Early Stage of Anchored Asset Trading (2018-2019)

Once upon a time, over five years ago, we could only trade on the mainnet with Uniswap, Bancor, and some clunky order book-based decentralized exchanges (DEX) like EtherDelta. Therefore, the options for anchored asset trading were extremely limited, and we could only use the USDC/USDT pool on Uniswap V2, which was simply crazy.

Let's focus on this historical anecdote to understand the extent of waste at the time. For liquidity pools, the key parameter is the relative change in the prices of two assets: if you've participated in liquidity provision (LP) with high volatility, you're surely familiar with this. For example, if you provide liquidity for LINK/ETH, the biggest impermanent loss pain point is when ETH skyrockets while LINK plummets: the ETH in your LP position (with rising price) decreases, while LINK (with falling price) increases.

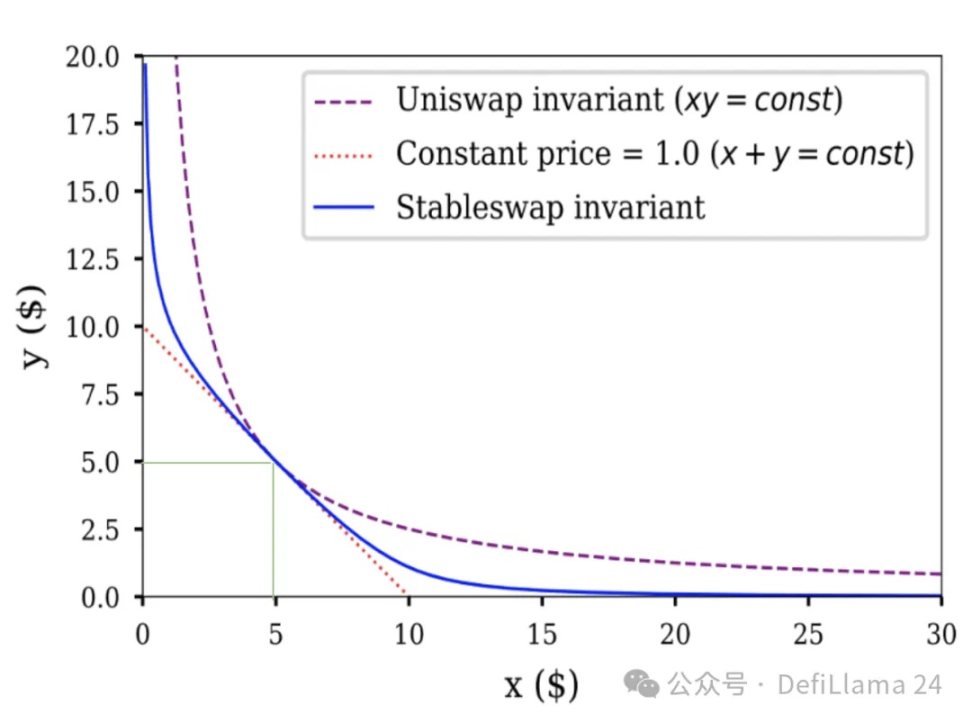

However, USDC/USDT is a different story. These two assets are highly correlated, with a maximum price difference of about 10% during a specific event (USDC SVB de-pegging); under normal circumstances, their price difference is only within basis points. Nevertheless, UNIv2 distributes liquidity across the entire price range, meaning it allocates equal amounts of liquidity anywhere between 1 USDC = 0.0000000001 USDT to 1 USDC = 10000000000000 USDT. Simply put: 99.9% of liquidity in UNIv2_USDC/USDT will never be utilized. I believe this would be clearer in a chart:

◎ x*y=k and StableSwap

The only valuable liquidity (assuming 1 USDC ≃ 1 USDT) is at the intersection of the two green lines, occupying an extremely small part of the entire liquidity distribution curve.

On the other hand, note the stablecoin trading liquidity distribution shown in blue on the same chart. For assets with similar prices, the area covered by this curve is far greater than the case under the Uniswap invariant.

The StableSwap Revolution in Anchored Asset Trading (2020)

Once StableSwap went online, stablecoin liquidity quickly migrated there due to its significantly improved efficiency (we're talking about an efficiency improvement of over 100 times compared to UNIv2). It was the first instance of concentrated liquidity on the mainnet, predating UNIv3. The two are difficult to compare directly, as UNIv3 is more flexible, while Curve-StableSwap is more focused; however, credit must be given where it's due. Besides efficiency improvement, Curve also provided an incentive model - veCRV+CRV incentives, which have been discussed multiple times in this blog.

Incentive mechanisms are crucial for anchored asset trading pairs due to some specific characteristics: compared to high-volatility trading pairs, they generally have lower trading volumes, and LPs can collect much lower fees (until recently, regular fees for volatile assets were 0.3% to 1% per transaction, while anchored assets were 0.05%). Their trading volumes show spikes related to events associated with the coin (for example, USDC de-pegging was one of the highest trading volume days in USDC's history).

