Author: Howe Demystifying

This article is based on Sister Nan's 'How Do Web3 VCs Raise Funds and Determine Valuations?', with some additional insights and expansion.

Therefore, before reading this article, it is recommended to first read the previous one. I will try to explain my perspective in a straightforward manner.

I. Fundraising and Valuation Process

Here, we need to first subdivide the types of VCs, which are VCs with lead investment capabilities, VCs with lead investment capabilities but not leading, and VCs without lead investment capabilities.

In the fundraising and valuation process of a project, the speaking power is proportioned as: VCs with lead investment capabilities >> VCs with lead investment capabilities but not leading ≈ VCs without lead investment capabilities.

Meanwhile, the earlier the funding round, the greater the speaking power of the lead VC. Based on the fundraising phenomena I've observed, lead VCs generally only appear in the first two funding rounds, with subsequent rounds being mostly strategic financing or ordinary rounds without a lead investor.

So why is this the case?

The biggest problem an early-stage project faces in fundraising is - where to find money? Most project teams have very narrow channels to pitch to investors, either through introductions from acquaintances, finding a FA to connect with VCs, or seeking help from angel investors.

VCs with lead investment capabilities who intervene in early rounds generally do more than just invest. They also act as advisors, helping internally to adjust narratives, modify decks, design tokenomics, and draft financing terms; and externally to connect with various VCs, introduce project collaborations, and endorse marketing activities.

It can be said that the level and status of the first lead VC basically determines the project's ceiling, while VCs with lead investment capabilities but not leading, and VCs without lead investment capabilities, basically just provide money, with the former occasionally offering additional resource support. Therefore, project teams at this stage need to be cautious in choosing their lead partners.

After categorizing VCs, we also need to divide projects into existing track projects and entirely new track projects.

Valuation of existing track projects is relatively straightforward, roughly based on the proportion of the project's track's total market value in the entire market, benchmarking against the market value of the top one or two projects in the current track. If the project has additional bargaining power, the proportion can be further increased.

Valuation of entirely new track projects is basically a shot in the dark. Generally, such projects are mostly first participated in by the top lead VCs, who then use a series of "standards/data/processes" to make an initial pricing of the track, and then roughly determine the specific project's valuation.

Early projects that stake a claim will generally have some valuation premium, after all, if the track is not disproven, pricing a bit higher within a reasonable expectation can help expand market scale (bubble).

To be honest, I think no matter how much analysis is done, it's very difficult to give a reasonable track valuation range in the early stages. It's basically a step-by-step process of gradual correction.

And why can only the top lead VCs do this track valuation analysis? Can other VCs not do it?

The answer is they can, but it's useless. Because such analysis requires sufficient and accurate market information, and the top lead VCs have a huge advantage in this regard (comparable to top predators in the ecosystem).

Other VCs can also do it, but without sufficient information sources, it's hard to draw a reasonable and accurate result. Therefore, most of the time they just listen to the "boss".

II. How Do Project Teams Determine Their Project Valuation

This part is mainly to demystify that what you think about project valuation is calculated and researched individually, when in fact this is just a rare case among many. Most of the time, it's:

➣ Looking at the financing information of neighboring peers, and arbitrarily adjusting it up or down.

➣ Being deceived by early-stage VCs who want to grab more tokens, with project teams blindly following (a common pit for first-time entrepreneurs).

➣ Mysterious self-confidence, coinciding with a market boom, causing project teams to become arrogant and arbitrarily increase prices.

➣ Completely listening to the lead VC, whatever the financial backer says goes.

...

Often, project teams themselves can hardly figure out their own accounts. The saying "the world is a massive makeshift operation" continues to gain value.

As early domestic venture capital investor Zhuang Minghao said, most investments and valuations are a "black box". VCs don't actually have a mature methodology or investment logic before investing in a project. They can explain it retrospectively, but can't predict it prospectively.

I highly recommend watching @HanyangWang's 'Zhuang Minghao: Is There Really a Methodology for VC Investment? Decisions, Regrets, Taste, and Stories from the Chaotic Early Days of Mobile Internet', which can provide additional perspectives to my previous article 'VC Evolution Trilogy: Arbitrage Chronicles'.

I will have the opportunity to write a separate review later.

III. How Significant is Discussing Fundraising and Valuation?

I personally think it can be significant or insignificant, but should not be completely trusted. Because this fundraising and valuation process is very vividly described by Zhuang Minghao.

VC investment, especially in early stages, is very much like ancient rain-summoning rituals. Looking back now, rain-summoning rituals have no scientific basis, but why have similar ceremonies existed in the history of so many countries for so many years? Because humans want to find something that can be determined in highly uncertain circumstances and continuously repeat it. If it truly works, even partially, it will be persisted and become a ritual. In blunt terms, or more directly, it's the fund's taste/preference/strategy.

This process involves numerous uncertain factors of timing, geography, and human dynamics.

It's like ancient people performing rain-summoning rituals, coincidentally catching a sea breeze that brings water vapor, cools and condenses into clouds, and causes rain. Yet people mistakenly believe the ritual was effective, placing hope in this uncertainty.

Let's take an industry example: In 2021-2022, during a bull market with abundant liquidity and a hot Non-Fungible Token track, Opensea's valuation reached tens of billions of dollars. Was this a reasonable valuation carefully calculated by VCs? Would VCs at that time have thought this valuation was expensive? In fact, most VCs were just afraid of not being able to invest, who would care about whether the valuation was reasonable or expensive (don't think VCs don't FOMO).

