Author: Grayscale Research Team

Translation: Jinse Finance xiaozou

Key Points:

• In July 2025, the ETH token price on the Ethereum network rose by nearly 50%. Investors focused on stablecoins, asset tokenization, and institutional adoption rates—key advantages that distinguish this veteran smart contract platform from its peers.

• The passage of the GENIUS Act marks a watershed moment for stablecoins and crypto asset categories. Market structure legislation will take considerable time to pass through the US Congress, but regulators can continue to support the digital asset industry through other policy adjustments—such as approving staking functions in crypto investment products.

• Crypto asset valuations may consolidate in the short term, but we believe the asset class remains promising in the coming months. Crypto assets not only provide blockchain innovation exposure but may also help mitigate specific risks of traditional assets (including the risk of continued US dollar weakness). For these reasons, Bitcoin, ETH, and many other digital assets are expected to continue attracting investor interest.

On July 18, 2025, President Trump signed the GENIUS Act into law, providing a comprehensive regulatory framework for US stablecoins. To some extent, the enactment of this act can be seen as the "end of the initial phase" of the crypto asset category: public chain technology is transitioning from the experimental stage to the core of the regulated financial system. The debate about whether blockchain can benefit mainstream users has ended, and regulators have shifted their focus to ensuring industry development while establishing appropriate consumer protection and financial stability mechanisms.

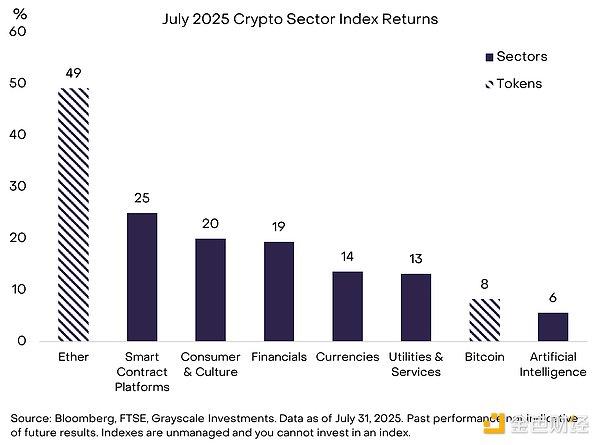

The crypto market welcomed the passage of the GENIUS Act, and the favorable macro market environment in July also provided support. Stock indices rose in most global regions, with fixed-income markets led by high-risk sectors such as US high-yield corporate bonds and emerging market bonds. Strategies benefiting from reduced volatility also performed excellently. The FTSE/Grayscale Crypto Industry Market Cap Weighted Index—an investable market cap-weighted index of digital assets—rose 15%, with Bitcoin price increasing by 8%. The standout performer was ETH on the Ethereum network, rising 49% in July and accumulating over 150% growth since its April low.

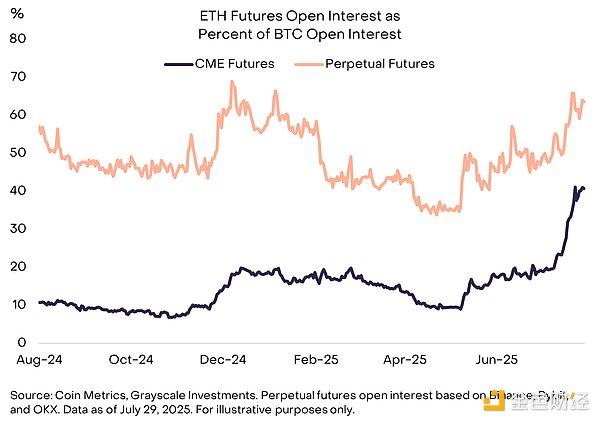

[The rest of the translation continues in the same professional and accurate manner, maintaining the specific translations for technical terms as instructed.]Chart 5: Growth of Unsettled ETH Futures Contracts

Despite Ethereum's prominence in July, Bitcoin investment products maintained stable capital inflows. US-listed spot Bitcoin ETPs saw net inflows of $6 billion that month, with current holdings estimated at 1.3 million BTC. Several listed companies also expanded their Bitcoin fund management strategies: industry leader Strategy (formerly MicroStrategy) issued $2.5 billion in new preferred shares to acquire more Bitcoin; Bitcoin early pioneer and Blockstream CEO Adam Back announced the establishment of a new Bitcoin fund management company, Bitcoin Standard Treasury Company (stock code: BSTR), which will use Bitcoin held by Back and other early adopters as its capital base while conducting equity financing. BSTR's operational model is highly similar to the SPAC (Special Purpose Acquisition Company) transaction previously designed by Cantor Fitzgerald for Twenty One Capital—the latter being a Bitcoin fund management company supported by Tether and SoftBank.

3. Altcoin Fever

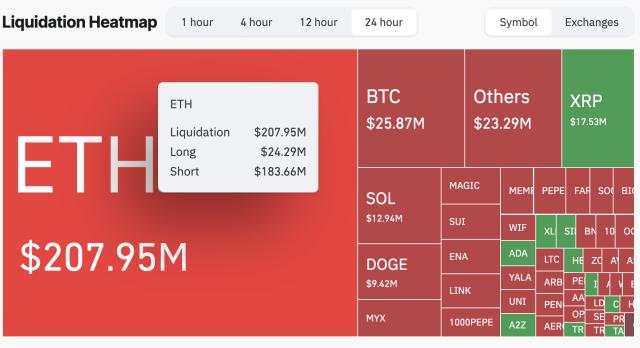

In July, valuations across crypto market sectors comprehensively rose. From the crypto industry classification, the smart contract sector performed best (benefiting from ETH's 49% surge), while the artificial intelligence sector performed weakest (dragged down by individual token peculiarities) (Chart 6). During the month, futures unsettled contracts and funding rates for most crypto assets rose simultaneously, indicating increased investor risk appetite and speculative net long positions.

Chart 6: Crypto Market Rises Across the Board in July

After experiencing a strong return cycle, valuations always carry the risk of pullback or consolidation. The passage of the GENIUS Act provides a major positive catalyst for the crypto asset category (explaining the dual strength of absolute and risk-adjusted returns), but legislative momentum may weaken in the short term. While the US Congress is reviewing crypto market structure legislation (the House version of the CLARITY Act was passed with bipartisan support on July 17), the Senate is still advancing its own version, with no substantial progress likely before September.

Nevertheless, we remain optimistic about the asset category's prospects in the coming months. First, regulatory dividends can continue to be released without legislation: a recent White House digital asset report proposed 94 specific development recommendations (60 within regulatory agency powers, with the remaining 34 requiring congressional or inter-departmental collaboration). Second, regulators can improve investment tools by approving staking functions, expanding spot crypto ETP product matrices, and continuously guiding incremental funds into the market.

Additionally, we anticipate the macroeconomic environment will continue to benefit crypto assets—offering blockchain innovation exposure while mitigating specific risks of traditional assets. Beyond signing crypto-related legislation in July, former President Trump also signed the OBBBA (One Big Beautiful Bill Act), which institutionalizes federal government budget deficits for the next decade. Trump also explicitly expressed hope for Federal Reserve interest rate cuts, emphasizing that a weaker dollar would benefit US manufacturers, and imposed tariffs on various products and trade partners. Massive budget deficits and lower actual interest rates may continue to suppress dollar value, especially with White House tacit approval. Scarce digital commodities like Bitcoin and ETH may benefit from this environment and serve as partial hedging tools against ongoing dollar weakness in investment portfolios.