Based on all these reasons, until recently, I believed incentive mechanisms were even more critical for anchored asset trading pairs compared to volatile asset pairs. However, with the emergence of Fluid DEX and EulerSwap, I no longer think so. Before delving into them, we must first review another important milestone in the history of anchored asset liquidity: the release of Uniswap V3.

The Arrival of Uniswap V3 Concentrated Liquidity (2021)

Uniswap V3 was released, providing customizable concentrated liquidity for almost all asset types, significantly improving efficiency for all liquidity providers. However, since it's not limited to anchored assets, this also almost meant higher impermanent loss for LPs of volatile assets. Considering the innovation of this liquidity structure and the lack of early infrastructure, the initial progress of UNIv3 was slow.

However, this customizable concentration brought tangible benefits, especially for what I call "loose anchored assets": such trading pairs as wstETH/ETH (related, but wstETH is unilaterally rising relative to ETH), LUSD/USDC (related, but LUSD might be slightly above or below the anchored price).

In these cases, UNIv3's concentrated liquidity allows LPs to replicate the equally efficient distribution of Curve's Stableswap, but adjusted according to the tokens' price trends, again bringing massive efficiency improvements. However, the ultimate breakthrough (in terms of current industry state) was only achieved years later with the emergence of Fluid DEX and EulerSwap.

Debt as Liquidity (2025)

For brevity, I won't delve deeply into the models of Fluid and EulerSwap in this article, as I'm more interested in their significance for liquidity construction. Simply put, Fluid found an innovative way to convert debt into liquidity through "smart debt".

Imagine a typical user providing ETH as collateral and borrowing USDC. Does he really want USDC specifically? Likely not, as long as he's borrowing a safe, USD-anchored stablecoin. He would probably also accept USDT.

This is exactly what smart debt achieves. In the smart debt vault, the borrower borrows a combination of USDC and USDT that continuously changes: his debt now serves as liquidity for the USDC/USDT trading pair. For the borrower, this means reduced borrowing costs, as he can now earn transaction fees that might offset the loan interest.

This is from the borrower's perspective, but now let's switch to the protocol's perspective. What does this mean for Circle and Tether? Essentially, nearly zero-cost liquidity without any incentives. For Circle, which has been supported by the entire ecosystem for years, this isn't new - but for other stablecoins like GHO, BOLD, or FRAX, this is significant.

I'm mainly focusing on Fluid, but the approach is similar to EulerSwap, though implemented differently. EulerSwap is currently in the testing phase but has already generated considerable trading volume on the USDC/USDT trading pair.

If you understand this, you'll grasp my point that: "I believe in the DeFi space, anchored asset trading will ultimately not be dominated by anything other than Euler/Fluid/similar projects."

Still not clear? Remember the following points:

Anchored asset trading pairs usually have low trading volumes ⇒ Lower fees, thus requiring substantial incentives to maintain on traditional decentralized exchanges. Fluid and Euler can maintain this liquidity at almost zero cost.

⇒ If (and it has already started) a price war begins in anchored asset trading fees, traditional decentralized exchanges (DEX) have zero chance of winning.

0xOrb, a Potential Challenger (Around 2026)?

Now, to give you a comprehensive view of the entire anchored asset trading landscape, I must mention another project not yet online but with considerable potential: 0xOrb. Its promise is simple: stablecoin trading, supporting up to n assets, with n potentially reaching 1000.

Using stablecoins as an example, you can imagine a super pool abundantly supplied with USDC and USDT, then gradually introducing "alternative" stablecoins and providing excellent liquidity for trading between them and mainstream stablecoins. This approach has advantages for long-tail pegged assets, but I believe such pools won't dominate core trading volumes (like USDC<>USDT or cbBTC<>wBTC).

Additionally, such pools could enable cross-chain trading, though I believe the benefits here are minimal or even harmful (⇒ increasing infrastructure risks and complexity without bringing any benefits), because thanks to products like CCTP, USDC and USDT can now achieve increasingly faster 1:1 cross-chain transfers.

What does this mean for existing pure decentralized exchange (DEX) participants?

First, the most important note: We are discussing the trading of anchored assets. Replicating the same strategy on highly volatile trading pairs would be much more difficult, as demonstrated by the losses suffered by Fluid's Smart Debt+Collateral ETH/USDC vault and its liquidity providers.

DEXs like Aerodrome, which generate most of their trading volume and fees primarily through volatile trading pairs, may not be affected by these new entrants. However, the reality is much more severe for DEXs focused on anchored assets, and at the end of this article, I would like to discuss two examples:

Curve: Game Over Unless Major Changes Occur

Anchored asset trading remains crucial for Curve, which is still considered the home of stablecoin liquidity. Indeed, they attempted to capture volatile trading volume through CryptoSwap but ultimately failed.

With the arrival of Fluid and EulerSwap, I believe Curve is the DEX most likely to lose market share, and I don't think it can maintain significant trading volume (in fact, it has already been kicked out of the top ten), unless major changes occur: Reshaping veCRV: Learning from new models like veAERO to optimize CRV incentive distribution. Improving DEX efficiency with crvUSD: For example, by providing crvUSD loans to Curve LPs. A new liquidity structure for volatile assets: To enable Curve to capture related trading volume.

