Trump's surprise appointment of Federal Reserve board members and dismissal of the Bureau of Labor Statistics (BLS) director has triggered an unprecedented test of the independence of U.S. economic institutions.

(Previous context: Taiwan's Collective Anxiety over Semiconductor Tariffs: What is the U.S. Section 232? )

(Background supplement: Taiwan 20% Tariff: New Taiwan Dollar Breaks 30 Yuan, Creating a Two-Month Low - Semiconductor Tariffs Next Week Will Be the Big Demon )

U.S. President Trump wants the Federal Reserve to immediately cut interest rates, and recently expressed dissatisfaction with non-farm employment data on Truth Social, believing the data is completely fabricated and reduces the possibility of an immediate rate cut. He immediately issued an order to dismiss BLS Director McEntarfer:

We need accurate employment data. I have instructed my team to 'immediately' dismiss this politically appointed Biden official. She will be replaced by someone more capable and qualified

Personnel Sudden Shift: White House Targets Fed and BLS

The timing of the BLS director's removal is extremely sensitive - just hours after the official announcement that July's job additions were below expectations and May and June data were significantly revised downward, Trump signed the dismissal order. Former director William Beach angrily stated:

"BLS employees are the most loyal Americans. The internal procedures are more rigorous than 30 years ago, and there is absolutely no legitimate reason to dismiss the director."

Almost simultaneously, Federal Reserve Board member Adriana Kugler announced her early departure, creating an immediate opportunity for Trump to nominate a successor. Potential candidates include National Economic Council Director Kevin Hassett, former board member Kevin Warsh, and current board member Christopher Waller. If the candidate is successfully confirmed, they will have the opportunity to take over as chair after Powell's term expires in May 2026, potentially reshaping monetary policy orientation.

Independence Loosening: Two Major Institutions Face Risks

Fed board members' terms are designed with a 14-year staggered approach to insulate against short-term political pressure. However, Trump has long been openly dissatisfied with interest rates being "too high" and has directly criticized Powell as "too angry, too stupid, and too politicized".

"Powell should step down because he refuses to lower rates to the level I consider appropriate."

If the new board member leans towards a loose stance, the market fears short-term stimulation might replace long-term stability, driving inflation and capital cost volatility. According to U.S. Chamber of Commerce historical data, central bank independence is highly correlated with low inflation records, and once weakened, market expectation mechanisms will be the first to be impacted.

For the BLS, the director does not directly compile or adjust data, but the dismissal undermines external trust in the institution's methodology and results. The Economic Policy Institute harshly criticized this move as "undemocratic and economically dangerous", warning that in the long term, it could push the U.S. into a gray area of "governing by data manipulation".

Institutional Safeguards: What Protection Networks Remain

On the Fed side, presidential nominations still require Senate approval, and regional reserve bank presidents sitting at the decision-making table help distribute pressure from a single appointment. However, if board membership changes more than half, the policy tone could still significantly tilt.

The BLS lacks similar protections. Although the process follows fixed sampling, seasonal adjustment, and post-revision scientific procedures, the director's tenure is entirely at the White House's discretion. Organizations like "Friends of BLS" are calling on Congress to legislate a fixed term for the director to prevent "looking good but not accurate" data from becoming the norm. Related groups emphasize that data losing credibility will turn business investments, wage negotiations, and household consumption decisions into gambling.

Market and Global Perspective: How Uncertainty Ferments

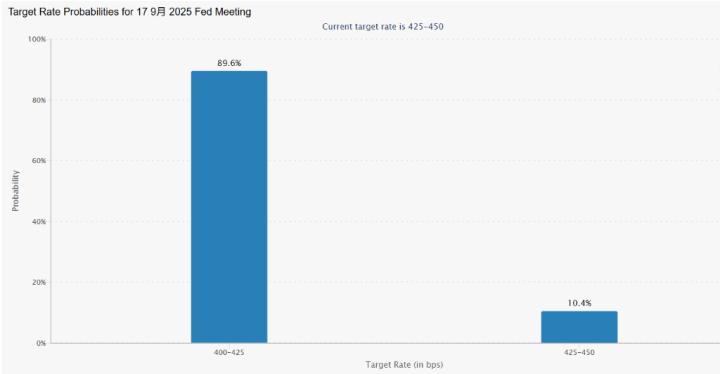

After Trump's dismissal announcement and potential nomination news, the U.S. dollar weakened slightly, and U.S. bond yields fluctuated, indicating that funds lack consensus on future interest rate paths. Investors are more concerned that if even official data can be "adjusted on demand", hedging needs will spread globally. Corporate internal budget models rely on employment, wage, and inflation baselines, and if these become unpredictable, capital costs will be forced to increase.