and GHO have significant differences in mechanism. USDe maintains its peg through a delta-neutral structure, with historical prices generally stable around $1, without the severe deviation of GHO to $0.94, and without encountering a liquidity crisis similar to relying on liquidity incentives to restore price. However, this does not mean USDe is completely immune to risks, as its hedging model itself has potential vulnerabilities, especially when facing market volatility or external incentive withdrawal.

Specific risks are manifested in the following two aspects:

1. Negative Funding Rate, Declining or Even Negative Protocol Earnings:

The main income of sUSDe comes from LST earnings of staked assets like ETH, combined with positive funding rates on ETH short perpetual contracts on centralized derivative platforms. Currently, with positive market sentiment, long positions pay interest to short positions, maintaining positive returns. However, if the market turns weak, with more short positions and negative funding rates, the protocol needs to pay additional fees to maintain hedged positions, reducing earnings or even turning negative. Although Ethena has an insurance fund buffer, its long-term ability to cover negative returns remains uncertain.

2. Incentive Termination → Promotional Rate of 12% Earnings Disappear Directly

The current Liquid Leverage activity on Aave platform only provides additional USDe rewards (approximately 12% annualized) for a limited time. Once the incentive ends, users' actual earnings will fall back to sUSDe's native yield (funding rate + LST earnings) and Aave platform deposit rate, potentially dropping to the 15-20% range. Under high leverage (e.g., 5x), with USDT borrowing rate (currently 4.69%) added, the earning space will be significantly compressed. More severely, in extreme environments with negative funding and rising rates, users' net earnings could be completely eroded or even turn negative.

If incentive termination, ETH price drop, and negative funding rate coincide, the delta-neutral revenue mechanism that USDe relies on will face substantial impact. sUSDe earnings might approach zero or become negative. If accompanied by massive redemptions and selling pressure, USDe's price anchoring mechanism will also be challenged. This "multiple negative overlay" constitutes the most core systemic risk in Ethena's current architecture and may be the deep-seated motivation behind its recent high-intensity incentive activities.

V. Will the Structure Stabilize with Ethereum Price Increase?

Since USDe's stabilization mechanism depends on Ethereum spot pledges and derivative hedging, its pool structure faces systemic drainage pressure during rapid ETH price increases. Specifically, when ETH price approaches market expectations' high point, users tend to redeem staked assets early to realize gains or shift to other assets with higher returns. This behavior generates a typical "ETH bull market → LST outflow → USDe contraction" chain reaction.

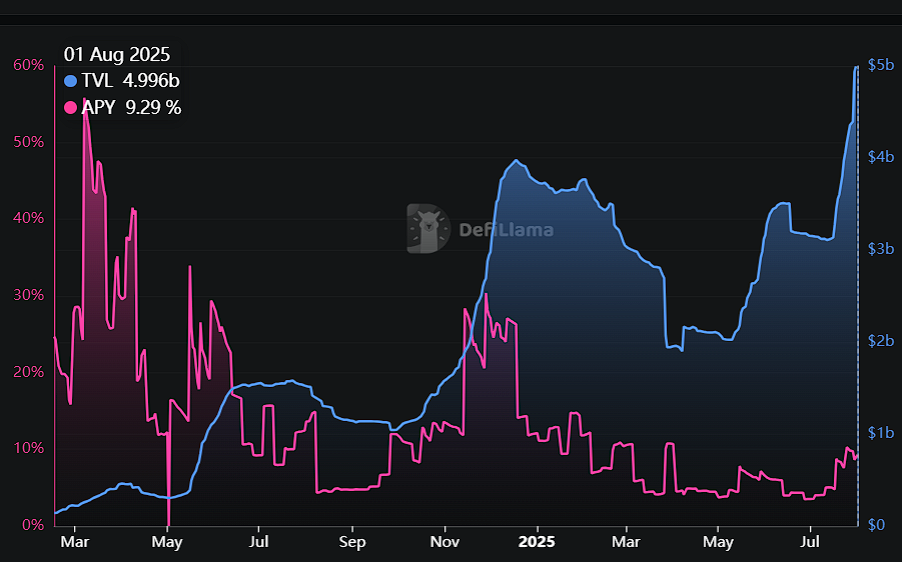

From defillama data, it can be observed that USDe and sUSDe's TVL simultaneously decreased during ETH's price surge in June 2025, without showing increased annualized yield (APY) accompanying price rise. This phenomenon contrasts with the previous bull market (late 2024): when ETH reached its peak, although TVL gradually declined, the process was relatively slow, and users did not collectively redeem staked assets early.

In the current cycle, simultaneous TVL and APY decline reflect increasing market participant concerns about sUSDe's yield sustainability. When price fluctuations and funding cost changes bring potential negative yield risks to the delta-neutral model, user behavior shows higher sensitivity and reaction speed, with early exit becoming the mainstream choice. This fund withdrawal phenomenon not only weakens USDe's expansion capacity but also further amplifies its passive contraction characteristics during ETH price increase cycles.

Summary:

In summary, the current annualized yield of 50% is not the protocol's norm but a stage-driven result of multiple external incentives (Merkl airdrop + Aave collaboration). Once risk factors like ETH price high-level oscillation, incentive termination, and negative funding rates concentrate, the delta-neutral revenue structure USDe relies on will face pressure. sUSDe earnings might quickly converge to zero or turn negative, thereby challenging the stable anchoring mechanism.

From recent data, USDe and sUSDe's TVL show synchronized decline during ETH price increases, and APY does not rise simultaneously. This "drainage during rise" phenomenon indicates that market confidence is starting to price in risks in advance. Similar to GHO's previous "anchoring crisis", USDe's current liquidity stability largely depends on continuous subsidies for stabilization.

When this incentive game ends and whether it can secure enough structural resilience adjustment window will be a key test of USDe's potential as the "third pole of stablecoins".