Author: 0xYYcn Yiran (Bitfox Research)

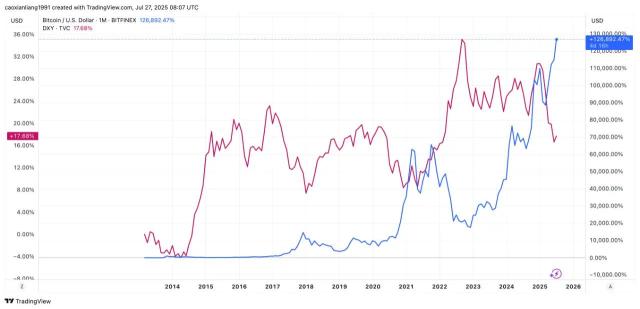

The scale and importance of the stablecoin market continue to surge, driven by the heat of the cryptocurrency market and the expansion of mainstream application scenarios. By mid-2025, its total market value has exceeded $250 billion, growing by more than 22% from the beginning of the year. A Morgan Stanley report shows that these dollar-pegged tokens currently have a daily trading volume of over $100 billion and will drive a total on-chain transaction amount of $27.6 trillion in 2024. According to Nasdaq data, this transaction scale has surpassed the total of Visa and Mastercard. However, behind this prosperous landscape, a series of hidden dangers are lurking, with the most critical being that the issuers' business models and the stability of their tokens are closely tied to U.S. interest rate changes. As the next Federal Open Market Committee (FOMC) decision approaches, this research focuses on fiat-collateralized USD stablecoins (such as USDT, USDC), adopting a global perspective to explore how the Federal Reserve's interest rate cycle and other potential risks will reshape the industry landscape.

Stablecoins 101: Growing Amidst Boom and Regulation

Stablecoin Definition:

Stablecoins are crypto assets designed to maintain a constant value, with each token typically pegged to the U.S. dollar at a 1:1 ratio. Their value stabilization mechanism is mainly achieved through two methods: supported by full reserve assets (such as cash and short-term securities) or relying on specific algorithms to regulate token supply. Fiat-collateralized stablecoins represented by Tether (USDT) and Circle (USDC) provide full collateral for each issued token unit by holding cash and short-term securities. This guarantee mechanism is the core of their price stability. According to the Atlantic Council, approximately 99% of stablecoin circulation is currently dominated by U.S. dollar-denominated types.

Industry Significance and Current Status:

In 2025, stablecoins are leaping beyond the crypto realm, accelerating integration into mainstream financial and commercial scenarios. Visa launched a platform supporting bank-issued stablecoins, Stripe integrated stablecoin payment functions, and Amazon and Walmart are brewing their own stablecoins. Simultaneously, the global regulatory framework is taking shape. In June 2025, the U.S. Senate passed the milestone Stablecoin Payment Clarity Act (GENIUS Act), becoming the first federal-level stablecoin regulatory law. Its core requirements include: issuers must maintain a stable 1:1 support rate with high-quality liquid assets (cash or short-term government bonds maturing within three months) and clearly define token holders' rights protection obligations. In the trans-Atlantic European market, the Crypto Assets Market Regulation Act (MiCA) implements even stricter provisions, empowering authorities to restrict non-euro stablecoins' circulation when they threaten the euro zone's monetary stability. In the market dimension, stablecoins demonstrate strong growth momentum: as of June 2025, their total circulation value has exceeded $255 billion. Citi predicts that the market size could surge to $1.6 trillion by 2030, achieving nearly seven-fold growth. This clearly indicates that stablecoins are moving towards mainstream adoption, but their rapid growth is also accompanied by new risks and frictions.

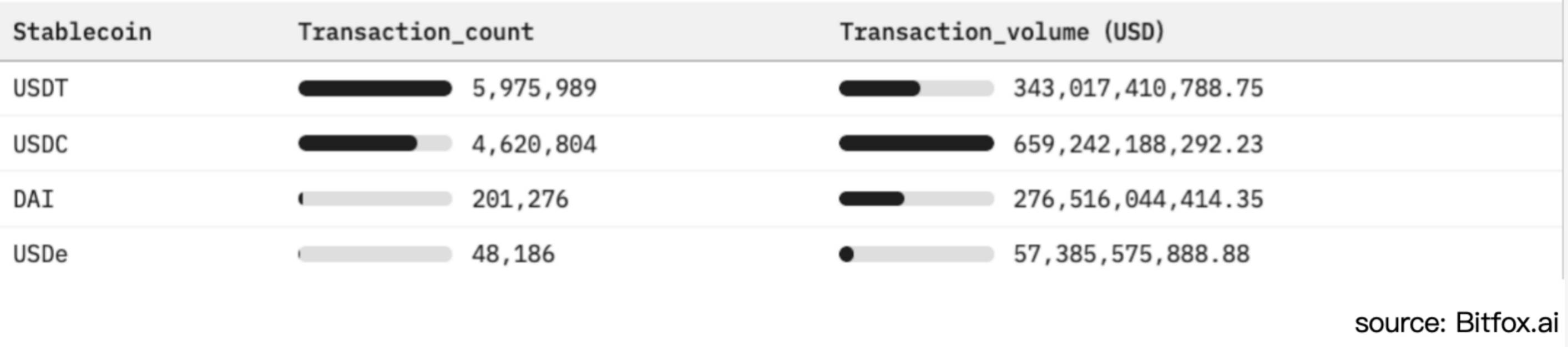

Figure 1: Ethereum Stablecoin Adoption Comparison and Market Activity Analysis (Past 30 Days)

