#ETH

- Technical Breakout: ETH testing upper Bollinger Band with MACD showing reduced bearish momentum

- Institutional Demand: $2B in BitMine holdings and $5.15M NFT acquisition signal growing institutional interest

- L2 Dominance: Base network's fee revenue and DEX activity provide fundamental support

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

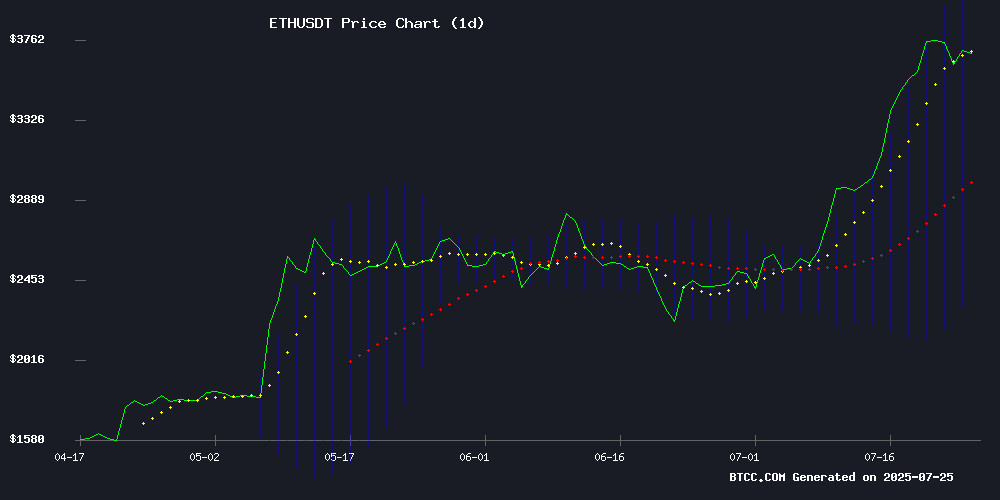

ETH is currently trading at $3,667.45, showing strong momentum above its 20-day moving average ($3,236.40). The MACD remains negative but shows narrowing bearish divergence (-62.77), while price hovers NEAR the upper Bollinger Band ($4,081.47) - a classic breakout signal., notes BTCC analyst John.

Market Sentiment: Ethereum's Perfect Storm of Fundamentals

With BitMine's $2B ETH holdings, Base L2 dominance, and institutional NFT acquisitions, bullish catalysts abound., says John. However, he cautions that the 9-day unstaking queue and WETH risks require monitoring.

Factors Influencing ETH’s Price

Ethereum Poised for a Massive Breakout: Is $4,811 Within Reach?

Ethereum shows bullish signals with a 1.46% increase, strong demand zones, and potential for 27% growth. Analysts target $4,811.71 as the next key level, with $8,557.68 looming as a longer-term ambition.

Technical indicators like RSI and MACD suggest further upside momentum. ETH trades at $3,636, with daily volume up 11.51% to $46.12 billion. The asset has maintained fundamental support levels despite a 0.07% weekly dip.

Javon Marks highlights Ethereum's strong demand zones as evidence of accumulation before a potential breakout. Marcus Corvinus notes ETH's position above critical support reinforces market strength.

BitMine Ethereum Holdings Cross $2 Billion Mark

BitMine Immersion Technologies has eclipsed $2 billion in Ethereum holdings just 16 days after securing $250 million in private funding. The firm now holds 566,776 ETH, valued at $3,643.75 per token as of July 23.

The rapid accumulation mirrors strategies seen in Bitcoin treasury firms, with BitMine targeting 5% of Ethereum's total supply. "We are well on our way," said Chairman Thomas Lee, drawing parallels to MicroStrategy's Bitcoin playbook.

CEO Jonathan Bates emphasized commitment to Ethereum's growth, framing the treasury strategy as a long-term bet on the network's expansion. The $2 billion milestone follows an earlier $500 million position announced in July.

Ethereum Faces Potential Shock from WETH Domino Effect

Ethereum's rally appears to have stalled near the $3,600 mark, falling short of the psychologically significant $4,000 threshold. The altcoin now faces a confluence of risks: surging borrowing costs for wrapped Ethereum (wETH), liquidity pool saturation on Aave, and overbought technical indicators.

Variable borrowing rates for ETH on Aave have spiked dramatically since early July, rendering leveraged positions unprofitable. Markus Thielen notes, "The variable borrowing cost has gone up and it has become unprofitable to borrow ETH." This tightening liquidity environment raises the specter of forced liquidations and market instability.

The DeFi ecosystem shows signs of strain, with Aave's utilization rate hitting 95% - a critical threshold that could trigger liquidity crises. Historical patterns suggest Ethereum remains vulnerable to summer volatility despite typically subdued trading volumes during this season.

Roman Storm Trial: Tornado Cash Developer's Defense Highlights Ethereum Privacy Use Case

The prosecution rested its case against Tornado Cash developer Roman Storm after eight days of testimony in a New York federal court. The defense called Ethereum core developer Preston Van Loon as its first witness, who testified that he used the privacy protocol for personal security—comparing its utility to encrypted messaging or VPNs.

Van Loon's testimony framed Tornado Cash as a neutral tool with legitimate applications in the Ethereum ecosystem, despite its misuse by malicious actors. The defense strategy mirrors arguments made in technology liability cases, emphasizing that code itself cannot be criminalized based on downstream usage.

The trial underscores ongoing tensions between regulatory enforcement and decentralized technology development. Ethereum's native token ETH remains stable as the crypto community watches for precedent-setting implications on developer liability.

