Wall Street is Experiencing a "Crypto Moment"

Written by: Sunny, Messari Research

Translated by: Alex Liu, Foresight News

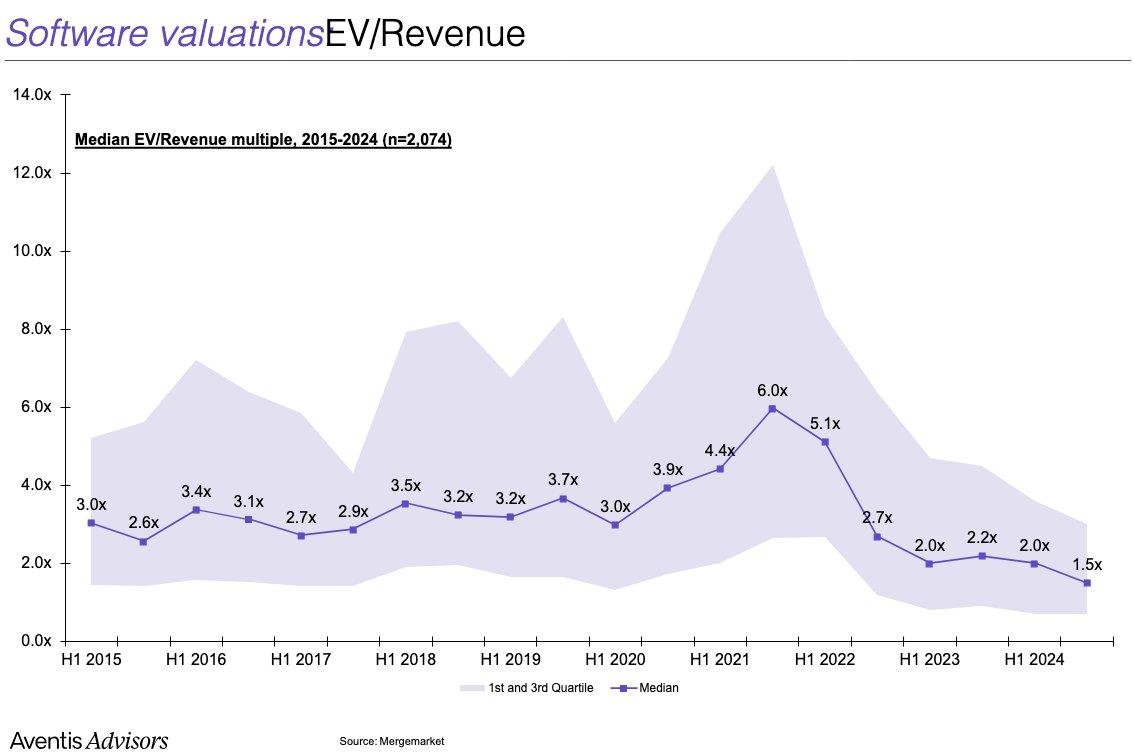

In the past few years, traditional finance (TradFi) has gradually lost its source of growth narrative. Artificial intelligence has been over-allocated, and software companies no longer have the same imaginative space as they did in the 2000s and 2010s.

For growth investors who raised funds to bet on disruptive innovation narratives, the reality is: AI asset valuations are generally inflated, and other "growth stories" are difficult to tell with novelty. The once-prominent FAANG stocks have gradually transformed into mediocre "compounding stocks" focused on maximizing profits. The median price-to-sales ratio (enterprise value / sales) of current software companies has dropped to below 2 times.

As a result, cryptocurrencies have returned to the spotlight.

Bitcoin has broken through its historical high; the U.S. President "strongly advocated" crypto assets at a press conference; a series of regulatory tailwinds have brought this asset class back into the mainstream view for the first time since 2021.

Unlike the previous cycle of Non-Fungible Tokens and Doge, this round's protagonists are digital gold, stablecoins, "tokenization," and payment system reforms. Stripe and Robinhood have declared that their next phase will focus on crypto business; Coinbase has successfully been included in the S&P 500 index; Circle has shown a sufficiently attractive growth narrative to the capital markets, making investors once again ignore valuation multiples and focus on potential stories.

But what does this have to do with ETH?

For crypto natives, the battle of smart contract platforms has long been divided: Solana, Hyperliquid, and numerous high-performance new chains and Rollup platforms have posed a real threat to Ethereum's dominance.

We know that Ethereum has not yet truly solved the value capture problem, and we also know that it is facing structural challenges.

But Wall Street is unaware of these. In fact, most Wall Street practitioners know almost nothing about Solana. In terms of recognition, older coins like XRP, LTC, LINK, ADA, and Doge might have more presence in their minds than SOL. After all, these people have almost completely faded from the crypto market in the past few years.

What they know is that ETH is "lindy" - standing the test of time; it has been tested through multiple market fluctuations; for a long time, it has been the main "Beta" target besides Bitcoin. They see that ETH is one of only two crypto assets with spot ETFs. What they prefer is a "value trap" with relatively cheap valuation and upcoming catalysts.

