At the beginning of August this weekend, the crypto world felt a sudden chill. Within just 24 hours, over $600 million in long positions vanished in a chain of liquidations. Market panic spread like wildfire. Bitcoin's price dropped from near 119,000, briefly falling below 114,000. Social media was filled with wailing, confusion, and accusations. People urgently wanted to know where this sudden storm came from.

This was not an isolated "crypto-native" event, but a chain reaction ignited by external macroeconomic impacts on a structurally fragile market. Geopolitical sparks and economic data paradoxes together lit the fuse, detonating a market already saturated with dangerous leverage. The entire liquidation cascade seemed precisely guided by the gravity of an existing Chicago Mercantile Exchange (CME) futures gap. This was a "perfect storm" of macro, micro, and technical factors in perfect resonance.

External Impact: Global Risk Aversion Trigger

The root of this crash was deeply planted in the soil of traditional finance. Two almost simultaneous macro events formed the catalyst for market-wide sell-offs, clearly demonstrating the increasingly tight linkage between crypto assets and the global economic pulse.

First was the geopolitical shadow. On August 1st, the Trump administration suddenly announced broad new tariffs on imported goods from 92 countries and regions, ranging from 10% to over 40%. This immediately triggered a classic "Risk-Off" mode globally. Capital fled risk assets and rushed into gold, viewed as a "safe haven", pushing gold prices to briefly surge above $3,350 per ounce. The Chicago Board Options Exchange Volatility Index (VIX), Wall Street's "fear index", also dramatically jumped. In this environment, institutional capital did not view Bitcoin as "digital gold", but classified it as a high-beta risk asset similar to tech stocks. Therefore, the tariff news directly pressured crypto prices, becoming a key external factor in Bitcoin breaking below $115,200.

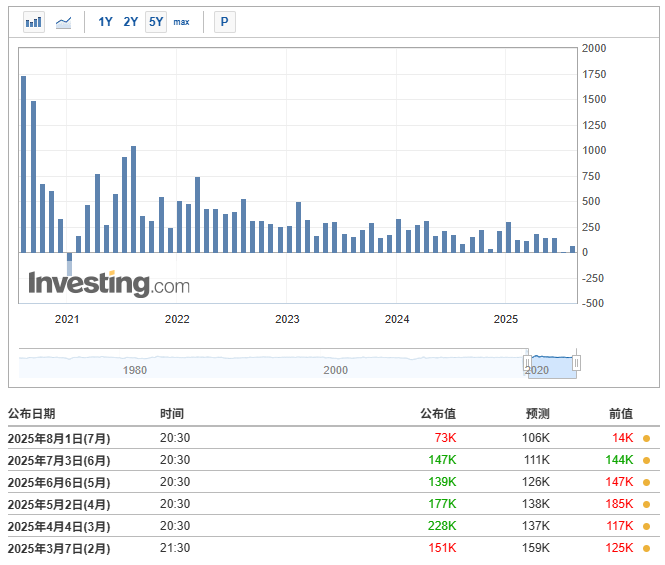

To make matters worse, the U.S. Bureau of Labor Statistics' July Non-Farm Payrolls (NFP) report on August 2nd showed only 73,000 new jobs added that month, far below the market's widespread expectation of 106,000. More impactful was that, as New York Fed President John Williams noted, the "real news" was the "exceptionally large" downward revision of May and June data, indicating the U.S. labor market was much weaker than previously imagined.

This weak report triggered a contradictory market response. On one hand, it intensified recession fears, directly fueling sell-offs under risk-averse sentiment. On the other hand, it dramatically changed market expectations of Fed monetary policy. According to the CME's FedWatch Tool, the probability of a 25 basis point Fed rate cut in September surged from less than 40% to 89.8%.