Ekubo: Confident Newcomers Accelerating Towards Extinction

Ekubo's situation could be said to be even worse, as they are recent entrants to this field. On the surface, Ekubo is a rapidly growing DEX on Ethereum with considerable trading volume. Essentially, Ekubo is an alternative to UNIv4, offering more customization options for liquidity structures, and its DAO has a lower extraction rate than Uniswap (though this is the lowest standard among all projects).

The problem lies in the source of trading volume: The vast majority (over 95%) is concentrated on the USDC/USDT trading pair, with fees as low as 0.00005%, and substantial incentives. Ekubo is essentially engaged in a price war that is destined to fail, because Ekubo cannot sustain such extremely low fees long-term (liquidity providers need returns), whereas Fluid/Euler can (if borrowers gain even 0.1% yield through smart debt, they will be better off than without smart debt and thus satisfied).

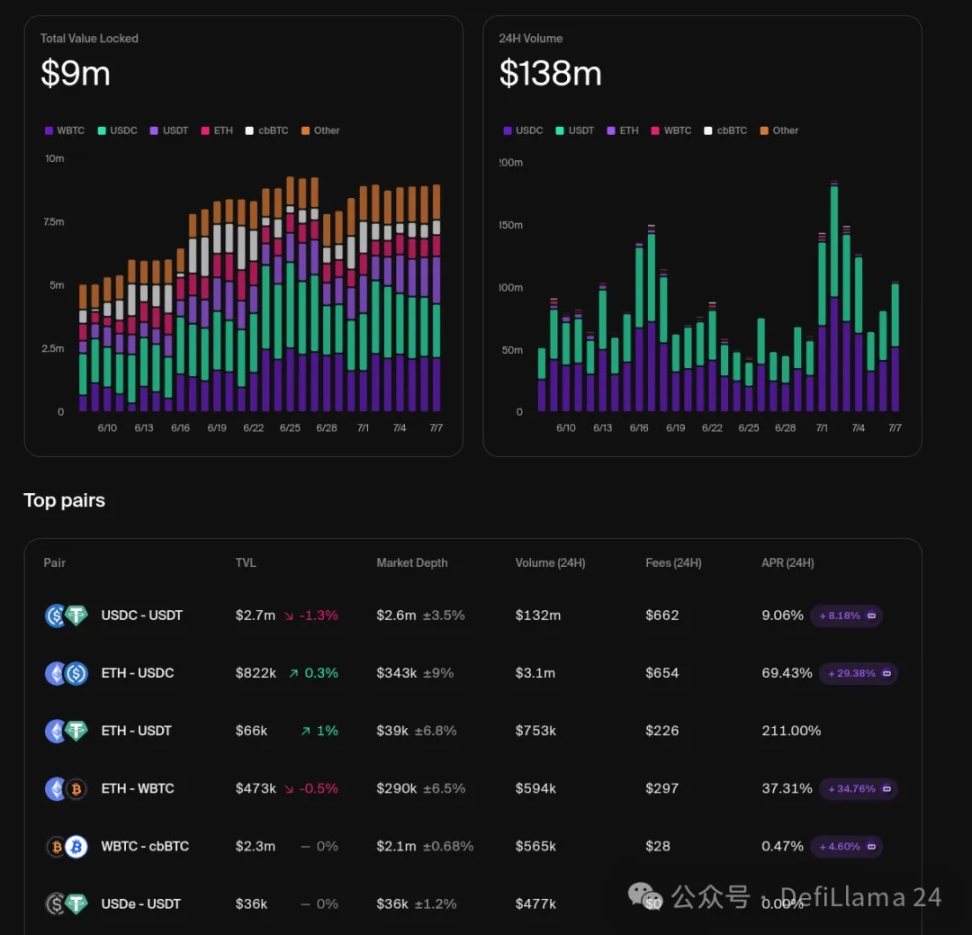

◎ Ekubo statistics, as of July 7, 2025

With a pool of $2.6 million TVL, processing about $130 million in daily trading volume, collecting $662 in daily fees, and incentivized by about 8% through EKUBO, they are rapidly approaching their capacity limits.

Most interestingly, it was Ekubo itself that initiated this "price war" with USDC/USDT trading pair fees, and they will ultimately be defeated by the rules they set. DeFi never fails to be interesting.

As always, I hope this article brings inspiration and deepens your understanding of the anchored asset trading game. I look forward to being "flamed" by the Ekubo community simply for stating fact-based observations, and their reactions only increase my confidence in my judgment, as I have observed similar responses in the past:

I condemned MAI's absurd security measures, and it was quickly hacked and de-pegged.

I condemned R/David Garai's manipulation and lies, and within 6 months, R was hacked and almost disappeared.

I criticized the Prisma team's behavior, and within 12 months they were hacked and shut down the protocol.

The list continues. Good luck to everyone.