[Images omitted]

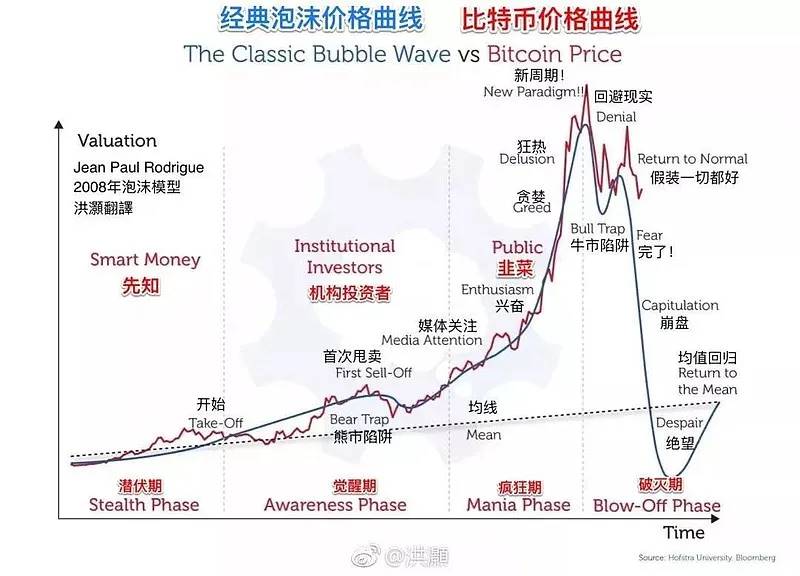

The so-called timing, geography, and human dynamics essentially correspond to the bubble cycle theory. Different stages of the bubble correspond to market liquidity and sentiment, and this liquidity and sentiment cause certain deviations in fundraising and valuation - FOMO makes fundraising valuation somewhat higher than normal, while FUD makes it somewhat lower.

Interestingly, some VCs or investors' investment logic in a certain track might be very instructive when looking back, but did they ultimately make money from their own logic? Not necessarily, most didn't earn much (somewhat criticizing myself).

So sometimes, good timing for intervention is more important than any theory.

History always repeats, and when you review the investment cycles of the past two rounds, they are basically trending like the following diagram:

IV. Some Supplementary Insights Based on the Original Text

This section will provide personal perspectives on some subsections of the original text by the author, for reference only.

Number of Projects in Different Valuation/Financing Brackets

It is necessary to exclude special values from existing data, such as the previously mentioned Opensea's billion-dollar valuation. These special variables have a significant impact on the results and offer little meaningful reference.

Essentially, these projects are valued too high or too low due to the market environment's greed/panic emotions at the time, deviating from normal market sentiment. Therefore, one should either choose to remove them or conduct separate statistical analysis.

Impact of Financing Rounds on Valuation/Financing Multiples

Based on current observations, the typical total number of financing rounds is 3-4 or fewer. More rounds are not particularly meaningful for Crypto projects. Currently, only large infrastructure projects from the first two rounds and bull market FOMO period innovation track leaders exceed this number.

Besides these, most projects emerging in the past two years have not surpassed this number. Moreover, with so many financing rounds, the time dimension would inevitably span a bull-bear cycle. Apart from projects continuously pivoting to find VC takeovers and then passing them on to retail investors, I cannot imagine any other possibilities.

Impact of Financing Year on Valuation/Financing Multiples

This essentially corresponds to the bubble cycle theory mentioned earlier, with different periods having varying levels of FOMO. You'll notice that Crypto's current dividends and liquidity are in a declining state.

The 2017 ICO wave, 2021 DeFi Summer, 2023 Inscription ecosystem, and 2024 Meme wave. Each macroscopic wave carries less liquidity, with the market's ability to generate liquidity shrinking. The scenario of massive flooding and universal revival may be difficult to achieve, at most resulting in scattered blooming.

Based on the current perception, I believe the accumulation of Crypto over the past decade represents a complete bubble cycle theory. With various compliance policies introduced in recent years, we are about to enter a new cycle of innovation and discovery. I look forward to more opportunities ahead.

Relationship Evolution of Project Parties, VCs, Exchanges, and Ordinary Investors in Different Market Environments

This evolution has many possibilities. Different roles each have their own hidden agendas but cannot escape the ultimate goal of maximizing personal interests. There are many ways to achieve this goal, forming a vast ecosystem map that will change with industry development.

If you can understand this ecosystem map, I believe you'll comprehend many things, such as who earns what money, and thus understand which path suits you and what money you should earn. Unfortunately, I currently only know fragments.

But to put it another way, after being in the circle for almost two years, I've discovered that good timing trumps everything, and luck is part of capability.

ZZ teacher also mentioned this point: entering the right industry at the right time means money is essentially picked up, but such people's cognitive levels often don't match their asset scale. Like the recent incident where "a user lost approximately 4 million assets by purchasing a cold wallet on JD", someone with such massive wealth yet unaware of the basic survival rules of the "dark forest" also confirms that choice matters more than effort.

https://x.com/ZTZZBTC/status/1948687136322191450

Finally, I wish everyone can seize their own opportunity. Slow is fast, and many things are not as "high-end" as they seem. Demystification is for better money-making. Let's encourage each other 🫡