The crypto financial reporting season is approaching, with major institutions presenting their "mid-term report" for 2025. Some achieved profit surges through soaring asset valuations, while others seek transformation paths amid core business slowdown, with the industry gradually shifting from single income dependence to diversified assets and comprehensive financial services. PANews will review the latest financial performance and strategic trends of representative institutions including Strategy, Tether, Coinbase, Robinhood, Kraken, and Riot Platforms that have actively disclosed their Q2 financial reports.

Overview of Six Crypto Institutions' Q2 2025 Financial Situation

Strategy: Earning Billions in Net Profit from Bitcoin, Plans to Continue Heavy Acquisition

Strategy's second-quarter revenue reached $14.03 billion, a year-on-year increase of 7106.4%, with full-year revenue expected to reach $34 billion and diluted earnings per share (EPS) projected to rise to $80.

The significant quarterly revenue growth was almost entirely composed of unrealized fair value gains from Bitcoin assets, with gains of $14 billion accounting for the majority of quarterly revenue. This is the second quarter since Strategy adopted fair value accounting principles in early 2025. In contrast, the company's traditional software business only generated revenue of $114.5 million, accounting for about 0.8% of total revenue.

Strategy's profitability surged this quarter, with net profit reaching $10.02 billion, in stark contrast to the net loss of $102.6 million in the same period of 2024, with full-year 2025 net profit estimated at $24 billion.

As of the end of July 2025, Strategy's Bitcoin holdings increased to 628,791 coins, with 88,109 coins added in the second quarter. The total holding cost is $46.07 billion, with an average Bitcoin cost of $73,277. Year-to-date Bitcoin yield has reached 25%, completing the original annual target in advance and raising the target to 30%. To further expand Bitcoin assets, Strategy announced it will raise $4.2 billion through issuing STRC perpetual preferred shares to continue Bitcoin acquisition.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms and preserving the structure of the original text.]Next, Kraken's global business will continue to accelerate, including obtaining new licenses, expanding local funding channels, upgrading multi-asset experiences, and launching innovative products such as international stocks, tokenized stocks, Kraken debit card, and NinjaTrader development.

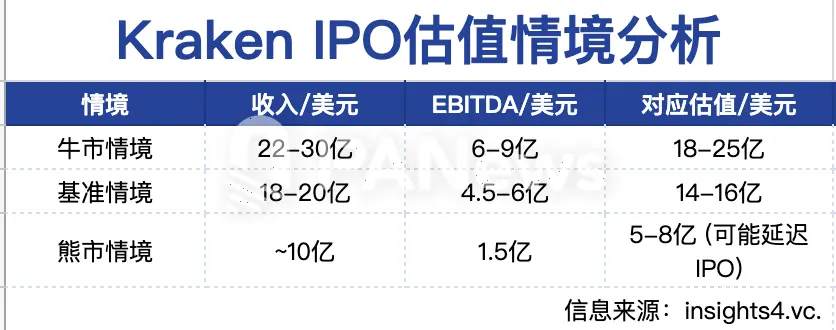

It is worth noting that Kraken is seeking to raise $500 million at a valuation of $15 billion and plans to go public in 2026. According to insights4.vc, Kraken ranks at the forefront of the industry in terms of user quality and trading activity, and continuously reduces its dependence on spot trading fees by expanding derivatives, stock trading, and payment services, thereby enhancing its risk resistance to market cycles. Meanwhile, in the context of increasingly strict regulation, Kraken has obtained multiple compliance licenses, with significant advantages in compliance, security, and fiat currency entry services. Facing fierce competition from Binance and Coinbase, Kraken has successfully established a "second-tier" brand positioning centered on product diversity and transparent compliance. If the crypto market continues to recover in the next year, Kraken is expected to become another profitable and compliant crypto exchange to go public after Coinbase.

Riot Platforms: Revenue Doubles Year-on-Year, BTC Production Increases by 69%

In the second quarter of 2025, Riot Platforms achieved total revenue of $153 million, more than doubling the $70 million from the same period in 2024, primarily driven by its Bitcoin mining business, which contributed approximately $141 million in revenue, growing by over 150% year-on-year. Driven by the strong Bitcoin price and capacity expansion, the company produced 1,426 BTC during the quarter, an increase of about 69% from 844 BTC in the same period last year.

Affected by the halving event in April 2024 and the continuous rise in global computing power, Riot's average Bitcoin mining cost (excluding depreciation) increased to $48,992 per Bitcoin, a 93% year-on-year increase, but still significantly lower than the average Bitcoin price during the same period (around $98,800). However, if Bitcoin prices fall or mining difficulty continues to rise, profit margins may be squeezed, with cost control and computing power efficiency becoming crucial. According to Riot's disclosure, with the increasing demand for high-performance computing (HPC) and AI infrastructure, the company will continue to diversify its power resource applications, gradually transforming from a single Bitcoin mining company to an "infrastructure platform centered on Bitcoin and oriented towards future computing needs".

In terms of profit performance, Riot recorded a net profit of $219.5 million, far exceeding the negative performance in the same period of 2024, with adjusted EBITDA reaching $495.3 million, reflecting its strong cash-generating capacity and high operating leverage.

Additionally, the company continues to maintain a robust balance sheet. As of the end of the second quarter, Riot Platforms held 19,273 BTC (worth approximately $2.1 billion) and $255.4 million in unrestricted cash, providing ample funding for future expansion, high-performance computing transformation, or addressing market fluctuations.