Fiat-Backed Stablecoins and Interest Rate Sensitive Model

Unlike traditional bank deposits that bring interest to customers, stablecoin holders typically do not enjoy any returns. According to the Stablecoin Payment Clarity Act (GENIUS Act), user account balances for fiat-collateralized USD stablecoins are explicitly set at zero interest (0%). This regulatory arrangement allows issuers to retain all returns from reserve fund investments. In the current high-interest-rate environment, this mechanism has transformed companies like Tether and Circle (USD Coin issuer) into high-profit entities. However, this model also makes them extremely vulnerable during interest rate downturn cycles.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.]Core Risks Beyond Interest Rates: Multiple Challenges in the Stablecoin System

Although interest rate dynamics occupy a central position in the stablecoin industry, multiple key risks and challenges still exist within this system. Against a backdrop of industry optimistic expectations, there is an urgent need to systematically summarize these risk factors to provide a calm and comprehensive analysis:

Regulatory and Legal Uncertainty

Stablecoin operations are currently subject to fragmented regulatory frameworks such as the U.S. GENIUS Act and the EU's Markets in Crypto-Assets (MiCA) regulation. While these frameworks grant some issuers legitimacy, they simultaneously bring high compliance costs and sudden market access restrictions. Regulatory measures targeting insufficient reserve transparency, sanction evasion (such as Tether's billions of dollars in transactions in sanctioned regions), or consumer rights violations can quickly suspend a specific stablecoin's redemption function or expel it from core markets.

Banking Cooperation and Liquidity Concentration Risks

Fiat-collateralized stablecoins heavily depend on limited partner banks for reserve custody and fiat channel services. Sudden banking crises (like Silicon Valley Bank's collapse causing $3.3 billion of USDC reserves to be frozen) or large-scale redemption waves can rapidly deplete bank deposit reserves, trigger token de-pegging, and threaten broader banking system liquidity stability when wholesale redemption pressure breaks through bank cash buffers.

Anchoring Stability and De-pegging Risks

Even when claiming full collateralization, stablecoins can experience pegging mechanism collapse during market confidence erosion (such as USDC's price plummeting to $0.88 in March 2023 due to reserve asset accessibility concerns). Algorithmic Stablecoins' robustness curve is even steeper, with TerraUSD's (UST) 2022 collapse providing a significant illustration.

Transparency and Counterparty Risks

Users rely on reserve proof reports (Attestations) published by issuers, typically quarterly, to assess asset authenticity and liquidity. However, lack of comprehensive public audits raises credibility doubts. Whether cash deposited in banks, money market fund shares, or repurchase agreement assets, reserve assets inherently contain counterparty and credit risks that can substantially damage redemption guarantee capabilities under stress scenarios.

Operational and Technical Security Concerns

Centralized stablecoins can freeze or confiscate tokens to address attacks, but this also introduces single-point governance risks; DeFi versions are vulnerable to smart contract vulnerabilities, cross-chain bridge attacks, and custodian hacking. Simultaneously, user operational errors, phishing, and blockchain transaction irreversibility pose daily security challenges for token holders.

Macroeconomic Financial Stability Concerns

Stablecoin reserve funds totaling hundreds of billions of dollars are concentrated in the short-term U.S. Treasury market, and large-scale redemptions will directly impact Treasury demand structure and yield volatility. Extreme outflow scenarios might trigger panic selling in the Treasury market; moreover, widespread stablecoin U.S. dollar application could weaken the Federal Reserve's monetary policy transmission effectiveness, potentially accelerating CBDC research or establishing stricter regulatory barriers.

Conclusion

As the next Federal Open Market Committee (FOMC) meeting approaches, while the market generally anticipates maintaining unchanged interest rates, the subsequent meeting minutes and forward guidance will become the focus. The significant growth of fiat-collateralized stablecoins like USDT and USDC masks the essential commercial model deeply tied to U.S. interest rate changes. Looking forward, even moderate rate cuts (such as 25-50 basis points) can erode hundreds of millions of dollars in interest income, forcing issuers to reassess growth paths or transfer partial returns to token holders to maintain market adoption rates.

Beyond interest rate sensitivity, stablecoins must address continuously evolving regulatory environments, banking and liquidity concentration risks, anchoring integrity challenges, and operational vulnerabilities ranging from smart contract loopholes to insufficient reserve transparency. Critically, when such tokens become systemically important Treasury bond holders, their redemption behaviors might impact global bond market pricing mechanisms and disrupt monetary policy transmission pathways.