Ethereum just smashed through its highest price level in six months—traders are scrambling to decode whether this surge has legs or if it's another classic crypto tease.

Breaking Down the Rally

ETH's 180-day peak isn't just a number—it's a psychological battleground. Bulls see a breakout; bears smell overleveraged longs about to get liquidated. The charts scream momentum, but remember: even meteor showers burn out.

Market Mechanics at Play

Liquidity pools are churning, derivatives open interest is ballooning, and—shockingly—some hedge funds might actually be hedging for once. Meanwhile, retail FOMO is creeping back like a bad habit you swore you'd quit.

The Cynic's Corner

Wall Street still can't decide if ETH is 'digital oil' or a glorified spreadsheet—but they'll keep collecting fees either way. Pro tip: when VCs start tweeting moon math, check your wallet balance twice.

Ascending Channel Targets $4,100 Breakout

Ethereum’s 4-hour chart reveals methodical progression through a well-defined ascending channel, building momentum since March lows.

ETH is currently testing the upper boundary around $3,700-$3,800, and trades well above all exponential moving averages in bullish alignment.

The positioning indicates strong underlying momentum with pullbacks likely finding support at progressively higher levels.

RSI readings of 78.54 indicate strong momentum approaching overbought conditions, but institutional ETF flows provide fundamental support for sustained advances.

The projection above $4,100 is based on measured moves from a channel breakout, combined with resistance levels aligning with previous cycle highs.

ETF inflows exceeding those of Bitcoin indicate a shifting institutional preference toward Ethereum, with multiple public companies expanding their treasuries to cover ETH as well.

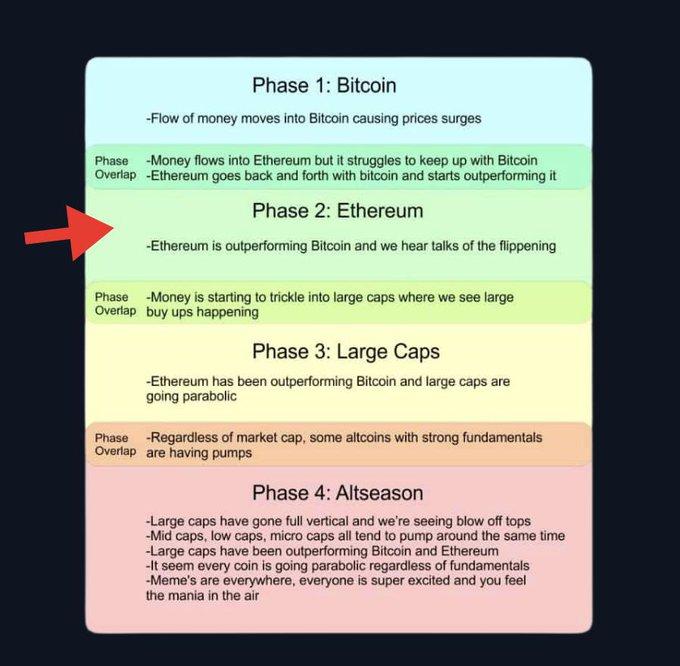

Cycle Analysis Suggests Explosive Phase Ahead

Ethereum approaches major resistance around $4,000-$4,200, which must be cleared to confirm the initiation of a new bull market cycle.

A breakout above this “Strong High” resistance zone WOULD likely trigger what analysts describe as “the most explosive part of the cycle.”

Market structure analysis reveals that ETH has successfully reclaimed multiple intermediate levels as it approaches the final major hurdle.

Cycle comparison analysis provides an even more compelling long-term outlook.

While bitcoin is 1,949% above its macro base, approaching upper expansion zones where previous cycles saw momentum shifts toward altcoins, Ethereum, at 961%, remains significantly lower in its expansion cycle.

$ETH is doing exactly what it did before every major rally.

BTC is now trading 56% above its macro base.

ETH is at 83%, still below its full expansion zone.

This chart isn’t showing price targets.

It’s showing where we are in the cycle.$BTC reached its upper expansion band,… pic.twitter.com/jqyCZmAazt

Historical patterns also suggest that Bitcoin typically consolidates at similar levels, while Ethereum enters periods of aggressive growth.

Current positioning suggests that the transition point may be approaching even further, with Bitcoin showing signs of deceleration.

At the same time, Ethereum builds momentum for its expansion phase, targeting cycle parity and potentially parabolic advances.

BTC Hyper: Final Chance to Join $3M Presale Success

As Ethereum moves towards $4,000+ levels, Bitcoin is not left behind. With, Bitcoin holders can participate in decentralized finance (DeFi) opportunities.

BTC Hyper’shas raised over $3.7 million, with a few hours left before the presale window closes permanently.

Early investors are securing positions in the Layer-2 solution that bridges Bitcoin into Ethereum’s expanding ecosystem.

The platform’s Solana VIRTUAL Machine architecture enables Bitcoin holders to access Ethereum-based DeFi protocols and yield farming opportunities without selling BTC positions.

holders benefit from high APY staking rewards, reduced transaction fees, and governance rights in the upcoming DAO launch, scheduled for Q3/Q4 2025, alongside the mainnet deployment.

As cycle analysis suggests, Ethereum may be entering its most aggressive growth phase while Bitcoin consolidates, time is running out for investors to participate at presale pricing.

The limited allocation remaining and approaching launch timeline create an opportunity for those seeking exposure to Bitcoin scaling infrastructure during Ethereum’s potential explosive altseason phase.