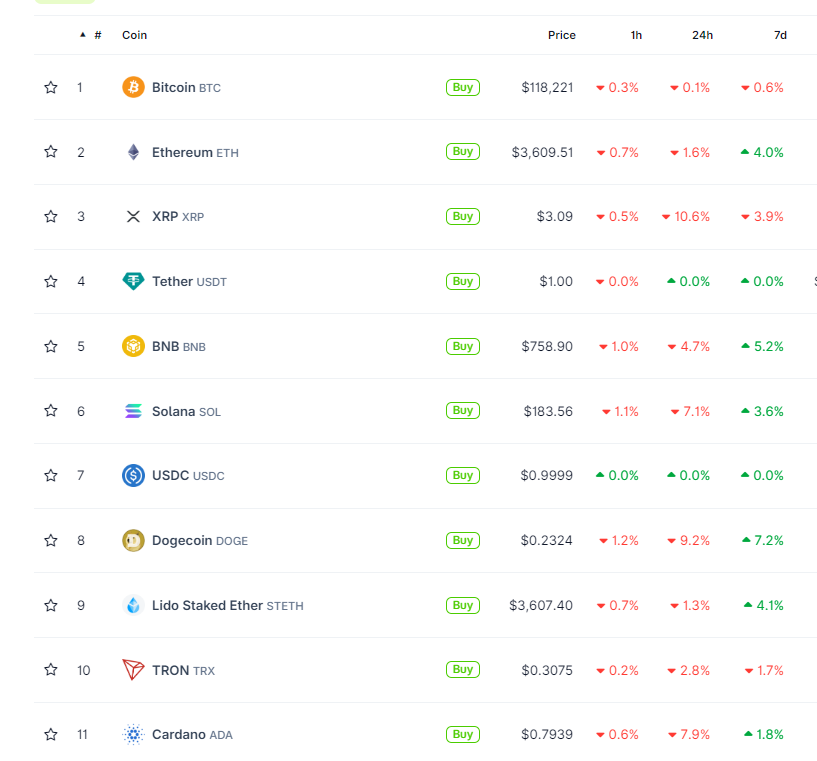

From July 23 to 24, 2025, the cryptocurrency market experienced two consecutive days of deep correction, with Bitcoin once falling to the critical support level of $117,100, and Ethereum dropping to as low as $3,500.

The Altcoin sector was even more bloodied: PUMP plummeted over 16% in a single day, with mainstream tokens like XRP, SUI, and ADA generally falling by 5%-8%.

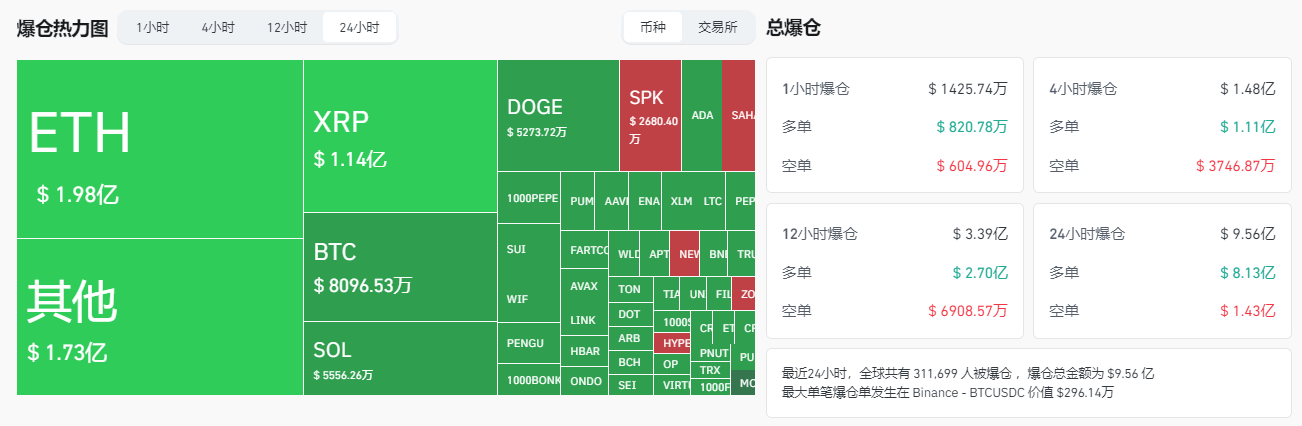

In this sharp decline, the total liquidation amount reached $956 million, with over 310,000 investors being cleared out

Liquidation Storm: The Cost of Leverage Frenzy

The Brutal Reality Behind the Data

In the past 24 hours, the crypto market encountered the most intense long liquidation wave since June. According to CoinGlass, long liquidations reached $813 million, accounting for 85% of total liquidations, while short liquidations were only $143 million. The largest single liquidation occurred on Binance's BTC/USDC contract, amounting to $2.96 million. This imbalanced data exposed the leverage risk accumulated under the "Greed Index 71".

