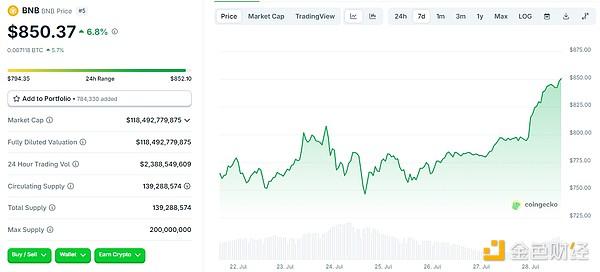

After Bitcoin became a benchmark for listed company reserve assets, other mainstream cryptocurrencies are also attracting institutional attention. The ecosystem token of Binance, the world's largest exchange, BNB, has recently seen another major breakthrough in its strategic reserve mechanism.

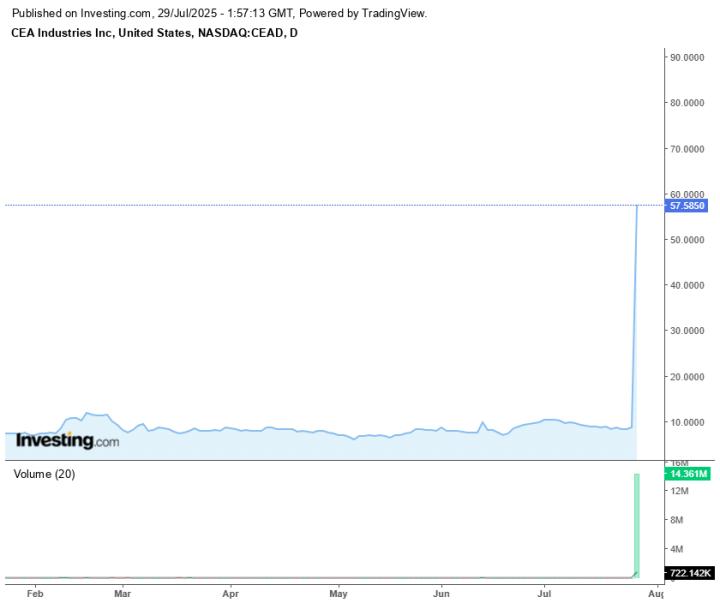

On the evening of July 28, the NASDAQ-listed company CEA Industries Inc. (NASDAQ: VAPE) and 10 X Capital jointly announced the completion of a PIPE (Private Investment in Public Equity) financing of up to $500 million, specifically used to establish a crypto asset treasury centered on BNB. The transaction structure also includes warrants of up to $750 million, bringing the potential total financing to $1.25 billion.

This collaboration is not without precedent. As early as July 10, YZi Labs first disclosed its support for 10 X Capital to establish a company called "The BNB Treasury Company", aimed at holding BNB in the secondary market and seeking listing on major US exchanges. Although the market response was lukewarm at the time, industry insiders already viewed it as a carefully designed "rehearsal".

According to the latest plan, CEA will officially launch its BNB treasury strategy: using the financing funds (combining cash and crypto assets) to build a position in BNB in the secondary market. The core is to leverage the compliant structure of a US-listed company to provide regulated BNB exposure for institutional and retail investors. This design logic is benchmarked against Strategy's (formerly MicroStrategy) Bitcoin reserve strategy - although there are differences in specific forms, the ultimate goal is consistent: achieving the "financialization" and compliant holding of core crypto assets.

This also raises a new market question: Is BNB about to have its own Strategy moment?

Three Main Characters Appear: Behind-the-Scenes Drivers and Executors

To understand how this BNB treasury plan went from conception to implementation in just three weeks, one must recognize three key roles: YZi Labs, CEA Industries, and 10 X Capital.

They come from different fields, and the combination seems "heterogeneous", but it is precisely this cross-role splicing that allows the project to smoothly land between traditional finance, crypto ecology, and US-listed companies.

YZi Labs was the first to release signals. This institution was formerly Binance Labs, which completed its brand independence in early 2025 and was renamed YZi Labs, supported by CZ and He Yi, focusing on cross-cycle investments in Web 3, AI, and Biotech. This institution has frequently appeared behind infrastructure projects such as TON, Zora, and ZKX this year, and is adept at designing penetrative structures between regulation and capital. Unlike traditional venture capital, YZi Labs is more like a "structural bridge": it does not directly operate assets, but deeply participates in the underlying design, financing structure, and governance mechanism of projects, helping emerging assets enter the market in a language that traditional finance understands.

In this BNB treasury plan, YZi Labs was the first party to promote the structural setup. On July 10, it first officially announced its collaboration with 10 X Capital to build The BNB Treasury Company, launching the official narrative of the BNB treasury.

It's worth mentioning that Ella Zhang, chairman of YZi Labs, has held a leadership position since the Binance Labs period, having led Binance's first-generation incubator program and deeply participated in the investment of multiple top projects. Although the institution now operates independently, its historical background and resource system still maintain high consensus with Binance.

