Original Author: ChandlerZ, Foresight News

Original Title: The Seven-Year Itch of a World Computer

Over the past century, humans have redefined the form of computers multiple times.

From the massive computers born in the mid-20th century for rocket navigation, to IBM pushing mainframes to enterprises, to Microsoft and Apple bringing personal computers into every household, and then smartphones putting computers into everyone's pocket.

Each leap in computing power reshaped the way humans connect with the world.

In 2013, 19-year-old Vitalik Buterin, while playing World of Warcraft, first seriously pondered a question after Blizzard arbitrarily weakened the warlock's skills: Who ensures that rules cannot be arbitrarily rewritten in the digital world?

Could a "world computer" that belongs to no company, is not controlled by a single authority, and can be used by anyone become the starting point for the next computing paradigm?

On July 30, 2015, in a small office in Berlin, dozens of young developers stared at the block counter, and when the number jumped to 1028201, the Ethereum mainnet automatically launched.

Vitalik recalled: "We were all sitting there waiting, and then it finally reached this number, and blocks started generating about half a minute later."

At that moment, the spark of the world computer was ignited.

Starting Point and Spark

Ethereum at the time had fewer than a hundred developers. It was the first to embed smart contracts into the blockchain, providing a Turing-complete stage that made blockchain no longer just an accounting tool, but a world-class public computer capable of running programs.

Soon, this newborn world computer faced severe tests.

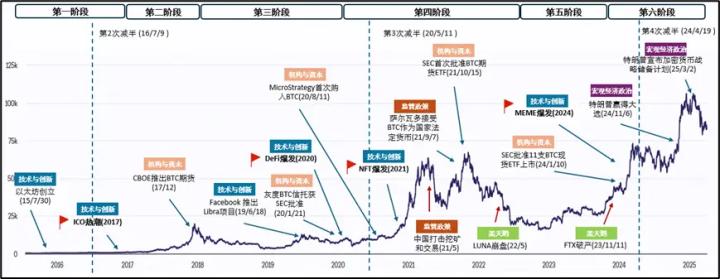

In June 2016, a major security incident occurred in the Ethereum-based decentralized autonomous organization "The DAO", where hackers used a smart contract vulnerability to steal approximately 50-60 million dollars worth of Ether. The community engaged in heated discussions about whether to "roll back history", ultimately choosing a hard fork to rescue the assets, which also split off another chain - Ethereum Classic.

This event first brought the governance issue of the world computer to the forefront: should immutability be maintained, or should errors be corrected to protect users?

The ICO wave from 2017 to 2018 pushed Ethereum to its peak, with countless projects issuing tokens and raising billions of dollars, driving ETH prices to soar. However, the subsequent bubble burst sent Ethereum into a trough, with ETH prices dropping over 90% from its high point in late 2018, and network congestion and high fees were widely criticized. During that period, the popularity of CryptoKitties even congested the mainnet to almost a standstill, exposing the first limitations of computing power for this world computer.

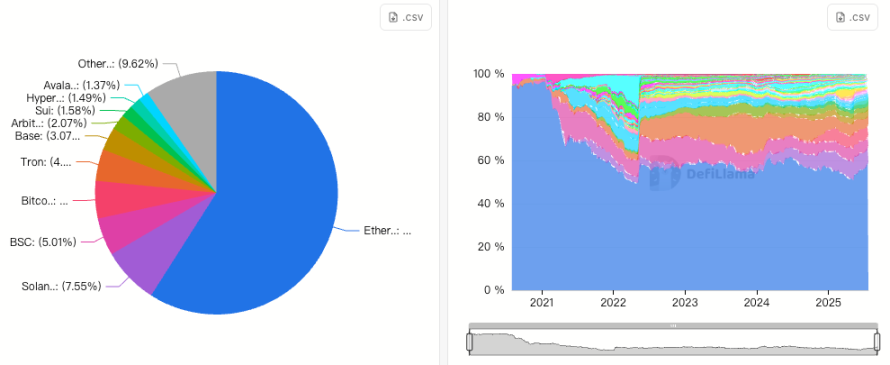

[The translation continues in the same professional manner, maintaining the specified terminology translations.]For example, Solana, which focuses on high throughput, is attracting a large number of developers, with most emerging projects and MEME projects primarily deploying on Solana; in the stablecoin domain, TRON, with its near-zero transaction fee advantage, has carried the massive issuance and transfer of mainstream stablecoins like USDT. The USDT circulating on the Tron chain has now exceeded 8 billion, surpassing Ethereum in scale to become the largest stablecoin network, with transaction volumes far higher than Ethereum. This means that in this critical track of stablecoins, Ethereum has relinquished its dominant position.

Moreover, public chains like BNB Smart Chain have also captured some traffic from GameFi and Altcoin trading. Although Ethereum still remains the largest ecosystem in terms of DeFi protocol count and TVL, accounting for approximately 56% of DeFi activity as of July 2025, it is undeniable that in a multi-chain landscape, Ethereum's relative dominance has declined compared to its peak period.