This formed the most subtle core motivational mechanism in this event: the market was forced to price between two completely opposite narratives. The first was the "fear narrative": tariffs and weak employment data both pointed to economic recession risks, and fund managers' instinctive reaction was to reduce risk exposure and sell high-volatility assets like Bitcoin. The second was the "hope narrative": the same weak data was interpreted by another group of algorithms and analysts as forcing the Fed to act by cutting rates to stimulate the economy. Historically, increased liquidity from rate cuts has been "rocket fuel" for risk assets. The market thus fell into a dilemma, and this profound uncertainty generated extreme volatility, laying the groundwork for massive liquidations.

Internal Detonation: A Market Prepared for Collapse

If macro impacts were the lit match, the internal structure of the crypto market was a barrel filled with gunpowder. On the eve of the crash, extreme optimism and rampant leverage had created perfect conditions for a catastrophic implosion.

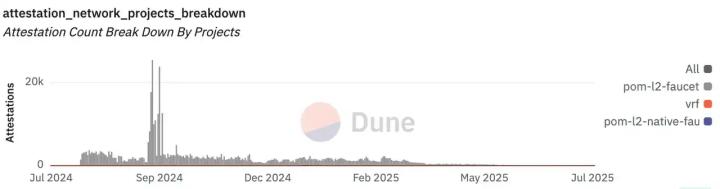

In the days before the crash, derivatives markets had already sent clear red alerts. Bitcoin futures' total Open Interest (OI) had surged to its highest level since late 2024, exceeding 300,000 Bitcoin with a nominal value of $42 billion. This indicated massive capital locked in futures contracts and extremely high market leverage. More critically, mainstream exchanges' funding rates remained consistently positive, an unmistakable signal that the market was dominated by leveraged long positions. Bulls were so confident that they were willing to continuously pay fees to shorts to maintain their long positions.

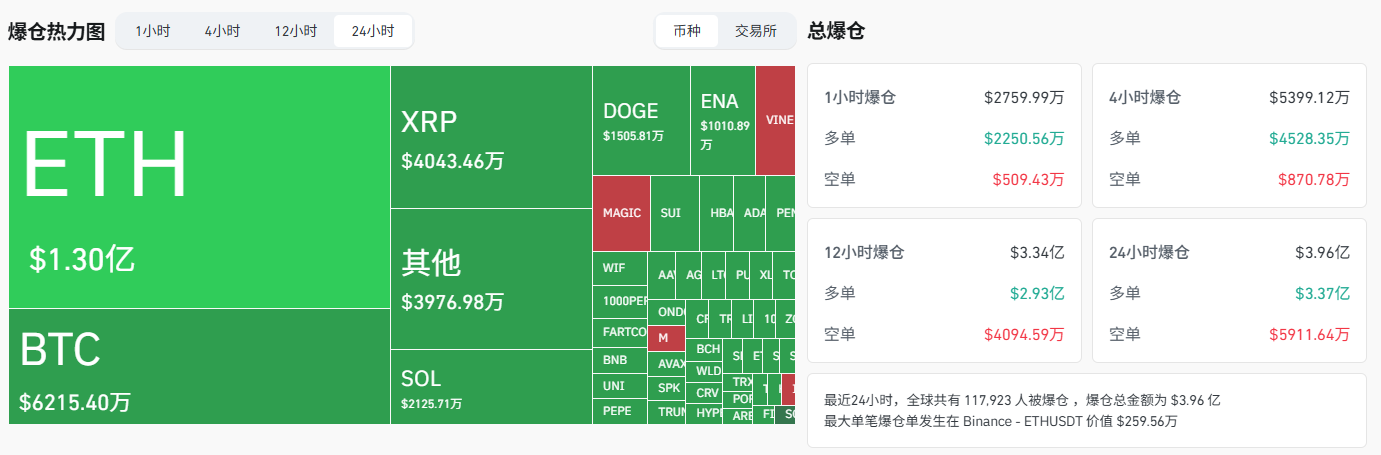

When macro-driven selling began, it triggered a domino effect. Coinglass data showed a total of $396 million in leveraged positions liquidated, with $338 million (85%) being long positions. Other sources indicated total liquidations between $635 million and $726 million, with longs comprising nearly 90%. This liquidation cascade was not accidental but a brutal yet necessary market self-correction mechanism.

Technical Destination: CME Gap's Gravity

Users' initial judgment—that the market dropped to "fill the gap"—touched on a key technical aspect of this event. The Chicago Mercantile Exchange (CME) futures gap played a black hole-like role in this chaotic market, providing a clear destination for price's free fall.

As a regulated traditional financial exchange, CME's Bitcoin futures products close on weekends. However, crypto spot markets trade 24/7. This creates a blank area, or "gap", between Friday's close and Monday's open on CME charts. A widely known theory among traders suggests markets tend to "fill" these gaps.

In the chaotic market, the CME gap served as a "Schelling Point"—a natural focal point naturally understood without communication. For sellers and liquidity-hunting algorithms, it was a predictable, perfect target. When macro news provided a catalyst for selling, these algorithms' sell actions were not random. They would apply pressure along the path of least resistance and maximum impact. Targeting a known gap ensured precise triggering of stop-loss and liquidation orders clustered near that level.

Capital Game: Whale Selling and ETF Accumulation

Beneath the surface of market price collapse, a silent war about capital flow is unfolding. On-chain data evidence reveals completely different behavioral patterns among market participants.

Data from on-chain analysis platforms like CryptoQuant and Lookonchain shows that "whales" holding large amounts of Bitcoin were actively transferring tokens to exchanges hours or even days before the crash. A notable example is that the well-known trading company Galaxy Digital deposited over 10,000 Bitcoins (worth approximately $1.18 billion at the time) into exchanges like Binance, Bybit, and OKX in less than 8 hours. This behavior is a typical "Smart Money" distribution signal.

In stark contrast to the whales' distribution behavior, newly established spot Bitcoin ETFs continued their systematic buying pace. Analysts point out that "institutional demand continues to absorb supply", with these ETFs playing a crucial supporting role during market declines, preventing further price collapse. This represents a powerful, non-discretionary buying force in the market. Unlike whales trading based on tactical needs, ETF purchases depend on customer fund inflows, creating a stable, continuous demand stream that provides solid price support. The short-term tactical sellers (whales) versus long-term systematic buyers (ETF) game clearly reveals the market's internal resilience and answers a key question: "Why didn't the price drop even lower?"

Long Road Ahead: Navigating the Crossroads

After this storm, the market did not find calm but entered a crossroads filled with confusion and divergence. Analysts' comments also showed significant disagreement. Some, like Nathan Peterson from Charles Schwab, advised investors to "sell at highs". Others believe the market is in a "healthy buy-the-dip zone". Crypto Banter's founder Ran Neuner even predicted Bitcoin could reach $250,000 by year-end, while MicroStrategy's founder Michael Saylor called this drop "God's gift".

Currently, the market is weighing short-term fears of economic recession against medium to long-term bullish expectations of Federal Reserve rate cuts and new liquidity injections. This crash fundamentally reset market dynamics, forcing every participant to re-examine their investment logic. The future direction will depend on which capital group exerts more influence - short-term traders scared away by macro fears or institutional investors committed to long-term accumulation. Large-scale liquidation events have washed away the most reckless leverage from the market, making its structure more "clean" but also more cautious. This post-crash era is a high-risk test of the crypto market's maturity and institutionalization.

Conclusion: Lessons in the Storm

The "August Storm" of 2025 was a multi-act play. It began with macro-political impacts, was infinitely amplified by a fragile and over-leveraged derivatives market, and ultimately found its technical resolution at a CME gap. This event provides profound lessons about the modern crypto market, revealing its inherent duality. On one hand, its increasingly tight integration with the global financial system provides long-term growth momentum and potential price floors. On the other hand, the same integration makes it highly susceptible to traditional market shocks and geopolitical events. The "August Storm" is the ultimate embodiment of this tension - a direct collision between old world macro fears and new world digital asset accumulation. The future of cryptocurrency will be defined by how it navigates between these two powerful and often opposing forces.