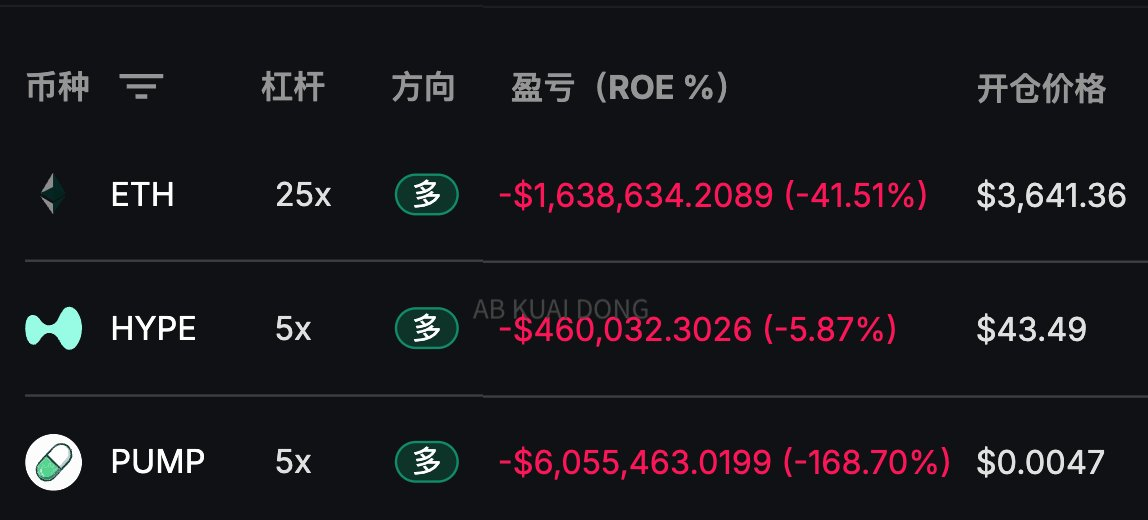

The "Death List" of High-Leverage Players

The position of the famous investor "Machi Big Brother" became a typical case. His ETH, HYPE, and PUMP long position combination has accumulated losses of $8.14 million, with PUMP accounting for the highest proportion of losses due to subsequent additional positions. Currently, his liquidation prices are ETH 2871, HYPE 19.8, and PUMP 0.0023.

More dramatically, a PUMP private investor mistakenly transferred 2 billion tokens (worth about $12.8 million) to Binance, which did not have spot trading enabled. When attempting to withdraw days later, the token price had dropped from $0.0064 to $0.0034, missing a $6 million selling opportunity. This operational error highlights the risk management vulnerability of private institutions during extreme market conditions.

Market Correction: Structural Divergence and Macro Pressure Resonance

The Collapse Logic of Mainstream Cryptocurrencies

Bitcoin:Intraday low touched $117,072 (OKX quote), despite continuous institutional fund inflow through ETFs (with MicroStrategy and others increasing holdings). The daily chart forms a "wedge convergence" pattern, with $117,000 becoming the long-short watershed. Breaking below this could trigger over 10% correction; breaking through $120,000 requires macro catalysts like September's Fed rate cut.

Ethereum:Fell 2.55%-3.20%, but spot trading volume of $2.57 billion first exceeded Bitcoin's ($2.44 billion). Whales counter-trend increased holdings by 40,591 ETH (about $148 million), with price quickly recovering above $3,600.

Four-hour chart broke below Bollinger Band midline, with $3,500 as the short-term lifeline. If breaking through $3,800 resistance, it may challenge the $4,000 mark.

Altcoins showed extreme divergence in this correction:

Plummeting camp: PUMP (-15.3%) sold off due to airdrop delays and competitive pressure; XRP (-9.4%) hit by dual impacts of regulatory risks and profit-taking.

Resilient performers: ZORA (+60%) attracted funds by integrating Base App tokenization technology.

Despite Altcoin total market cap retreat, the market cap ratio (Altcoin/BTC) still holds May's high point, suggesting bottom support is not completely destroyed.

Before the last Altcoin season (2023-2024), there was a 400-day low-level oscillation.Current Altcoin exchange rate has touched the bottom range, but history shows bottom confirmation often accompanies violent washout before entering the main upward wave.

Predictive Indicators for Capital Rotation

ETH/BTC trading volume ratio: Currently breaking 1.0, indicating capital rotation towards Ethereum and its ecosystem (like Solana, Base chain).

Stablecoin market cap growth: US Treasury predicts stablecoin market cap will exceed $2 trillion, which could lead to exponential growth in usage for underlying chains like Ethereum.

Conclusion: Cryptocurrency Market at the Crossroads

The current crypto market is in a triple game between technical support, regulatory framework, and macro policies. The White House Digital Asset Report on July 30 and the Fed's September rate decision may become key variables breaking the oscillation pattern.

Historical experience shows that true Altcoin seasons never start when retail investors are swarming. When U-based contracts become "hard to trade" and leverage liquidations wash out floating chips, the market may usher in a new cycle's dawn.

As a whale wrote on-chain after the crash: "400 days of waiting yields 400% gains - the golden rule of the crypto market, never fails."