Table of Contents

ToggleEthereum (ETH) is currently forming an ascending triangle pattern, with a potential target towards the $16,700 area - according to technical analysis from several experts.

Although still trading around 23% lower than the near-historic peak of $5,000 in November 2021, many analysts believe the $4,000 resistance level is the final barrier before ETH can make a strong breakout. With market sentiment gradually shifting towards altcoins, many traders believe Ethereum is preparing for the "biggest shift of this cycle."

Technical Analysis of Ethereum Targeting Five-Digit ETH Price

Ethereum (ETH) has increased by over 300% since touching the cycle bottom around $880 in June 2022. During this recovery, ETH has formed several notable technical patterns on the monthly timeframe, raising expectations of an imminent major breakout.

Famous crypto investor Ivan On Tech recently shared a chart showing ETH is within a symmetrical triangle pattern, typically a sign of a strong acceleration when the pattern is confirmed. Based on calculations from the triangle's height, the potential price target could reach $7,709, equivalent to an increase of over 105% from the current price.

"Ethereum is compressing for the biggest shift of the cycle," the analyst from Bitcoinsensus noted while observing the symmetrical triangle pattern forming on ETH's monthly chart. He emphasized: "You are not ready for what's coming."

Sharing the same view, the famous crypto analysis platform Mikycrypto Bull also shared a chart showing ETH's price action is creating a rising triangle extending nearly 5 years on the monthly timeframe. "Ethereum is preparing for a macro explosion. If this happens, it will trigger a massive altcoin season," the analyst wrote on X on Wednesday. He concluded: "This is an extremely critical moment for Ethereum."

This technical pattern will be confirmed when the price breaks through the resistance level around $4,000, matching the previous peak. If the breakout occurs, the upward momentum could extend to the full height of the triangle, pushing ETH's price to a target of around $16,700 in the 2025-2026 period, equivalent to an increase of over 350% from the current level.

The MACD indicator on the monthly timeframe is sending a strong price increase signal for Ethereum. Specifically, the MACD line (green) has just created a Golden Cross with the signal line (orange) - a signal often associated with major price increases in the past. In the 2020-2021 cycle, this crossover led to an increase of over 2,000%, and in the fourth quarter of 2023, ETH also jumped 130% after a similar signal.

"Ethereum is preparing for a massive shift, with a strong monthly candle and a new MACD crossover," analyst Merlijn The Trader noted, also affirming: "If it breaks $4,200, ETH will explode like in 2021."

Many analysts are increasingly optimistic about ETH's potential to return to five-digit prices, with anonymous DeFi trader DeFi Dad expecting Ethereum could reach $30,000, based on the current momentum and technical structure.

ETH Spot ETF Witnesses 18 Consecutive Days of Inflow

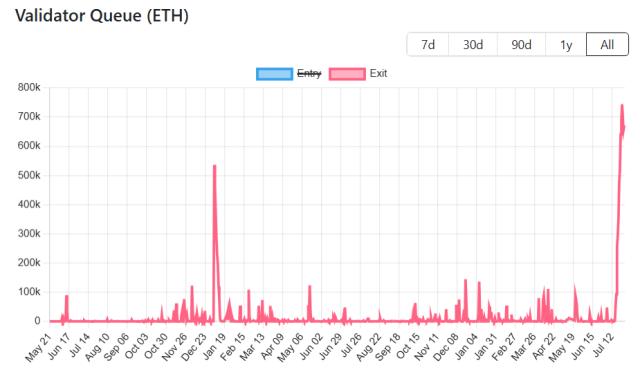

Net inflows into Ethereum Spot ETFs continue to surge, with $218 million flowing in just on Tuesday. This marks the 18th consecutive day of positive inflow, raising the total capital inflow since July 2nd to over $5.3 billion. Since the official launch of ETH Spot ETFs in July 2024, total net inflows have exceeded $9.6 billion - indicating growing interest from institutional investors towards Ethereum.

Beyond ETF inflows, companies like SharpLink Gaming are actively accumulating ETH, with a total of 438,000 ETH valued at over $1.69 billion added to their balance sheets. According to Matt Hougan, CIO of Bitwise, the combination of institutional capital flowing into ETFs and corporate ETH holdings is creating a clear supply-demand imbalance, as Ethereum only issues around 800,000 ETH annually, while expected demand is around $20 billion.

Strong ETF inflows, corporate accumulation, and Ethereum's solid fundamentals are reinforcing a strong price appreciation case for ETH in this cycle.

- $5.15 billion in ETF inflows in just 16 days

- Accepted by corporations as a reserve asset

- +176% recovery from the bottom

This is not a FOMO wave from small retail investors. This is a solid belief from institutions. Ethereum is no longer a gamble. It is the infrastructure of a new era.

This article does not contain investment advice or recommendations. Each investment and trading decision carries risks, and readers should conduct their own research when making decisions.