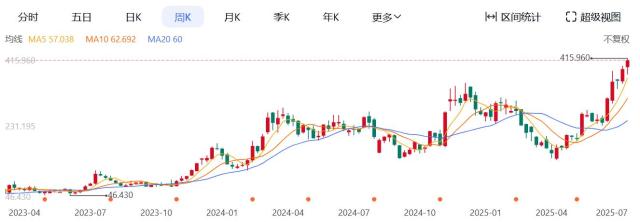

On July 14, 2025, Bit broke through the historical mark of $120,000, with Wall Street institutions toasting in celebration. On the other side of the world, 135,800 retail investors were staring at the glaring liquidation notices on their mobile screens - $493 million in wealth vanished within 24 hours.

Social media lacked retail investors' celebratory memes, no "overnight riches" trending posts, only BlackRock's 13 ETF subscription orders per second silently scrolling. This capital feast, dubbed the "silent bull market", is profoundly changing the power structure of the cryptocurrency market.

1. Institutional Entry: A Carefully Planned Power Transfer

The cryptocurrency market is experiencing an unprecedented reconstruction of capital power, with institutional investors systematically taking over market dominance.

Custody Breakthrough: Traditional financial giants like BlackRock and Fidelity pioneered breaking regulatory barriers, establishing compliant custody channels. BlackRock's iShares Bitcoin Trust alone manages over $80 billion in assets, holding more than 700,000 BTC. These "financial aircraft carriers" opened the floodgates for subsequent capital influx.

Product Matrix Expansion: Bitcoin spot ETF is just the beginning. Following are futures ETFs, leveraged ETFs, Bitcoin-backed loans, and other structured products forming a complete institutional investment toolkit. When Japanese listed company Metaplanet added 797 Bitcoins in a single day, with a total holding of 16,352, the corporate balance sheet revolution was quietly underway.

Asset Restructuring Wave: Cryptocurrencies are being reclassified as strategic reserve assets. MicroStrategy's holdings exceeded 528,000, valued at $35.63 billion; the German Central Bank even began selling gold to hold Bitcoin. This asset restructuring drove exchange Bitcoin inventory to a five-year low, completely reversing supply and demand dynamics.

2. Retail Marginalization: A Capital Game Within High Walls

As institutions occupy center stage, ordinary investors find themselves being squeezed out of the feast. Data shows transactions over $100,000 have surged to 89%, a 23 percentage point increase from 2022.

Market structure has fundamentally changed:

Decreased volatility but more concentrated liquidations: Despite Bitcoin's cumulative rise of over 40% in three months, the 5% single-day drop on July 15 triggered liquidations for 135,800 people, with $3.54 billion in wealth evaporating. 80% of liquidation losses came from long positions, with high-leverage retail investors becoming the primary casualties of market fluctuations.

Wall Street's pricing power monopoly: Simultaneous exchange inventory shortage and whale address increase (addresses holding over 1,000 BTC reached 2,135) indicate institutions complete large transactions through OTC counters, bypassing public market depth. With BlackRock injecting $380 million daily into the market, retail orders have become mere market noise.

Psychological threshold and data gap: After Bitcoin broke $120,000, Google search interest was only 45, less than a third of the peak when first breaking $100,000 in November 2024; the Fear and Greed Index at 73, far below historical peaks. Japanese retail investors' lament, "A coin costs $110,000? I've already missed out!" reflects global retail investors' collective sense of powerlessness.

3. Hidden Risks: Cracks Beneath the Feast

Institutionalization has not eliminated risks but instead generated new systemic threats.

Stablecoins become the dual focus of regulation and crime:

Hong Kong's Stablecoin Regulation effective August 1 requires 100% reserve asset isolation; the US GENIUS Act demands the ability to "freeze involved tokens within 10 minutes". However, in cross-border money laundering cases, a single criminal controls over 200 wallet addresses to disperse funds, rendering traditional risk control systems ineffective.

Virtual currency illegal foreign exchange involves staggering amounts - a Shanghai case involved 6.5 billion yuan in cross-border arbitrage. Tether (USDT) became an "against" trading tool, with criminal groups building a high-profit model through 1%-3% high handling fees and two-way arbitrage strategies.

Pseudo-decentralized protocol regulatory arbitrage is even more covert. Some projects wave the "compliance" banner while actually issuing unregulated stablecoins through offshore shell companies; technical vulnerabilities are frequent, with Wormhole cross-chain bridge losing $180 million in Q2 2025 due to signature verification failure.

4. New Risk Forms: Fatal Traps in Institutionalized Markets

Kinto token's flash crash became the best footnote to the institutionalized market. On July 10, the project was hacked due to contract vulnerabilities, causing a 90% price plunge and market value evaporation to less than $2 million. This "precision strike" exposed new risk forms.

Mining giant Canaan's gross margin plummeted from 42% to 29%, with high computing power competition eroding safety margins. Tether issued 4 billion USDT in a single week, with Stablecoin Supply Ratio (SSR) breaking 1.2 and perpetual contract funding rates rising to the year's peak - behind these numbers is the silent accumulation of leverage bubbles.

With $3.7 billion in options contracts gathered at the $125,000 mark, a long-short showdown is imminent. Institutional investors leverage derivative tools and hedging strategies to gain an advantage, while retail investors are forced out of the high-leverage game.

The institutional wave has reshaped the rules: volatility curves are smoothed, price discovery mechanisms monopolized by over-the-counter trading, and even market sentiment redefined by institutional holding reports. When the German Central Bank exchanges gold for Bitcoin, when listed companies list crypto assets as strategic reserves in their financial reports, the blockchain utopian narrative has completely given way to a balance sheet revolution. Cryptocurrency no longer disrupts traditional finance; it has become traditional finance's sharpest new weapon.