When ETH breaks through 3400, and the ETH/BTC exchange rate breaks through the 0.026 resistance, no one expected ETH could change hands.

The ETH at the beginning of the year was like a derailed high-speed train, surging and then plummeting. From the end of 2024 to April 2025, ETH's price dropped from $4000 to $1500, halving repeatedly, underperforming BTC, SOL, and even lagging behind a bunch of meme coins.

Just when retail investors were wailing, KOLs were going short, and institutions were silent, a quieter and more covert script was unfolding backstage: a classic wash-out.

The sharp decline was not just a "pricing adjustment" by the market for ETH, but more like a deliberately designed and purposeful exit cleansing.

The price drop from 4000 to 1500 was not to prove ETH's lack of value, but to systematically wash out retail investors who had heavily positioned during the bull market's high points.

When those who once waved the E-guard flag began to cut losses and escape. And the ones taking over were no longer another batch of retail investors, but more silent and disciplined funds: it was like a group of Wall Street professionals had arrived.

They didn't shill ETH on social platforms, nor did they build positions ostentatiously, but quietly bought in through small-cap US stock fundraising, market-making accounts, and structured arbitrage funds.

When everyone was asking "Has the bottom been reached?", the real position-building was already complete.

Looking back, this sharp decline from 4000 to 1500 was not a signal of recession, but more like a handover ceremony of discourse. Ethereum no longer belongs to KOLs, nor to speculators.

But this time, are the ones taking over really from Wall Street?

Changing Hands: How Institutions Quietly Initiated ETH's Momentum

The story of changing hands had been widely circulated in the first half of the year. After the Hong Kong conference, rumors even spread about "changing hands in Ethereum's underground parking garage".

At the time, most people's evaluation was: Retail investors love to fantasize.

However, on-chain data had long shown signs - from December 2024 to April 2025 was a free-fall stage for Ethereum's price, but also the moment when the Herfindahl-Hirschman Index (HHI) quietly turned upward.

HHI is an indicator measuring asset concentration. On the Ethereum chain, it represents the trend of chip ownership. While prices plummeted, HHI was rapidly rising, indicating that ETH was not being widely sold off, but instead was concentrating from dispersed retail investors to fewer large holders or institutional addresses.

... [rest of the text continues in the same manner]At the same time, they launched the DAT fund, specifically investing in companies with digital assets as strategic reserves (Digital Asset Treasury Companies, DATs), and referred to this model as a new narrative of crypto exposure through public markets.

"Digital Asset Treasury Companies (DAT) will emulate MSTR, using publicly listed permanent capital vehicles as a medium to provide exposure to digital assets. After researching this strategy, we have built confidence in this investment argument and concentrated our bet."

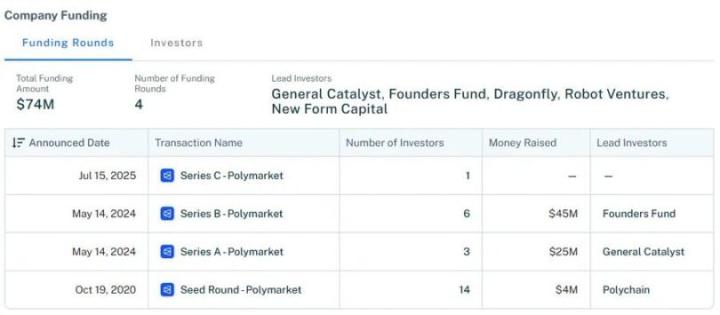

Currently, the top two strategic reserve companies in ETH holdings, SharpLink and Bitmine, both have Pantera's involvement.

In May 2025, Pantera participated in SharpLink's $425 million private equity financing, jointly investing with crypto VCs such as ConsenSys, ParaFi Capital, and Galaxy Digital.

On June 30, 2025, Pantera also participated in BitMine's $250 million private equity financing, with Galaxy Digital and ParaFi Capital also investing alongside Pantera.

Galaxy Digital manages the ETH ETF, while ParaFi Capital, like Pantera, has invested in numerous Ethereum DeFi applications including Uniswap and Aave.

Additionally, ParaFi has invested in ConsenSys, which is the main driving force behind SharpLink and a long-time partner of Pantera for over a decade.