For this reason, in the context where Binance itself finds it difficult to directly promote BNB financialization in US stocks due to compliance considerations, YZi Labs becomes the most suitable "spokesperson" and "structural agent" - it is not Binance, but it understands Binance and can open a channel that the traditional market can understand.

CEA Industries is truly responsible for implementing the treasury. This NASDAQ-listed company (NASDAQ: VAPE) originally mainly operated indoor agricultural equipment and was not particularly prominent. However, reviewing its announcement history shows that CEA has explored "capital transformation" through PIPE, asset swaps, and management changes in recent years. This BNB treasury strategy is its latest attempt to switch strategies by "holding on-chain assets on a listed platform". In other words, it has become the "financial container" for BNB.

The structural design party that shaped this container is 10 X Capital. Founded by financial veteran Hans Thomas, this investment bank focuses on PIPE, SPAC, and De-SPAC transactions, and has frequently participated in the compliant structure design of Web 3 assets in recent years. In this project, 10 X not only operated the PIPE structure and warrant mechanism but also deeply participated in team building: David Namdar, co-founder of Galaxy Digital, serves as CEO; Russell Read, former CIO of CalPERS, serves as CIO; and Saad Naja, former Kraken executive, also serves as a director.

Capital has direction, listed companies have execution frameworks, and the Web 3 camp provides asset narrative - their combined efforts have transformed the BNB treasury plan from a concept to a "auditable, tradable, and transmissible" financial interface.

140 Investors Bet, BNB's "Institutional Anchoring" Logic is Taking Shape

If the treasury mechanism is still a structural innovation, the capital participation lineup in this PIPE directly injects market weight into its narrative.

According to disclosures, the $500 million financing attracted over 140 institutional subscriptions, covering crypto native funds, family offices, traditional financial players, and even multiple personal capital representatives. This subscription breadth is extremely rare in recent Web 3 financing cases, and more importantly, it is anchored not on BTC or ETH, but on BNB, which has long navigated the US regulatory gray area.

The subscription list is quite representative: Pantera Capital, Arrington Capital, Arche, GSR, dao 5, Kenetic, Protocol Ventures, Hypersphere, Blockchain.com... covering almost half of the crypto primary market; BitFury founder, Polychain founder Olaf Carlson-Wee, former SoftBank executive Rajeev Misra are also on the list; traditional financial funders mostly participate indirectly through structured funds or family trusts.

More noteworthy is that this PIPE is also accompanied by a warrant subscription mechanism of up to $750 million. Investors not only allocated current positions but also bet on the value release space in the next 12-24 months. Such a structural design may be exercised in stages at a certain valuation point in the future, adding to BNB's "financial pricing model".

From a funding structure perspective, this is a typical "structured long-term" plan. BNB may not have an ETF, but the PIPE treasury is becoming its new channel to reach Wall Street.

Why are investors willing to bet on the BNB treasury? After BTC and ETH, the capital market urgently needs to find the "next anchored asset". BNB's user base, chain applications, trading volume, NFT, and chain game activity still lead in the L1 network.

In June this year, the US-listed company Nano Labs Ltd (NA) announced that it has signed a convertible bond subscription agreement. According to the agreement, the company will issue convertible notes with a total principal of $500 million, subscribed by multiple investors. The first phase plan is to purchase $1 billion worth of BNB through convertible bonds and private placement; the long-term goal is to hold 5% to 10% of BNB's total circulating supply. Nano Labs founder Kong Jianping stated that 120,000 BNB have been purchased so far and continue to be acquired.

In July, the US-listed company Windtree (WINT) announced that it has signed a $60 million securities purchase agreement with Build and Build Corp, with potential future subscriptions of up to $140 million, totaling $200 million. The raised funds will mainly be used to launch the BNB treasury strategy and acquire BNB. Windtree is expected to become the first NASDAQ-listed company to provide direct investment exposure to BNB tokens.

Conclusion: BNB's Financial Narrative Officially Enters the Third Stage

This is not the first time BNB has attempted to enter the US capital market.

In 2021, during Binance's global expansion, BNB once carried the market expectation of a "third-pole asset". However, the rapid changes in the regulatory environment quickly marginalized it from the North American market, and it even became the direct subject of SEC's questioning. Lacking recognition from the "American valuation system" has long kept its price logic outside the mainstream financial framework.

A turning point emerged this year, and BNB's US stock narrative has finally landed. This breakthrough reveals a key trend: the financial narrative rights of crypto assets are moving from Bitcoin's monopoly to diversification. The subsequent question is: will more L1 projects (such as Solana, TON, Sui) follow suit? Do they possess similar "containerization" potential?

Although the answer is uncertain, BNB's financial process has clearly entered a new stage: it is no longer just an exchange platform token and BNB Chain ecosystem token, but has established a new positioning in the global financial system by reshaping valuation models, accounting frameworks, and compliance disclosures. This may not be the climax, but it is undoubtedly an important prelude.

Click to learn about BlockBeats job openings

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Communication Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia