Compiled by: Jerry, ChainCatcher

Crypto Spot ETF Performance Last Week

US BTC Spot ETF Net Outflow of $642 Million

Last week, the US BTC spot ETF experienced a two-day net outflow, with a total net outflow of $642 million, and a total net asset value of $146.48 billion.

Last week, 3 ETFs were in net inflow, with inflows primarily from IBIT, HODL, and EZBC, at $355 million, $9.1 million, and $200,000 respectively.

Data Source: Farside Investors

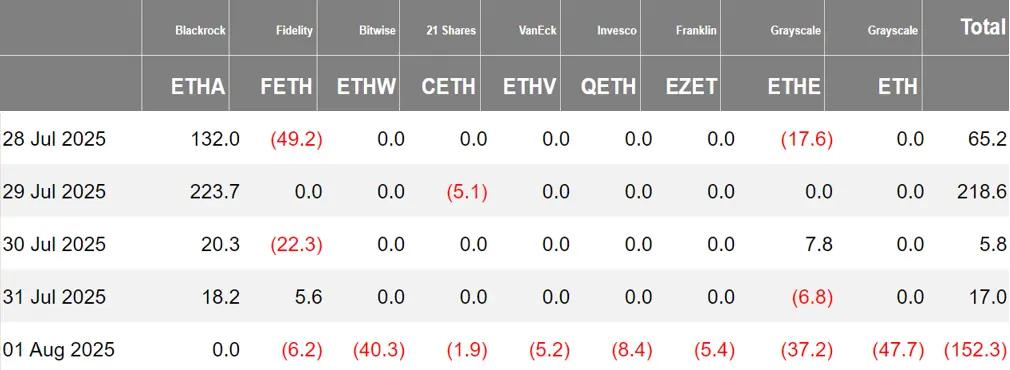

US ETH Spot ETF Net Inflow of $154 Million

Last week, the US ETH spot ETF had a consecutive four-day net inflow, with a total net inflow of $154 million, and a total net asset value of $20.11 billion.

Last week's inflow was mainly from BlackRock's ETHA, with a net inflow of $394 million. Only 1 ETH spot ETF was in a net inflow state.

Data Source: Farside Investors

Hong Kong BTC Spot ETF Net Inflow of 1,499.9 BTC

Last week, the Hong Kong BTC spot ETF had a net inflow of 1,499.9 BTC, with a net asset value of $489 million. Among them, the issuer Jiashi BTC holdings decreased to 293.02 BTC, while Huaxia increased to 2,300 BTC.

The Hong Kong ETH spot ETF had no capital inflow, with a net asset value of $86.45 million.

Data Source: SoSoValue

(The rest of the translation follows the same pattern, maintaining the specified translations for specific terms.)Views and Analysis on Crypto ETF

Bloomberg ETF Analyst: 75% of IBIT Investors Are New BlackRock Customers

Bloomberg ETF Senior Analyst Eric Balchunas stated on X platform that 75% of investors purchasing BlackRock's spot BTC ETF "IBIT" are new BlackRock customers.

Moreover, 27% of these new customers subsequently purchased other iShares ETFs. This represents a huge success for BlackRock.

Pudgy Penguins CEO LucaNetz stated that the Pudgy Penguins team and Abstract have officially participated as government advisors in US cryptocurrency legislation, having visited Washington D.C. multiple times to submit related suggestions. Currently, the team has submitted a PENGU ETF application, which will cover PENGU tokens and Non-Fungible Tokens.