Governance and Security Concerns

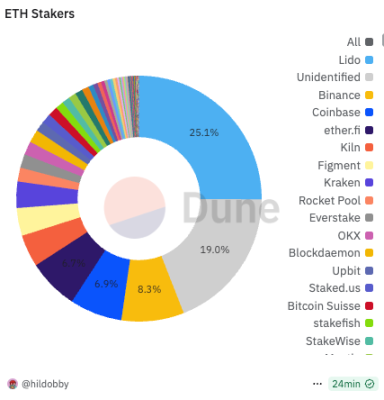

After transitioning to PoS, the issue of staking centralization has raised community concerns. According to the rules, participating in Ethereum network validation requires staking 32 ETH, which encourages retail investors to participate through staking pools or exchange delegations, ultimately forming a landscape dominated by a few large staking service providers. The largest decentralized staking pool, Lido, once occupied over 32% of the network's staking market share. With more competitors joining, Lido's share has slightly dropped to around 25%, but still far ahead of subsequent entities like Binance (around 8.3%) and Coinbase (around 6.9%). The community widely fears that if any single entity holds over 1/3 of the validation weight, it could potentially affect block consensus and network security.

Vitalik has called for limiting the proportion of single validation entities through transaction fee rates, such as capping it below 15%. However, in the 2022 Lido governance vote, a proposal to set a self-imposed limit was rejected by over 99% of votes. Currently, according to Dune data, the Ethereum network has over 1.12 million validators, with a total of over 36.11 million ETH staked, representing 29.17% of the total supply. How to promote diversity in staking participants without compromising network security remains an unresolved issue.

(Translation continues in the same manner for the rest of the text)Vitalik elaborated in his article "The Possible Future of Ethereum: The Surge" that the core objective of the next stage is to enhance the overall throughput of the mainnet and Layer 2 networks to 100,000 transactions per second while maintaining Layer 1 decentralization and robustness. Simultaneously, ensuring that at least some Layer 2 networks fully inherit Ethereum's core characteristics (trustless, open, and censorship-resistant), and making the entire network experience feel like a unified ecosystem rather than 34 fragmented blockchains. This means that future cross Layer 1/Layer 2 transfers, fund flows, and application switching will become as seamless as operations within a single chain.

The EIP-4844 in 2024 is just the beginning, with subsequent introduction of data sampling and compression technologies.

With the maturation of zero-knowledge proof technologies like ZK-SNARK and ZK-STARK, performance bottlenecks are expected to be overcome, and users who previously overflowed to other public chains and Layer 2 networks may potentially flow back.

Governance and Economics: How the Main Chain Can Recapture Value

Beyond performance, Ethereum is also contemplating how to continue capturing value for the world computer's core.

In July 2025, the Ethereum Foundation launched a new architectural reform dubbed the "Future of Ecosystem Development", attempting to move from behind the scenes to the forefront as a guide for ecosystem development. The foundation proposed two long-term goals: maximizing the number of people who directly or indirectly use Ethereum and benefit from its underlying values, and enhancing the resilience of technological and social infrastructure.

To this end, the foundation restructured around four pillars of "accelerate, amplify, support, and long-term unblocking", reorganized internal teams, established modules such as enterprise relations, developer growth, application support, and founder support, and strengthened team content and narrative to enhance community cohesion.

The foundation also promised increased transparency, emphasized more targeted public goods funding, launched Launchpad to support governance and sustainable operations, while reducing operational expenditure and establishing a funding buffer of approximately 2.5 years.

The external world generally views these actions as a substantive adjustment by the foundation to address criticisms of inaction, and also as a boost for its next decade.

In community discussions, new ideas have emerged: could a portion of revenues be extracted from Layer 2's prosperity? Or optimize protocol fees and MEV distribution mechanisms to allow the main chain to share growth dividends in the Rollup era. These proposals are still being explored, but they reflect a widespread concern - if not actively adjusted, the main chain might degrade into a mere settlement layer, with its value and vitality continuously diluted.

Standing at the Crossroads, Seeking New Sparks

Technology and funds are not enough.

Each previous Ethereum peak was ignited by new applications and narratives. Currently, the entire blockchain industry is in an innovation stagnation period, lacking phenomenal breakthroughs.

Perhaps blockchain itself needs self-revolution, generating new narratives and applications in social, identity, and AI domains. Some believe the next breakthrough might come from external ecosystem impacts.

Vitalik previously warned in his "Next Decade of Ethereum" speech that Ethereum developers should not merely replicate Web 2, but should focus on future interaction forms, including wearable devices, AR, brain-computer interfaces, and local AI, incorporating these new entry points into Web 3 design perspectives.

Looking back over the past decade, Ethereum still possesses the industry's largest developer community, richest applications, and profound technical accumulation. However, it is facing an intersection of bottlenecks, competition, and emerging challenges.

As Vitalik said: "Ethereum's past decade was our decade of theoretical focus. In the next decade, we must shift our focus and consider our impact on the world." In his view, the next generation of applications must not only have different functionalities but also preserve shared values, and these applications must be user-friendly enough to attract those not yet in the crypto realm.

The world computer, at its ten-year itch. It has not stopped functioning, but is seeking a new direction.

The next decade belongs to it, and to everyone who still believes in this dream.

But as Vitalik says, "Everyone who speaks in the Ethereum community has the opportunity to participate in collectively building the future."