From the chain perspective, ETH's supply and demand structure remains solid. EIP-1559 continues to be implemented, with ETH supply trending towards moderate deflation; the staking rate is steadily rising, with over a quarter of circulating supply locked in the mainnet or LRT structure, providing a chassis for network security while giving ETH characteristics similar to "on-chain government bonds".

The expansion route is clear, EIP-4844 has been launched, Rollup costs are continuously decreasing, and although the L2 developer ecosystem's enthusiasm is not high, infrastructure is still continuously improving.

However, off-chain, ETH's narrative is changing. In the past few years, Ethereum's protagonists were KOLs, VCs, and DeFi protocols, built on growth curves driven by imagination and market dreams. But since the LSD narrative faded in 2024, the NFT sector became dormant, and L2 expansion stagnated, the market has grown weary of ETH's "future story".

VCs can't create new PPTs, retail investors are drawn away by meme, and Ethereum suddenly loses its reason for price appreciation.

But just as retail investors grow tired of the Ponzi scheme of meme and have their confidence extinguished by altcoin sell-offs, Ethereum OGs have equipped ETH with a narrative that aligns with traditional financial logic.

ETH's rise is now explained by: can it be packaged as a structured note, can it produce a 6% annual stable on-chain yield, can it become that quasi-government bond asset in a "TradFi investment portfolio".

BTCS's approach is particularly typical: this veteran Web3 company in the US stock market announced in June 2025 that it will issue up to $100 million through an S-3 registration, with funds to be used for increasing ETH holdings, expanding node operations, and on-chain yield management.

BTCS proposed a "DeFi + TradFi hybrid structure" flywheel model:

Using a certain leverage rate, the listed company conducts ATM and convertible bond financing to purchase ETH, then uses ETH as collateral, combining on-chain lending, node staking yields, MEV extraction, and even future interactions with the Builder ecosystem to construct a stable cash flow model.

In their hands, ETH is not a speculative asset, but a financial instrument that can be repeatedly discounted, a part of institutional financial models.

This narrative shift essentially aligns with the logic of traditional financial institutions.

In this sense, ETH hasn't changed; what's changed are its audience and narrative method. The old consensus is withering, but a new financial pricing narrative is slowly emerging.

From Consensus to Conspiracy: ETH's Script Seems Familiar

In the past, when discussing ETH, we looked at technological iterations, narrative rotations, and consensus strength.

But today, what truly determines ETH's next fate is no longer the "storytellers" but the "structure writers".

After all, crypto can't be just about meme, Ponzi schemes, and gaming; blockchain application value and decentralized financial narratives must continue to be told to be truly discovered by mainstream financial value.

SBET, BMNR, BTCS, BTBT... Behind these quietly entering US stock companies are Ethereum's most OG investors and whales, also the players most familiar with "traditional financial games".

They know that once a digital asset can be standardized, structured, and incorporated into traditional investment portfolios, its price will be redefined.

When Joseph Lubin and Tom Lee start accepting interviews from mainstream financial media like CNBC, deeply binding Ethereum's potential with stablecoin narratives; when Pantera and Peter Theil begin publicly disclosing their Ethereum strategic reserve holdings:

Crypto giants and Ethereum whales are selling Ethereum's "new story" to Wall Street and more traditional financial institutions.

Looking back, Ethereum's "changing guard" process is quite typical: emotional panic, retail investor exodus, then main players using PIPE financing, "on-chain staking yield models", and "US stock secondary market speculation" to take over and build positions.

This is not a Web3 native story, but a familiar TradFi script reproduced: channelizing assets, structuring narratives, commodifying volatility.

And ETH is transforming from a consensus asset to a conspiracy asset. Consensus is retail self-identification in communities; conspiracy is the silent handover behind institutional structural transactions.

All of this is a sign that main players have completed "position switching" and are beginning to "control the plate".

We'll ultimately find that ETH's underlying hasn't changed, the chain is still running, code is still updating, and the largest holdings are still by the same group. But who is talking about it, who is matching it, the narrative driving ETH's rise, and the target audience have changed.

The mask worn is Wall Street's face, but the hands manipulating are still those familiar old sickles.

Click to learn about BlockBeats job openings

Welcome to join BlockBeats official community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Communication Group: https://t.me/BlockBeats_App

Twitter Official Account: https://twitter.com/BlockBeatsAsia