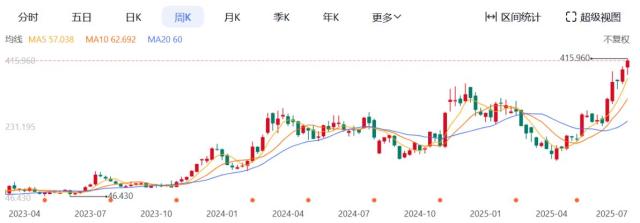

In their eyes, Coinbase, Kraken, and Robinhood have all chosen to build products on Ethereum. With a bit of due diligence, they can know that Ethereum has the largest stablecoin pool on-chain. They start doing "moon calculations" - and then discover that Bitcoin has set a new high, while Ethereum is still more than 30% away from its 2021 peak.

For them, this "relative undervaluation" is not a risk, but an opportunity. They are more willing to buy an asset that is still low and has a clear target price, rather than chase a coin that is "too late" on the chart.

And they may have already entered the market. Now, institutional investment compliance restrictions are no longer a big problem. As long as there is sufficient incentive, any fund can seek to allocate crypto assets. Although crypto Twitter (CT) has been swearing for the past year that they would "never touch ETH" again, based on market performance this year, ETH has been outperforming other mainstream assets for over a month.

So far, SOL/ETH has dropped nearly 9% this year; Ethereum's market cap dominance has begun its longest rally since mid-2023 after bottoming out in May.

So the question is: If the entire crypto community believes ETH is a "cursed coin," why is it still outperforming?

The answer is: It is attracting new buyers.

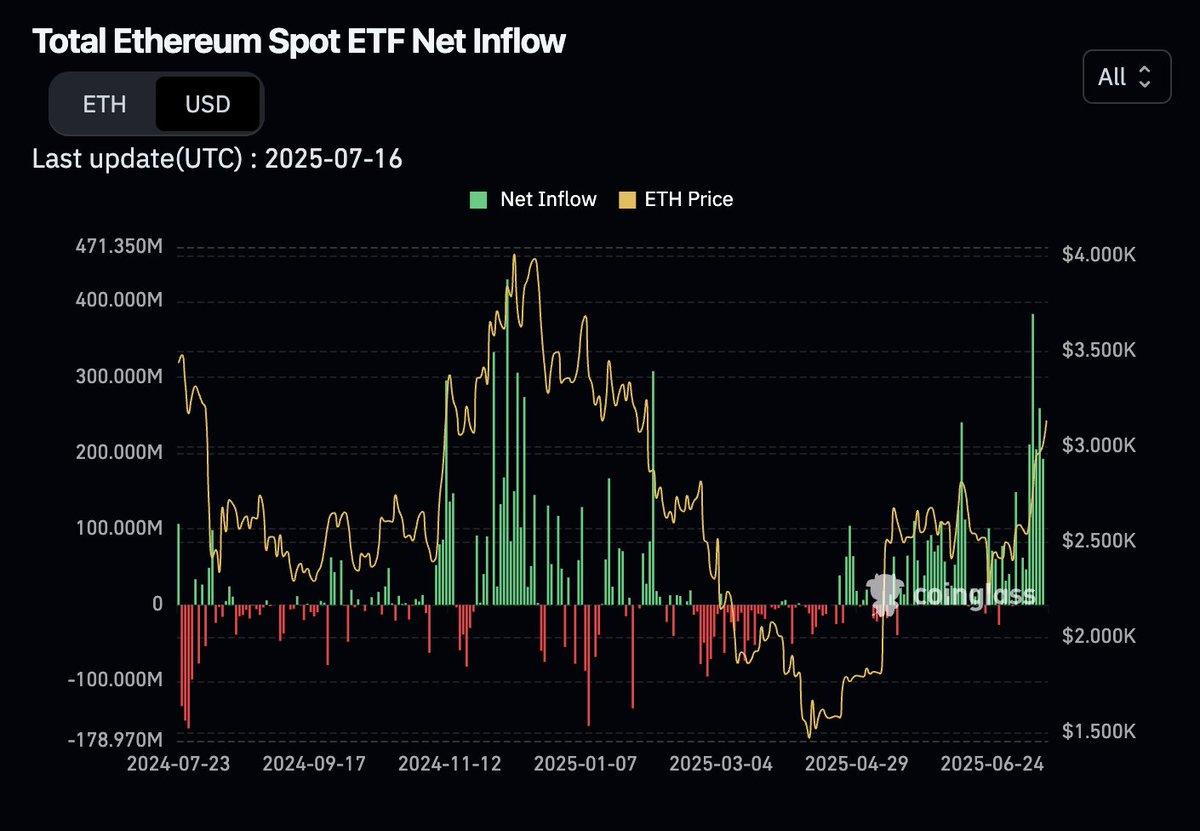

Since March, Ethereum spot ETF net inflows have been in an "up only" mode.

(Data source: Coinglass)

Ethereum "accumulators" stocks mimicking the MicroStrategy model are taking off, injecting structural leverage into the market.

At the same time, some crypto native users may have realized they are under-allocated and are starting to transfer funds out of BTC and SOL, which have already risen significantly in the past two years.

It needs to be clear that we are not saying the Ethereum ecosystem has solved its problems. Rather, the ETH asset is beginning to gradually "decouple" from the Ethereum network.

External buyers are reshaping the market narrative about ETH, from "decline is certain" to a paradigm shift of "valuation reassessment". Short sellers will eventually be squeezed out, and at that time, native funds may also join the chase, ultimately leading us to a market frenzy centered on ETH, reaching a climactic top at some point.

If this happens, ETH's historical high may not be far away.