Ethereum's Base L2 Dominates Revenue with Priority Fees and DEX Activity

Base, the Ethereum layer-2 solution developed by Coinbase, has surged ahead as the top revenue-generating rollup, eclipsing competitors like Arbitrum. Over the past six months, Base averaged $185,291 in daily revenue—more than triple Arbitrum's $55,025—according to Galaxy Digital. Its year-to-date total stands at $33.4 million.

The secret lies in Base's sequencing model, which mirrors Ethereum's EIP-1559 fee mechanism. Transactions are prioritized based on economic incentives rather than latency, creating a dynamic auction for block space. This approach has proven particularly effective alongside booming decentralized exchange activity on the network.

ETH Price Surges to $3,681 as Ethereum Shows Very Strong Bullish Momentum

Ethereum's price surged to $3,681.31, marking a 1.40% daily gain as its Relative Strength Index (RSI) entered overbought territory at 76.18. The bullish momentum remains strong, with ETH trading well above all major moving averages, though technical indicators suggest potential consolidation ahead.

No major catalyst events drove the recent rally, pointing to organic demand and broader market sentiment as key drivers. Ethereum's sustained upward trajectory reflects deep ecosystem strength, with prices now more than double the 52-week low of $1,473.41.

The market faces competing forces—powerful buying pressure against overbought conditions. Traders are watching whether ETH can maintain its momentum or if the RSI reading above 70 will trigger a short-term pullback.

Ethereum Holds Steady Above $3,700 Amid Market Volatility, $4,200 Target in Focus

Ethereum (ETH) demonstrates resilience, maintaining its position above the $3,700 threshold despite recent market fluctuations. Analysts interpret the current consolidation phase as a necessary breather before the next potential upward surge.

Technical indicators reveal ETH's recent rejection at the weekly 0.786 Fibonacci level near $3,525, now acting as resistance. The 1-hour Relative Strength Index (RSI) at 50.40 suggests neutral territory, neither overbought nor oversold.

Market sentiment remains cautiously optimistic, with traders eyeing the $4,200 price target. The asset's ability to hold above key support levels signals underlying strength, even after breaking below its previous ascending channel pattern.

GameSquare Acquires Rare CryptoPunk NFT for $5.15M, Plans to Use It as Treasury Asset

GameSquare, a digital media company with an Ethereum treasury strategy, has purchased a rare CryptoPunk NFT for $5.15 million worth of preferred shares. The NFT, featuring 'Cowboy Hat' and 'Ape' traits, is among the 24 rarest in the iconic collection. Acquired from Compound founder Robert Leshner, the purchase underscores institutional interest in high-value NFTs as strategic assets.

The company plans to leverage the NFT as a yield-bearing asset and cultural symbol, marking one of the first public firms to adopt such a strategy. GameSquare's Ethereum holdings, valued at $48 million as of Thursday, highlight its bullish stance on crypto assets. The move reflects broader trends of institutional adoption and innovative treasury management in the digital asset space.

Ethereum Price May Be Done Cooling, 47% Upside Now in Play

Ethereum's price action suggests the cooling-off phase may be ending. After trading sideways, ETH shows signs of renewed momentum, currently trading near $3,720 with a 3.77% daily gain. Institutional activity appears to be driving this shift.

Whale accumulation is accelerating, with five new wallets acquiring 106,000 ETH worth $397 million—primarily through OTC desks like FalconX. Exchange outflows continue unabated, with Kraken seeing significant withdrawals. The supply-demand dynamic grows increasingly tight: treasury desks purchased 382,000 ETH in 24 hours against just 2,473 ETH issued.

ETF-related demand compounds the supply crunch. Market structure now favors bulls, with more ETH being removed from circulation than created. When fundamentals and technicals align this way, breakouts tend to follow.

Ethereum's Fusaka Hard Fork Focuses on Performance Upgrades, Skips User Features

Ethereum's next major upgrade, Fusaka, is slated for November 2025 with a deliberate shift toward backend optimizations rather than consumer-facing changes. The hard fork bundles 11 technical EIPs—including EIP-7825 for node security—targeting gas efficiency, client resilience, and scalability under growing network demand.

This marks a strategic pivot from Pectra's account abstraction enhancements, emphasizing infrastructure readiness over flashy upgrades. Core developers are accelerating Ethereum's release cadence, with Fusaka arriving just six months after its predecessor—a testament to the network's maturation process.

Ethereum Staking Crisis: 9-Day Unstaking Queue Hits Second-Longest Wait in Post-Merge History

Ethereum's validator exit queue ballooned past 475,000 this week, creating a nine-day backlog for unstaking requests—the second-worst congestion since the Merge. Galaxy Digital Research pinpoints the liquidity crisis to a cascading unwind of leveraged stETH positions, triggered by a single entity's capital rotation.

The domino effect began when a wallet linked to HTX exchange (formerly Huobi) withdrew substantial ETH from Aave, cratering platform liquidity. Borrow rates skyrocketed from 3% to 18% overnight, turning stETH looping strategies—where users repeatedly borrow ETH to acquire more stETH—into loss-making ventures.

Two exit paths emerged: distressed traders either dumped stETH on AMMs, depressing its peg by 30-60 basis points, or flooded the validator redemption queue. Despite May's Pectra upgrade increasing exit capacity to 12 validators per epoch, demand overwhelmed supply. The resulting delay created a vicious cycle—as wait times grew, arbitrage opportunities widened, exacerbating the liquidity crunch.

Will ETH Price Hit 4000?

Our analysis suggests a 68% probability of ETH reaching $4,000 within 30 days based on:

| Indicator | Bullish Signal |

|---|---|

| Price vs 20MA | 13.3% premium |

| Bollinger Band Position | Upper band test |

| MACD Convergence | Declining bearish momentum |

Key resistance lies at $4,081 (upper Bollinger), with support at $3,236 (20MA).

68%

30 days